Proof Point: There hasn’t been this much rental housing under construction in Canada in a generation—which is encouraging news given the acute supply shortages across the country. But even more construction will be needed as rental demand continues to rise rapidly in the years ahead.

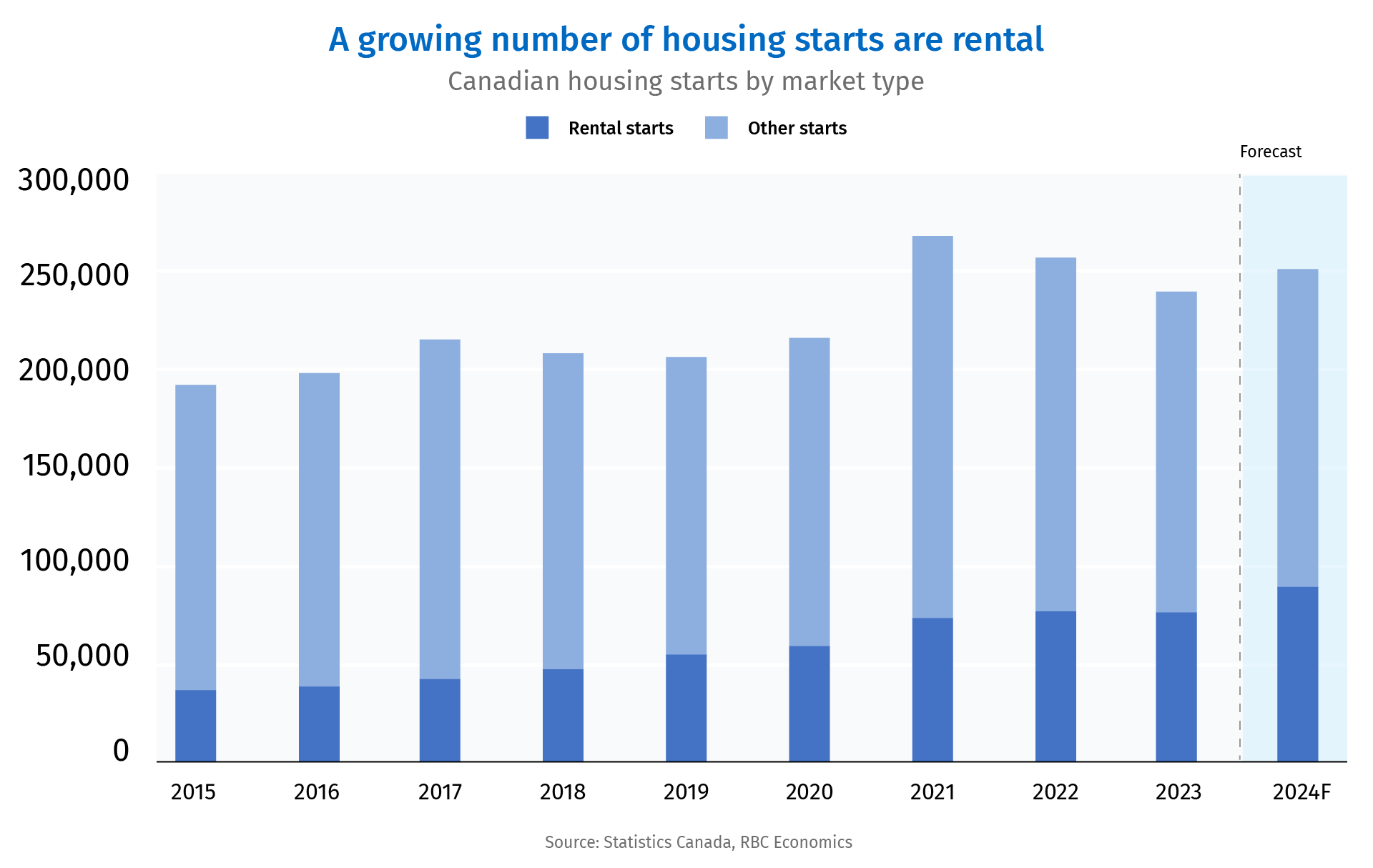

- Rental housing starts surpassed 80,000 per year in 2022 and 2023, nearly doubling the average pre-pandemic (2015–2019) annual increase.

- Fast-growing demand for rental housing and a suite of policy measures provide enough support to keep building activity strong—even in the high interest rate environment.

- A backlog in demand, however, is likely to result in quick absorption of new units when they come to market.

Canada’s housing supply problem is undeniable, but it doesn’t mean homebuilding is weak. Builders started construction on 240,000 units in 2023, which would have been a 36-year high if not for a short-lived spike earlier in the pandemic.

This year is turning into another busy one for homebuilders. Housing starts are already up 11% from last year, and the anticipation of further interest rate cuts is projected to keep this trend going.

