- The shakeup in Canada’s post-pandemic labour market saw nearly 200,000 women stream into jobs involving less in-person contact—and often significantly higher wages.

- This is far more than we would expect based on women’s pre-pandemic share of employment in these jobs.

- These shifts added $9 billion in additional household wage income for women and accounted for 15% of the total boost to their earnings during the pandemic recovery.

- Yet women still reaped smaller wage gains than men who made similar moves. This is likely a result of more men moving into senior management roles.

- The bottom line: Canadian women disproportionately powered the workforce shift into low-contact, higher-paying and higher-skilled jobs. Though this has improved their earnings, a wage gap will remain until equal representation in senior management is acheived.

Women three times as likely to leave high-contact jobs during crisis

Women didn’t just flood back into the workforce following pandemic lockdowns. Many of them changed the nature of the work they do—moving into higher-paid and more productive roles.

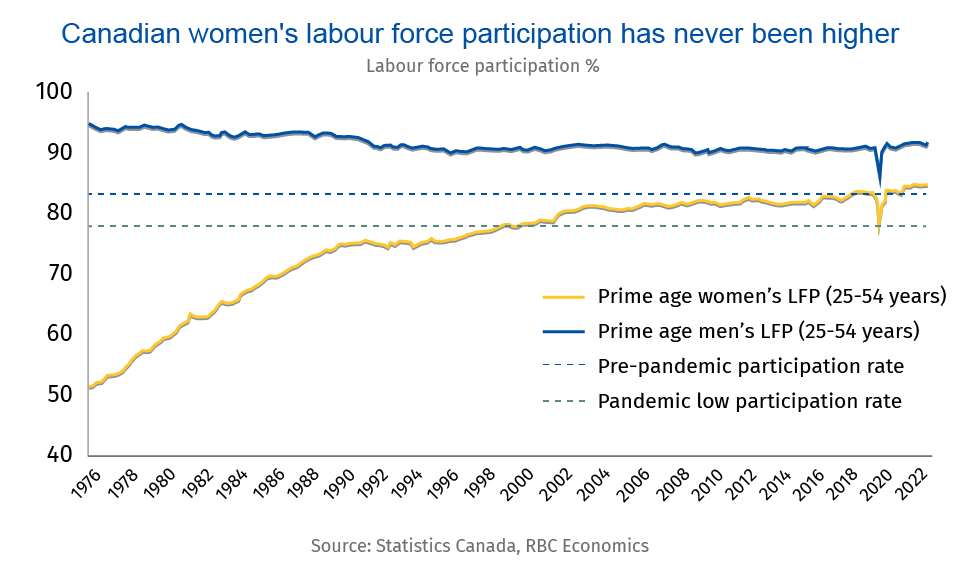

Labour force participation among working women hit a record high of 85.6% in January. That’s a dramatic u-turn from the onset of the crisis, when participation plummeted to its lowest level in over 30 years. Aided by more flexible work arrangements and affordable childcare, this rebound also saw a wave of women take steps to advance or reshape their careers. This is particularly true for those working in high-contact sectors, like hospitality services, that were heavily affected by the crisis. These businesses—many of which were forced to temporarily close due to public health measures—experienced an exodus of roughly 178,000 employees.

