- Wobbly consumer demand and a weaker property market in China have been spurring global concerns.

- Crashing or not, a rapidly aging population in China means the world will have to get used to slower growth in demand beyond the current economic cycle.

- Canada is relatively less exposed when it comes to direct trade linkages with China. But production and exports for certain products, particularly minerals, are more exposed.

- Slower demand in China could help with Canada’s inflation problems by driving commodity prices lower, but that would also lower revenues in commodity producing regions.

- Bottom line: China’s cooling economy is on a growing list of concerns when it comes to the outlook for Canada. But with export ties to China limited to certain sectors and weaker commodity prices a double edged sword, it’s far from being at the top of that list.

Softening trends in China are spurring global concerns

China’s economy – for decades the engine of global growth – has been showing signs of sputtering. While most other economies struggle with higher-than-normal rates of inflation, in China, consumer prices have remained around levels a year ago over August and September after posting an outright decline in July. Lower prices are a good thing for consumers, but the concern here is that weaker prices in China are reflecting softening consumer demand alongside a slower economic growth backdrop.

Indeed, while most advanced economies’ central banks have aggressively hiked interest rates to cool overheating demand, China’s has done the opposite to try and encourage more spending. The People’s Bank of China over the summer put forward measures to prop up the economy including cutting key lending rates and lowering the required downpayment on mortgages.