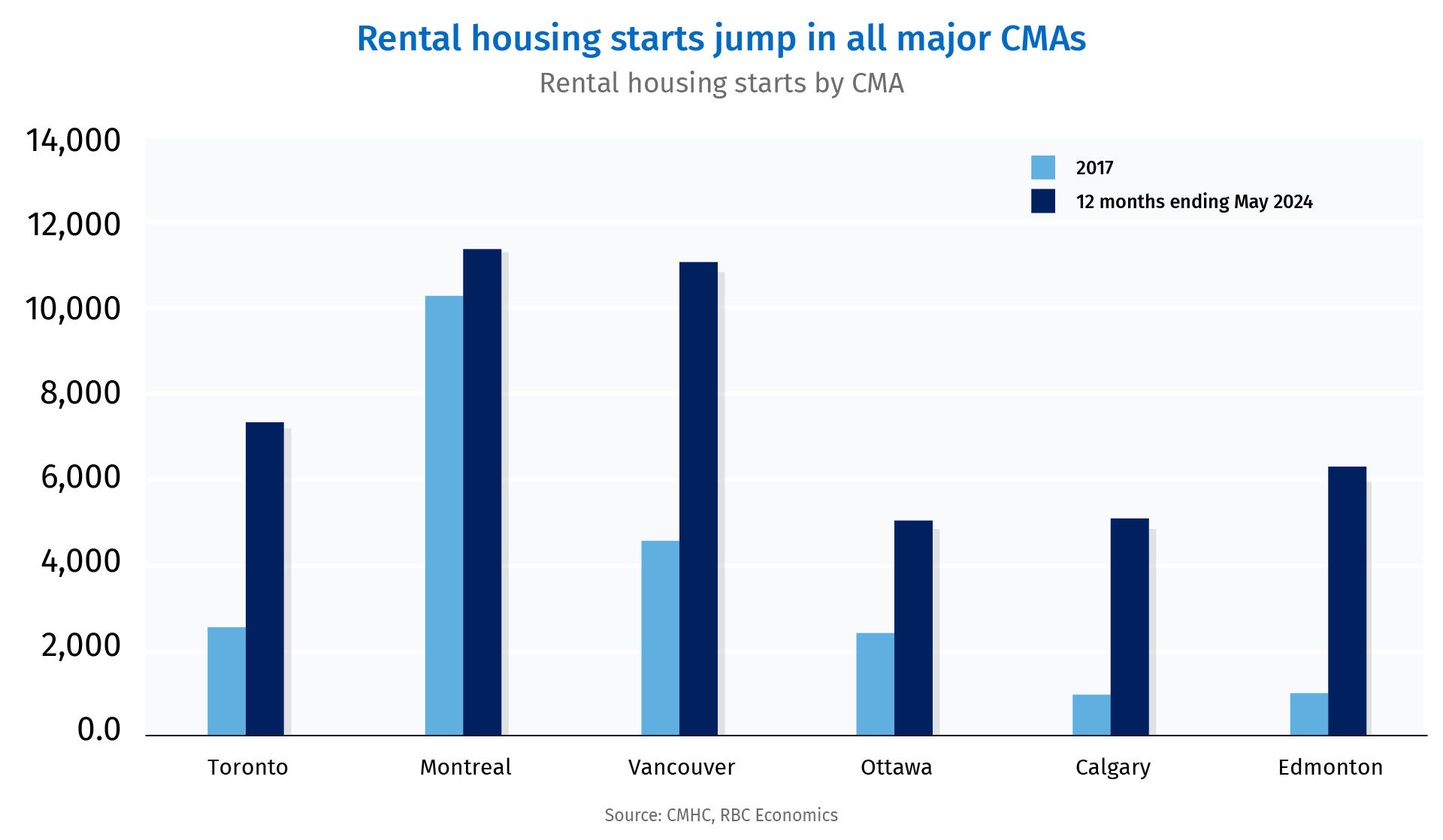

But not all residential projects are picking up. Most homebuilding activity is coming from new rental construction projects, which have nearly doubled from six years ago. Meanwhile, the construction of single-family homes has dwindled to just three-quarters of the housing start activity seen in 2017.

Growing demand, policy measures drive rental construction projects

Rental housing starts reached the highest in decades in 2022 and 2023 with more than 80,000 new units started each year. That number is set to rise even more in 2024 as surging demand and new policy measures tip the scale for developers despite persistently high inflation challenges and skilled labour shortages.

On the demand side, demographic shifts and deteriorating homeownership affordability have made rental housing increasingly popular. The rate of homeownership among Canadians has fallen an estimated 2.5 percentage points (as of the last census) after peaking at 69% in 2011.

But, rental housing is also slipping out of reach for many as more Canadians move into the rental market. A severe market imbalance has put a lot of upward pressure on rents, bringing annual rent growth to its fastest pace on record, reaching 8% in 2023—well-outpacing inflation (3.9%) and wage growth (2.8%).

Growing rental supply shortages and soaring rent caught the attention of developers and policymakers. Governments have responded with a suite of rule changes and incentives to promote high density and rental housing developments.

Since 2017, all levels of government have put forward measures to grow Canada’s rental stock. The federal government introduced the National Housing Strategy and more recently, Canada’s Housing Plan—which include programs and initiatives for boosting rental housing construction. Ontario and British Columbia implemented their own housing plans as well, with measures to get more rental housing built.

