- Fallout from the upheaval in U.S. regional banks has further squeezed borrowers south of the border.

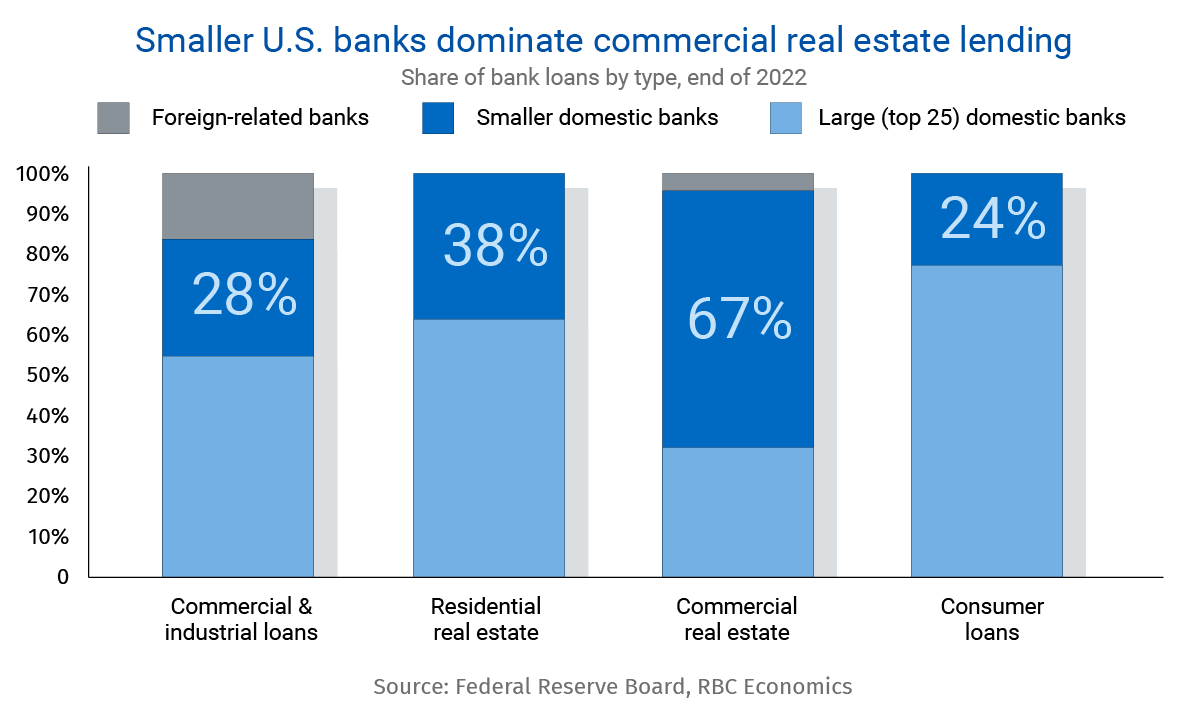

- This is a key concern for commercial real estate investors, since smaller U.S. banks are particularly active in this space.

- American companies are less reliant on bank loans than they are on other market-based funding sources like bonds and equities.

- But higher interest rates, wider spreads, and weaker equity markets have made those sources less attractive as well.

- Bottom line: The U.S. Federal Reserve’s aggressive tightening cycle has made borrowing tougher across the board. This will hinder American businesses looking to invest in operations—at a time when labour shortages make these productivity-enhancing moves critical. We expect business investment to remain sluggish this year but look for a modest recovery in 2024.

A wave of bank failures created a ripple effect in U.S. lending

Commercial lending contracted sharply in March as troubles at several U.S. banks prompted a decline in deposits. Intervention by regulators and the Fed helped calm the storm and both lending and deposits have stabilized in recent weeks.

