- Consumers have been hit by higher living costs – spending per person has declined 2% since Q2 2022 and the household financial obligations ratio has reached record highs.

- Headwinds will continue to build this year with households, particularly in the bottom 60% of the income scale, dipping into savings or borrowing more to make ends meet.

- Still, the adjustment to higher interest rates may be closer to the end than its beginning.

- With central banks looking at pivoting to interest rate cuts, the ratio of household debt payments to income should rise less this year than in 2023 as price growth for essentials slows.

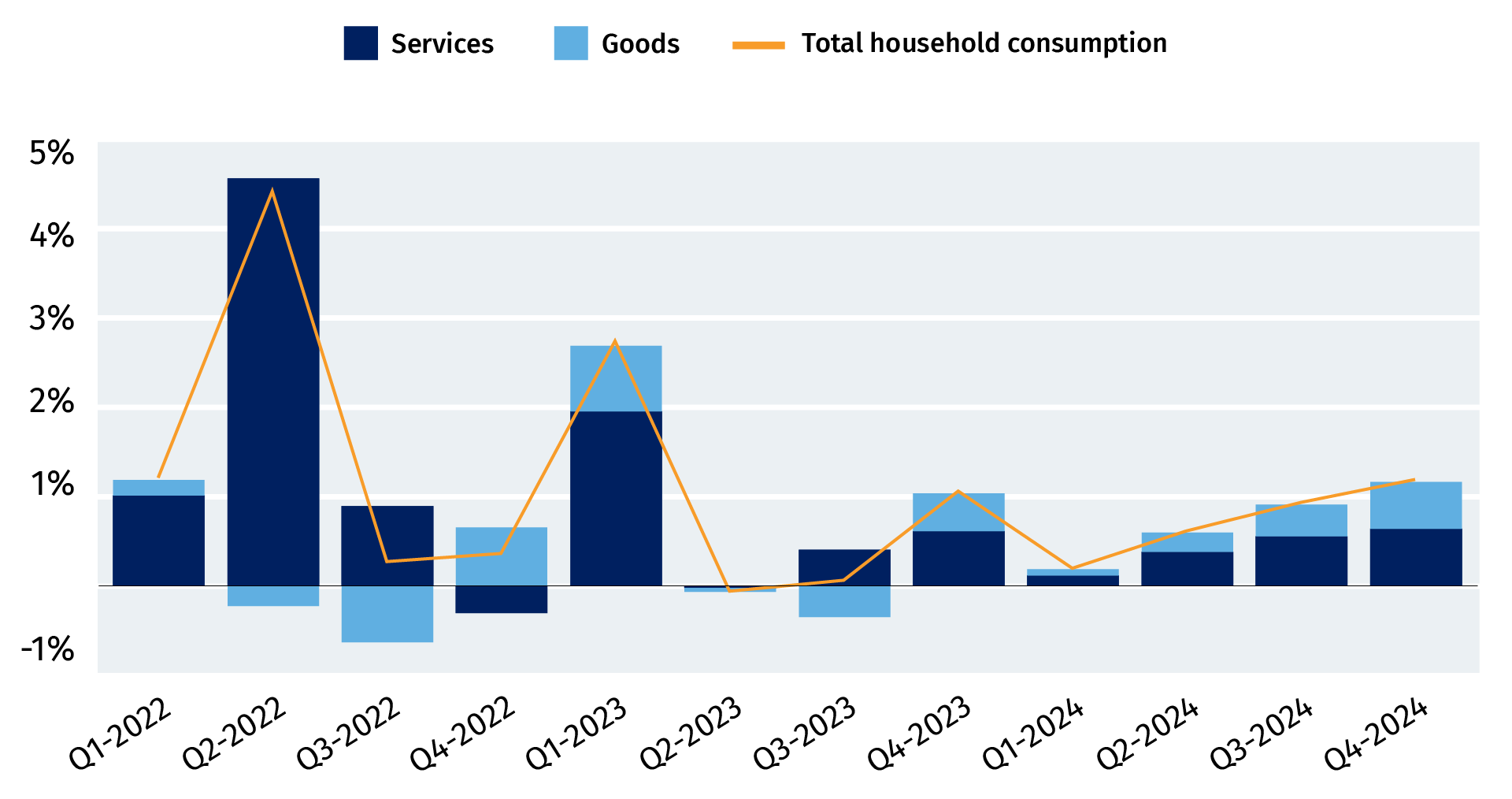

The Bottom Line: 2024 is still likely to be a challenging year for Canadian consumers as higher interest rates continue to trickle through the economy and push debt payments higher. But if central banks start to ease monetary policy by mid-year as expected, there is reason to believe that consumer spending headwinds will start to ease over the second half of the year.

