Monthly Housing Market Update

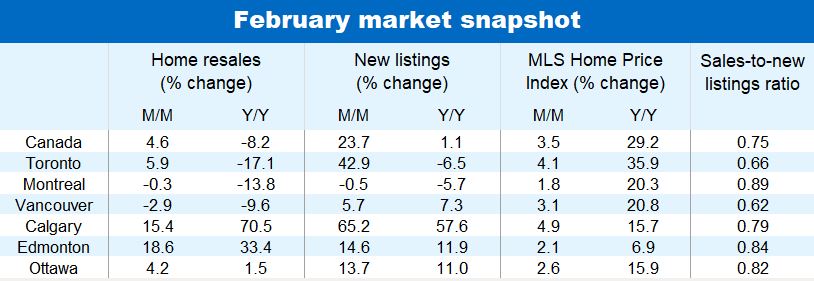

Canadian homebuyers finally saw some positive action on the supply side last month. Sellers boosted new listings in Canada by a significant 24% from January. This helped unlock some unmet demand in the market. Home resales climbed 4.6% m/m—the strongest increase in four months—to 699,000 units (seasonally adjusted and annualized). But the rise in new listings did little to ease upward price pressure. On the contrary, February’s transactions came with much steeper price tags. Canada’s composite MLS Home Price Index increased the most on record, jumping 3.5% in a single month and 29.2% relative to a year ago. Nonetheless, we see the arrival of more sellers on the market as a positive sign. This could mark a turning point toward more balanced demand-supply conditions later this year.

New listings rise almost everywhere

Even more positive is the fact that new listings picked up in virtually every market. The number of homes put up for sale increased to historically high levels in parts of British Columbia, Alberta (especially Calgary) and Ontario though the jump in most other markets came from exceptionally low levels in January. The Omicron wave has possibly held back would-be sellers in many regions of the country following the re-imposition of restrictions at the end of 2021. The easing of those restrictions in February, in turn, might have pulled them into the market. Despite their higher numbers in February, sellers continue to be in a widely favourable position with scarce inventories persisting across the country.

Incredibly strong price momentum

Demand-supply conditions remain especially tight in Manitoba, Ontario, Quebec and parts of British Columbia, Alberta and Atlantic Canada. This kept home prices appreciating very rapidly in those regions. Gains from January exceeded 3% in Winnipeg, three out of four Ontario markets (including Toronto), and most major markets in British Columbia (including Vancouver) and New Brunswick. Calgary’s composite MLS HPI surged 4.9% m/m, providing further evidence this market has joined the ranks of Canada’s housing hot spots. Edmonton may not be far behind with conditions becoming extremely favourable to sellers over the past few months.

Demand-supply conditions are comparatively softer in Saskatchewan, and Newfoundland and Labrador where property values display more stable trends.

Rising interest rates to be part of the rebalancing process

To be sure, even more sellers will need to list their properties to rebalance Canada’s housing market. But we expect rising interest rates will help the process by cooling the demand side. After maintaining its policy rate at the lower bound for nearly two full years, the Bank of Canada has sprung into action at the beginning of March, implementing its first rate hike since 2017. We anticipate it will follow up with five additional hikes, raising its policy rate by a total of 150 basis points by the middle of 2023. In time, we believe increasing borrowing costs will restraint homebuyer demand. The likelihood of new housing policy measures targeting speculators, at the margin, could further cool demand. The federal government is widely expected to introduce new housing initiatives to address housing affordability issues in its spring budget. The details (including timing) will be key to assess the market impact.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More