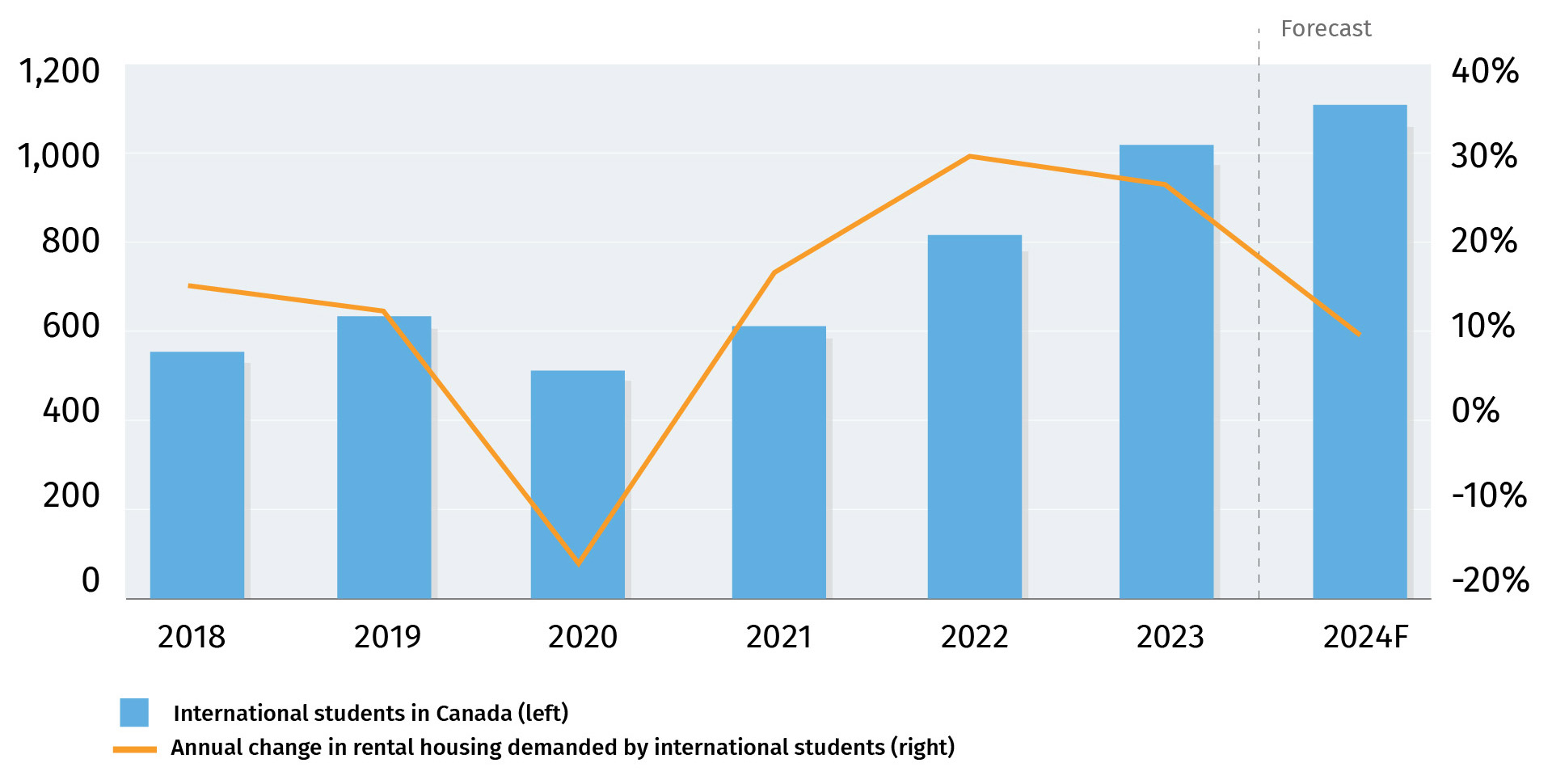

The federal government’s new cap on international study permit applications will not immediately reduce rental demand from international students this year—but it should dramatically slow its growth in 2024.

- We estimate the increase in rental units demanded by international students could fall by roughly half in 2024.

- The number of international students living in Canada—and rental units they need—would eventually decline if the cap is maintained at the current level and beyond its expiry in 2025.

Ottawa has introduced a suite of initiatives to support a rebalancing of the rental market, given housing affordability has reached crisis levels in Canada. The latest is a new cap on international study permit applications that will be approved over the next two years. The number of permits issued will be capped at 364,000 as of September 2024—which is nearly half of the 684,000 permits issued in 2023.

However, the number of study permits issued in a year is only one factor that contributes to the number of international students who are physically living in Canada at any given time. Students that came in prior years, the share of permit applicants that go on to enroll, and expiring permits of graduating students are other crucial contributors.

Assuming similar enrollment rates and outflow patterns as those observed in the three post-pandemic years, we estimate 391,000 new international students will enter Canada this year and 291,000 will graduate or otherwise see their study permits expire. This means the number of international students in Canada will continue to grow by 100,000—about 55% less than the net increase in 2023.