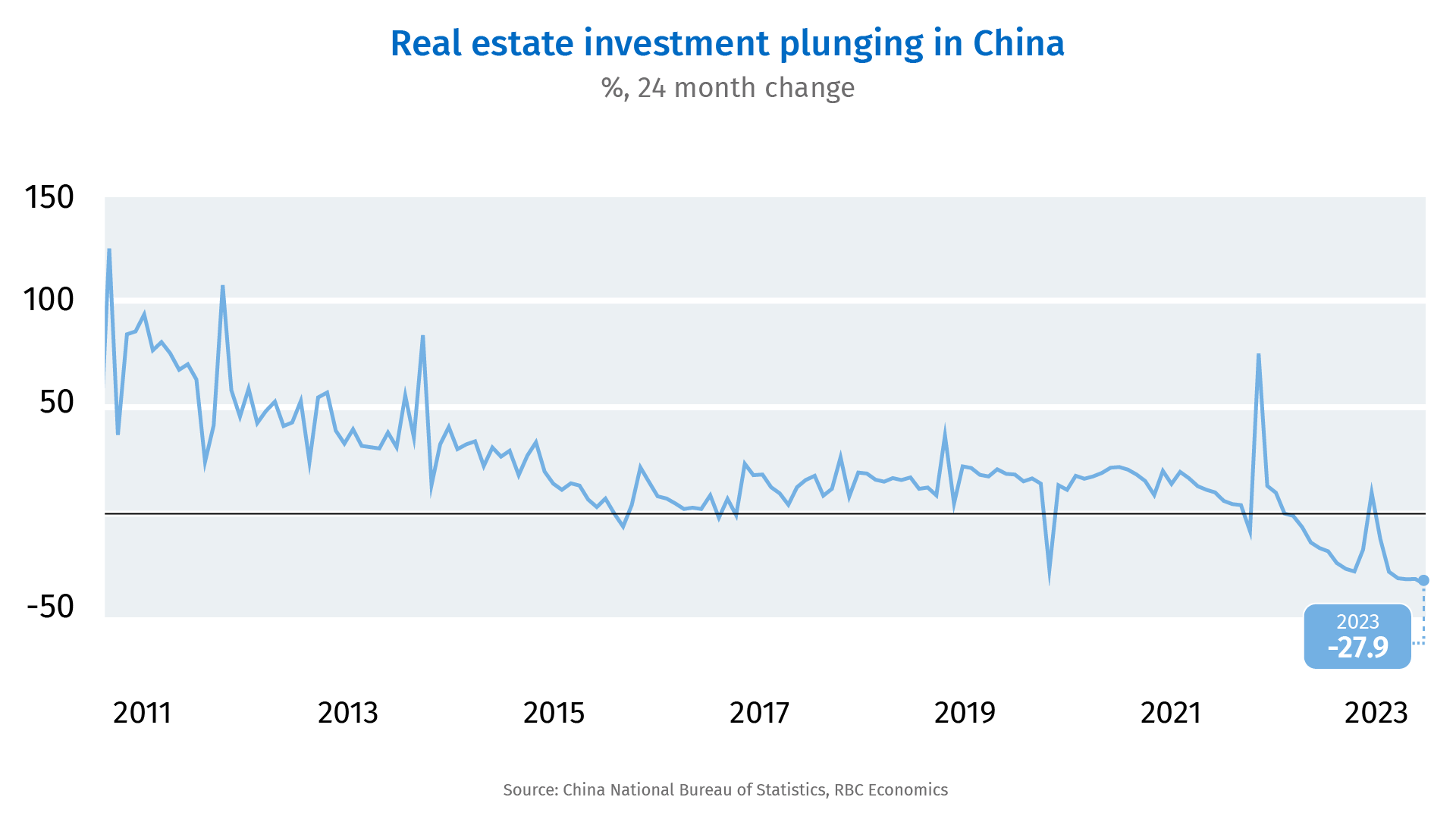

And those measures may be working – recent data including PMIs and retail sales have shown marginal improvement in activities. But uncertainty surrounding a slower property sector still loom. Investment in real estate development in China has been scaling back significantly, to 30% below 2021 peak levels as of August. Prices for existing homes have also declined persistently over the past two years. Other data out of China has been watched closely for signs that disruptions in property markets are spilling over into a broader economic slowdown. Indeed, given how closely intertwined the housing sector is with other segments of the economy, a persistent slowing could lead to further declines in residential investment and employment, lower household net worth, deteriorating sentiment, and ultimately much weaker consumer demand.

Aging population will continue to put the brakes on growth in the Chinese economy

For decades, China has acted as a net lender to the world by running a large net trade surplus. This means China’s government is well equipped with capacity to further support the economy in a pinch, preventing a more disruptive slowdown in the near-term. China still has over $3 trillion in foreign currency reserves, consisting of roughly 18% of total GDP. But that won’t help to counter larger structural demographic headwinds tied to a rapidly aging population.