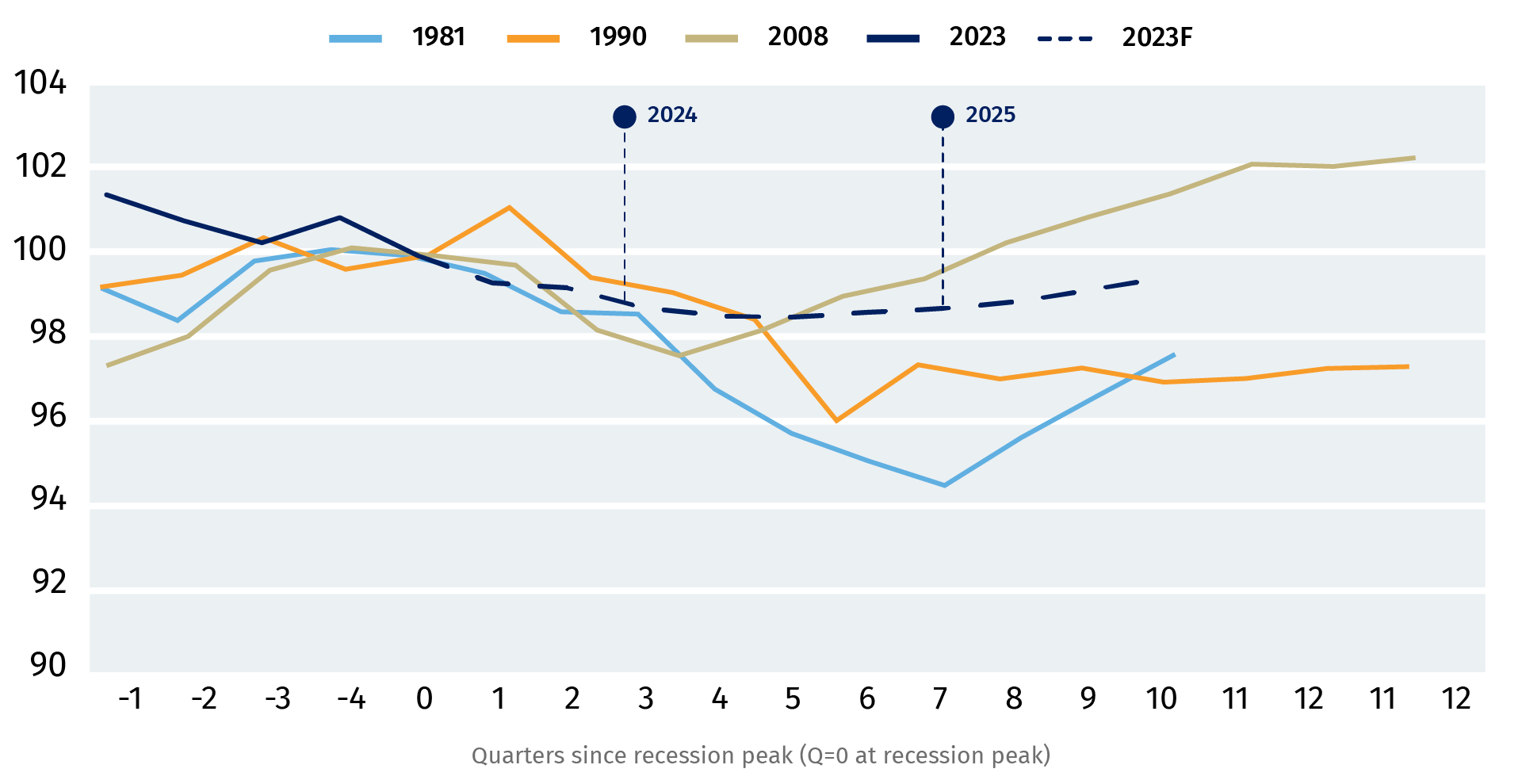

Canadian per-capita consumption still softening

Household consumption (real) per capita index (100=recession peak)

Source: Statistics Canada, RBC Economics

Cash-strapped Canadians kill post-lockdown spending surge

Higher interest rates and prices have been taking a toll on Canadian consumers. Surging population growth is helping to prop up measures of total spending, but on a per-capita basis, increases in the cost of living have been outstripping household purchasing power growth. While per capita household income rose by 2.8% from Q4 2022 to Q3 2023, debt payments (including interest on mortgage and consumer credit and obligated principal payments) rose by a much higher 6.4% in the same period.

Renters didn’t fare much better while homeowners grappled with mortgage renewals. Higher mortgage interest costs faced by landlords, a lack of purpose-built housing supply in Canada’s largest cities, and soaring demand for residential rental units have driven rental costs higher. Rents rose by over 4% from Q4 2022 to Q3 2023. Canada’s financial obligations ratio—which represents debt servicing costs along with rent and utilities payments—hit a record high 22% by the middle of 2023. This measure hit a decades-low 19% during the pandemic.

