The Price of Power is the latest report in RBC Economics and Thought Leadership’s climate series, building from the team’s flagship report, The $2 Trillion Transition. This climate series is designed to inform and inspire Canadian prosperity, while advancing RBC’s ongoing commitment to speak up for smart climate solutions, a key pillar of RBC’s Climate Blueprint. It’s clear electricity will form the backbone of the Net Zero economy. Getting the build-out of Canada’s Net Zero grid right is a key challenge for the next decade.

Is Canada ready to meet a 50% surge in electricity consumption over the next decade? It’s a tall order, even unlikely at our current pace of decision-making. Add to it another complexity: we have committed to a Net Zero grid by 2035, yet natural gas continues to make a compelling economic and reliability argument.

The situation has taken an urgent turn in Ontario, Canada’s economic engine, which faces energy shortages as early as 2026, and must decide between various energy sources, including eliminating gas altogether from the grid. Other provinces will soon be asked to make variations of these tough and expensive decisions within the decade. If they get it wrong, Canada could suffer Europe’s fate of a hobbled, energy-insecure grid that leaves consumers with soaring bills.

There’s not a moment to lose, especially as the US and other competitors are eyeing rapid decarbonization of their energy infrastructure in the aftermath of the energy crisis triggered by Russia.

Canada shouldn’t just keep up – it needs to accelerate the expansion of its electricity system or risk falling behind in a renewed Net Zero grid race.

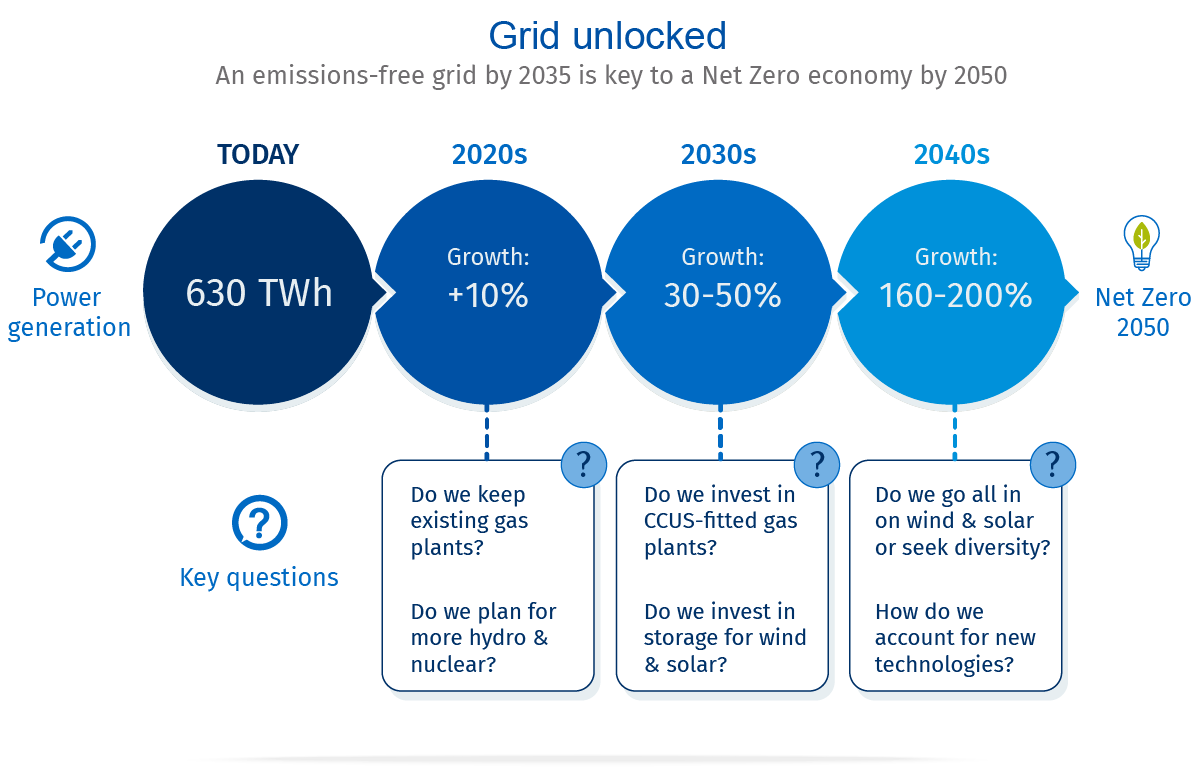

Here’s the scale of the challenge facing our policymakers over the next three decades:

Key findings

Additions to Canada’s grid should be predominantly wind and solar in the near-term, but other sources have a role to play. Policymakers will need to manage the cost of dealing with fluctuations in wind and solar power by tapping into the spectrum of options at our disposal.

