Canadian Housing Health Check

Read the full report for an assessment of key Canadaian housing market indicators.

Read full report

COVID-19 wasn’t the much-feared Armageddon for Canada’s housing market: Unprecedented government aid, supportive actions from financial institutions and rock-bottom interest rates contributed to keeping property values on track.

Main near-term risk is overheating, not price collapse: Super-strong demand is quickly depleting inventories across the country. Competition between buyers is extremely fierce in many markets (including smaller ones), and a ‘fear of missing out’ is taking hold. Such dynamics often lead to self-reinforcing price trends.

Interest rate risk could rise if the economy outperforms expectations: Exceptionally low rates provide a powerful tailwind for the market. This wind could change direction if a quick economic recovery stokes inflation fears, causing interest rates to rise.

Odds of policy intervention increase the hotter markets get: Events in British Columbia (2016) and Ontario (2017) have shown us policymakers come under intense pressure to stabilize markets and contain household leverage risks when prices spiral upward.

Fall in immigration could put the brakes on housing demand if sustained: The impact of persistently low in-migration would likely spread beyond the rental market of Canada’s largest cities. Condo markets could become vulnerable.

Prolonged labour market weakness would pose a risk: High unemployment could outlast government support programs, potentially undermining housing demand.

Pandemic still represents a threat to the housing market: New variants could emerge that could destabilize the economy.

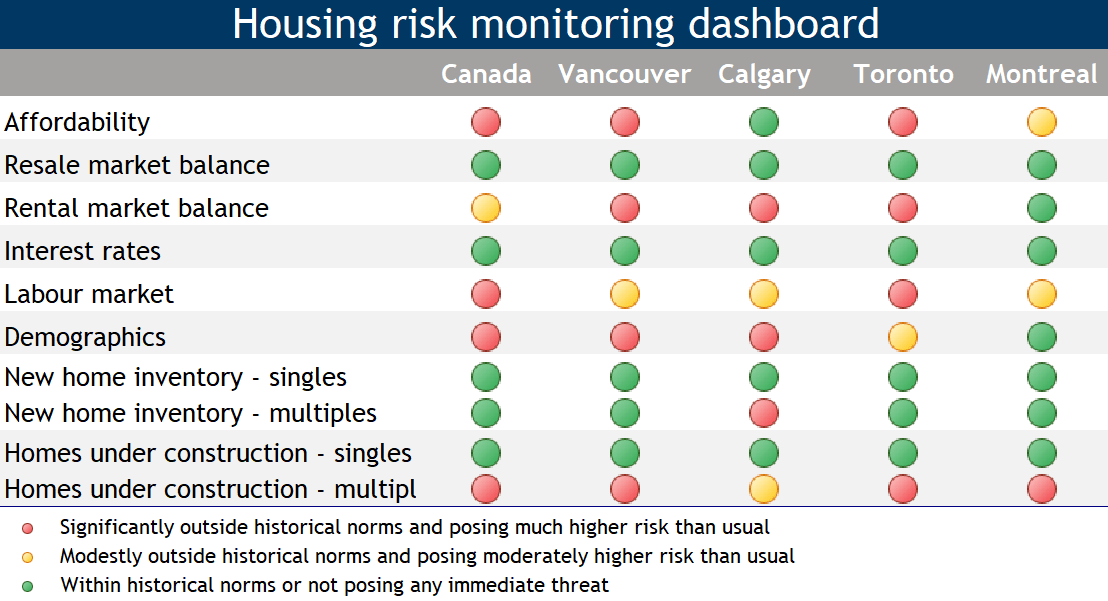

Poor affordability remains a major issue in major markets: The high cost of homeownership in Vancouver, Toronto and, to a lesser extent, Montreal are a top vulnerability for Canada’s major markets.

Strong condo construction isn’t a sign of overbuilding: But elevated levels of apartment construction in Vancouver, Toronto and Montreal raise some potential longer-term absorption issues. Very low unsold inventories significantly limit risks near term.

Largest four markets

Toronto

The market rallied to record-high levels since last summer. Demand is supercharged and buyers act with a sense of urgency on fear of missing out. For-sale inventories are very thin except for downtown condos. There’s an increasing potential for overheating. Single-family home prices are escalating at an accelerating pace. Condo prices are largely stagnant reflecting the downturn in the rental market. Overstretched affordability remains a significant issue and top vulnerability.

Montreal

Demand-supply conditions are extremely tight. Prices are soaring, especially in the suburbs. With few signs the buying frenzy is about to ease, there’s a growing risk of overheating. Affordability is a strain but not a major issue yet. Elevated rental apartment construction warrants close monitoring.

Vancouver

Activity has rebounded vigorously, and strong demand significantly has drawn down inventories. Home prices are gathering steam. The plunge in immigration poses a potential risk though the impact so far has been limited to the rental market. Softer rental demand and increased supply created some slack in the rental space. Despite recent improvement, housing affordability is exceedingly poor and a major source of vulnerability.

Calgary

The market has recovered solidly since last summer despite significant economic uncertainty in Alberta. Demand-supply conditions are the tightest they’ve been in years though this primarily reflects the situation for single-family homes, where prices are now rising modestly. A high rental vacancy rate and drop in immigration is keeping the condo segment in a fragile state.

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More