Proof point: Demand for Canadian tourism has yet to fully recover from the pandemic and is being impacted by global geopolitical uncertainties. However, improving economic conditions should help support the rebound later this year and in 2025.

- Canadian residents are taking more trips than before the pandemic, but there’s still a gap in the number of tourists visiting Canada, partially due to disruptions in air travel from Asia because of geopolitics.

- Surging inflation has also meant travellers are paying more and getting less. Tourism demand in Canada (in constant dollars) in 2023 was still about 10% below pre-pandemic levels.

- Over the medium term, broader trends in the economy—including lower interest rates, easing inflation and rapidly rising population growth—should support recovery in the Canadian tourism industry.

More Canadians are venturing further away

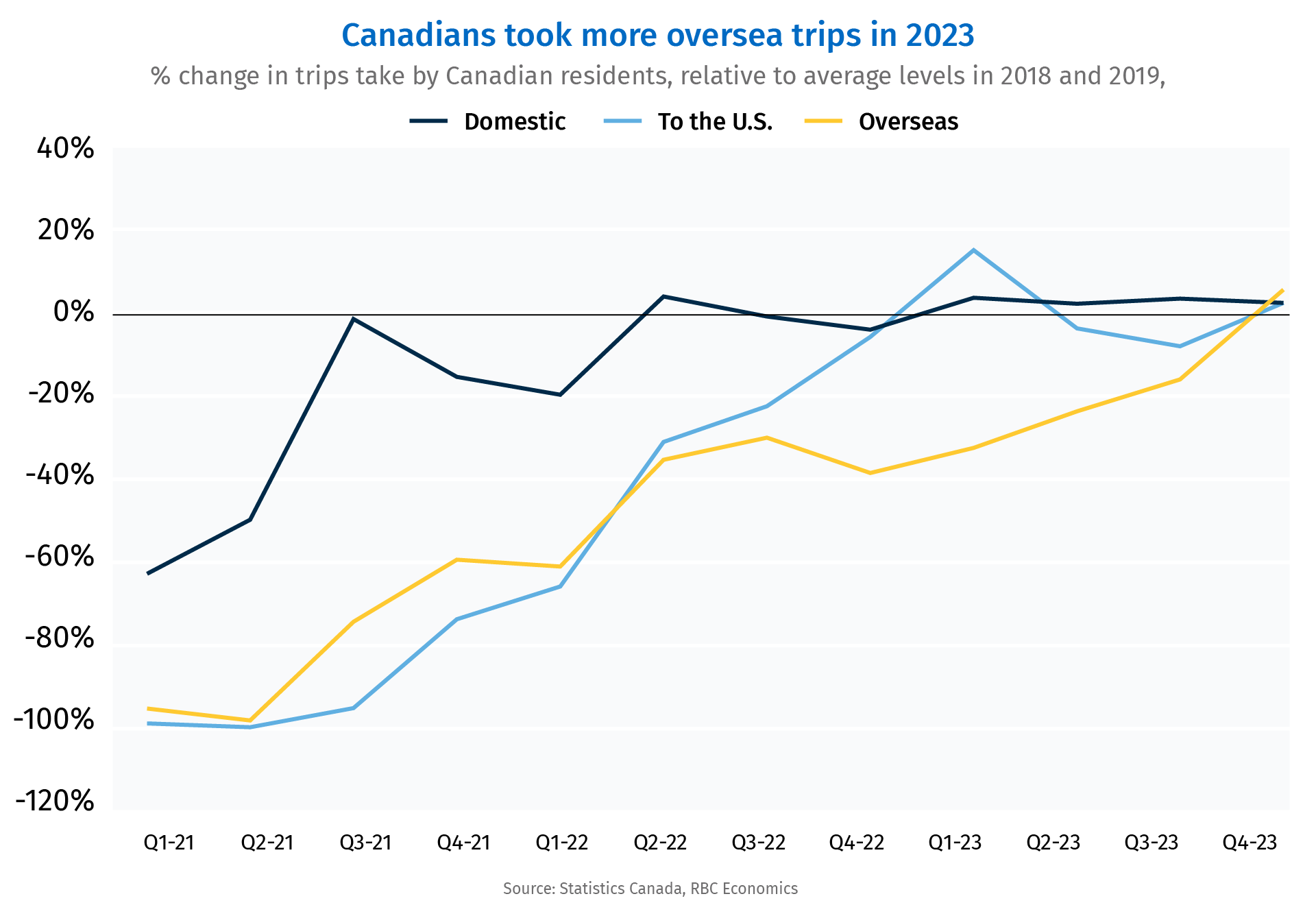

It didn’t take long for Canadians to rekindle their passion for travel after the onset of the pandemic. Demand for domestic tourism recovered quickly in 2021 when restrictions started to ease. In late 2022 and after the United States border reopened, Canadians took more trips to the U.S. Finally, as pandemic-related health concerns gradually subsided, overseas travel also started to catch up before making a full rebound in 2023.

Overall, data from Statistics Canada suggests that Canadians took 319 million trips in 2023—1% above the number of trips taken on average during pre-pandemic 2018 and 2019. Trips abroad, outside of the U.S., rose most rapidly from 30% below pre-pandemic levels at the start of 2023 to 5% above it by the end of the year.

