New Brunswick Budget 2022

Overview

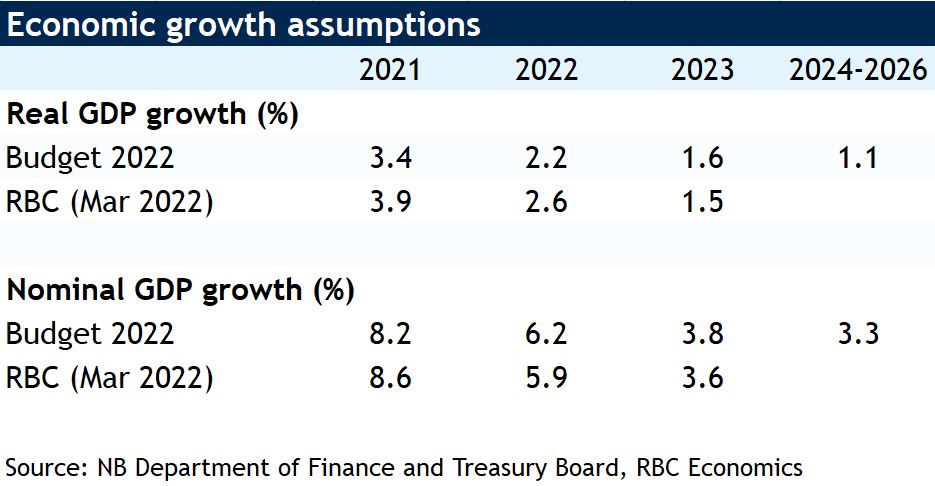

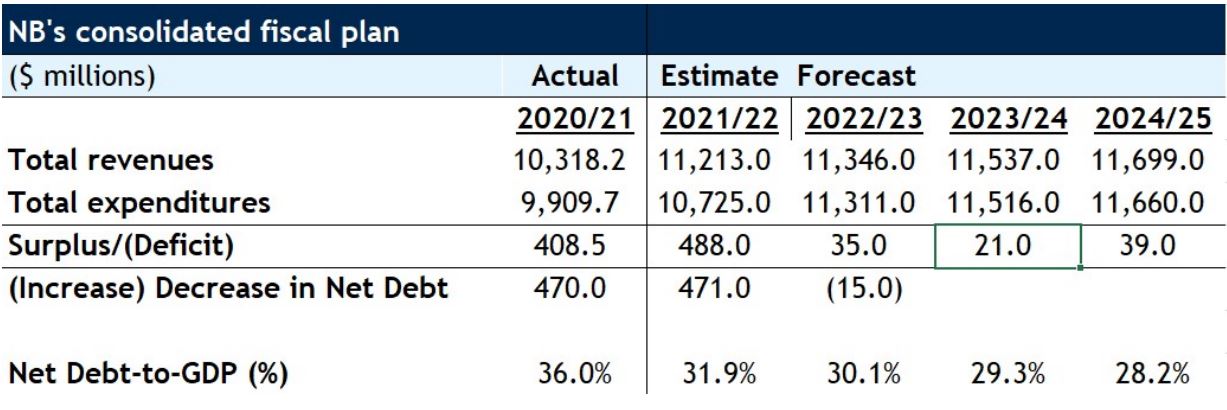

New Brunswick’s Budget 2022 is a transitional budget as the province shifts from daily pandemic management to moving forward. The theme of the budget was “Building on Success.” As the first province to deliver a pandemic surplus (of $409 million in FY 2021-2022) and maintain a positive balance, New Brunswick has plenty of success to build on. Again in the fiscal year starting April 1, New Brunswick will deliver a surplus, though a smaller one at $35 million. Expenses will grow by more than 5% to $11.3 billion as the province acts on capacity constraints illuminated by the pandemic. At the same time, revenues will grow by a modest 1.2% to $11.3 billion, reflecting tax cuts and the end of pandemic-related federal transfers. Net debt-to-GDP will hover just above 30% by the end of the fiscal year.