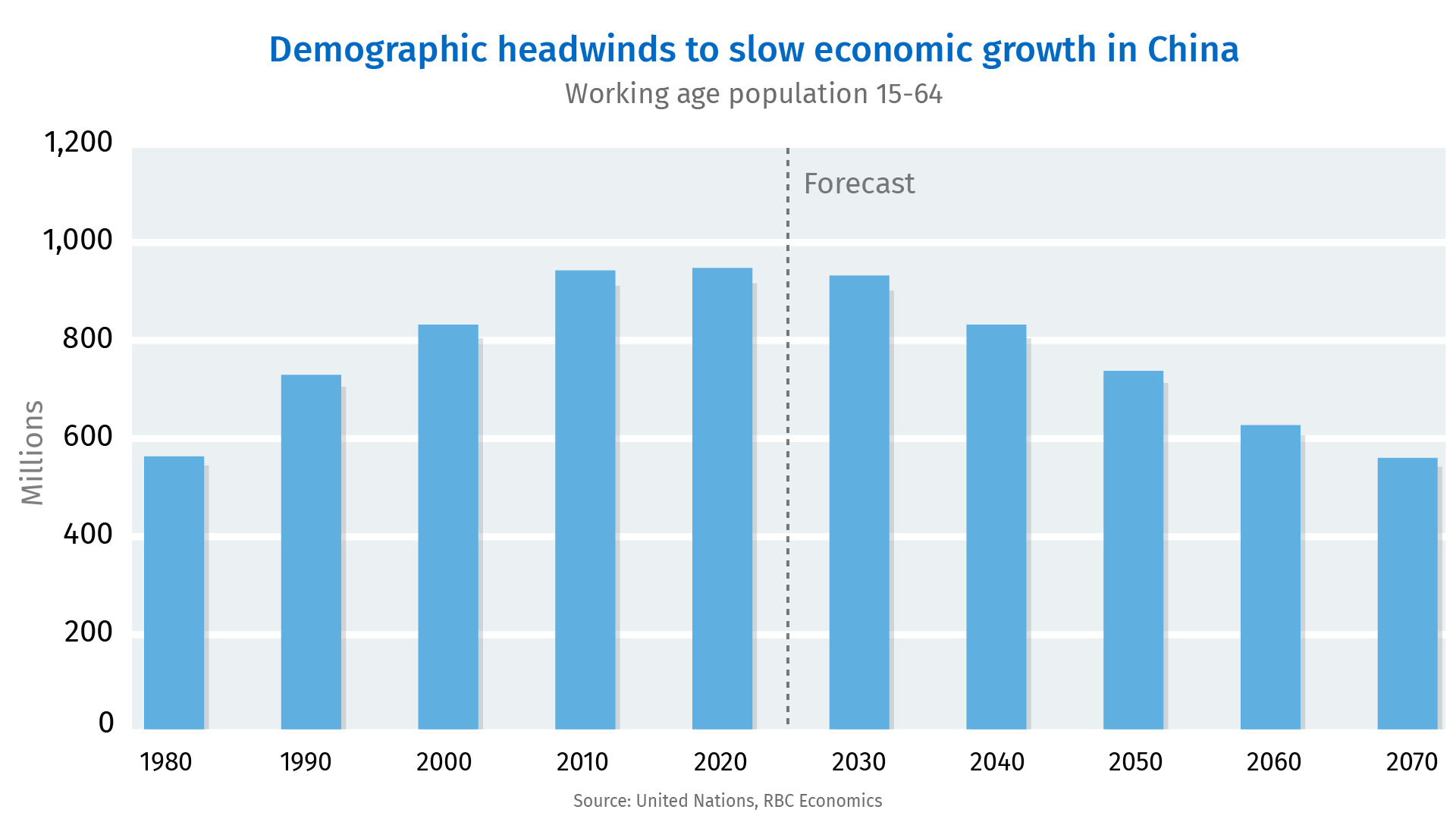

Indeed, slower economic growth in China is something that has long been anticipated. The one-child policy that was first introduced in 1980 dramatically curbed population growth. The parents of the one-child generation are now hitting retirement age and dropping out of the labour market quickly. The ‘working age’ population in China (those between ages 15 and 64) has been outright declining since 2016 and is expected to shrink to just over three quarters of its peak size by 2030, according to projections from the UN. An ever-dwindling labour force means that the “trend” rate of economic growth in China will continue to decline, and the ultra-fast expansion period when the Chinese economy grew by 7% or 8% a year is a thing of the past.

Spillovers to the Canadian economy will be limited

It goes without saying that countries that rely more heavily on China as an export market – including Germany, Australia, Japan, and South Korea- are more directly exposed to a slower economy in China. This is especially true for Germany which exports a lot of discretionary goods to China, including autos and parts. Business surveys have been pointing to softer German manufacturing activity for some time now. As of September, the closely watched HCOB German manufacturing PMI has been below 50 (signaling a contraction in activity) for 15 consecutive months.