The impact on the rental housing market will run along the same lines. But even though we’re expecting growth to moderate, this doesn’t translate to an outright fall in rental demand—at least not in the near-term. Given nearly all international students live in rented accommodation (we’re assuming 97%), we estimate this slowdown could cut demand for new rentals by international students in half (relative to 2023).

Rental demand for international students

expected to moderate in 2024

Number of international students in Canada (thousands of persons) and annual

change in demand for rented accommodation for international students (%)

Source: IRCC, RBC Economics

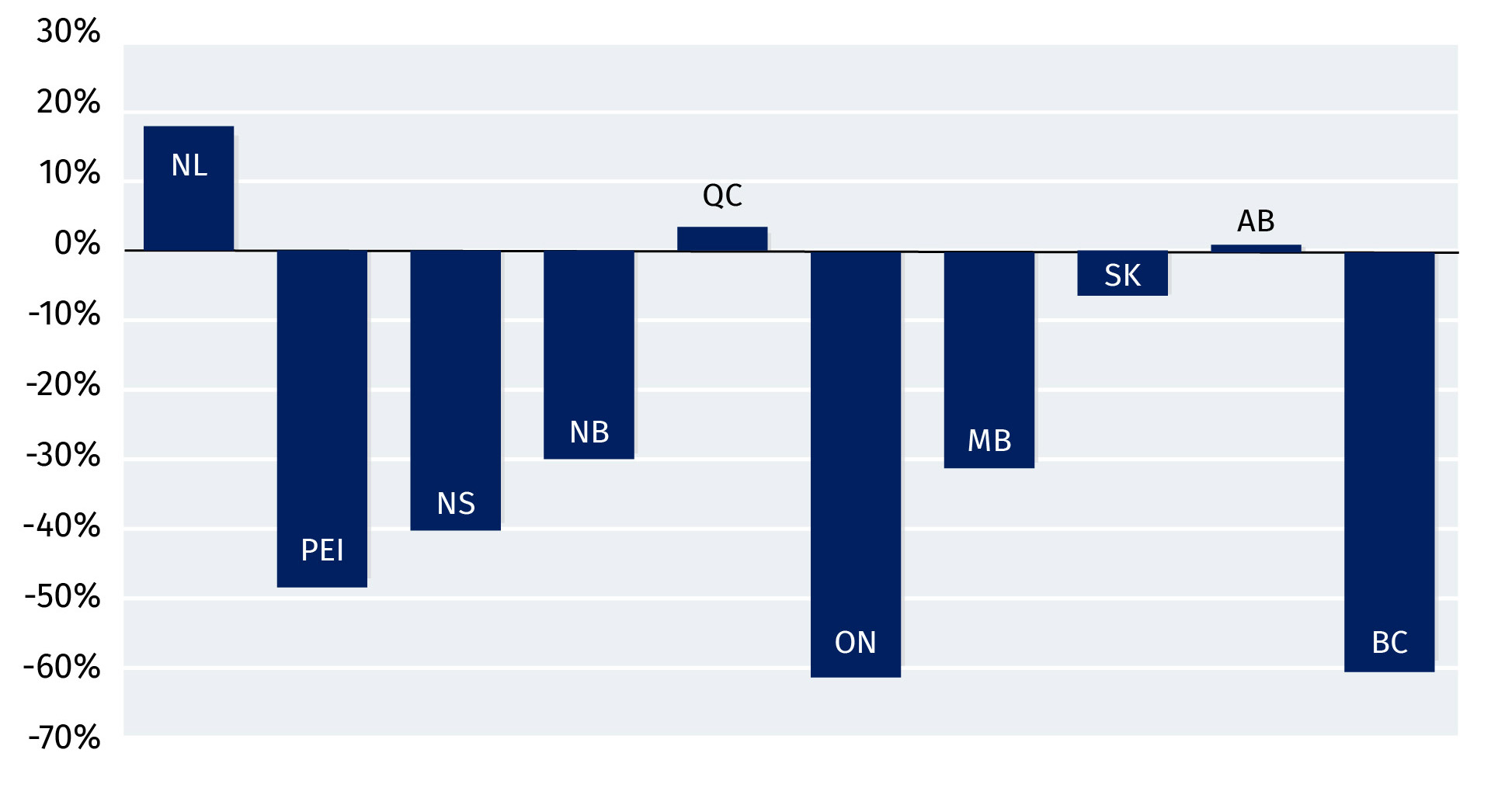

International student cap will impact Ontario and BC most

Not all rental markets will be impacted equally. Given the federal government has allocated the national cap based on provincial population shares, the cap will be most constraining in Ontario and BC where international student admissions (53% and 19% of the Canadian total, respectively) outweigh their share of the Canadian population (39% and 14%). We see the number of international students in Ontario and BC remaining relatively flat in 2024, effectively stalling new rental demand by this group.