Expenses build up capacity in key sectors

Budget 2022 includes $11.3 billion in expenditures this year, a 5.5% increase (up $586 million) as the province transitions from reactionary pandemic spending to allocations geared towards “building capacity and resiliency.” Much of this rebuilding is targeted to health spending, which is why New Brunswick announced the largest increase to health expenditures since FY 2008-2009. At $3.3 billion, a 6.4% increase from year-ago levels, health care accounts for just under 30% of total spending. In November, the province released a plan titled Stabilizing Health Care: An Urgent Call to Action. In FY 2022-23, in addition to typical program spending, $38 million will be allocated to targeting five areas outlined in the province’s plan including expanding access to primary health care, access to surgery, creating a connected health care system, providing access to mental health care services, and to assist seniors to remain in their homes.

Education and Early Childhood development account for an additional 14% of Budget 2022, with New Brunswick investing $110 million in early learning and childcare to create additional childcare spaces and reduce average fees to $10 per day within five years, in partnership with the federal government. The province will invest $500 million over this five year plan. The province’s tourism-related program spending will grow by 26% in FY 2022-23, or an additional $6.9 million. New Brunswick is targeting affordable housing supply, but most of the work is reflected on the revenue-side, as the province has allotted $6.3 million to build up the stock of affordable housing (an allocation representing less than 1% of total expenditures).

Revenue growth slows reflecting tax cuts and end of pandemic aid

New Brunswick’s total revenues of $11.3 billion are up a modest 1.2% from year-ago levels ($133 million). This slower revenue growth is largely due to the province’s new tax reductions coupled with the ending of one-time pandemic-related revenue growth. Tax receipts, the province’s largest source of revenue, are projected to fall $37.7 million to $5.4 billion. Much of the decline is attributed to lower corporate tax revenues (down $33 million). Personal income taxes are expected to grow a modest 0.7%.

In keeping with the federally-mandated carbon price requirement, New Brunswick will see the carbon tax rate increase from $40/tonne to $50/tonne on April 1st. The government is taking action to offset the impact of rising inflation and higher gas taxes by increasing the province’s basic personal amount from $10,817 to $11,720.

Total federal grants will grow 3.2% in FY 2022-23 to $4 billion. The growth reflects higher equalization and Canada Social Transfer payments that more than offset the decline in pandemic-related transfers as one-time supports end such as the $38 million decline in the Canada health transfer. Over the medium-term, revenues are expected to grow 3% by the end of FY 2024-25.

Capital Plan addresses province’s infrastructure deficit

This year, New Brunswick has allotted $747 million to its capital plan, and increase of $45 million (6.4%). The lion’s share of the allocation (87% of the total budget) is allocated to the department of Transportation and Infrastructure. Close to half of the budget is earmarked for the maintenance and improvement of highways, roads, and bridges. Additionally, $153 million (20% of the budget) will be allocated to health-care infrastructure.

Debt-to-GDP to fall to 30%

Net debt is projected to reach $13 billion by the end of 2023, an increase of $15.5 million though the net debt-to-GDP ratio is expected to fall to 30.1% from just below 32%. The province’s revised estimate for FY 2021-22 reflects higher GDP growth since Budget 2021. Over the medium-term, New Brunswick expects net debt-to-GDP to fall to 28.2% (FY 2024-25). At $634 million, debt servicing costs represent ~6% of total expenditure. As interest rates rise, these costs will grow over the forecast horizon.

Read report PDF

Carrie Freestone is an economist at RBC. She is a member of the macroeconomic analysis group and is responsible for monitoring key indicators including consumer spending, labour markets, GDP, and inflation. Carrie produces economic analysis that she delivers to clients and the public through publications and presentations. She holds a Bachelor of Arts in Economics from Queen’s University and a Master of Arts in Economics from the University of Ottawa.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More