Natural gas is unavoidable in the energy mix in the short-to-medium term. Keeping existing gas plants running at least through 2035 is likely the best way to meet near-term challenges as we stick-handle a smooth transition to a Net Zero grid.

Ontario will be the first to confront this conundrum. The province could face energy shortages as early as 2026, especially as contracts for renewables and gas plants expire. Into the 2030s, demand growth means choosing between new natural gas plants with a gamble on carbon capture, expanding nuclear or hydro, or going all-in on wind, solar, and storage.

Alberta and Saskatchewan are also staring down stark choices. The Prairies can tap their excellent solar and wind resources, but the significant role coal has played means producers are planning to convert to gas in the near term. How long those plants and any new gas plants operate is the big question, one made more political given the region’s abundant gas.

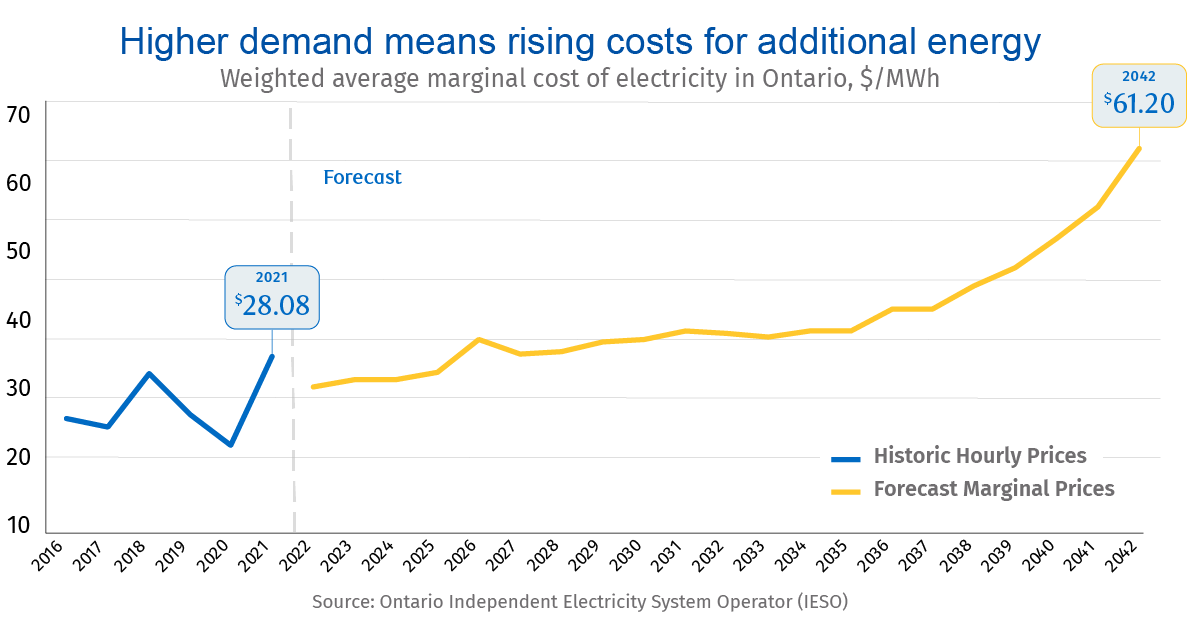

Canada has a choice between cheaper or reliable Net Zero electricity, but having both will be challenging. A wind or solar project costs US$40 per MWh, compared to US$60 MWh for gas-fired power. Add another $70 per MWh for a carbon-capture fitted gas plant, or $230 per MWh for the small share of renewables we need to store in batteries, and costlier hydro and nuclear power start becoming tantalizing.

