TLDR:

- For many young entrepreneurs across Canada, entrepreneurship is a path to finding purpose, growth and balance for their futures

- Young entrepreneurs are well-positioned to identify gaps and opportunities in the market, launching solutions with fresh ideas

- Futurpreneur has long been a champion of young entrepreneurs across the country, providing a range of resources, including financing, mentorship, networking and skill building

- RBC and the RBC Foundation offer vital supports that can empower Futurpreneur’s young entrepreneurs to start, buy and grow thriving businesses

Young people are increasingly seeking meaningful careers. Beyond earning a paycheque, young people aged 18-35 are looking for a sense of purpose, growth opportunities and a healthy work/life balance. For many, entrepreneurship is the path to find all three.

In fact, according to the Global Entrepreneurship Monitor, 30% of Canadian entrepreneurs are 25-34, with the 18-24 population a close second at 28%. This is why organizations like Futurpreneur exist. A national non-profit, Futurpreneur helps aspiring entrepreneurs ages 18–39 start, buy and grow businesses with mentorship, learning programs and access to capital. Since 1996, they have supported more than 20,000 young entrepreneurs launch over 15,600 businesses in every province and territory. And with RBC and RBC Foundation as long-time partners, more young entrepreneurs are getting the support they need to build ventures that are both financially sustainable and deliver social impact.

The power of new ideas – and new business owners

Karen Greve Young, CEO of Futurpreneur, sees entrepreneurship as a vital force for Canadian prosperity.

“Entrepreneurs across Canada are creating meaningful employment for themselves and others,” she explains. That they are contributing to thriving communities in all pockets of the country – not just urban centres – is crucial. “Canada is a country of big cities, small towns and rural communities,” notes Greve Young. “It really matters that we have vibrant businesses throughout the country.”

Not only do small and new businesses play a meaningful role in the health of the Canadian economy, they’re also the source of fresh thinking, “If we only relied on companies that were founded 20 years ago, our economy would stagnate. New entrepreneurs bring innovative solutions to old problems,” Greve Young points out. “And young entrepreneurs especially are in tune with the challenges and opportunities of our time.”

Canada’s population of business owners is aging, with more than 76% of small business owners expected to retire in the next 10 years. Now is the time for the next generation to step up. The good news is, they’re doing just that – and Futurpreneur, RBC and RBC Foundation are helping to clear the path.

The Futurpreneur offices in Toronto, Ontario

Skills, support and the start of something big

Of course, building a business is no small feat – especially in today’s economy. From inflation and supply chain disruptions to rising costs and regulatory changes, the challenges business owners face are real. What’s more, new entrepreneurs often lack the financial cushion and track record to weather early setbacks. That’s why support systems – including vital skill building – matter so much.

“There are three main categories of skills entrepreneurs need,” explains Greve Young. First are the technical skills at the heart of their business – how to provide their service or make their product. “Most entrepreneurs come to us already strong in that area,” she says. Second are the business skills: marketing, managing cash flow and selling – skills essential to turning a good idea into a sustainable business. And third are the soft skills: confidence, resilience, self-belief. “Those are often underestimated, but being an entrepreneur is lonely, and it takes inner strength. That’s where our support—especially with RBC’s help—really makes a difference,” adds Greve Young.

Futurpreneur helps to provide the foundation entrepreneurs need. One of its flagship offerings is the Rock My Business program – a free, four-part workshop series delivered by Futurpreneur on behalf of Futurpreneur Foundation, RBC and RBC Foundation. The program includes three key set-up stages: Rock My Business Idea, Rock My Business Plan and Rock My Cash Flow. A fourth stage, Rock My Business Launch, has recently been added to help entrepreneurs successfully launch their businesses after they’ve received funding from Futurpreneur. Together, these four virtual workshops guide aspiring founders through the early stages of turning an idea into a viable business.

“Those four components – idea, plan, cash flow and launch – are the foundation of early-stage business success,” says Greve Young. “But Rock My Business is more than a curriculum. It’s a community. It’s a place where young entrepreneurs don’t have to go it alone.”

Providing entrepreneurs with the tools to advance their business idea, formalize a business plan, create a viable cash flow and successfully launch, Rock My Business equips aspiring entrepreneurs with the skills they need to start, grow and thrive in entrepreneurship.

From ideas to impact: The role of funding

Even with a solid plan, funding remains a critical barrier. This is another area where Futurpreneur steps in, offering up to $75,000 (along with mentorship support) to help young aspiring entrepreneurs start and succeed. RBC and the RBC Foundation amplify this impact by supporting Futurpreneur’s programs and by creating the RBC Rock My Business Start-up Awards – eight annual awards of $10,000 each, designed to help young entrepreneurs move from dream to launch.

