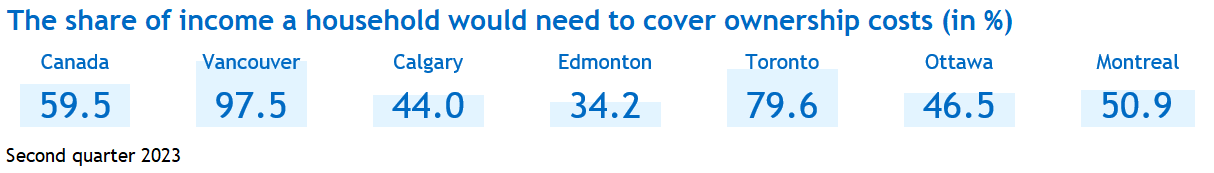

- The burden of home ownership costs got slightly lighter in the second quarter in Canada: RBC’s aggregate affordability measure for Canada fell for the second-straight time by 0.3 percentage points to 59.5%. Growing household income entirely accounted for the small improvement as buyers faced still-higher mortgage payments.

- But that burden remains extremely heavy overall: RBC’s measures for Canada, Vancouver, Victoria, Toronto, and Ottawa, Montreal and Halifax to a lesser extent, are still near all-time worst levels.

- And the improvement was sporadic: It tended to be scattered across Central and Atlantic Canada. Solid price gains drove affordability in the wrong direction in Vancouver, the Prairie region (including Calgary, Canada’s hottest market), and Toronto.

- No quick fix in view: While cooler resale activity and a rebalancing of demand-supply conditions are likely to temper price appreciation in most of Canada in the near term, high interest rates will keep the bar elevated for buyers. We think it will take material interest rate cuts to get ownership costs on a distinctly more affordable track. However, our view is the Bank of Canada isn’t about to switch to cutting mode until mid-2024. We expect little relief in the interim.

Income gain takes some of the sting out

Home ownership costs ticked higher in the second quarter as a surprisingly strong rebound in housing demand this spring heated up property values by a few degrees, ending a nearly year-long price downslide. But a solid gain in household income (up 1.4% from the first quarter Canada-wide) provided buyers with more purchasing room. This was in fact sufficient to lower the ratio of ownership costs to median household income—i.e., RBC’s aggregate affordability measure—for the second-straight time this year. (A decline in this ratio represents an improvement in affordability.)

The effect of growing income on affordability is most often obscured by swings in home prices and interest rates, which tend to move ownership costs in larger increments. The last time income tilted the RBC measure was early in the pandemic when governments provided Canadians with massive financial support to help deal with lockdowns.

Near term outlook is likely to disappoint

Odds are income will take a back seat again in the period ahead amid higher mortgage rates and appreciating prices. Housing affordability looks set to erode in Canada in the third quarter, unfortunately. That said, we see a turning point taking shape once rates and prices stabilize. We think an improving trend will emerge in 2024, and more clearly so after the Bank of Canada starts cutting rates—around mid-year in our view.

The bar is impossibly high for many

Buyers will continue to contend with extremely difficult affordability conditions in the meantime in many of Canada’s large markets. We believe those pressures are behind the notable cooling in home resale activity we saw this summer in Ontario and British Columbia. They are poised to weigh on demand for months to come in both regions, with many buyers entirely priced out in Vancouver and Toronto. The sharp erosion of affordability during the pandemic will also likely temper demand in other parts of Canada, with the possible exception of Prairie markets (including Calgary) where buyer confidence seems strong at this juncture.

It will take years and concerted efforts to restore affordability

Short of a housing crash that would destroy property values or an unexpected about-face in monetary policy, any progress in restoring housing affordability is likely to be slow. Supply must increase by giant leaps to make a material difference. But building new homes takes a long time—up to several years in the case of large condo apartment complexes. And it’s increasingly hard to build units ordinary Canadians can afford to buy given soaring construction costs and finite construction capacity.

We’re encouraged to see all levels of governments now at work on removing obstacles in the way of homebuilding, and implementing measures to reduce the regulatory and administrative burden. More will be needed.