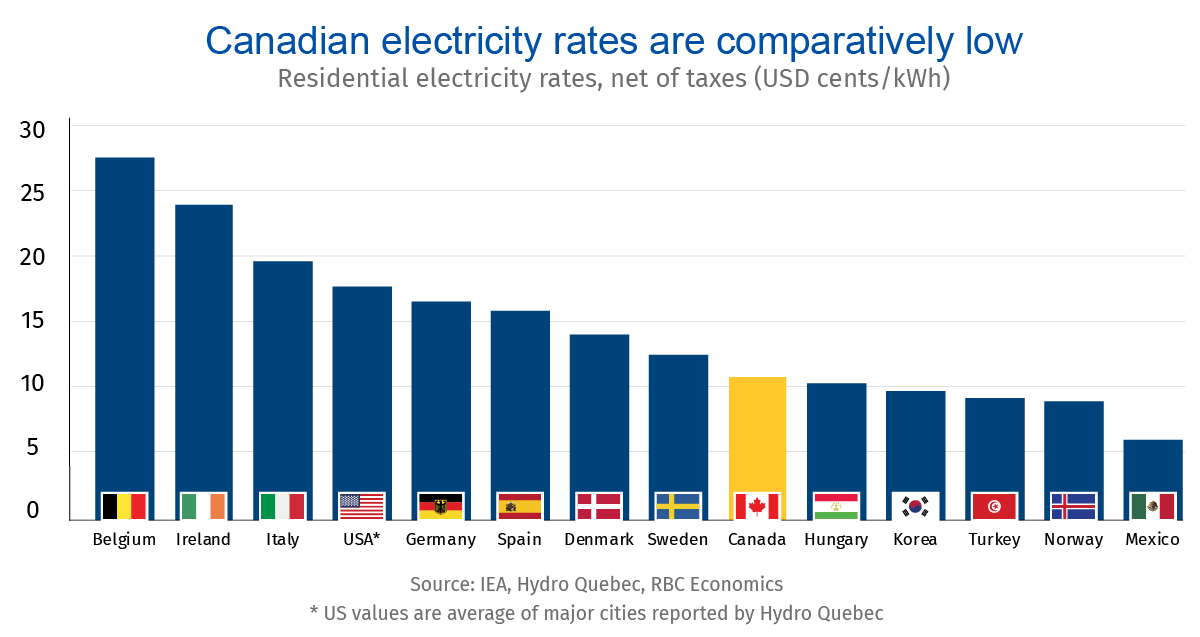

Electricity rates could rise 30%. While power bills will rise, overall consumer energy spending will fall as more efficient EVs and home heat pumps replace gasoline cars and natural gas furnaces.1

There is a need for nuclear in Canada’s climate-resilient grid. Our modelling shows that a grid that maintains and expands nuclear (as well as hydro) may well be more affordable. An all-renewable grid with battery storage could add $7 billion in annual costs, while one with a more diverse mix would cut that nearly in half.

Hydro is Canada’s trump card. The emissions-free source can serve as baseload power and reservoirs can back up intermittent supplies of wind and solar generation. Excluding hydro projects from the grid for their perceived high costs today—given how long they take to build—risks eliminating a cost-effective, sustainable source in the long run.

Canada’s electricity sector is entering a generational shift

Today, Canada is a clean electricity powerhouse. We boast 80% non-emitting electricity across the country thanks to our excellent hydroelectric resources and the ambitious development of dams since the early 1900s. Hydro is also largely to thank for Canada’s relatively low electricity rates,2 but it’s only available in some parts of the country.

A grid that is twice as big by 2050 would require a major overhaul. For one, we’ll need significant upgrades to the infrastructure that delivers power—regardless of how it’s produced—as more businesses electrify. In Hamilton, steel mills are replacing coal fires with electric arc furnaces, in BC, more electric vehicles are hitting the roads than ever before, and plans are taking shape in Quebec for a massive green hydrogen facility powered by hydroelectricity.

Those businesses are hoping that electrifying will help them get to Net Zero. Policymakers have to grapple with phasing out coal and reckoning with the growth of natural gas power, and its emissions. Astute policy decisions in the face of uncertainty around when EVs will dominate regular cars, and heat pumps will replace gas furnaces, could usher in a renaissance for the electricity sector that will buttress a climate and energy-secure grid.