At the municipal level, Vancouver and Toronto have made strides in expanding their social housing stock. These cities have also relaxed rules around zoning, parking and floorspace requirements for residential housing—and modulated development fees for rental construction projects to encourage more development.

Together, strong demand for rental accommodation and government support have contributed to a substantial uptick in rental construction while most other types of development projects are at a standstill. We expect policies in Canada’s latest Housing Plan will help carry this momentum forward.

More is needed to bring rental market back to balance

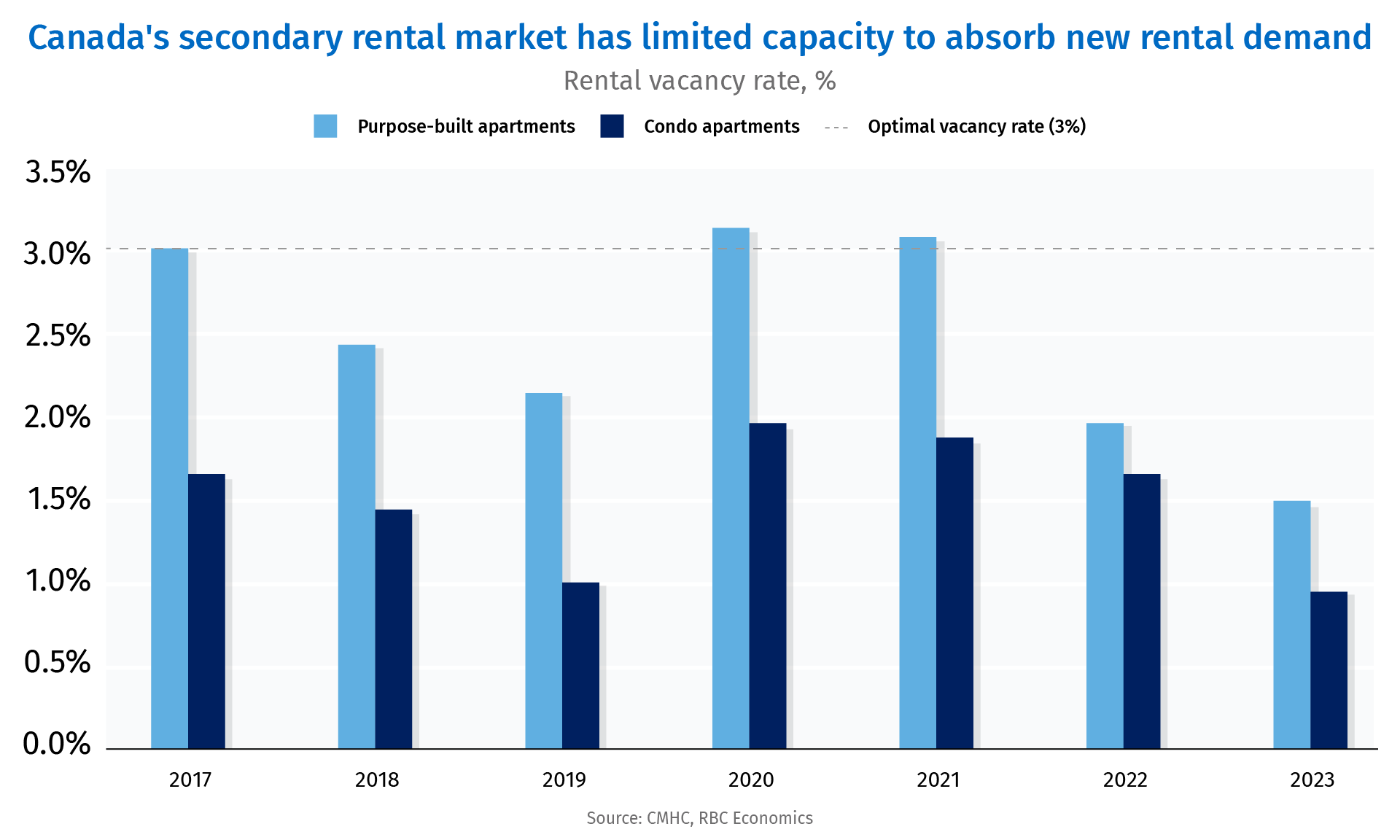

However, the rental market supply shortage is massive. The rental vacancy rate fell to an all-time low (1.5%) last year—well below the equilibrium level (3%) in virtually all census metropolitan areas (CMAs).

Demand for rentals has increased more than three times faster than the purpose-built rental stock has grown between 2017 and 2023. Other types of rental units such as condo apartments and secondary suites have filled part of that gap, but they have also come short. Rental vacancy rates for condos are even lower than for purpose-built rental apartments, dropping to 0.9% in Canada last year.

The ramp-up of rental housing starts is welcome and should help rebalance Canada’s rental housing market over time. The challenge, though, will be delivering units Canadians can afford in the right locations. Steep development and construction costs, along with restrictive (although easing) zoning policies still pose serious challenges to growing the supply of affordable rental housing.

Rachel Battaglia is an economist at RBC. She is a member of the Macro and Regional Analysis Group, providing analysis for the provincial macroeconomic outlook and budget commentaries.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More