Proof point: The timing and magnitude of interest rate cuts from the Bank of Canada will be determined by domestic economic and inflation conditions and not the gap in monetary policy with the U.S. Federal Reserve or the value of the Canadian dollar.

- A sharply underperforming Canadian economy argues for more urgency to start moving interest rates lower than in other countries. We expect the BoC to cut interest rates earlier and more than the Fed this year.

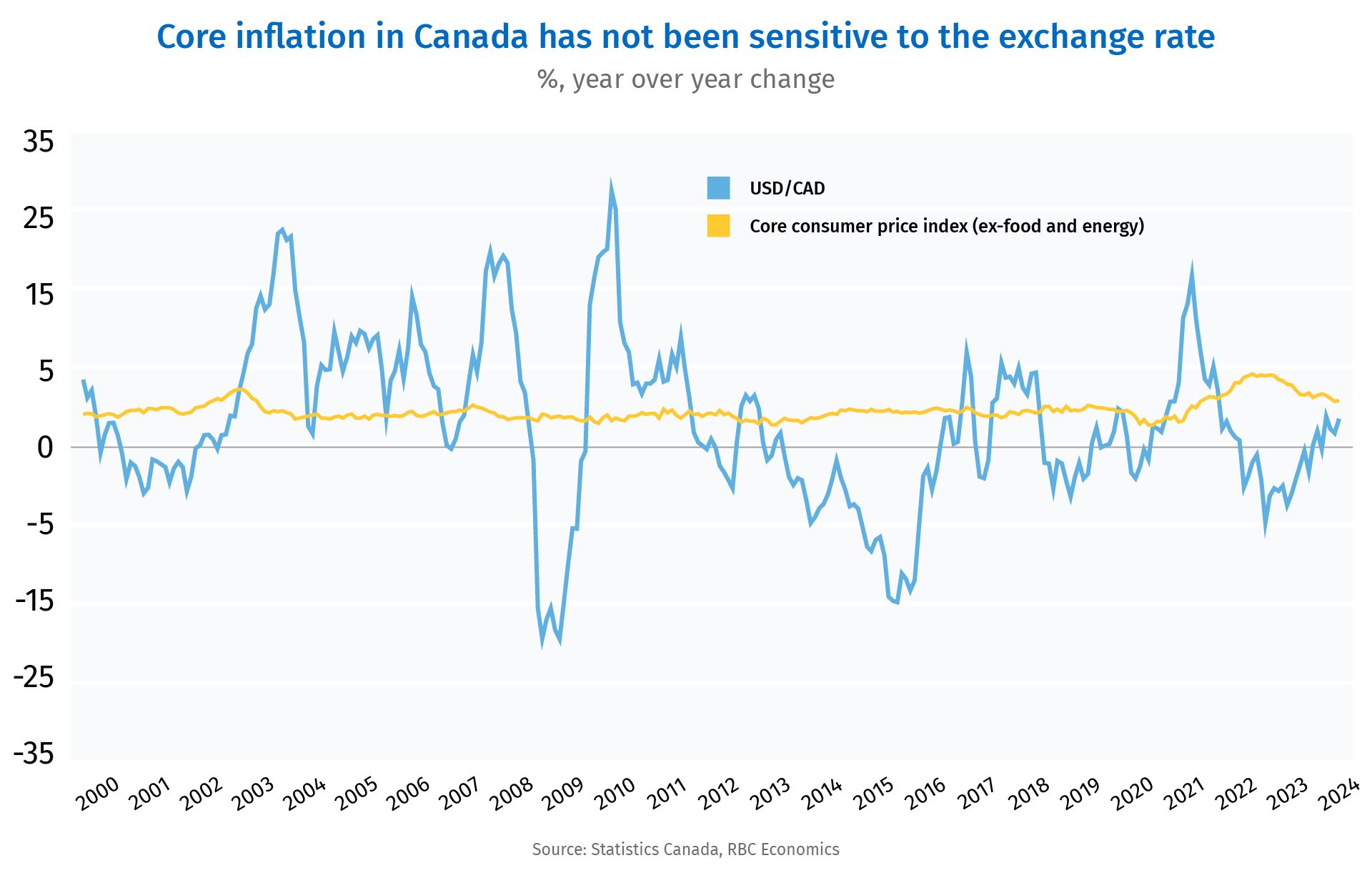

- A widening gap between Canadian and U.S. interest rates will mean a weaker Canadian dollar than otherwise would have been the case and higher prices for imported consumer goods.

