Highlights

Summary

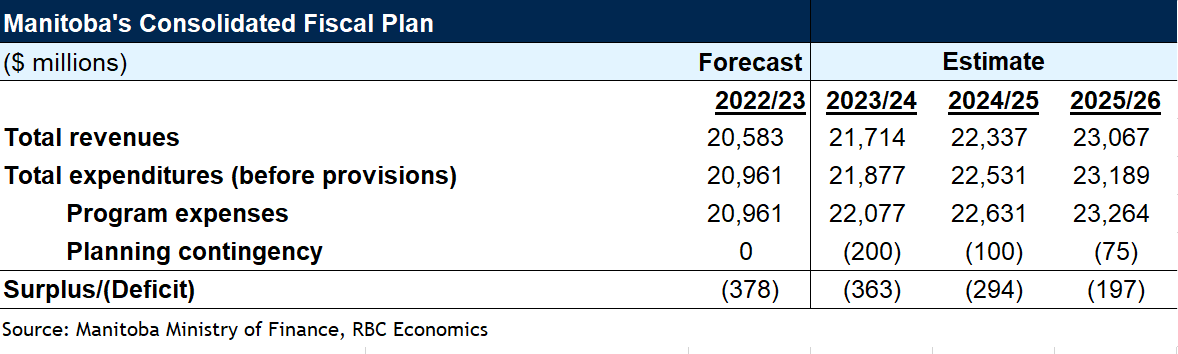

As the only Prairie province to project a deficit in FY 2022 – 23 (-$378 million), news of another deficit planned for the coming year came as no surprise. The shortfall of $363 million in FY 2023 – 24 would represent a small improvement in the province’s bottom line, though, thanks to revenue growth (+4.5%) narrowly outpacing expenditure growth (+4.4%). This would also be another step toward fulfilling the Manitoba government’s commitment to balance its budget by FY 2028 – 29.

Tax cuts were a main theme of Budget 2023. The government raised the basic personal amount from $10,145 to $15,000, removing 47,000 taxpayers from tax rolls. It raised tax bracket thresholds for personal income tax and health and post-secondary education tax levy for businesses. Reduced revenues from corporate income tax (-$183 million) and a reduction in net income of government business enterprises (-$202 million) were more than offset by increased federal transfers in the form of equalization (+$577 million), health (+$134 million), and other transfers (+$331 million).

Budget 2023 shows some degree of spending restraint with program expenditures projected to grow by 3.7% in FY 2023 – 24, down from 5.3% in FY 2022 – 23. The department of families is allocated the largest funding increase (+$234 million), followed by agriculture (+$211 million), health (+$171 million), and education and early childhood learning (+$110 million).

Expenditures creep up alongside higher agriculture premiums

Eating up nearly 50% of the budget, healthcare ($7.1B) and education ($3.7B) continue to be the province’s largest expenses. But despite accounting for nearly half the provincial budget, this isn’t where most of the increases were directed. Representing an additional $211 million (+53%) from FY 2022 – 23, agriculture took the lead – primarily due to higher insurance payments after the challenging year in 2021. Now accounting for 6% of total expenditures, debt servicing costs in the province have jumped $175 million (+16%) from FY 2022 – 23 estimates amid higher interest rates. Increases to advanced education and training (+$211 million) as well as families (+$234 million) – including sector wage increases for social services – account for other notable expenditure boosts.

Own-source revenues to stay flat amid tax cuts and weakening economic backdrop

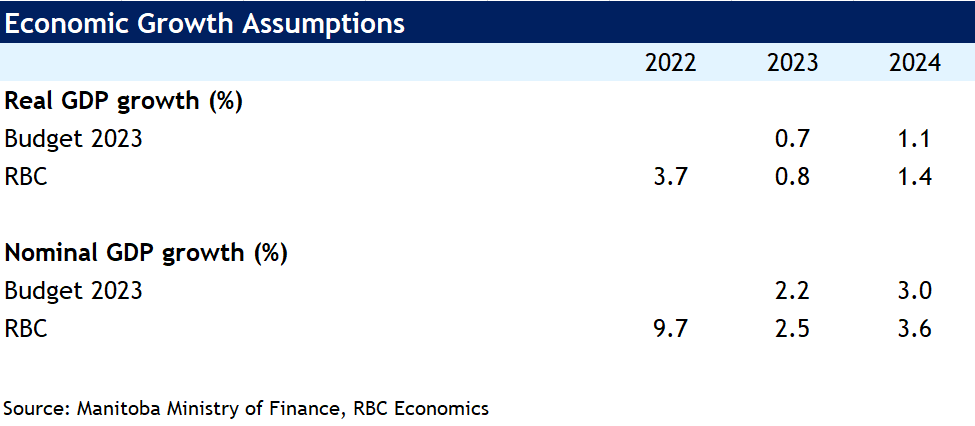

Now forecasting real GDP to grow a mere 0.7% in 2023, the weakening economic outlook and the implementation of tax cuts are projected to flatten own-source revenues in FY 2023 – 24. Costing more than $350 million in forgone revenue for the province, taxation changes are projected to be more than offset by revenue growth in other areas. Increased revenue from retail sales tax (+$53 million), sinking funds and other earnings(+$38 million), and tuition fees (+$39 million) are projected to boost revenues in the year ahead. But the bigger contributor to Manitoba’s coffers is a $1 billion (+17%) surge in federal transfers. These transfers will account for 33.9% of total provincial revenues in FY 2023 – 24, up from 30.4% in FY 2022 – 23. The province hasn’t been this dependent on federal handouts in nearly 30 years.

Investing in infrastructure and education

Budget 2023 included a capital investment plan worth $14B over the next five years – a steep increase from the province’s historical investment amounts. Accounting for $854M (27%) and $654M (21%) in FY 2023 – 24, the bulk of Manitoba’s capital investment has been dedicated to roads, bridges, and flood protection as well as improvements to Manitoba Hydro, respectively. Other notable investments include $387M for K-12 and advanced education to support the building of new schools, offset operating cost pressures, and implementation of the province’s Education Action Plan.

Provincial debt burden to remain among the highest in the country

Budget 2023 projects a 33.5% net debt-to-GDP ratio at the end of FY 2022 – 23 and a slight deterioration through the remainder of the four-year fiscal plan with the ratio reaching 34.6% by FY 2026-27. It’s somewhat disappointing that Manitoba isn’t on track to lighten its debt burden over the medium term. Being among the more indebted provinces, it may not have as much fiscal flexibility as others to face unexpected adverse events in the future.

Rachel Battaglia is an economist at RBC. She is a member of the Macro and Regional Analysis Group, providing analysis for the provincial macroeconomic outlook and budget commentaries.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More