Highlights

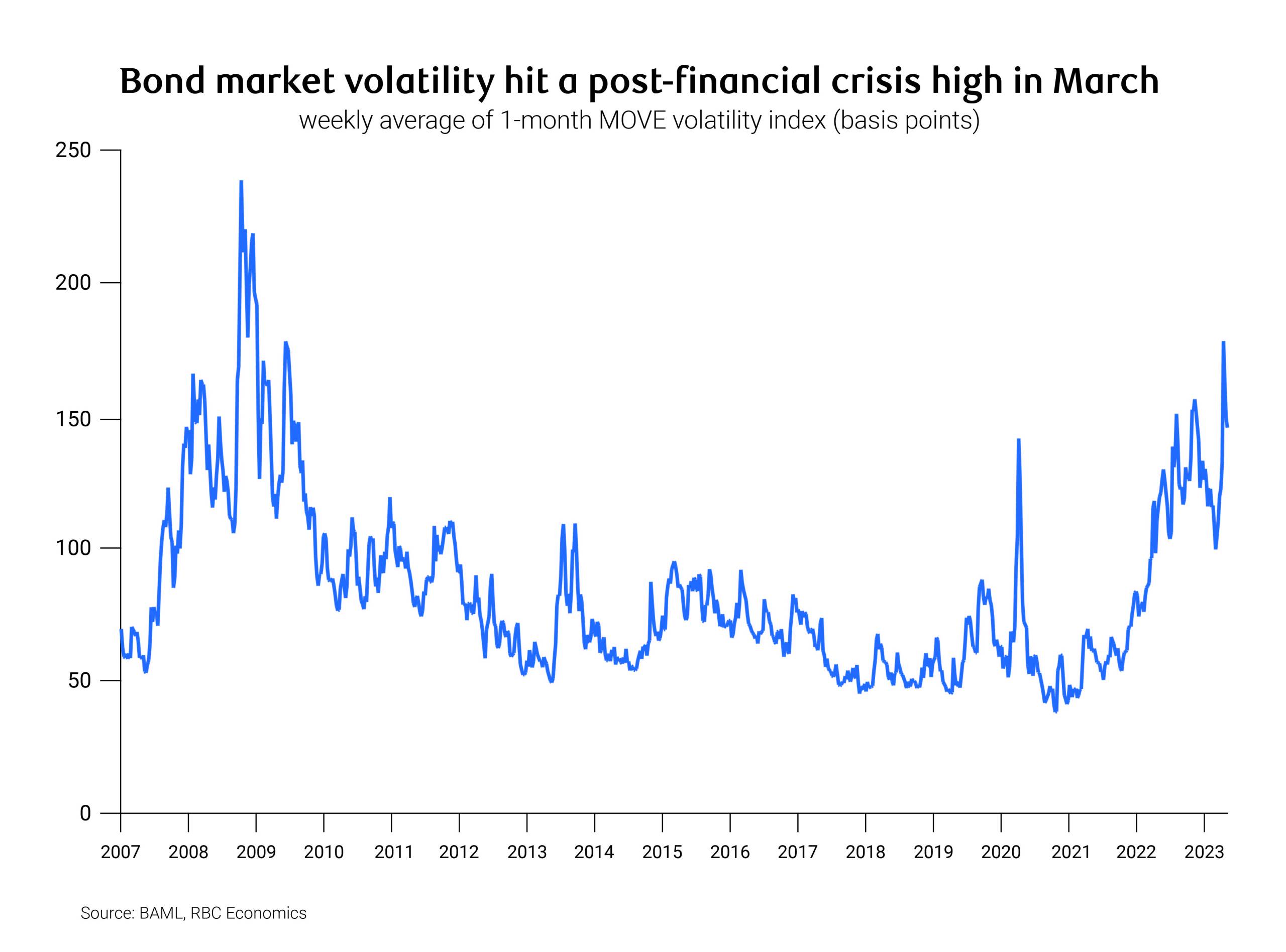

- Banking sector turmoil caused significant bond market volatility…

- …but didn’t keep the Fed, ECB and BoE from hiking rates last month.

- Job growth remains firm but there are signs that economic resilience is beginning to fade…

- …and tighter lending conditions could add to headwinds from higher interest rates.

