2021 Ontario Budget

Highlights:

- The projected deficit for FY 2021-22 is unchanged from November, at $33.1 billion

- Expenses will reach $186 billion, with a focus on protecting the health of Ontarians and the economy

- Revenues will grow modestly to $152 billion with some upside risk due to potential for faster economic growth

- Debt-to-GDP rises to 49%, just under the provincial fiscal anchor of ~50% in FY 2021-22

- Ontario aims to balance the budget over the next decade, by FY 2029-30

Finance Minister Bethlenfalvy unveiled his first budget saying Ontario faces a “historic challenge”. Budget 2021 makes it clear that Ontario’s deep deficit is here to stay – at least in the near term. The province restated that they expect a deficit of $33.1 billion for FY 2021-22, unchanged from the November budget and, slightly below the $38.5 billion deficit for FY 2020-21. In fact, much was unchanged from the November 2020 release.

Budget 2021 adheres to the same framework introduced earlier by the province. Ontario’s Action Plan continues to focus on two pillars for recovery: “Protecting People’s Health,” and “Protecting Our Economy.” This year, expenses will tally $186 billion, with revenues up only slightly to $154 billion. The debt-to-GDP ratio will reach 48.8%, approaching the province’s announced upper limit of ~50%. What is new is the fact that Ontario is one of the first provinces to provide guidance on its long-term fiscal trajectory, aiming to bring the budget into balance by FY 2029-30.

As the recovery progresses and vaccinations ramp up, a rebound in economic growth will translate to higher tax revenues, necessitating lower borrowing requirements. But the province’s job is not over yet, and Ontario has spared no expense to defeat COVID-19. The Minister emphasized that the 2021 deficit is necessary to recover stronger. “After a year in stormy seas, a safe harbor is finally in sight.”

Expenses- “Without healthy people, we cannot have a healthy economy”

Provincial expenses will amount to $186 billion in FY 2021-22, largely due to historic investments in health care under the pillar of “Protecting People’s Health”. Ontario will allocate $64 billion to health spending (up 5% from FY 2020-21) alongside a $5 billion one-time investment in the COVID-19 health response. Ontario has earmarked a sizeable allotment ($1.8 billion) in budget 2021 to help hospitals recover from cost-pressures associated with the pandemic including addressing the backlog of surgeries, creating more beds for patients, and caring for COVID-19 patients. In addition to recouping lost costs and funding the health care infrastructure required in a post-pandemic Ontario, Bethlenfalvy drives home the point that the province is committed to rapid mobilization of vaccines in the near-term. Ontario has allotted $1 billion to distribute and administer vaccines across the province alongside $2.3 billion for testing.

The second pillar outlined in Budget 2021, “Protecting our Economy,” includes supports for individuals, families, and businesses. Ontario will devote $1.7 billion in FY 2021-22 to a second round of payments through the Ontario small business support grant, which will provide between $10,000 and $20,000 to over 100,000 small businesses. Ontario will also release a third round of payments through Ontario’s COVID-19 child benefit – a $400 allocation per child or $500 for children with special needs – alongside a 20% top up to Childcare Access and Relief from Expenses (CARE) tax credits. To address the impact of the burden of childcare on women’s labour force outcomes, Ontario will devote $5 billion over 5 years to create affordable childcare spaces.

In total, Ontario’s expenses represent 24% of GDP (based on the province’s prudent growth estimates for 2021), which is still comparatively lower than the majority of provinces, although significantly higher than pre-pandemic expense levels. Upside risk to the province’s economic growth scenario may drive expenses down relative to GDP.

Revenues edging up– higher economic growth poses upside risk

Revenues are set to grow a modest $2.2 billion (+1.5%), largely due to higher tax revenues (+5.8%). As the vaccine rollout results in broader provincial re-opening measures, we expect to see higher corporate and personal income taxes this year. Federal transfers will fall 19% from FY 2020-21, as one-time government transfers related to COVID-19 in FY 2020-21 aren’t likely to be repeated. The 2021 budget makes no mention of tax increases (or spending cuts). Bethlenfalvy points to economic growth as a third path to stir up revenues in the return to fiscal sustainability.

Overall, revenues are expected to represent 19% of GDP in FY 2021-22, at $152 billion. Higher growth in output this year would translate to higher revenues – a 1 percentage point increase (decrease) in nominal GDP growth would result in revenue growth (loss) of $1.1 billion.

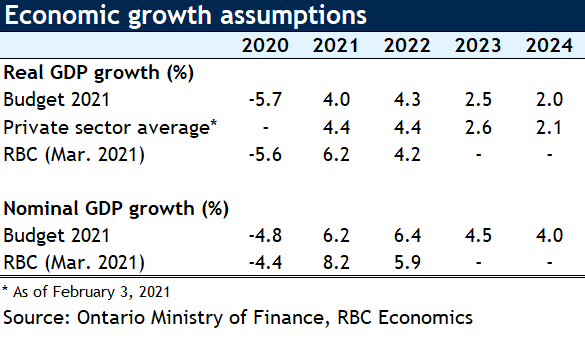

As in the 2020 budget, Ontario provided low and medium-growth scenarios. The province’s slower growth scenario of 3.1% corresponds to a deficit of $34.9 billion for FY 2021-22. The faster growth scenario of 5.9% (resulting in a $30.3 billion deficit) is more closely aligned to RBC Economics growth projection of 6.2%. Typically, the Ontario growth projection in the budget is slightly below private sector consensus, as a measure of prudence. A strong end to 2020 and signs of sustained growth in early 2021 as the pace of vaccinations ramps up resulted in an upward revision of our RBC forecasts this spring, so there is upside risk to the province’s base case growth scenario in our view.

Net debt-to-GDP to peak at 50%

Provincial net debt will inch higher this year, to $405 billion, with debt-to-GDP at 48.8% under the province’s base case. Provincial net debt-to-GDP levels are over 15 percentage points above post-financial crisis levels, the highest since the early 80s. But a lower-for-longer environment has meant that interest on debt is still historically low. In the mid-90s, Ontario faced debt levels nearly 20 percentage points below where they are now and yet interest on debt was nearly 2x higher as a share of total revenue. Of course, there is certainly some upside risk to interest on debt levels, posed by stronger economic growth. But all in all, the magnitude of the impact that stronger growth would have on revenues would certainly bear more weight than (and may even offset) interest on public debt.

In the medium term, the government has been transparent in its desire to slow the rate of increase of net debt-to-GDP, and capping this ratio at just above 50%. This defined fiscal anchor signals prudence on the government’s part. Borrowing requirements in FY 2021-22 will approach $68 billion, but will diminish over time as the deficit shrinks.

The provincial government has spared no expense to protect Ontarians health and the economy that has created a deep fiscal hole that will take nearly a decade to close. Nevertheless, the finance minister emphasized that the price of inaction would be much, much higher. A low interest rate environment is favourable for servicing debt levels of this magnitude, at least for now. “Hope is on the horizon. The safe harbor is not far away.”

Read report PDF

Carrie Freestone is an economist at RBC. She is a member of the macroeconomic analysis group and is responsible for monitoring key indicators including consumer spending, labour markets, GDP, and inflation. Carrie produces economic analysis that she delivers to clients and the public through publications and presentations. She holds a Bachelor of Arts in Economics from Queen’s University and a Master of Arts in Economics from the University of Ottawa.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More