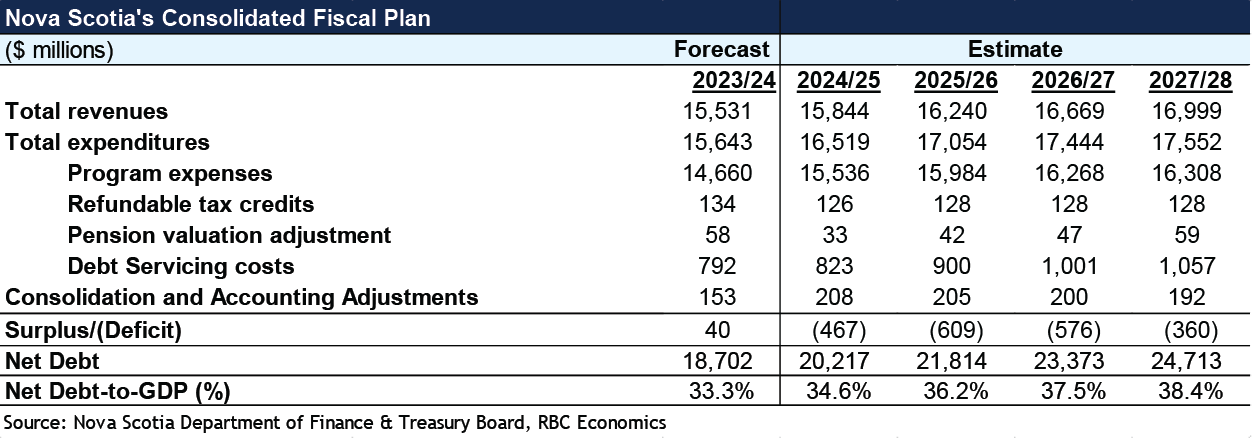

- Nova Scotia is expected to run a $467 million deficit in fiscal 2024-25 after surprising with a balanced budget in 2023-24.

- Revenue is projected to rise by $313 million from fiscal 2023-24.

- Expenses will grow by $875 million as healthcare investments continue to be prioritized.

- Larger deficits are expected in fiscal years 2025-26 and 2026-27 with no plan to return to balance over the four-year fiscal horizon.

- Net debt-to-GDP to rise to 34.6% in fiscal 2024-25, marking the start of an upward trajectory.

Budget 2024 built on prior budgets with another year of significant investment in healthcare, which Nova Scotia Finance Allan Minister MacMaster emphasized as necessary to improve an “outdated system” and to accommodate rapid population growth.

Financing requirements for healthcare and affordability mean Nova Scotia is expected to be $467 million in the red in fiscal 2024-25 after a surprise balanced budget last year. But, the province’s debt trajectory is expected to worsen over the medium term, placing Nova Scotia among Canada’s more indebted provinces in terms of a share of GDP.

Revenues ramp up thanks to higher federal transfers

Total revenue is expected to rise by $312.8 million (2%) from fiscal 2023-24. The single largest contributor is higher equalization payments attributed to strong population growth and slower growth in fiscal capacity. Revenue from federal sources is expected to grow by nearly 12% ($631 million). This growth will be partially offset, however, by weaker provincial source revenues. Higher income tax revenue (both personal and corporate) alongside higher HST will offset pullbacks in other areas. Revenue from government businesses is expected to be roughly in line with prior years.

A big sell in Budget 2024 was the new personal income tax indexation measure starting in the 2025 tax year. While this measure will not weigh significantly on tax receipts in the upcoming fiscal year, it is expected to reduce tax revenues by $13.4 million. Tax revenue will be reduced by a larger $64.5 million annually once the measure is fully incorporated in fiscal 2025-26.

Priority on healthcare in the face of rapid population growth

Total expenses are expected to rise by $875 million (5.6%) with the increase attributed to higher departmental expenses and an uptick in debt servicing costs. Allotments to refundable tax credits will be smaller along with less sizeable pension valuation adjustments.

Unsurprisingly, the budget continued to support the healthcare system’s overhaul after the foundations were laid in the previous two budgets. Health and wellness program spending is expected to grow by a whopping 8.3% ($424.5 million) in fiscal 2024-25 from two years ago. But against the backdrop of Nova Scotia’s soaring population growth (3.2% from mid-2022 to mid-2023) and two years of above-target inflation, the province has only ramped up nominal per capita health spending by just almost 2% over two years. Adjusting for inflation, health sector spending per person has outright declined.

Healthcare spending this fiscal year is expected to increase by $305 million. The bulk of the increase is allotted to Nova Scotia Health Authority and IWK Health for program spending. An additional $59 million is earmarked for “primary healthcare initiatives including developing care pathways to treat chronic diseases.” Workforce retention strategies, investments in cancer care technologies and initiatives moving Nova Scotia towards universal mental health and addictions care also topped the list.

