Newfoundland & Labrador Budget 2021

Highlights:

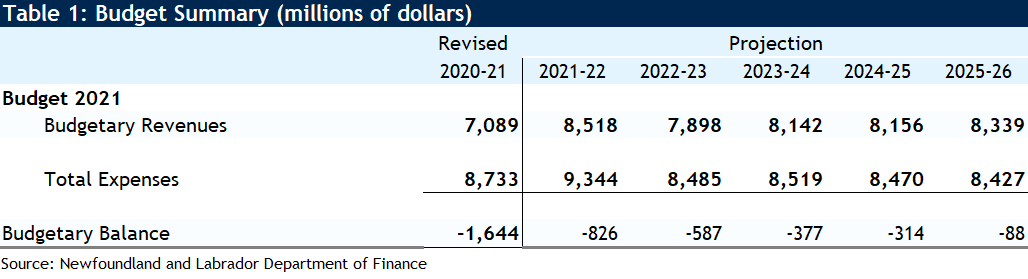

- Smaller projected deficit of $826 million in FY 2021-22

- Revenues to grow by 20% thanks to recovering oil prices

- Expenses to rise by 7% but government commits to cutting back in coming years

- Path to balance is sketched out by FY 2026-27

Newfoundland to address “mountain” of a debt load, one stone at a time

Newfoundland and Labrador Finance Minister Siobhan Coady delivered her second budgetary address on a solemn note. Coming just three weeks after the release of a report from the Premier’s Economic Recovery Team (PERT) titled the Big Reset which outlined the precariousness of the province’s fiscal position, Minister Coady recognized the monumental task ahead: “we understand our fiscal realities.” But the Minister conveyed fortitude and resolve, adding “you can move a mountain one stone at a time.” Budget 2021 is the first chapter in the province’s broader plan to tackle its fiscal challenges head on.

The plan is ambitious. The province expects to record a deficit of $826 million this fiscal year, half the size of the revised deficit in FY 2020-21. It also sketches out a path to balance within the next five years, committing to a surplus in FY 2026-27. This will require drastically cutting expenses in coming years, including by 9% in FY 2022-23. The government will launch reviews to streamline the province’s spending. “Change starts here.”

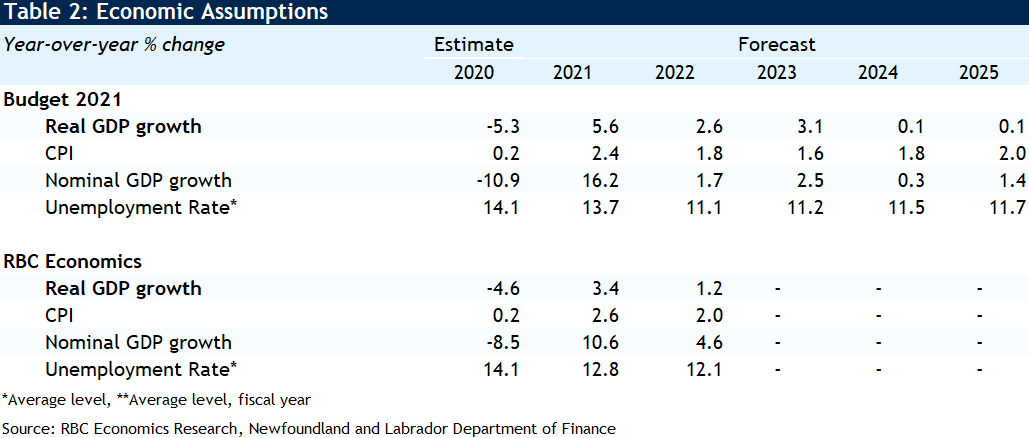

Revenues grow by $1.4 B due to higher oil prices and tax rate revisions

Newfoundland and Labrador’s revenues will grow by 20% this year, to $8.5 billion. This sharp increase is largely a base effect, as lower oil prices depressed revenues last year. In fact, over half of the province’s revenue growth this fiscal year can be attributed to higher offshore royalties, despite production slated to fall 5%. The projection is based on Brent crude surging 53% from 2020 to US$64/barrel and a Canadian dollar of 79.6 cents US, causing offshore royalties to more than double this year. A $1 increase in the price of oil would boost offshore royalties by $19 million (and vice versa) and a 1 cent appreciation in the exchange rate, could drive royalties down by $15 million. We find those assumptions conservative, as both are closely aligned with our RBC’s own forecasts.