- But USD/CAD movements have not moved the needle on broader inflation trends in the past. More than half of Canadian consumer spending is on services. Goods are imported from a variety of partners and not just the U.S. The end consumer prices of goods also depend on domestic transportation costs that are falling as the economy softens.

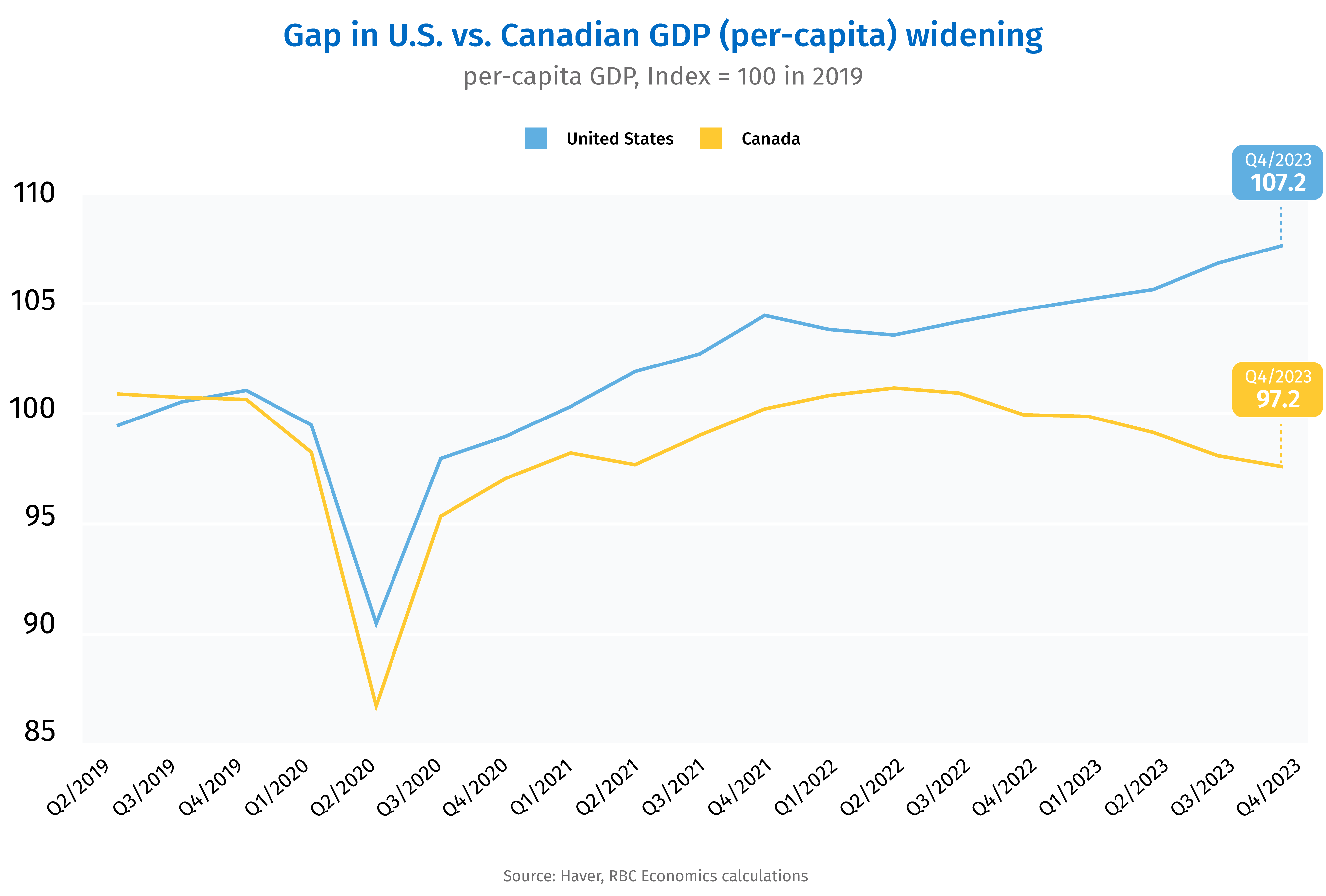

The Canadian economy is sharply underperforming global peers—particularly the United States—in the wake of earlier aggressive interest rate hikes. Surging population growth has propped up measures of total economic activity, but that is masking underlying softness when measured on a per-person basis.

Since 2019, Canadian gross domestic product per capita has declined 2.8% versus a 7% increase in the U.S. That marks the largest underperformance of the Canadian economy versus the U.S. over a comparable period since at least 1965. The unemployment rate in Canada has increased by 1.3 percentage points since the summer of 2022 compared to just 0.4 percentage points in the U.S.

The divergence indicates the BoC should begin cutting interest rates earlier (and faster) than the Fed. We look for a first cut in June compared to the first expected move from the Fed later in December. We anticipate 100 basis points worth of interest rate cuts from the BoC by the end of this year versus just one 25 basis point cut from the Fed.

Markets have been cautious about “pricing in” a significant gap in expectations between interest rates set by the Fed and other central banks, but the reality is, historically, monetary policy responses have varied significantly across borders. Indeed, that’s exactly why independent central banks exist. A floating exchange rate is what enables interest rate policies to diverge across regions and acts as a shock absorber for the economy by increasing net trade.

Weaker Loonie risks shouldn’t dissuade BoC from cutting first