Community services spending received a $182 million (13%) increase with an emphasis on Supportive Housing Action to address homelessness. A few incentives to build more homes to address a growing population included the (previously announced) $80-$100 million annual investment to introduce a rebate equal to 10% of provincial HST on the construction of purpose-built multi-unit rental apartments. In addition, $27.1 million was given for Nova Scotia Community College student housing.

Nova Scotia also devoted $36.7 million to advance the province’s Climate Change Plan, which includes both a Clean Energy Fund to help communities complete clean energy projects and a Clean Fuels Fund to support business and industry adoption of low-carbon and renewable fuels.

Debt servicing costs are expected to rise by $31 million (3.9%) in fiscal 2024-25. Debt servicing costs for fiscal 2023-24 were revised higher (25.4 million) despite lower overall debt levels, thanks to higher borrowing requirements and a higher-than-expected interest rate environment.

Capital Plan builds on previous action for health Plan

The capital plan allocates $1.6 billion for fiscal 2024-25, continuing the province’s priority on healthcare. Roughly a quarter ($410 million) will be devoted to the Halifax Infirmary expansion and Cape Breton Regional Municipality healthcare redevelopment projects, along with the construction and renewal of other hospitals and medical facilities. Other big ticket items are $208.5 million to build and renovate schools, and a whopping $483.3 million towards projects included in the province’s Five Year Highway Improvement Plan.

Debt levels mount with deficits

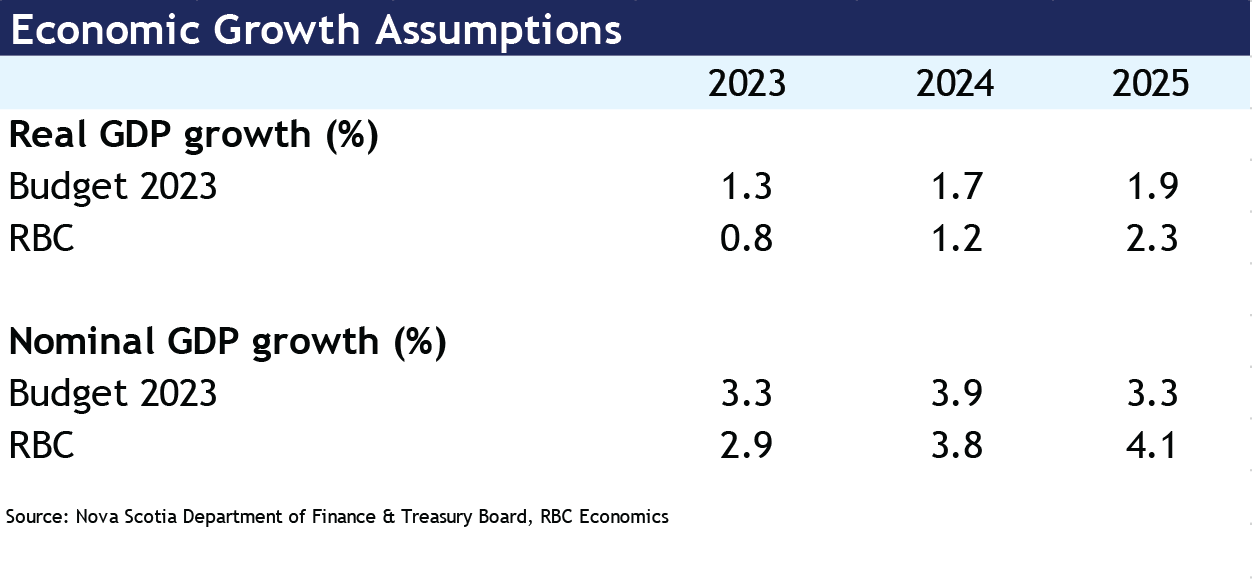

Nova Scotia’s debt is projected to grow to $20.2 billion in fiscal 2024-25, up $1.5 billion from 2023-24. It is expected to approach $25 billion by the end of four fiscal years. Net debt represents 34.6% of nominal GDP—placing Nova Scotia’s debt levels in line with Ontario and Quebec. The province’s total borrowing requirements are expected to rise by $580 million in large part due to a significant uptick in cash operating requirements to maintain the budget deficit.

Carrie Freestone is an economist at RBC. She is a member of the macroeconomic analysis group and is responsible for monitoring key indicators including consumer spending, labour markets, GDP, and inflation. Carrie produces economic analysis that she delivers to clients and the public through publications and presentations. She holds a Bachelor of Arts in Economics from Queen’s University and a Master of Arts in Economics from the University of Ottawa.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More