The time to act is upon us: what provinces do today, especially with regards to natural gas-fired power plants, electrical infrastructure, and energy efficiency programs will start narrowing our options or determining future costs. Pursuing a wide range of options for new electricity projects will limit the need to decide on the most challenging aspects—new gas plants, expensive batteries—for a little while longer.

Canada can pursue a number of paths to meet Net Zero electricity goals, but each comes with its own set of challenges.

The 2020s: Filling in for coal, nuclear (and gas?)

Look no further than Ontario for the immediate electricity challenge facing Canada.

The country’s most populous province could be in an energy shortage as early as 2026, and the problem will worsen as contracts for non-hydro renewables and gas plants expire. Without the ability to generate power from these existing facilities, Ontarians could face significant power shortages by 2030.

As constant generators like nuclear and coal get refurbished or shut down, running more natural gas generation remains the go-to solution. Ontario’s electricity system operator recently published an outlook that foresees nearly tripling of emissions by the end of the decade, as gas plants meet increasing demand and declining nuclear production.

The key questions: should the province extend the life of existing gas plants to fill the gap in the near term, and should it build new gas plants, or build a lot more renewable power to fill the 2030s gap?

In the near term, keeping the gas that’s already firing, and filling the rest of the gap with quick-to-build and cheap renewables makes sense, and would hold electricity sector emissions constant.

The province has done it before. Between 2008 and 2019, coal generation in Ontario fell 22 terawatt hours (TWh), from 14% of the province’s power to nil. Initially, gas generation replaced as much as 70% of that shortfall, doubling between 2008 and 2011. Thereafter, nuclear and renewables grew enough to replace gas. Following deliberate policy, Ontario’s installed renewable capacity has grown to be the largest in the country.3

Other provinces, where the gap from coal is more significant, and gas plays a larger role, face a bigger challenge. Alberta, Saskatchewan, and Nova Scotia will need to phase out coal plants without raising or locking in the emissions their grids produce.

The good news: wind and solar power have so declined in cost—some 70 and 90%, respectively—that they’re now the cheapest sources of new electricity. Across Canada, wind and solar development has grown exponentially, and will continue to grow rapidly given its quick construction time. And the Prairies, where coal phase out is most challenging, have some of Canada’s best wind and solar sites.

Provinces facing near-term challenges should lean hard into building renewables, cutting inefficiencies, and maintaining their current gas capacity. The harder choices are yet to come.

The 2030s & 2040s: A bumpy growth path

Having integrated a large share of solar power in its sunny interior, California’s grid suffers a unique challenge. When the sun stops shining, it needs to find a significant amount of quick-to-ramp power. Gas fits the bill, but so do batteries. The former adds emissions and the latter increases cost.

California’s lesson is instructive. Canada will likely rely more on wind power, which has fewer issues than solar, but is less predictable day-to-day. We’ll need investments in storage that could add as much as $13 billion in electricity storage costs per year by 2035, if battery costs don’t fall.

Provinces that pursue renewables instead of natural gas will see lower costs in the medium term, but risk raising them over the long term when they need more storage.

In provinces where coal retirements mean new gas assets can still cut emissions, they’ll likely be used to avoid storage challenges.

A federal clean electricity standard—a suite of regulations limiting how much pollution power plants can emit—could avoid this new gas, or enforce carbon capture systems which could cost $5 billion a year by 2035.

There is a risk of slowing the transition in either case. If electricity emissions rise, firms that rely on clean electricity to cut their carbon footprint may struggle to sell into markets that are increasingly focused on sustainability. And higher power bills may discourage consumers from adopting electric vehicles and heat pumps, slowing economy-wide emissions cuts.

Through the 2030s, uncertainties around demand growth and the longer-term challenges of intermittent renewable power mean provinces are reckoning with whether to build additional natural gas capacity and risk missing the 2035 target in service of a flexible grid, or else rely entirely on non-emitting power.

Many forecasts assume robust demand growth, even in the near-term, driven by government policy. Outlooks often assume the government will enforce its EV targets, for example. But governments can change. And vehicle demand drivers are complex: EV charging infrastructure remains a key obstacle in Canada, with 85% of Canadians in a recent KPMG survey worrying about wait times for scarce public chargers.