The cap will be generally restrictive in Atlantic Canada as well, albeit to a lesser degree. We think it could lead to a 10% pullback in international student demand for rental housing in the region in 2024. The cap won’t be much of a factor in Quebec and the Prairie Provinces, so we don’t expect it to restrain rental demand in these parts of the country.

International student cap will hit most provinces

Annual change in study permits under international study cap (2024), %

Source: IRCC, RBC Economics

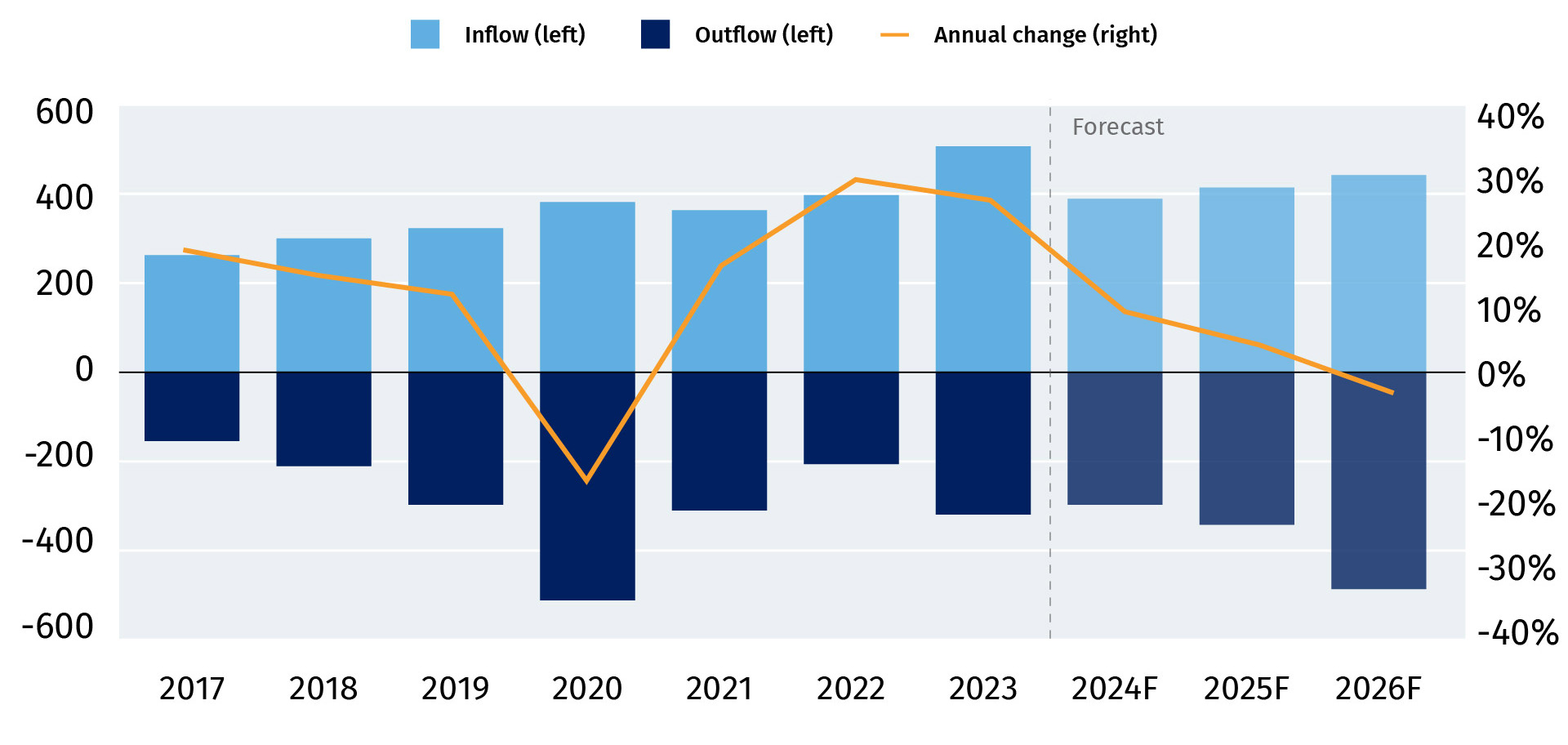

Current cap could cut medium-term demand if maintained

We could see a decline in the number of international students in Canada by 2026 if the cap is maintained at the current level and extended beyond its set expiry in 2025. That’s because the outflow of international students (which is a function of past international student arrivals) is set to rise substantially in the coming years. We see the outflow of international students picking up by next year—potentially surpassing the number of new international student arrivals in 2026—given enrollments jumped 7% in 2022 and an estimated 34% in 2023.

If this materializes, an outright decline in the number of international students in Canada would relieve rental market pressures more meaningfully. In the meantime, post-secondary institutions and other stakeholders must find creative ways to grow the student housing stock amid challenges in quickly building new structures.

International student cap will hit most provinces

Annual change in study permits under international study cap (2024), %

Source: IRCC, RBC Economics

Rachel Battaglia is an economist at RBC. She is a member of the Macro and Regional Analysis Group, providing analysis for the provincial macroeconomic outlook and budget commentaries.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More