Monthly Housing Market Update

Highlights:

- Home resales rebounded in June: Easing in social-distancing measures produced a quicker-than-expected recovery in home resales in June. Sales increased 63% from May, and were up 15% year over year. The year-over-year gain benefited from 2 additional weekdays this June relative to last.

- New listings continued to rise in June, but less than resales: New listings rose another 50% in June after surging 66% in May from April’s trough. In June, listings climbed back to within +90% of pre-shock February levels on a seasonally adjusted basis. The sales-to-new listings ratio bounced back to 0.64 after slipping to 0.58 in May.

- Prices holding up to-date: The composite price index rose 0.5% from May in June after holding flat the prior month. Prices were up 5.4% from a year ago, little changed from May. Price growth remained strong in Toronto and Montreal, but continued to decline from a year ago in Calgary.

- Despite more robust initial bounce-back, long-run housing market outlook still cloudy: Pent-up demand and supply over March and April, alongside lower interest rates and unprecedented government income supports, will maintain the floor for housing activity in the near-term. But longer-run risks remain given the possibility that labour market weakness outlives exceptional policy supports.

Resale activity continued to rebound impressively in June

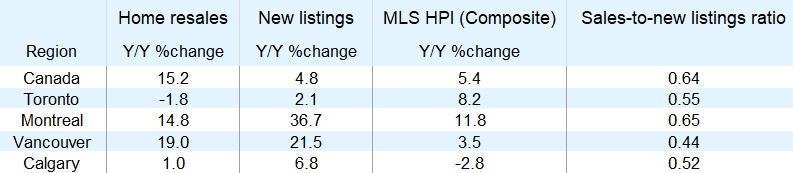

A significant bounce-back in home resales in June had already been flagged by improvement from local real-estate boards, but is nonetheless impressive given the scale of the downturn over March and April. The 15.2% year-over-year surge in resales benefitted from 2 additional week-days this June relative to a year ago. All major markets posted double-digit increases in resales from May – sales in Quebec and BC were substantially above year-ago levels (led by Montreal and Vancouver). Toronto sales were still slightly below year-ago levels, likely reflecting the region lagging in terms of early easing of containment measures.

Markets shifting to give sellers the upper hand – but not evenly by region

Canada-wide new listings rose by less than resales (+5.4% year-over-year). The resulting increase in the sales-to-listings ratio tilted supply/demand conditions more significantly in favour of sellers in June – the sales-to-listings ratio edged up to 0.64 from 0.58 in May. In Ontario the increase in home listings has been stronger resulting in the sales-to-listings ratio below the national average. And the ratio remained relatively low in Vancouver.

Low interest rates and policy supports keeping a floor under market near-term

The resilience of housing markets near-term is in sharp contrast to a labour market backdrop that, even with partial rebound over May and June is still exceptionally weak by historical comparison. But interest rates are also exceptionally low, household income supports (like CERB) have been unprecedentedly large, and the sharp pull-back in March and April almost certainly delayed transactions that would have occurred if not for containment measures. So part of the near-term bounce in June likely reflected the release of pent-up demand. Nonetheless, the early housing market recovery has been stronger than most expected, and it would not be surprising to see the momentum continue in July.

Yet longer-run outlook still clouded by uncertainty

The broader bounce-back in economic activity to-date appears to have been stronger-than-expected, but the pace and magnitude of the recovery going forward remains largely uncertain. That was one of the reasons the Bank of Canada signaled today that interest rates will stay low for the foreseeable future – but it also raises the risk that labour market weakness remains once past the expiry of mortgage deferrals and the phasing out of government support programs (including CERB) later this year. And disruptions to immigration flows could significantly weigh on housing demand relative to pre-shock expectations. We continue to expect the housing market to eventually soften once again – and for prices to decline modestly. But the near-term bounce-back in activity has been impressive nonetheless.

See PDF with complete charts

This report was authored by Senior Economist, Nathan Janzen, and Economist, Claire Fan.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More