Building a lot of new generation today, into an uncertain demand outlook, risks increasing system costs significantly. Analysis for Ontario already shows that electricity generation costs will rise, although overall energy bills could fall as consumers with EVs avoid gasoline costs.

While wind and solar grids can be built quickly, they still have challenges. Take the European experience this summer: with a dearth of Russian gas, climate change-driven disruptions have acutely affected power prices. Drought has led to low hydro reservoirs in usually wet parts of Norway, and record heatwaves have lowered wind power availability and warmed rivers so much that nuclear plants can’t use them to cool reactors without environmental waivers.

Over this time horizon, planners should consider if there are ways to reduce the use of gas and limit how frequently it’s needed by firing it up when renewables need balancing (before battery storage costs start falling). As we decide which path to take through the 2030s, the alternatives that avoid these hard choices are worth considering in more detail.

What a Net Zero grid could look like?

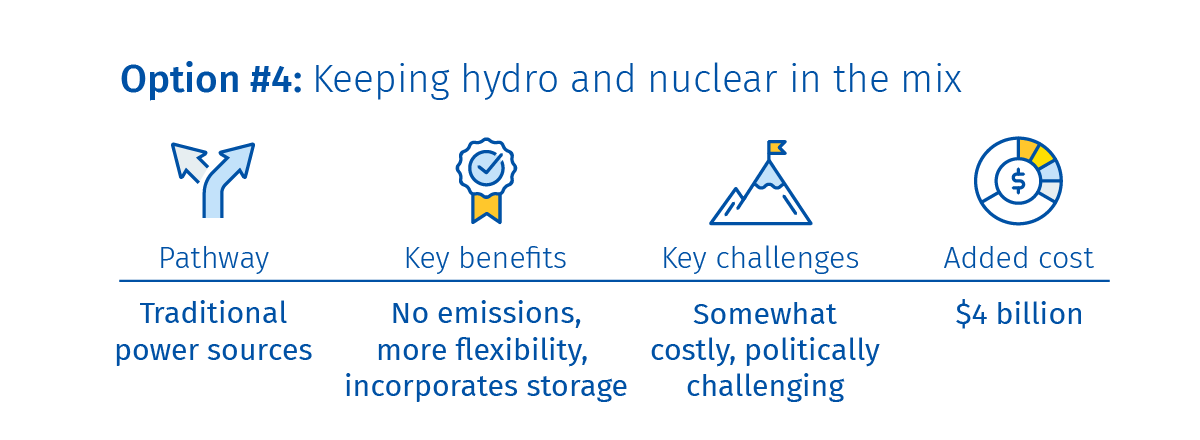

There’s good news: Canada has four main options to address the integration of intermittent power sources in the long run.

Each potential pathway offers some benefits but also several challenges. We’ll likely use some combination of each, but they’re worth exploring in isolation.

Leveraging Canada’s large geography, power can move from where it can be most efficiently produced to where it’s needed. That would require swapping power between provinces that have good wind and solar resources and those with a lot of hydro. During periods with high solar and wind generation, we’d send renewable power to the hydro provinces, and at night or on calmer days, dispatchable hydro would return the favour. In most studies, this helps Alberta, Saskatchewan, BC, Quebec and the Maritimes decarbonize.

The challenge? Building any transmission infrastructure has proven politically challenging. Cross-border, a recent Hydro Quebec project is tied up in Maine’s Supreme Court. And inter-provincial lines are no easier: while a transmission line from Manitoba to Minnesota proceeded without subsidy, a similar line into Saskatchewan received significant federal funding, likely because the economics of the line were less compelling. A system with a high reliance on renewables could require fully doubling the capacity of our current high voltage transmission system. Doing so could prove challenging.

In the absence of more robust transmission infrastructure, we’ve relied on flexible gas generators to smooth out fluctuations in wind and solar. Doing so long-term would lead to problematically high emissions. To reach Net Zero, we’d need to fit gas plants with carbon capture, utilization and storage (CCUS) units. That would make them significantly more expensive to run, as noted above, but maintains the ability to respond to changing renewables output on a minute-by-minute basis.

