Fall Economic Statement 2021

As advertised, today’s Fall Economic Statement was more fiscal update than mini-budget. It was mostly good news with Canada’s strong economic recovery and higher commodity prices boosting government revenue and trimming program expenditures relative to Budget 2021. New spending went to finishing the fight against COVID-19, helping BC recover from floods, and most significantly to advance reconciliation with Indigenous peoples. Positive economic and fiscal developments were enough to cover this new spending and reduce budget deficits throughout the government’s projections. The key debt-to-GDP ratio now peaks at 48% in the current fiscal year rather than 51.2% projected in Budget 2021, and falls to 44% by the end of the forecast horizon.

While these fiscal developments are clearly positive, today’s numbers feel like a placeholder ahead of what’s likely to be a more expansive budget in the spring. The Liberals campaigned on $78B in new spending, much of which didn’t show up today, and $25B in new revenue. The statement hinted the government will use some of its new-found fiscal room (i.e. a debt-to-GDP ratio that’s 4 ppts lower than previously projected) to “support Budget 2022 investments that will help boost long-term growth.”

We’re cautious on that last point, as we had to look pretty far down the list of campaign promises to find measures specifically targeting growth. In our recent report, The Great Canadian Restart, we laid out a six point plan for the federal government to set a new course for economic growth and business investment. We think innovation policy, climate and infrastructure funding, IP strategy, tax competitiveness, attracting talent and improving education and lifelong learning can help move the needle on Canada’s sluggish potential GDP growth. Today’s update shows the extent to which a stronger economy can improve the fiscal outlook, which we hope will motivate the government to focus on measures that grow the economy on a sustained basis. A debt-to-GDP ratio that’s set to remain well above pre-pandemic levels, and a rising interest rate environment, underscore the need for fiscal prudence and growth-targeted spending.

More details on the updated fiscal projections and new spending:

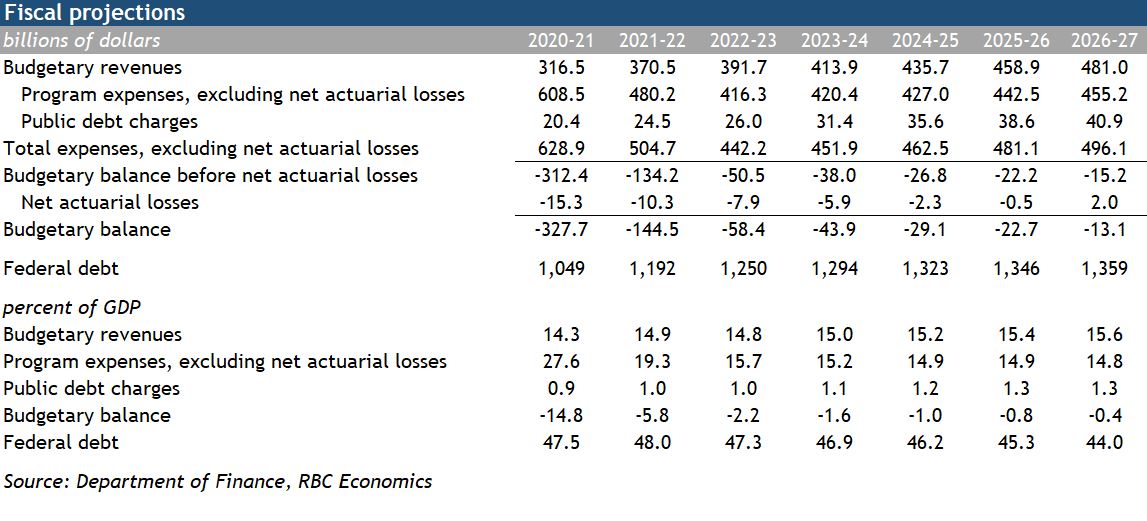

The government unveiled $71B in net new spending over seven years, most of which shows up in the current ($28B) and upcoming ($13B) fiscal year. With positive economic and fiscal developments to the tune of $127B, the government is projecting smaller-than-expected deficits—$27B lower in the past fiscal year and $10B lower in the current fiscal year. But it’s not until FY24/25 that the government’s budget deficit falls to pre-pandemic levels of less than 1% of GDP—a sluggish return to normalcy for an economy that’s expected to be operating close to full capacity in the upcoming fiscal year.

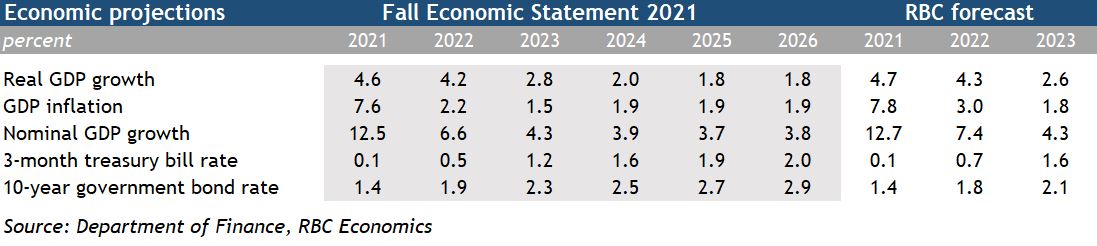

Positive economic and fiscal developments partly reflected stronger revenue, particularly income taxes, in the past fiscal year which carries forward through the government’s projections. Nominal GDP—a broad measure of the government’s tax base—is now projected to grow 12.5% in 2021 (up from 9.5% in Budget 2021), most of which was front-loaded and delivered a revenue surprise in late FY20/21. Re-estimating the cost of some early pandemic supports also significantly reduced program spending in the past and current fiscal year. But higher spending on inflation-linked programs will add to program spending in the coming years, and public debt charges will be slightly higher than previously thought.

Between measures unveiled today and a number of announcements since Budget 2021, new spending ate up more than half of those positive economic and fiscal developments. The biggest item, some details of which were leaked yesterday, is $40B to “address past harms and discrimination related to First Nation child welfare,” though when subtracting funds already committed the new spending totals $24B ($10B of which was booked last fiscal year). In the current fiscal year the government is provisioning $4.5B for Omicron response and $5B for natural disaster recovery in BC.

Other key spending announcements saw $26B over six years to finish the fight against COVID-19. That includes nearly $12B for vaccine procurement and pandemic preparedness, COVID-19 therapeutics and rapid tests, and $14B in support programs for businesses and households (mostly extensions and new, tapered programs that have already been announced). A separate $11B went to other policy actions taken since Budget 2021, about $8B of which fell into the “non-announced measures” category. The federal government’s COVID-19 response now totals $346B in direct spending plus another $166B in tax and payment deferrals and credit support.

Projections from Fall Economic Statement 2021

Josh Nye is a senior economist at RBC. His focus is on macroeconomic outlook and monetary policy in Canada and the United States. His comments on economic data and policy developments provide valuable insights to clients and colleagues, and are often featured in the media.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More