All else equal, a widening gap in central bank policy rates that we expect is more negative for the Canadian dollar than would otherwise be the case. A weaker Canadian dollar will increase the cost of imports at a time when the central bank has been working hard to get inflation under control – with prices adjusting particularly quickly for products like gasoline, fresh fruits and vegetables.

But for a large geographically diverse country like Canada, end consumer prices also depend a lot on the added cost of getting a product on store shelves after it crosses the border and the pricing practices of domestic wholesalers and retailers. Imports from regions other than the U.S. aren’t also necessarily impacted by changes in the CAD/USD exchange rate.

A weaker economy makes it more difficult to pass increased import prices to customers and domestic transportation costs have trended persistently lower. The cost of general freight trucking, for example, is running around 6% below year-ago levels.

Canada still trades disproportionately with the U.S., but when it comes to final consumer goods imports, a relatively larger share (65%) comes from elsewhere. Added to this, the Canadian dollar doesn’t look as weak when measured against other currencies. Almost 20% of consumer goods imports and 30% of electronics imports come from China. China’s economy has also looked wobbly due to an ongoing pullback in the property market, and the Canadian dollar has not depreciated as much against the renminbi.

Domestic demand, inflation expectations will be primary inflation driver

Broadening the scope of consumption outside of just goods, more than half of overall household spending in Canada is on services. For these services, it is domestic demand and inflation expectations that will set the pace of price growth. Even in the U.S. where inflation concerns have been resurfacing, most of the concerning uptick has come from domestic services rather than tradeable goods.