The challenge is that carbon capture is still relatively unproven: the world’s only gas power plant with carbon capture stopped operating in 2005, and if the technology suffers frequent outages, it could lead to higher than expected emissions (something that has plagued several new facilities recently). It also relies on specific geology to store the carbon (so may only be an option in parts of the country), and assumes natural gas extraction will also fully decarbonize. While proposed investments in CCUS may offer breakthroughs, these are important risks, and if realized well into the 2030s, could threaten the economic activity Canada’s clean power production could attract.

Storing the ample energy produced by renewables, either charging batteries while they produce more than needed, or using the excess power to pump water into reservoirs and releasing it through turbines later is a viable option. Traditionally used to arbitrage electricity prices, pumped hydro storage has real potential in Canada, but with just one operating facility built in 1957 it’s hard to know what new hydro storage could cost. It’ll be useful to smooth out seasonal differences in wind power, and will likely be located in mountainous parts of the country, such as BC.4 While pumped hydro will be an important new resource for some key parts of the country, like Ontario, many provinces will rely more on batteries.

The key challenge of a high-storage grid is cost. Additional generation capacity and the cost of the batteries themselves would raise the price of electricity further, when inflationary pressures are already mounting. Relative to the cost of the gas-fired system above, storing electricity could be $7 billion more expensive each year. The benefit of paying that premium: a system guaranteed to have low emissions.

Another key challenge: producing key battery metals such as nickel, cobalt and lithium, and batteries themselves, within friendly jurisdictions to ensure security of supply.

The last option available goes back to the foundations of Canada’s existing electricity system. As electricity demand rises, we’ll need to provide more power in almost all hours of the day. Such “baseload” power needs have often been met by hydro, and in some cases, nuclear power. There are reasons to think we will need them again.

For one, nuclear power stations have been declining in scale: Ontario Power Generation (OPG) will install a new, small nuclear reactor about a third of the size of traditional ones at Darlington. As a test case, it could provide learnings for an expansion of nuclear to other parts of the country that are phasing out coal and struggle with hydro for storage, and to other industries. In this case, it would replace some renewables buildout and help keep the share of intermittent electricity lower, helping to lower storage costs. Learnings from deploying these smaller reactors could help lower costs for future ones.

There’s also significant new hydro potential in Canada. In the near term, optimizing and refurbishing existing hydro makes the most sense. Studies show that as demand for electricity grows, hydro provides more value to the system, meaning more expensive hydro sites could still be cheaper than other sources of power.5 Traditional reservoir hydro offers two main benefits: it can provide clean power around the clock, helping solve the baseload challenge, and also flexibly respond to intermittent renewables.

Still, like all major projects, hydro and nuclear face fiercer local opposition. While hydro is in some cases more expensive than renewables, cost challenges are even more relevant for nuclear. Regardless, one scenario where select provinces add more hydro, nuclear, and fewer batteries to displace gas generation adds $4 billion in costs (as compared to $7 billion for an all-renewables scenario with storage).

Closing the circuit

Each technology above solves a particular challenge, but also comes with its own unique risks. A system that relies on CCS risks high emissions, one that relies on wind will suffer seasonal changes and possibly high storage costs, and hydro may suffer from droughts or cost overruns.

There’s uncertainty on which technologies will develop, too. CCS, battery storage, and small modular nuclear reactors are cited as areas where cost improvement could mimic wind and solar power over the last decade. But battery availability and the associated price volatility, technological risks, and changing regulatory environments could slow cost declines.

Avoiding these pitfalls requires diversification, and recognition that the pathways to Net Zero power and the distinct challenges in each decade are not mutually exclusive. What’s done in one decade will affect another, and stacking solutions across pathways can diversify away from each pathway’s risk.

In the 2020s, the best option will be to focus on conservation, use existing gas assets a while longer, and build renewables to plug the gaps. Coal-dependent provinces will probably build new gas plants this decade, too. But using some new gas to balance a lot of new renewables could still cut emissions in the near term. Provinces should plan to fit those with carbon capture—sharing learnings from doing so with other industries—or retire them by the mid-2030s.

By then, hydro and nuclear can provide significant value by avoiding a system that relies too heavily on wind and solar power and needs to store them. Existing sites can be optimized and refurbished today, and planners can include new ones in their outlooks. Smart planning and project management, including economies of scale, can help control the costs of these additions. But we’ll need to be mindful of the risk that mega-projects can often expensively over-supply power for some time. Pairing projects with specific demand sources could be a good way to hedge that risk.