The awards include six Youth Entrepreneur Awards, one Emerging Black Entrepreneur Award, and one Emerging Indigenous Entrepreneur Award. To qualify, applicants must complete both the business plan and cash flow workshops of the Rock My Business series and submit their business documents for review. It’s one of the ways the program prioritizes skill building above anything – after all, it’s imperative that young entrepreneurs have the tools they need to succeed. Judges then evaluate their preparedness – and the award recipients receive vital capital to seed, start or grow their businesses.

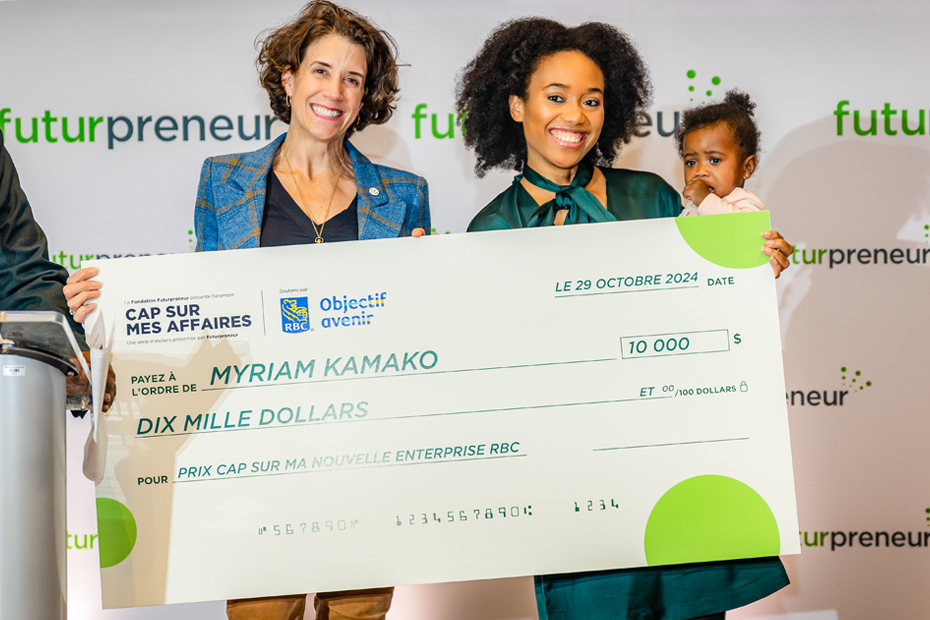

Myriam Kamako at an event for her line of hair care products from Vertueuse

Myriam Kamako: An entrepreneur with a mission

For Myriam Kamako, winner of the Youth Entrepreneur Award, the skills she learned through Rock My Business – as well as the financial support she received through the award – were transformative.

Kamako founded Vertueuse with an aim of helping people from smaller towns with pigmented skin and textured hair access hair and skin care products. It was an idea that came to her after wanting to go back to her natural hair – but having no hairdressers in Sherbrooke, Quebec, where she lived, with the expertise or product to style hair like hers. “In Sherbrooke, there were no hairdressers that specialized in my kind of hair, so I had to travel to Montreal to find products. That’s how the idea came to me – I wanted to bring something to people in small towns,” she says.

Her experience with Futurpreneur was game-changing. “Rock My Business helped me realize it’s not just about having a good idea,” she says. “The finance workshop in particular opened my eyes. It gave me a realistic picture of what I didn’t know, and what I needed to learn.”

And, winning the $10,000 award was a turning point. “Without RBC, Vertueuse would still be a PDF document,” she says. “We had the idea and the belief, but we didn’t have the money. That award showed us someone believed in us.”

A Canadian approach to inclusive growth

Futurpreneur exists because young entrepreneurs face real barriers. And RBC has been there since the beginning, helping them access capital, develop business skills and connect with mentors. Today, the RBC Foundation continues to support Rock My Business and other programs that turn ideas into enterprises. For instance, RBC also funds Futurpreneur’s Black Entrepreneur Startup Program (BESP). Tailored to support the unique needs of young Black entrepreneurs, ages 18-39, [DA5] on their journeys to success, the program offers startup loan financing with mentorship.

“The partnership is special,” says Greve Young of Futurpreneur’s relationship with RBC. “You have Canada’s largest company supporting its smallest businesses. That’s a very Canadian approach – creating opportunity and prosperity for all.”

Building inclusive prosperity and equipping people with the skills needed to thrive in the future of work are core to RBC’s purpose. And through partnerships like this, that purpose is being fulfilled every day – by entrepreneurs like Myriam Kamako, and by the communities they uplift through the businesses they create.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subject matter discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or its affiliates.