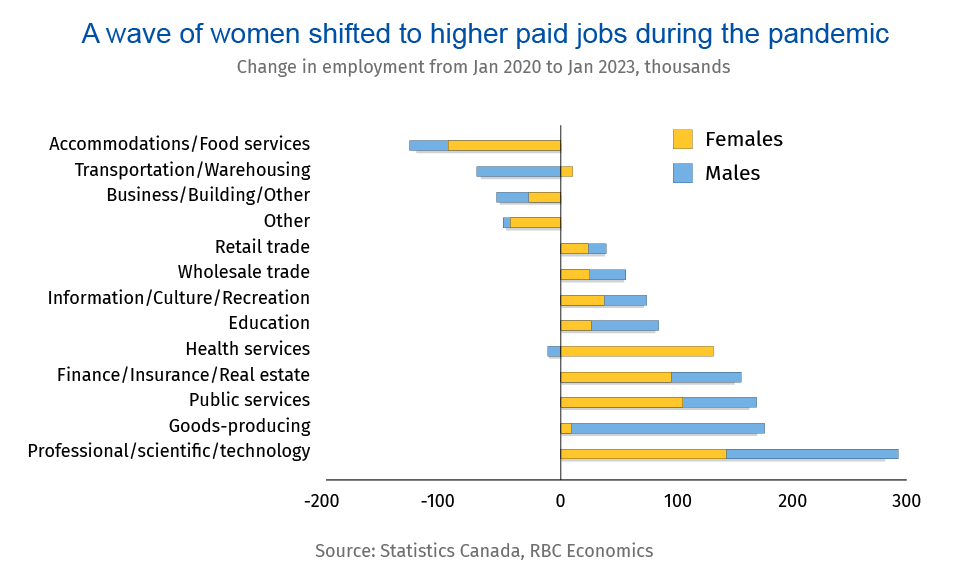

Most of them were women. Despite filling ~55% of jobs in these sectors before the pandemic, women have made up 80% of the labour force movement away from them. In all, nearly 140,000 women have now streamed out of these jobs.

These jobs raised women’s incomes, but men’s gains were higher

At the same time, women accounted for more than half of the workers who started jobs in low-contact industries (including professional, scientific, technical services and finance, insurance, and real estate). More than three quarters of the women who shifted into these sectors had at least one post-secondary degree.

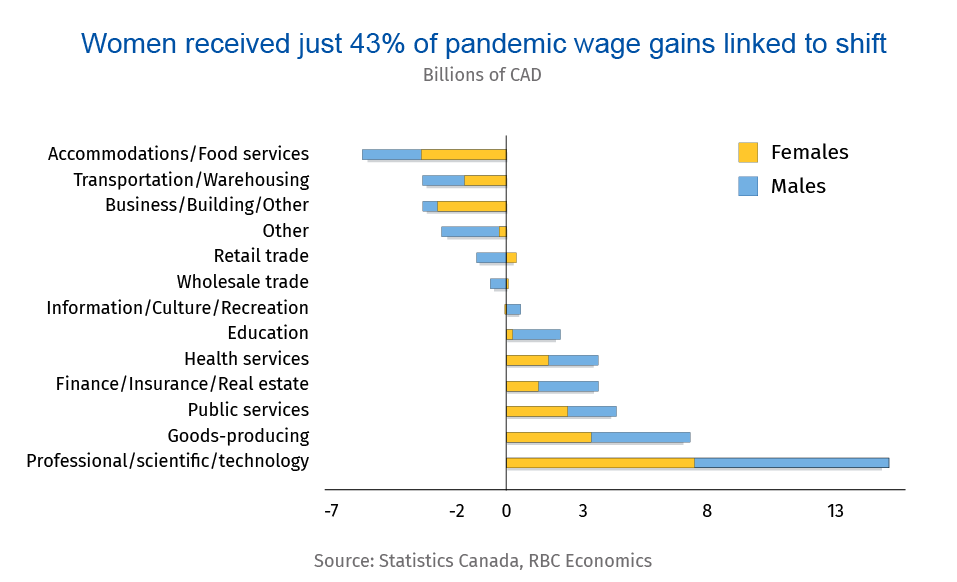

Women who made this change have been rewarded with higher earnings. Of the $21 billion in added income created by the labour force shift to higher paid sectors over the pandemic, $9 billion (or 43%) went to women. This accounted for 15% of the total boost to women’s earnings during the pandemic recovery.

Yet men reaped much higher wage gains. For instance, though women accounted for 60% of jobs created in finance, insurance, and real estate alone over the course of the pandemic, they realized less than half (46%) of the wage increases attributed to movement into this sector. In fact, women (with degrees) in finance, insurance, real estate and rental leasing earn roughly 85 cents for every dollar earned by men. And the wage gap in this industry is most pronounced among the employees with the highest education levels.

Women are far less likely to be senior managers

What could be the cause? Likely the positions that women occupy. On average, across all sectors, men made up over two-thirds of senior leadership positions even though the number of women and men in the labour market are equal. Among parents, women’s labour market outcomes are even worse. Fathers with young kids are much more likely to be senior managers, filling 10% of these roles while mothers make up less than 3%.

While affordable childcare stands to boost women’s labour force participation, ensuring adequate representation of women in senior leadership roles is also critical.

Carrie Freestone is a member of the macroeconomic analysis group and is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

Proof Point is edited by Naomi Powell, Managing Editor of RBC Economics & Thought Leadership.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More