With high interest rates currently dampening demand for new single-family homes and condo apartments, governments would do well to incentivize the construction purposed-built apartment projects and social housing to grow our rental stock. The recently announced cut to the GST (and PST in some provinces) on the assessed value of new apartment projects is a step in the right direction. Significantly boosting investment in our affordable rental housing stock will be critical in addressing the pressing needs of struggling Canadians.

Victoria – Slight relief hardly noticeable

Strictly speaking, owning a home became more affordable in back-to-back quarters this year. But Victoria buyers will be forgiven if they haven’t noticed. With RBC’s aggregate measure at an astounding 73.0%—just barely off its all-time worst level of 75.7% recorded at the end of 2022—the bar is impossibly high for most. This is clearly holding back demand at this stage. Home resales remain some 15% below pre-pandemic levels, with the recovery coming under renewed cooling pressure this summer. More balanced demand-supply conditions should keep any price appreciation minimal in the near term but won’t bring about material relief to buyers.

Vancouver area – Hopes for improving affordability trend dashed

The market rebound this spring sent home prices climbing at a rapid clip again after soaring interest rates ultimately sliced close to 10% off them in the previous year. The end result: a small loss of affordability in the second quarter that put a hoped-for improving trend into question—after just one quarter. RBC’s aggregate measure rose 0.4 percentage points to 97.5%, just shy of the worst level ever recorded in any Canadian market (99.1%). In short, it’s still prohibitively expensive to own home in the Vancouver area. The outlook for buyers isn’t encouraging either though more balanced demand-supply conditions heading into the fall may temper price increases in the months ahead.

Calgary – Strong fundamentals trump rising ownership costs

Ownership costs continue to rise steadily in Calgary but buyers remain eager to get into action. Calgary is easily the hottest market in the country with home resales running at the pre-pandemic peak and prices reaching ever new highs as buyers compete fiercely for the little inventory that is available. That affordability has sunk to a 15-year low—RBC’s aggregate measure increased nine times in the past 10 quarters to 44.0%—isn’t top of mind for buyers at the moment. Their focus is no doubt on how favourably Calgary compares to most other major markets, and its solid economic and demographic underpinnings. We see little that will change this view in the near term.

Edmonton – Calm and busy at the same time

Relatively plentiful inventories have a calming effect on price negotiations in Edmonton, which in the end keeps affordability within historical norms in the area. RBC’s aggregate measure barely moved in the second quarter—edging up 0.2 percentage points to 34.2%—just slightly above its long-run average (32.6%). Despite a material loss of affordability over the past two years, buyers are still very much in the game. Home resales have rebounded strongly from the winter lows, and are getting closer to the pre-pandemic peak. We think interest in buying a home in Edmonton is unlikely to dim anytime soon.

Saskatoon – On a roll

The market is on a roll this year with booming population growth helping to drive resales back near pandemic highs this summer. Much tighter demand-supply conditions are pressuring up prices though gains so far remain modest overall. Yet they’ve been large enough to stall the emerging improvement in affordability in the second quarter. RBC’s aggregate measure inched 0.2 percentage points higher, partly reversing a drop in the first quarter. While the measure is slightly worse than its long-run average (31.0%), it still paints a favourable picture for buyers. We expect this to persist in the near term.

Regina – Relatively low ownership costs are a big draw

There’s a similar market upswing taking place in Regina—also driven by rapidly growing demand arising from soaring population. Both resale activity and prices have picked up since the spring. Favourable affordability is likely a significant draw for many buyers, as ownership costs in Regina are the lowest among the markets we track in Western Canada. RBC’s aggregate measure, at 28.9%, compares well against nearly all markets in Canada for that matter, despite deteriorating in the past two years. The measure was little changed in the second quarter.

Winnipeg – Sales up, affordability getting better but for how long?

Sales momentum has picked up noticeably since hitting a cyclical bottom this winter. A fast-growing population no doubt fuels demand but likely so is a (slightly) lighter ownership cost burden. RBC’s aggregate affordability measure eased in the last two quarters—including a 0.4 percentage point drop in the latest period. Its level (31.1%) ranks favourably among other large markets nationwide. Further gains might be harder to achieve, though. Demand-supply conditions and prices have firmed up considerably of late, which is poised to curb buyers’ enthusiasm to an extent.

