Higher interest rates are increasingly cooling down housing markets across the country. There’s no region feeling it more than Ontario at this stage. Home resales in the province fell for the fifth straight month in October, reaching the lowest levels since the Great Financial Crisis (excluding the pandemic shutdown period). Demand-supply conditions in nearly half local markets (including the Greater Toronto Area, Hamilton, Niagara, Barrie and Kingston) now favour buyers outright. And inventories are building fast, especially relative to weak sales. This is all weighing on prices. The aggregate MLS Home Price Index for Ontario fell in the last three months—and doing so at an accelerating pace (-1.4% m/m in October).

Market softness is widespread

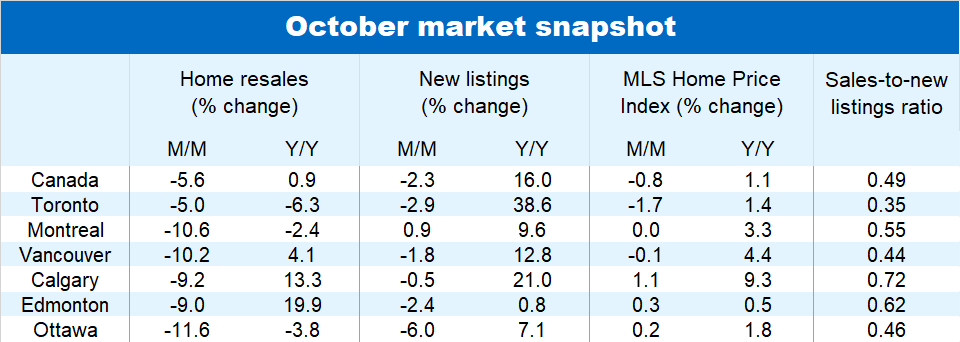

The temperature is dipping in other parts of Canada too, albeit to a lesser degree. Even super-hot Alberta is showing early signs of softening with resales falling 8.3% m/m in October. For now, prices continue to rise in the majority of provinces (including Alberta, Saskatchewan, Quebec and most Atlantic provinces), though British Columbia recorded its first decline (-0.1% m/m) in seven months.

Spring rebound has largely reversed in Canada

Nationwide, resales have dropped nearly 12% over the past four months (including a 5.0% m/m decline in October), reversing three-quarters of the spring rebound. This, along with a growing number of homes put up for sale since spring, has entirely unwound the tightness in demand-supply conditions that prevailed earlier this year. And buyers are taking advantage of their stronger bargaining position. They’ve successfully extracted price concessions from sellers in the past two months. The national aggregate MLS HPI fell 0.4 % m/m in September and a larger 0.8% in October. We expect this downtrend to continue in the coming months.

Supply-side watch: still few signs of trouble

While new listings have trended higher since spring, their levels generally remain well within pre-pandemic range. And there’s been little evidence that the rise is accelerating. In fact, new listings actually fell in Canada (-2.3% m/m) and most major markets in October. With interest payments soaring for Canadians with variable-rate mortgages and renewing fixed-rate mortgages, the financial squeeze could prompt a growing number of existing owners to sell their property. This would pose a risk to the market if a wave of sellers ensued.

Market likely stay quiet into next year

Transaction activity has been very quiet this fall across most of Canada. High interest rates, major affordability challenges and mounting economic uncertainty have kept homebuyer demand muted, especially in high-priced markets in Ontario and BC. We see this trend continuing into next year. With the prospect of higher interest costs bringing more sellers to market, buyers could gain even more pricing power in the months ahead. This would set the stage for further price erosion in Ontario and BC. The weakness could potentially spread to other regions as well. Any meaningful turnaround in the market will have to wait until interest rates are reduced. RBC expects the first cut in the Bank of Canada’s policy rate will be around mid-2024 though sees longer-term bond yields drifting lower ahead of that point.

See PDF with complete charts

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More