Personal income tax revenues are also expected to grow significantly by 9.5% (or $129 million) this year.1 Roughly 13% of this increase is due to the province raising tax rates for higher income earners (those whose annual earnings exceed $135,973) and the addition of new income brackets for the highest earners. These adjustments are among the recommendations included in the PERT report and will come into effect on January 1st, 2022. The government, however, did not go forward with the recommendation to also raise lower and middle-income tax brackets as well.

Expenses grow this year as Newfoundland commits to tightening its belt later

This fiscal year, Newfoundland’s expenses are projected to grow by 7% to $9 billion. The largest provincial allocation (39% of the province’s operating budget) is devoted to the province’s health care sector, $100 million of which will be used to continue the fight against COVID-19, earmarked for testing, PPE, and mobilizing vaccines. To assist one of the hardest-hit sectors, Newfoundland’s budget also includes a $30 million allocation to support the province’s tourism and hospitality industry alongside $20 million in small business supports. Additionally, the province plans to deploy $230 million (mostly funded by federal transfers) to assist newcomers in the province with skills-matching, as Newfoundland has set the goal of welcoming 5,100 newcomers by 2026 to grow the provincial population.

Capital expenditures account for 7% of total budgeted expenses. Close to $600 million (the majority of these funds) target infrastructure development including support for offshore oil projects. A sizeable $147 million will be deployed to improve local infrastructure, using federal assistance.

Following the release of the PERT report, Minister Coady has made it very clear that Newfoundland is committed to addressing its “fiscal realities.” The Minister laid out tangible courses of action to streamline and cut costs including commitments to integrate the Newfoundland and Labrador English School District into the Department of Education. The province will also begin a comprehensive analysis (one of many!) of Nalcor and review the provincial oil and gas corporation.

Net Debt to GDP mostly unchanged

Newfoundland’s debt level is projected to increase to $17.2 billion this fiscal year, $900 million above FY 2020-21 (but lower than the debt level expected in Budget 2020). Newfoundland has the highest per-capita debt level and the highest debt service costs relative to the size of its budget. Thanks to stronger provincial GDP this year, the province’s net debt-to-GDP level will be slightly lower (47%) than in FY 2020-21 (50%). Newfoundland’s debt service costs are expected to be 13% lower this year, but still account for nearly 8% of total provincial current account expenditures. In Budget 2021, Minister Coady conveyed her intention to reduce the province’s debt level by up to $10 million annually.

Borrowing Requirements

This year, Newfoundland and Labrador will borrow $1.7 billion, $1.1 billion less than in FY 2020-21.

Conclusion

In addition to recovering an oil price crash in the midst of a global pandemic, Newfoundland must face its fiscal challenges head on. The path to balance laid out in Budget 2021 coupled with a commitment to streamline expenses and adjust tax rates for higher earners signals that the government is serious about “taking definitive action now.” This budget is the first chapter of a huge task that will require not only resolve but courage. As Minister Coady concluded, she reiterated her initial remarks, “Change starts here.”

1. These estimates are provided on a cash basis.

Read report PDF

Carrie Freestone is an economist at RBC. She is a member of the macroeconomic analysis group and is responsible for monitoring key indicators including consumer spending, labour markets, GDP, and inflation. Carrie produces economic analysis that she delivers to clients and the public through publications and presentations. She holds a Bachelor of Arts in Economics from Queen’s University and a Master of Arts in Economics from the University of Ottawa.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More