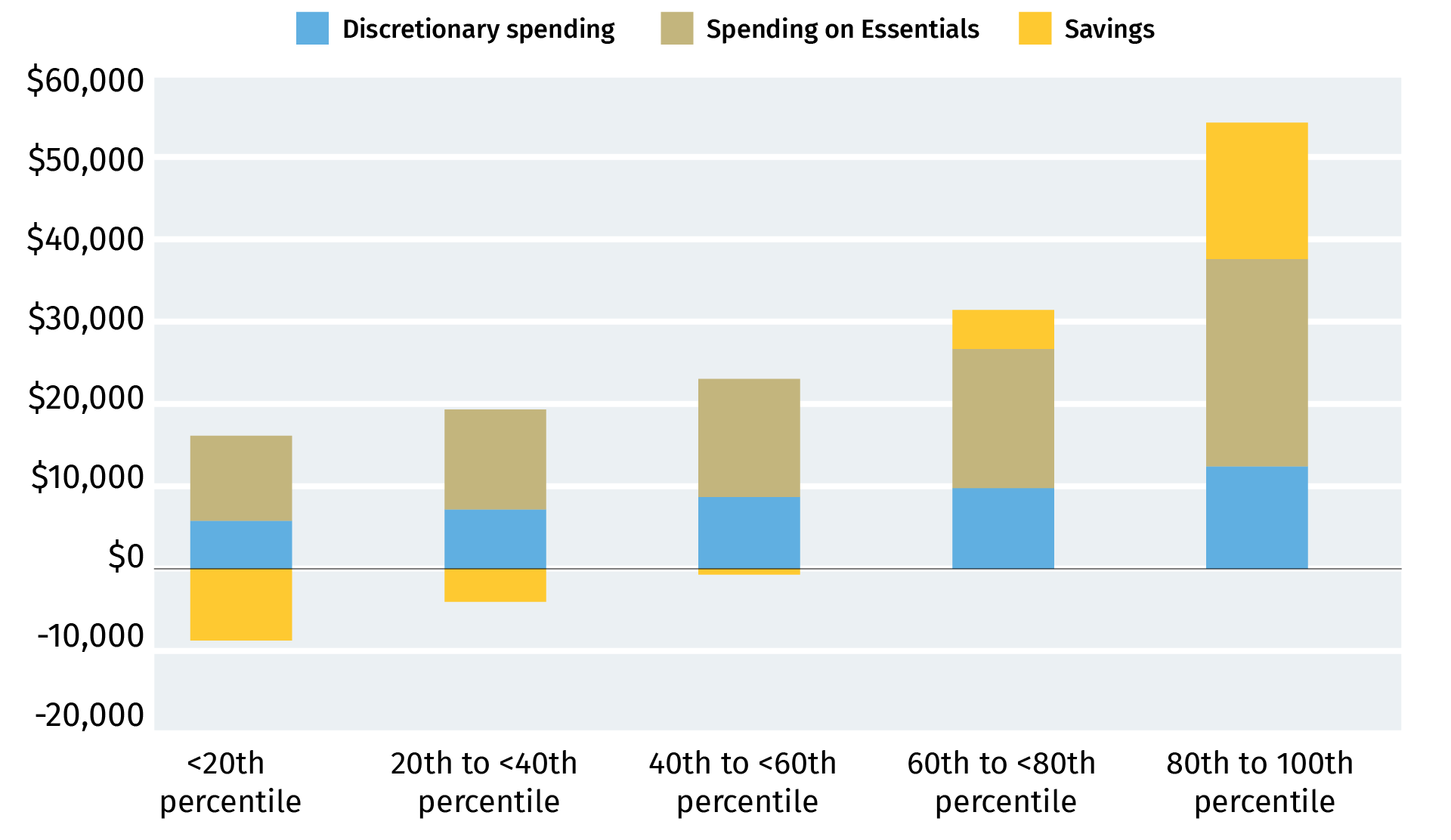

Only top 2 income brackets saved in Q3 2023

Q3 consumption and savings by income quintile: value per household, CA$

Source: Statistics Canada, RBC Economics

Low-income earners hit the hardest

Households are still sitting on high levels of savings accumulated during the pandemic, but that cash buffer is not evenly distributed. Canadians in the lowest income brackets— those who devote most of their take-home pay to essentials—have been hit the hardest. Canadians still spent less than what they earned as of Q3, but that came from households in the top 40% of income distribution. Canadians in the first- and second-income quintiles will typically dissave, meaning they consume more than they earn. These pressures intensified in 2023. Middle-income Canadians (earners in the 40th to 60th income percentile) —a group who typically saved at least a portion of their earnings—also dissaved.