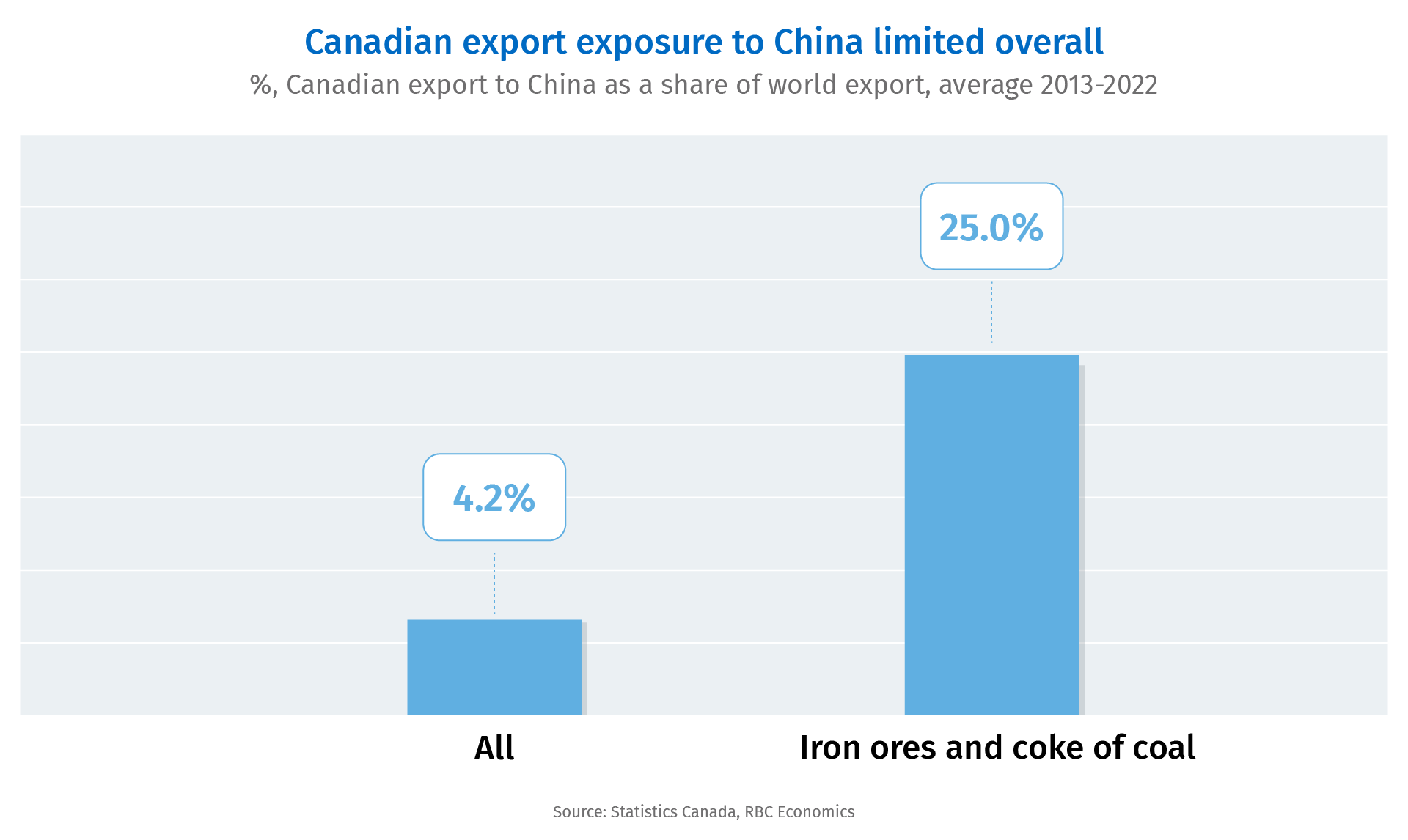

Canada’s direct trade links with China are relatively small – with the latest data suggesting China accounts for under 5% of Canadian exports and around 10% of imports. But the impact might be especially large for product groups that are more exposed to weakening demand and slower real estate development in China. In 2022, 25% of iron ore and coking coal produced in Canada – minerals used heavily in steel production and housing construction – were exported to China.

Outside of direct trade ties, China, as one of the largest economies in the world, impacts global prices of key Canadian commodity exports. Lower commodity prices mean less revenue for producers and exporters, and potentially less investment and hiring activity down the road. That impact however will likely be concentrated among provinces that are more active in the commodity producing space, such as Alberta.

But lower commodity prices together with a depreciating Chinese Yuan (down 3.5% against the Canadian dollar relative to the beginning of this year) also mean lower input costs for other businesses and lower inflation for consumers. Households meantime could also see prices for gasoline drop, for example, if global oil prices were to decline from weakening demand out of China. All that will help but won’t solve Canada’s inflation problem. Indeed, sticky “core” inflation prints in Canada these days that draw concerns for the Bank of Canada are largely a result of price pressures spurred by domestically produced services, instead of global inflationary forces. And that’s something that will be tamed in time only by weaker domestic demand in Canada (that we’re continuing to see early signs of), regardless of economic conditions elsewhere.

Claire Fan is an economist at RBC. She focuses on macroeconomic analysis and is responsible for projecting key indicators including GDP, employment and inflation for Canada and the US.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More