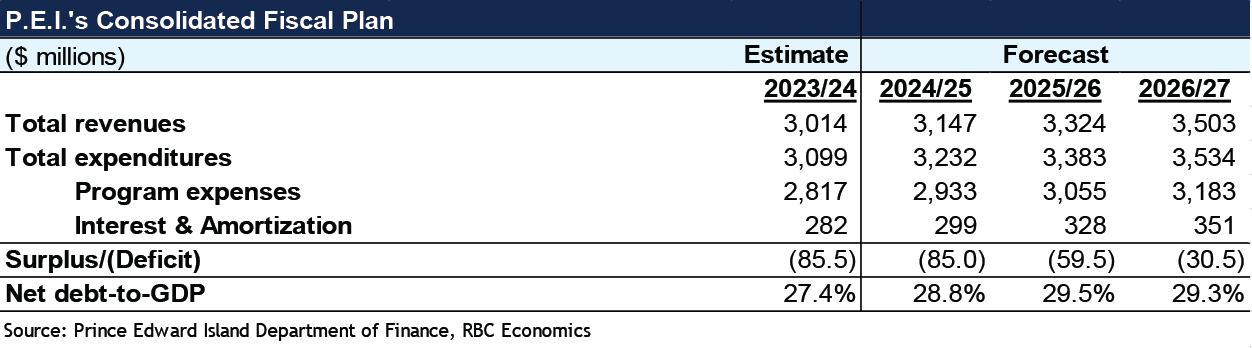

- P.E.I. deficit to linger around the year-ago level ($86 million) in fiscal 2024-25 with no plans for balance over the fiscal planning horizon.

- Higher revenue growth in the out years of the fiscal plan will narrow—but not eliminate—the deficit by fiscal 2026-27.

- Continued influx of migrants keeps healthcare and housing investments a priority.

- Near-term net debt-to-GDP ratio anticipated to improve from previous expectations, but still set to hit 29.3% by the end of the fiscal plan.

A ‘stay the course’ fiscal plan

P.E.I.’s latest budget didn’t include many surprises this year. The province’s bottom line is set to linger around an $86 million shortfall—remaining largely unchanged from fiscal 2023-24—before shrinking to a deficit of $31 million in fiscal 2026-27.

Government spending growth is set to normalize down to 4.4% in fiscal 2024-25, staying around this pace for the remainder of the forecast horizon after an outsized jump in expenditures last year. Increases to healthcare (8.7%) and housing (16%) are set to make up a sizable share of the operating expenditure increase like last year’s budget.

The influx of prime career-aged individuals over the last few years has done wonders for the province’s labour market, leaving its mark on the province’s income statement as record high rates of employment growth translate into higher personal income tax inflows.

P.E.I. plans to peg expenditure growth at revenue growth (4.4%) this fiscal year, but higher provincial income in the out years of the plan are set to narrow (though not eliminate) the deficit by fiscal 2026-27. The lighter provincial debt load should shift the province’s net debt-to-GDP ratio to a downward trajectory starting in fiscal 2025-26, reaching 29.3% the following year.

Accommodating a growing population

Health-related expenditures accounted for the largest chunk of this year’s budget at $1.1 billion—roughly $90 million more (up 8.7%) than health expenditures in fiscal 2023-24. The notable boost included $10 million for more patient medical homes and $10 million in new funding for the island’s medical school. The province will also allocate $7.1 million in new spending towards support for more doctors and residency seats and $6.2 million towards recruitment of healthcare professionals.

New housing and affordability measures included $10 million to grow and maintain the inventory of affordable housing units and $6.7 million in tax rebates (HST and property) for builders constructing new multi-unit residential buildings.

The province will also be rolling out a new P.E.I. children’s benefit starting January 2025. The monthly payments are set to cost $4.4 million annually to help families with the costs of raising children.

Overall, new operating program expenditures are set to see an increase of 4.4%—on par with revenue growth.

Population growth boosts provincial revenue

The wave of in-migrants is expected to keep revenues growing at a good clip, up more than 4% annually over the course of the plan. A continued implementation of tax system changes are set to take hold in January 2025 and include increases to the basic personal amount (from $13,500 to $14,250) as well as raised thresholds for each of the first four tax brackets. Changes to the tax system are expected to cost the government $15 million in forgone revenue.

Investing in housing and healthcare

P.E.I’s capital budget kept healthcare and housing investments at the forefront of its plan to meet the needs of a fast-growing population (3.9% in 2023). The capital plan includes an investment of $1.3 billion over five years with $369 million planned for fiscal 2024-25.

About $167 million over five years will go towards the ongoing design and construction of the Mental Health and Addictions Campus project and $126 million over five years will be for improvements to healthcare facilities across the island.

Another $176 million each over five years will be put towards 95 additional social housing units and expansions and replacements for schools.

Debt-to-GDP creeping up from decades low

We expect nominal GDP to be less volatile over the next two years as inflation stabilises. But even so, the province’s debt burden is expected to get worse before it gets better. Creeping up from a 30-year low, the province’s net debt-to-GDP is still projected to peak at 29.5%—but in fiscal 2025-26 (a year later than last year’s plan). In budget 2024. P.E.I. renewed plans to bring net debt-to-GDP down to 29.3% by the end of the fiscal planning horizon. This should keep the province faring relatively well compared to other Canadian provinces.

Rachel Battaglia is an economist at RBC. She is a member of the Macro and Regional Analysis Group, providing analysis for the provincial macroeconomic outlook and budget commentaries.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More