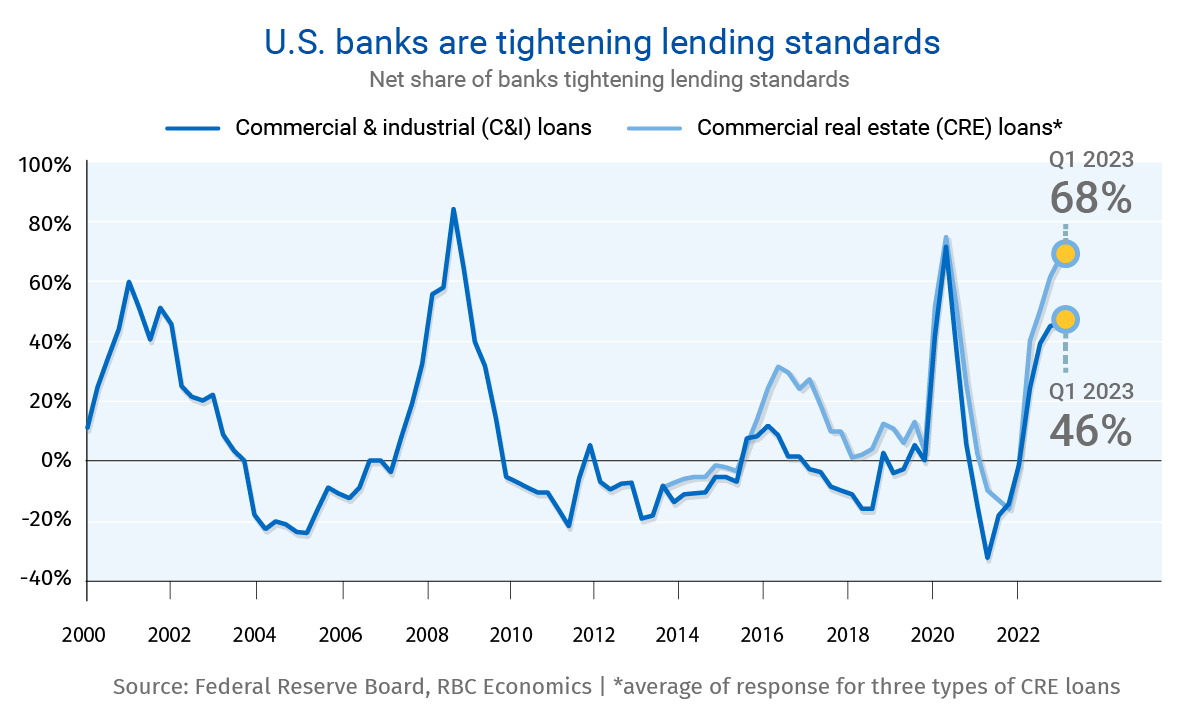

Nevertheless, a recent Fed survey shows banks continued to tighten credit conditions in the first quarter, charging higher spreads over their funding costs and greater premiums for riskier loans. Lenders expect conditions to tighten further over the rest of the year. Mid-sized and smaller banks in particular cited funding costs, liquidity concerns and deposit outflows as reasons for tightening. Demand for new commercial and industrial (C&I) and commercial real estate (CRE) loans has also flagged.

This squeeze comes as the excess corporate cash that accumulated during the pandemic erodes. A dash for liquidity, government support programs, and later, a surge in corporate profits all helped businesses build up (by our math) nearly US$1 trillion in excess cash and deposits. But with some of that money being returned to shareholders and corporate profits now declining, just US$180 billion remained on corporate balance sheets at the end of last year.