Inbound travel is struggling to fully recover

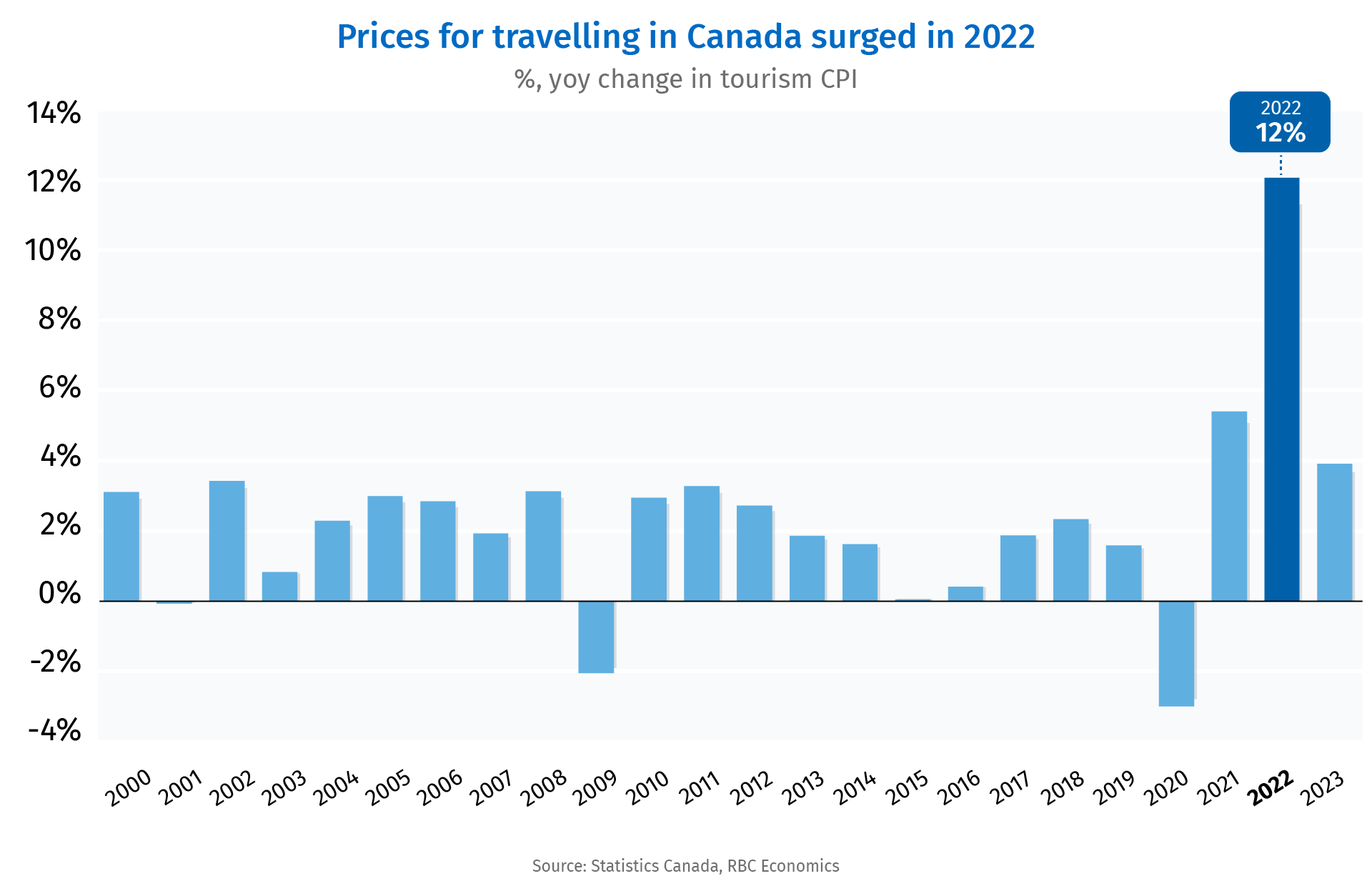

Yet despite the healthy recovery in travel among Canadians, overall real tourism spending in Canada is still lagging. Part of the reason is tied to surging inflation over the last few years. Overall, the price of spending on tourism in Canada (hotels, restaurants, airfares, etc.) was 19% above pre-pandemic 2019 levels in 2023. And despite a loftier price tag for many activities, tourists are getting less for their travel dollars.