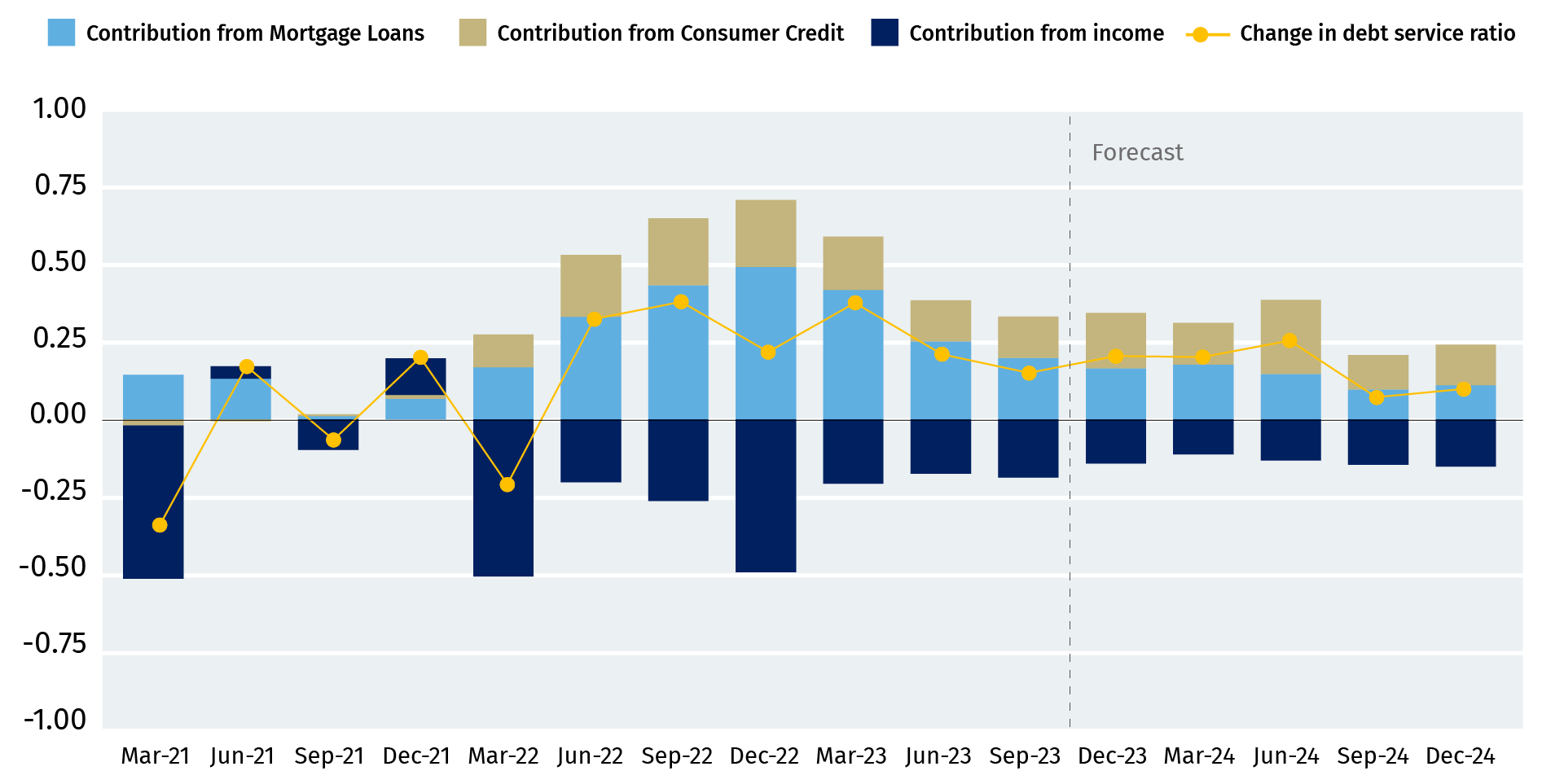

Uptick in Canada’s debt service ratio will be smaller in 2024

Contribution to percentage point change in debt service ratio

Source: Statistics Canada, RBC Economics

2024 won’t bring much relief but second half looks better

Household debt payments will continue to rise in 2024 as the lagged impact of earlier interest rate hikes filters through to borrowing costs. Indeed, mortgages will continue to be renewed at sharply higher interest rates for some consumers into 2025 and 2026.

Still, there are signs that those consumer headwinds could begin to let up, particularly over the second half of the year. The Bank of Canada has paused interest rate hikes and is expected to pivot to rate cuts later in 2024. Canada’s household debt service ratio will continue to rise from record levels, but the 0.6 percentage point increase we expect in 2024 is one-fifth of the gain from the lows of 2020 to 2023.

There are still substantial downside risks, including the gradual deterioration of the labour market in 2023 turning into something more severe. But our base case forecast assumes that about half of the rise in the unemployment rate in Canada is in the rear-view mirror. The 1 ½ percentage point increase from the lows of last spring is substantial but ranks among the smallest rises during a labour market downturn in history. And while prices remain high, growth in prices for food and other necessities has slowed substantially. The concerns about the sustainability of consumer spending haven’t gone away, but there are reasons for cautious optimism in the second half of 2024.

Services sector spending to ramp up towards end of 2024

Contribution to real annualized quarter-over-quarter growth, seasonally adjusted %

Source: Statistics Canada, RBC Economics

Carrie Freestone is an economist at RBC. She is a member of the macroeconomic analysis group and is responsible for monitoring key indicators focusing on consumer spending and household debt as well as labour markets, GDP, and inflation. She holds a Bachelor of Arts in Economics from Queen’s University and a Master of Arts in Economics from the University of Ottawa.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More