Nova Scotia Budget 2022

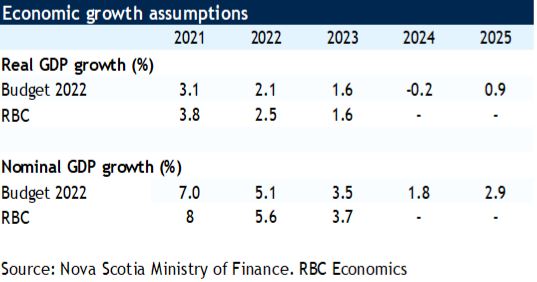

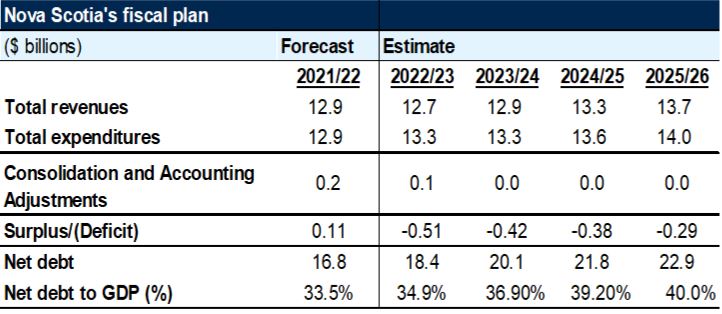

Nova Scotia Minister of Finance, Allan MacMaster, delivered his first budget at a pivotal time for the province. He called it a compassionate budget with a strong emphasis on addressing health care issues and the rising cost of housing. He could have also called it steadfast. His government intends to forge ahead with boosting expenditures despite falling revenues, resulting in a $500-million deficit in FY 2022-23. It’s a significant swing from a $108-million surplus now expected in FY 2021-22. In FY 2022-23, Nova Scotia’s net debt-to-GDP will hover just below 35%, growing to 40% by FY 2025-26 as the province makes generational investments in health care infrastructure. Over the medium-term, the government projects the deficit to ease to $294 million by FY 2025-26.

Expenses grow to expand key health care services

In FY 2022-23, total expenses are expected to reach $13.3 billion, an increase of $363 million (up 2.8%) from the prior fiscal year. Departmental expenses will grow 2.8% to $12.4 billion, with COVID-related expenses accounting for a much smaller portion (1.8%) of total expenses this year. Nearly one-third of budgeted expenses are earmarked for healthcare, a $5.7 billion allocation in FY 2022-23, mostly targeted to address pandemic-induced shortfalls.

Noteworthy allocations include the expansion of nursing seats in Nova Scotia universities, the reduction of surgical backlogs and wait times, and funding for more staff to support an enhanced standard of care for long term care residents (4.1 hours of one-on-one care every day) while opening 2,800 additional long-term care spaces in the province. Education and early child development spending, at $1.8 billion will grow 6.7% from FY 2021-22 due to the province’s five year agreement with the federal government for universal childcare to lower childcare fees, create additional childcare spaces, and expand after-school care.

Community service spending is also set to increase $111 million to $1.2 billion. These increases are partially offset by lower advanced education funding, as one-time university infrastructure grants for deferred maintenance in FY 2021-22 will not be repeated. Debt servicing costs are $5.8 million lower in FY 2022-23 as high coupon debt matures and pension debt servicing obligations will be lower this year.

Lower expected fee revenues and federal transfers

Nova Scotia’s revenues are projected to drop $216 million (down 1.7%) to $12.7 billion in FY 2022-23. Falling provincial own-source revenues ($145 million lower in FY 2022-23) accounts for two-thirds of the decline, with lower federal transfers explaining the remainder. Provincial own-source revenues are expected to reach $8.0 billion this year, 1.8% below year-ago levels largely due to increases in offshore license forfeitures, lower revenues from licenses and fees, and lower sinking fund earnings. Higher interest rate revenues (+ $16.7 million) will partially offset the decline. Personal and corporate income tax revenues are expected to grow 3.5%, accounting for $3.8 B in revenue combined. Harmonized Sales Tax receipts will grow 4.6% to $2.2 billion as the pandemic recovery continues and consumer spending rebounds. Federal transfers will fall 1.5% this year to $4.7 billion due to declining

Offshore Accord payments (FY 2022-23 is the last fiscal year for which Nova Scotia will receive payments from the extension of the Accord), falling tangible capital asset cost-shared revenue, and lower Canada Health Transfer payments from the prior year (related to one-time pandemic assistance).

In order to address eroding housing affordability, Budget 2022 introduces a non-resident property tax. The tax will apply to home purchases made by non-residents of Nova Scotia (including owners from other provinces as well as outside Canada). Effective FY 2022-23, the tax will be $2.00 per $100 assessed value of residential property. On a home valued at $420,000 (the average home price in February), this translates to an $8,400 tax. Additionally,

Nova Scotia will introduce a 5% deed transfer tax on residential properties purchased by non-residents, effective April 1st, 2022. Combined, these two new tax measures will generate an additional $81 million in provincial revenues in FY 2022-23.

Capital Plan includes generational investments in health care re-development

Capital Plan 2022-23, at $1.6 billion, is $408.7 million (35%) higher than in Budget 2021. The lion’s share (40%) of spending is being directed to health care, including generational investments in health care redevelopment projects including the QEII Hospital and Cape Breton Regional Hospital. An additional $175.3 million (11% of the total capital plan) is earmarked to build and renovate schools.

Debt-to-GDP to grow to 40% over the medium term

Net debt is expected to reach $18.4 billion, a $1.6 billion (9.5%) increase from FY 2021-22, reflecting investments from the 2022-23 Capital Plan and the budget deficit. This will represent 34.9% of GDP—the highest ratio in the Maritimes, though still lower than Newfoundland, Ontario, and Quebec. Net debt will grow to $22.9 billion by FY 2025-26 (40% of GDP). Total borrowing requirements for FY 2022-23 will reach $1.6 billion, a $510.9 increase from FY 2021-22.

Read report PDF

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More