The green economy of the future demands green power, and as Canada’s population and economy grow towards 2050, a lot of it. The time to start acting is now, if we’re to transition the sector and meet the reliability and affordability standards Canadians have come to expect.

The weaponization of energy by Russia has forced the world to reimagine what an adaptable and affordable Net Zero grid could look like past 2030. Developed and emerging economies are now in a hurry to launch new transition and renewable energy projects, attracting investment dollars, raw materials and skilled labour. To stay in the race, Canada needs to expedite its big push on electricity: between provinces, through decades, and across the country.

Recommendations:

Maintain current levels of gas-fired power in provinces with major mid-2020s challenges. While emissions need to fall quickly, phasing out existing gas assets during baseload disruptions in the near-term will add significant costs.

Focus more on conservation in the near-term. Energy efficiency measures can dramatically reduce demand cost-effectively. Ontario’s electricity consumption could fall 6% from switching to LED lightbulbs, alone.6 By delaying the need to build new generation until the outlook is more certain, leaning into conservation this decade will cut the overall cost of transition.

Lengthen procurement cycles to explicitly scope in hydro and nuclear development. Utilities and system operators often procure power in short bursts, once a need is identified. This manages the risk of overbuilding capacity, but also means long-duration projects such as hydro rarely have runway to compete. Engaging in longer-term procurement processes would allow provinces to identify high-value sites for expansion.

Reward flexible power providers. As renewables grow, producers that provide consistent power and cut output to reflect periods of high renewable generation, should be compensated for the benefit they provide.

Explicitly include resilience to climate shocks in planning outlooks. Planners must consider generation disruption from low water and wind levels, and the damage from extreme heat to our transmission and distribution infrastructure. Assets that have fewer extreme weather uncertainties, like nuclear power, have higher value in an uncertain world.

More carrots than sticks. Major economies across the world are unveiling incentives for all forms of non-emitting power. Canada’s subsidy environment favours wind, solar and CCS, but leaves out hydro and nuclear. Carrots and sticks will promote all forms of non-emitting power and keep power bills affordable during the transition to a Net Zero grid.

Coordinate major projects across provinces to cut costs. As all provinces consider major electricity projects, coordinating procurement could help manage costs. Procuring turbines for 10 hydro dams, or reactors for ten small modular nuclear sites will access economies of scale, and engineering and other expert labour can avoid downtime. While challenging, provincial coordination is the norm on other important national issues.

Yadullah Hussain, Managing Editor, Climate and Energy, RBC Economics & Thought Leadership

Cynthia Leach, Assistant Chief Economist, Thought Leadership

Darren Chow, Senior Manager, Digital Design, RBC Economics & Thought Leadership

Zeba Khan, Manager, Digital Publishing, RBC Economics & Thought Leadership

Aidan Smith-Edgell, Research Associate, RBC Economics & Thought Leadership

1. https://climateinstitute.ca/wp-content/uploads/2022/05/Electric-Federalism-May-4-2022.pdf

2. https://www.oeb.ca/sites/default/files/rpp-price-report-20210422.pdf, table 2

3. https://renewablesassociation.ca/by-the-numbers/

4. https://www.nature.com/articles/s41467-020-14555-y

5. https://www.nrel.gov/docs/fy21osti/79225.pdf

6. https://www.ieso.ca/2019-conservation-achievable-potential-study

ACKNOWLEDGMENTS

We thank the following individuals and organizations for their insights:

- John Gorman, Canadian Nuclear Association

- Gary Sutherland, Hydro Quebec

- Heather Ferguson & Eric McGoey, Ontario Power Generation

- Julia McNally & Salvatore Provvidenza, The Independent Electricity System Operator

- David Butters, Association of Power Producers of Ontario

- Paul Norris & Stephen Somerville, Ontario Waterpower Association

- Paisley Sim, Transition Accelerator

- Brad Griffin, Simon Fraser University

Colin joined RBC in 2019 as an economist. He holds a Bachelor’s degree in Economics from the University of Ottawa, and Master of Arts in Economics from the University of British Columbia. Prior to joining RBC, Colin worked on mortgage, housing, and economic policy at the Department of Finance Canada.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More