Market funding is also losing its lustre

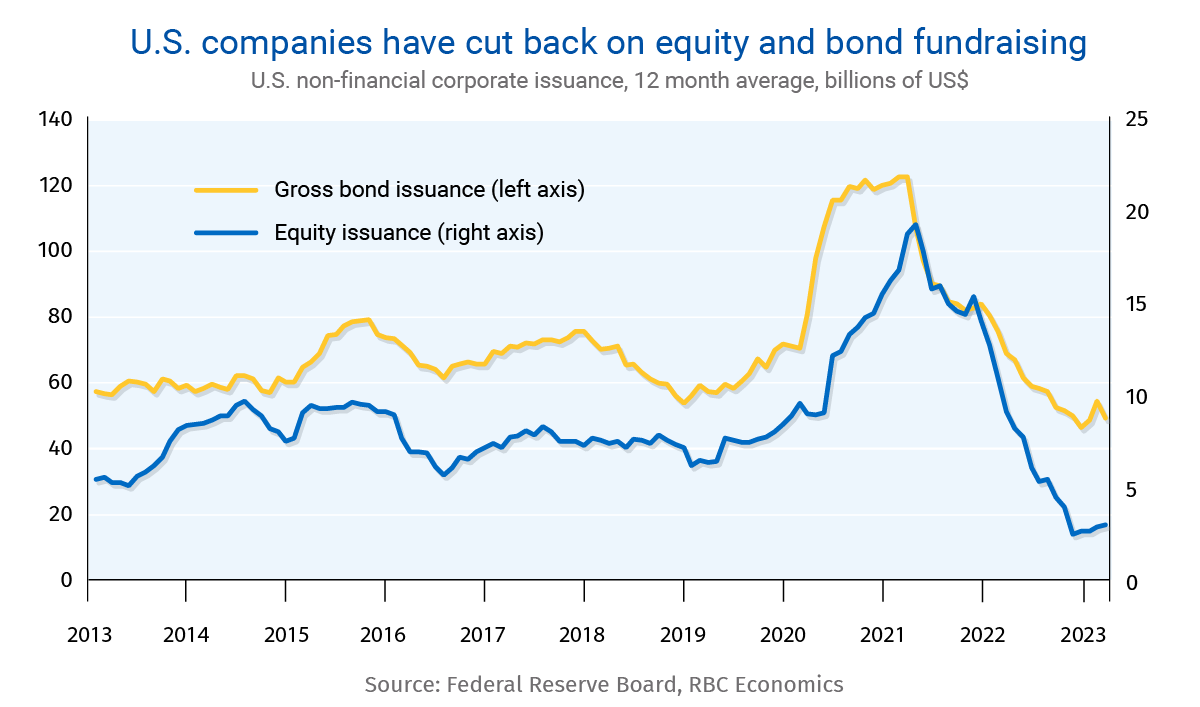

U.S. companies rely more on equity and debt financing than bank lending, relative to other advanced economies. But businesses haven’t seen market-based financing as a particularly attractive option over the past year. Gross bond issuance by non-financial corporates fell to an 11-year low in 2022, and new equity issuance fell to a 22-year low.

Some of the decline likely reflects lower financing needs after a surge in the first year of the pandemic when financial conditions were more accommodative. But a significant selloff in equity markets last year, a sharp rise in interest rates, and wider corporate credit spreads all have taken the shine off market-based fundraising.

Banking turmoil hasn’t had a lasting impact on market financial conditions. Equities have performed well, further widening in credit spreads has been relatively modest, and Treasury yields have fallen sharply. After showing some tightening in March, the Chicago Fed’s National Financial Conditions Index is back to late-February levels. Bond and stock issuance remained subdued in March, but it doesn’t appear market volatility caused a significant, further pullback.

Concerns swirl around commercial real estate and business investment

Smaller U.S. banks (i.e. those outside the 25 largest) account for two-thirds of commercial real estate lending. These banks trimmed CRE loans in the wake of banking turmoil in March, adding to already significant post-pandemic challenges in the sector. Though industrial space has performed well, a slow return to work and increase in e-commerce sales has hurt valuations in the office and retail segments. With significant refinancing needs this year, investors are concerned that CRE could be the next source of financial instability. Real estate investment trusts (REITs) are down nearly 20% since the Fed began raising interest rates, making them the worst performing sector in the S&P 500 over that period.

With both bank and market financing becoming less attractive, capital spending has softened. Business investment in structures and equipment was flat over the past year. Software and R&D investment, which are less interest rate sensitive, have performed better.

Given an uncertain demand outlook—we continue to expect the U.S. economy to slip into a mild recession in the coming quarters—and tightening credit conditions, business investment is expected to decline over the remainder of 2023. But as in Canada, chronic, structural labour shortages are pushing the future cost of not investing in operations higher.

We think those considerations will keep U.S. business investment from collapsing this year—and help underpin a recovery as financial conditions ease in 2024.

Josh Nye is a senior economist at RBC. His focus is on macroeconomic outlook and monetary policy in Canada and the United States. His comments on economic data and policy developments provide valuable insights to clients and colleagues, and are often featured in the media.

Proof Point is edited by Edited by Naomi Powell, Managing Editor of RBC Economics & Thought Leadership.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More