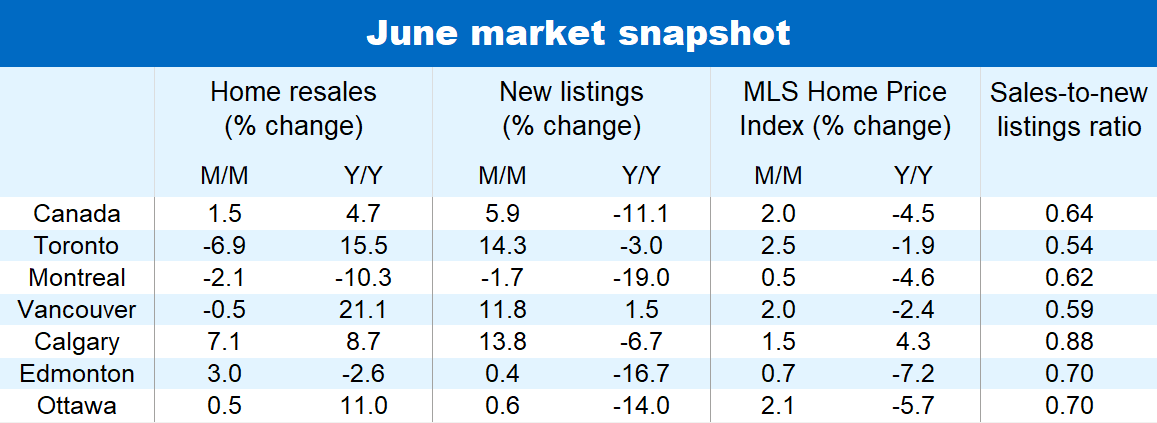

The spurt of real estate transactions this spring is tempering off. Home resales increased just 1.5% in June across Canada, marking a sharp deceleration from the (surprisingly) strong 16.3% advance over April and May. The Bank of Canada resuming its rate hike campaign and unexpectedly solid price gains in some markets this spring no doubt have dampened buyers’ enthusiasm by a few notches.

At least supply is crawling back up. New listings grew faster than sales for the second-straight month in Canada—up 5.9% m/m in June. A lot more supply is needed to bulk up historically-low inventories though. Buyers still face a scarcity of options in the majority of markets, tilting the scale in favour of sellers.

So for now home values continue to appreciate at a rapid clip. The national composite MLS Home Price Index jumped by a sizable 2.0% m/m—matching the May increase and slightly surpassing the 1.9% rise in April. But any further loosening in demand-supply conditions is bound to moderate the pace. We expect higher interest rates to trim the purchasing budget of many buyers.

June activity was a mixed bag across the country

For the first time in about a year, local market trends diverged last month. Home resales generally continued to rise m/m in British Columbia (except Vancouver), Alberta, Manitoba, Nova Scotia and Newfoundland; while they stalled in Saskatchewan and Quebec (including Montreal); and fell in Ontario (including Toronto), New Brunswick and PEI. New listings picked up in most regions—significantly so in Vancouver (up 11.8% m/m), Calgary (up 13.8%) and Toronto (up 14.3%)—though fell slightly in Manitoba, Quebec and New Brunswick.

Price gains remain broadly based

The vast majority of markets are still tight despite last month’s sales divergence. This maintains strong, broad-based upward pressure on property values at this stage. Local MLS HPIs rose more than 2% m/m in June for the most part in British Columbia and Ontario, and more than 1% in Alberta, New Brunswick and Nova Scotia. Gains were more subdued (generally less than 1%) in Saskatchewan, Manitoba and Quebec.

More muted price appreciation on the horizon in Vancouver and Toronto?

That said, sizable increases in new listings and stalled or declining resales last month in Vancouver and Toronto have considerably eased the tightness in demand-supply conditions in those markets. Their respective sales-to-new listings ratio has returned to a balanced setting. If sustained, we would expect this to moderate to rate of price appreciation in the period ahead.

Spring burst has likely run its course

We believe the slower pace of resales growth in June marks a shift in Canada’s market recovery. The strength of this spring’s rebound, in our view, wasn’t sustainable—especially in light of the Bank of Canada turning up the screw a couple more times, further raising the bar for potential buyers. We expect the overall trajectory to be flatter through the remainder of 2023, as buyers contend with very challenging affordability conditions and an expected recession. This would set aggregate prices on a more moderate appreciation path.

See PDF with complete charts

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More