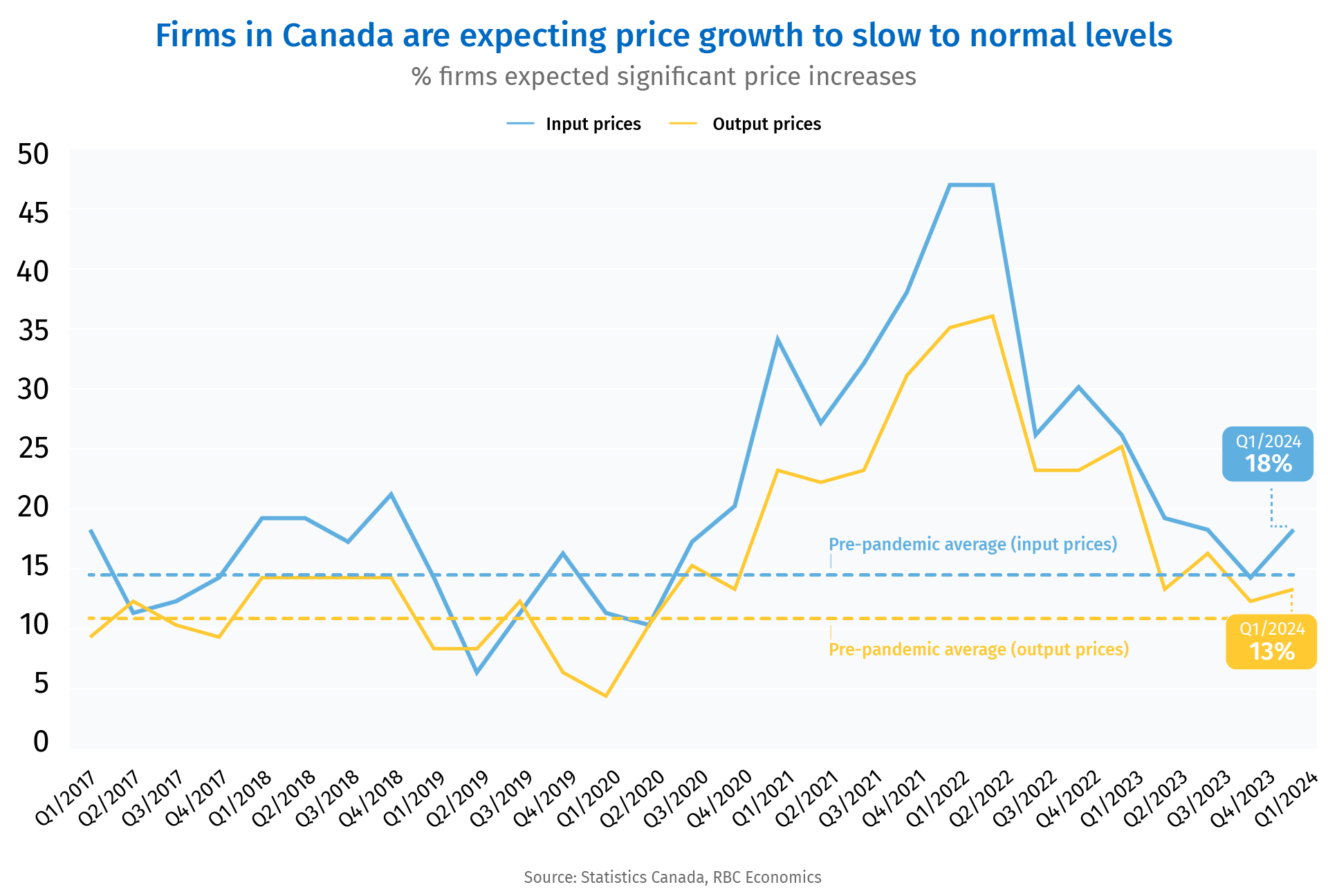

A softening economy— which has happened in Canada substantially over the last year and a half—makes it more difficult for businesses to pass on price increases and stay competitive. The BoC’s Business Outlook Survey showed that businesses have been raising prices less frequently, while the size of price adjustments has also declined as consumer demand softens. Wage growth has also shown signs of moderating as hiring demand falls (job openings are down more than 25% from a year ago) and the unemployment rate rises.

Commodity price volatility remains a risk for inflation going forward, and oil prices have risen in recent months. But with domestic demand expected to stay soft through much of 2024, and longer-run inflation expectations are still well-anchored in Canada. We expect overall inflation pressures will keep receding, and that will drive BoC to cut the overnight rate this year, regardless of actions from the Fed.

Nathan Janzen is an Assistant Chief Economist, leading the macroeconomic analysis group. His focus is on analysis and forecasting macroeconomic developments in Canada and the United States

Claire Fan is an economist at RBC. She focuses on macroeconomic analysis and is responsible for projecting key indicators including GDP, employment and inflation for Canada and the US.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More