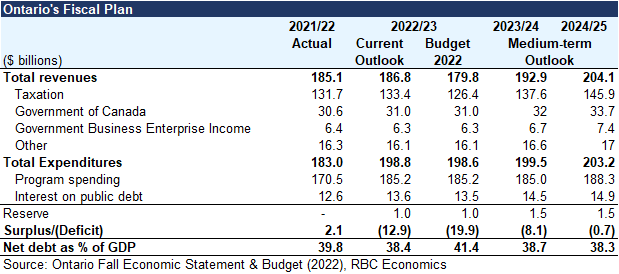

As expected, Ontario’s Fall Economic Statement included sizable downward revisions to budget deficit projections. Revenue windfalls in the 2021-22 fiscal year left most provinces with unexpected surpluses—including Ontario. The dramatic uplift to Ontario’s overall balance has rippled through to future years allowing the provincial government to slash its 2022-23 deficit projections by more than one third from $19.9 billion at budget time to $12.9 billion. The improvement stems almost entirely from a $7-billion upward revision to revenues while the government left this year’s projected expenditures largely unchanged.

Despite a mild recession forecasted in 2023, the overall budget balance is expected to improve further over the next two years. Ontario is now projecting deficits of $8.1 billion and $0.7 billion projected in 2023-24 and 2024-25, respectively.

Revenue growth moderates from last year’s spurt

Following a 15-year high (+12.3%) last year, growth in government revenue is now projected to moderate over the next two years—though remain positive. With interest rates still in restrictive territory and an economic contraction projected early next year, the slowing of business activity and employment is poised to temper revenue gains from personal and corporate taxation over the next few quarters. Nonetheless, revenue growth is projected to continue outpacing expenditure growth to support overall improvements to Ontario’s fiscal balance.

Expenditure projections largely unchanged from Budget 2022 projections

Changes from the 2022 Budget projections are marginal on the expenditure side of the ledger. The Ontario government added a mere $8 million (+0.1%) to its expenditure projection over three years and now expects total expenditures to reach $198.8 billion this fiscal year. Revisions come from slightly higher than projected interest on public debt (+$3 million) and program spending (+$4 million).

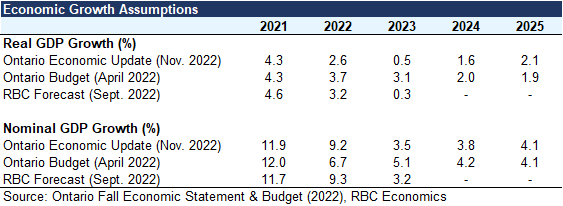

A mild recession now baked into Ontario’s economic outlook

The government now assumes a mild recession in early 2023. Its base-case forecast now calls for real GDP growth to slow significantly to 0.5% in 2023, which represents a material 2.6 percentage-point downgrade from the Budget 2022 forecast. The government also forecasts nominal GDP to slow considerably next year, though remain far more above water at 3.5%. Both economic projections are very close to our September projections (growth of 0.3% and 3.2% for real and nominal GDP, respectively, in 2023).

While a recession poses clear downside risks to Ontario’s fiscal outlook, the budget’s $1 billion contingency reserve (rising to $1.5 billion in the next two years) and other prudence items embedded in the budget should allow the government to manage most unexpected economic developments without jeopardizing the province’s bottom line.

Strong nominal GDP, lower deficits push down net debt-to-GDP ratio

Lower budget deficits and strong nominal GDP expectations have shifted the net debt-to-GDP trajectory down from Budget 2022 expectations. Today’s Fall Economic Statement projects the province’s indebtedness to fall below its pre-pandemic level of 39.6% to 38.4% this fiscal year, and remain close to that level in the following two years. Debt servicing costs as a share of revenues are also projected to moderate below pre-pandemic levels, dipping to around 7.3% over the medium-term instead of rising to 7.6%.

Lower expected deficits will help reduce borrowing requirements. The government has also cut its long-term public borrowing outlook by $9.3 billion this year to $32.2 billion, and to $38.4 billion in 2023-24 and $32.3 billion in 2024-25.

Ontario’s fiscal outlook back on track after pandemic-spending

After a record year for revenue growth, Ontario has seemingly diverted the fiscal catastrophe feared at the onset of the pandemic. Last year’s surge in government income is projected to benefit the province’s fiscal position over the next three years, as its deficit continues to shrink. The sharp cuts to deficit projections and downward revisions to the net debt-to-GDP ratio are clear indications that Ontario’s finances are getting back to a sustainable path.

Rachel Battaglia is an economist at RBC. She is a member of the macro and regional analysis group, providing analysis for the provincial macroeconomic outlook.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More