Toronto area – No material relief in sight

Last year’s housing correction brought little relief to Toronto buyers. So far, it translated into only one period (the first quarter of this year) of decline in RBC’s aggregate measure. The second quarter reading (an eye-watering 79.6%) was up again—indicating the dream of owning a home remains far out of reach for ordinary folks. That reality has reasserted itself in the market this summer after a pause in the Bank of Canada’s interest rate campaign at the start of this year ignited resale activity this spring. A more subdued tone is likely to prevail in the months ahead as interest rates stay high. We think prices will level off as a result, with occasional slim declines a possibility.

Ottawa – Owning a home is still a tough proposition

A second-straight quarter of improving affordability might have energized buyers this spring but the effect will be short-lived. The fact is RBC’s aggregate measure (46.5%) is still near all-time worst levels in the area—meaning that owning a home remains a very tough proposition for many. Indeed, home resales have cooled this summer, a trend that we believe will extend to the remainder of this year. A better balance between demand and supply should keep future price gains subdued. The flip side of this, however, is it won’t fast-track the restoration of affordability.

Montreal area – Affordability conditions biting hard after all

The sharp loss of affordability during the pandemic has significantly cooled homebuyer demand since early 2022. Still, a recovery has taken hold in the market this year with resales up 17% from the January low. A slight easing in ownership costs could have been what some buyers were looking for to get back into the fray. RBC’s aggregate measure edged lower in each of the first two quarters of this year, including a 0.9 percentage point drop in the latest period. The recovery, however, appears to be flagging of late. We think it’s a reminder that affordability conditions are still very challenging—RBC’s measure, at 50.9%, continues to be way up there—and biting hard.

Quebec City – Manageable ownership costs keep buyers in the game

The market continues to be resilient in the face of high interest rates with transactions running above year-ago levels and generally low inventories keeping sellers in the driver’s seat. Owning a home isn’t as affordable as it used to be but is still manageable for average buyers. RBC’s aggregate measure was 34.0% in the second quarter, which compares favourably to larger markets such as Montreal. That said, we think tight demand-supply conditions will limit the extent to which affordability can improve in the near term.

Saint John – Conditions are less hospitable but far from dire

While the recovery from last year’s sharp correction is ongoing, the action is quiet in Saint John’s market. Home resales are down 26% year to date. The spike in ownership costs—due in part to a 56% jump in home prices—during the pandemic no doubt continues to sting potential buyers. But the situation isn’t dire by any means. Saint John buyers still benefit from some of the better affordability conditions in the country. RBC’s aggregate measure (29.8%) is bested by only St. John’s (26.2%) and Regina (28.9%) among the markets we track. The measure was largely unchanged in the second quarter after improving slightly in the first. We think the market is poised to recover further in the period ahead, keeping prices on a upward trajectory.

Halifax – Some of the lustre has faded

The market is slumping this year after a wild (and historic) ride in the previous three. Part of the draw that attracted so many buyers—low housing costs—has lost some of its lustre. Housing affordability in Halifax is no longer one of the best among Canada’s larger markets, as it was four years ago. RBC’s aggregate measure for the area (42.1%) now ranks in the middle of the pack. For locals buyers, that’s close to the biggest share of their income they ever needed to cover the costs of ownership. But the slump is also partly attributable to a lack of supply. New listings are down 21% so far this year. So despite the softness in sales, demand-supply conditions remain tight, and prices are going up.

St. John’s – Good affordability an eye-catcher

The pace of transactions has picked up this summer and resales are now running more than 15% above pre-pandemic levels. St. John’s is catching the eye of many buyers for its affordability. RBC’s aggregate measure (26.2%) is the lowest (best) among the markets we track. And it’s the one that improved the most (down 1.1 percentage points) in the second quarter. It will be hard to replicate in the period ahead, though. Supply is struggling to keep up with demand, and the market has become more competitive for buyers. Prices are now tracking higher and we expect this to continue in the near term.

Read the full Housing Trends and Affordability report for extensive market-by-market analysis.

Read full report

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More