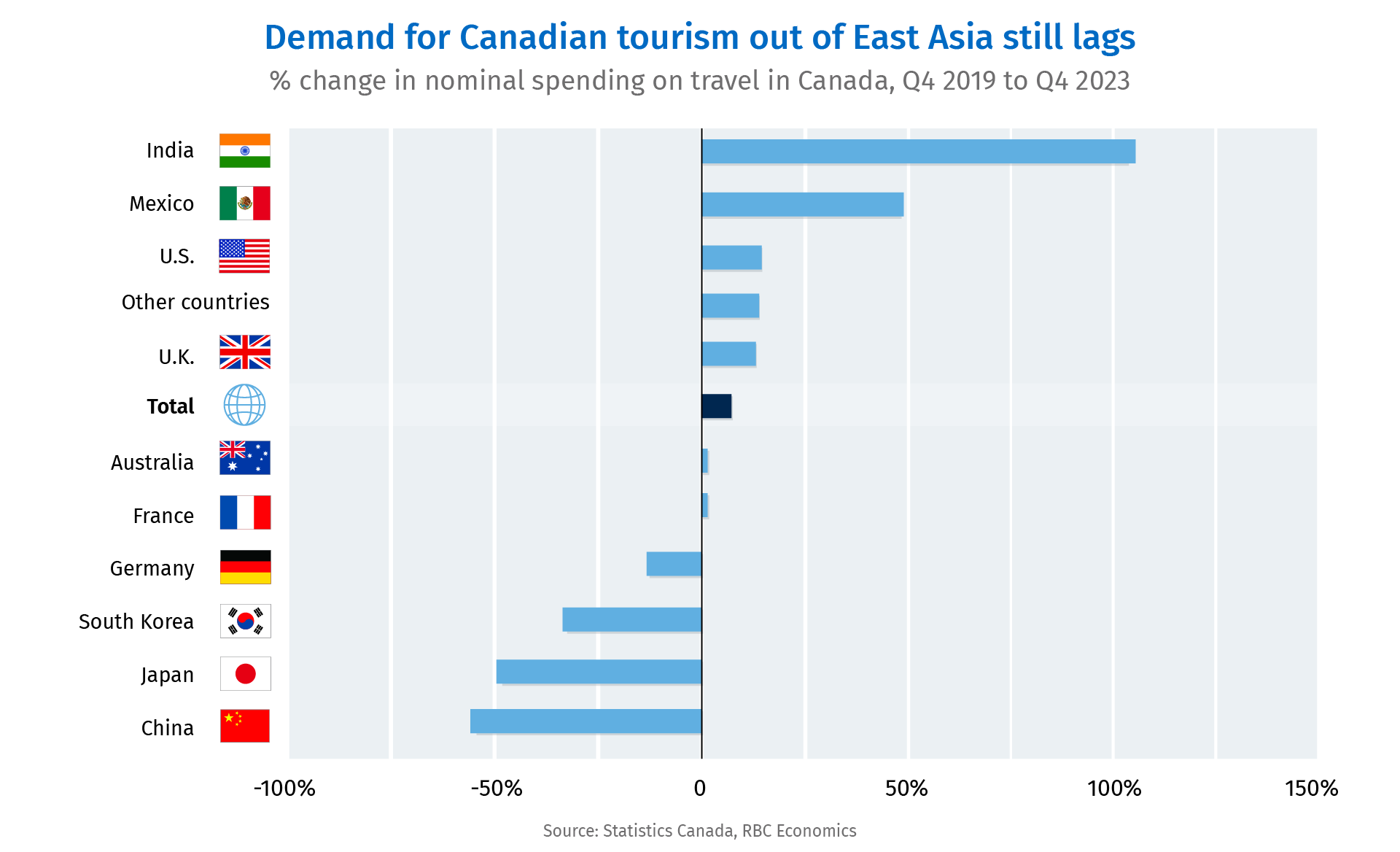

Another factor behind a lag in Canadian tourism is the lack of foreign demand. In Q4 2023, there was still a sizable gap in the number of trips taken to Canada from foreigners —12% fewer compared to before the pandemic. Demand is especially weak for visitors from East Asia. Travel spending from China, Japan, and South Korea was still down by 30% to 50% by the end of 2023 relative to the end of 2019. But, more than making up that shortfall was higher spending by visitors from other countries including India, Mexico, and the U.S.

Economic trends will support demand for Canadian travel

The slower comeback of foreign travel to Canada is partly the result of heightened global geopolitical tensions. The Russian invasion of Ukraine has, for example, severely disrupted normal flight paths between Canada and East Asia. That’s raising both the time and costs associated with air travel, leading to lower demand for trips that pass along those routes. The number of international travellers to Canada will likely remain suppressed for the foreseeable future since there is no indication that those conflicts and disruptions will resolve soon.

Still, there is room for optimism. Domestic demand accounts for the lion’s share of Canadian tourism spending. That was true even during the pre-pandemic years. Spending from Canadians on Canadian tourism recovered quickly during 2021 but has been lagging since. Part of that can be explained by rising interest rates since the spring of 2022, that have pushed debt-servicing costs much higher for Canadian households, lowering spending on goods and services (on a real per-capita basis), including travel activities.

Slower demand, however, has also led to meaningful improvements in inflation. Most of the 19% price increase in the tourism consumer price index between 2019 and 2023 was concentrated in 2022 when prices rose by 12%. Growth in tourism CPI eased to a much smaller 4% in 2023, and potentially, slowed even further this year as prices for car rentals and airfares see outright declines from a year ago. Broadly softening inflation pressures have also allowed for a first interest rate cut from the Bank of Canada in June, and our forecast is for more to follow in the quarters ahead to lead the overnight rate to (a still restrictive) 4% by the end of this year.

And as these cyclical trends continue to unfold, there have been other structural changes in the economy that will also have an impact on tourism demand. Record levels of population growth – Canada’s population grew by a staggering 9% between 2019 and 2023 – should provide a solid boost to travel demand as newcomers settle down and start to explore their home provinces among others. That together with lower interest rates, easing inflation should mean that broader macro conditions will be supportive of further recovery in Canadian tourism this year and next, despite a shortfall in foreign demand.

Claire Fan is an economist at RBC. She focuses on macroeconomic analysis and is responsible for projecting key indicators including GDP, employment and inflation for Canada and the US.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More