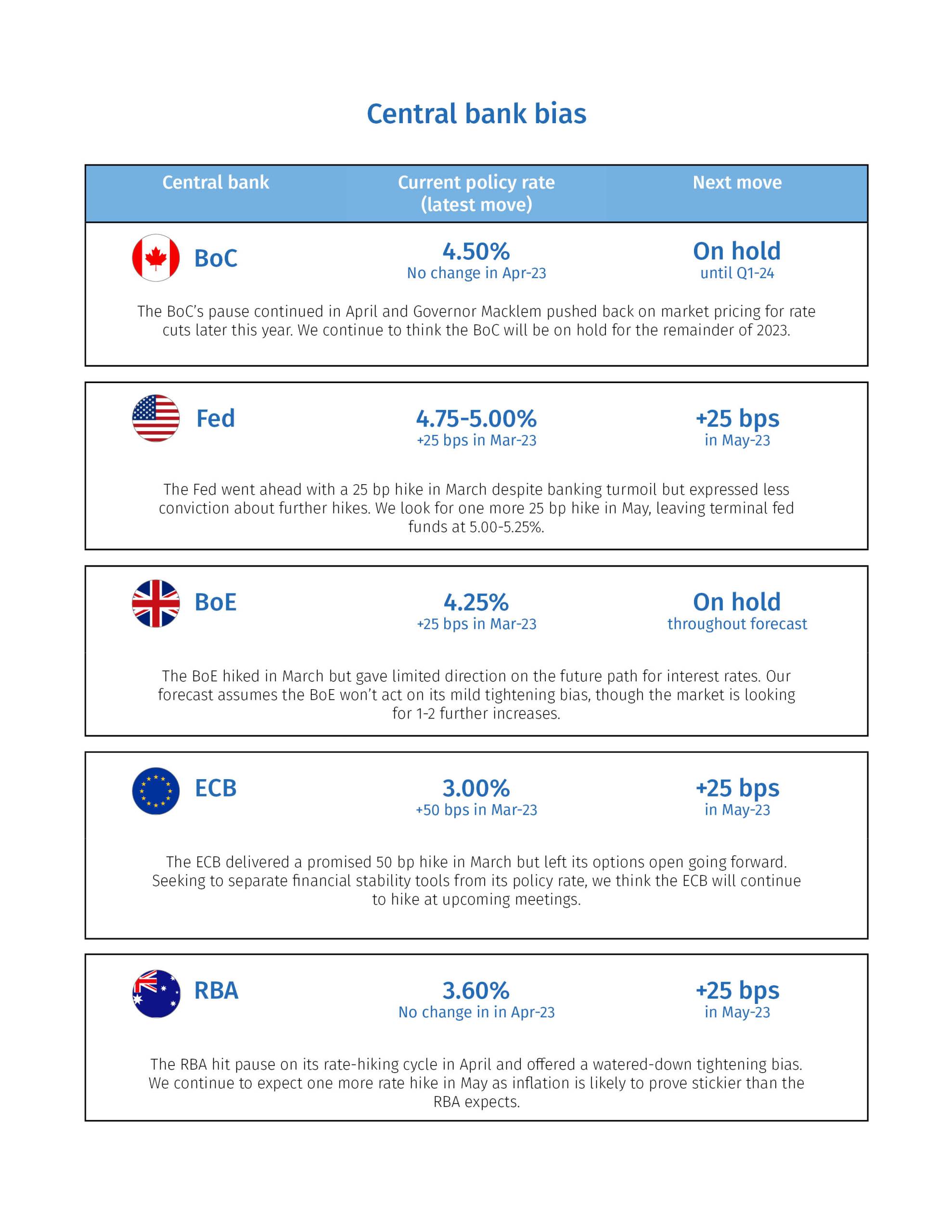

- The BoC remained on the sidelines and should soon be joined by other central banks.

Banking sector turmoil caused significant bond market volatility in March, particularly at the front end of the curve. Shorter-term Treasuries sold off early in the month amid hawkish Fed speak but then rallied sharply as concerns about the health of the financial system raised the prospect of imminent rate cuts. Yields were free falling ahead of key central bank meetings as investors worried about contagion risks, waiting for the next shoe to drop. But policymakers, confident they have the tools in place to manage financial instability, didn’t back down from planned rate hikes. The Fed, ECB and BoE all delivered rate increases mid-month, but shied away from giving firm guidance on future interest rate decisions while acknowledging a more uncertain backdrop.

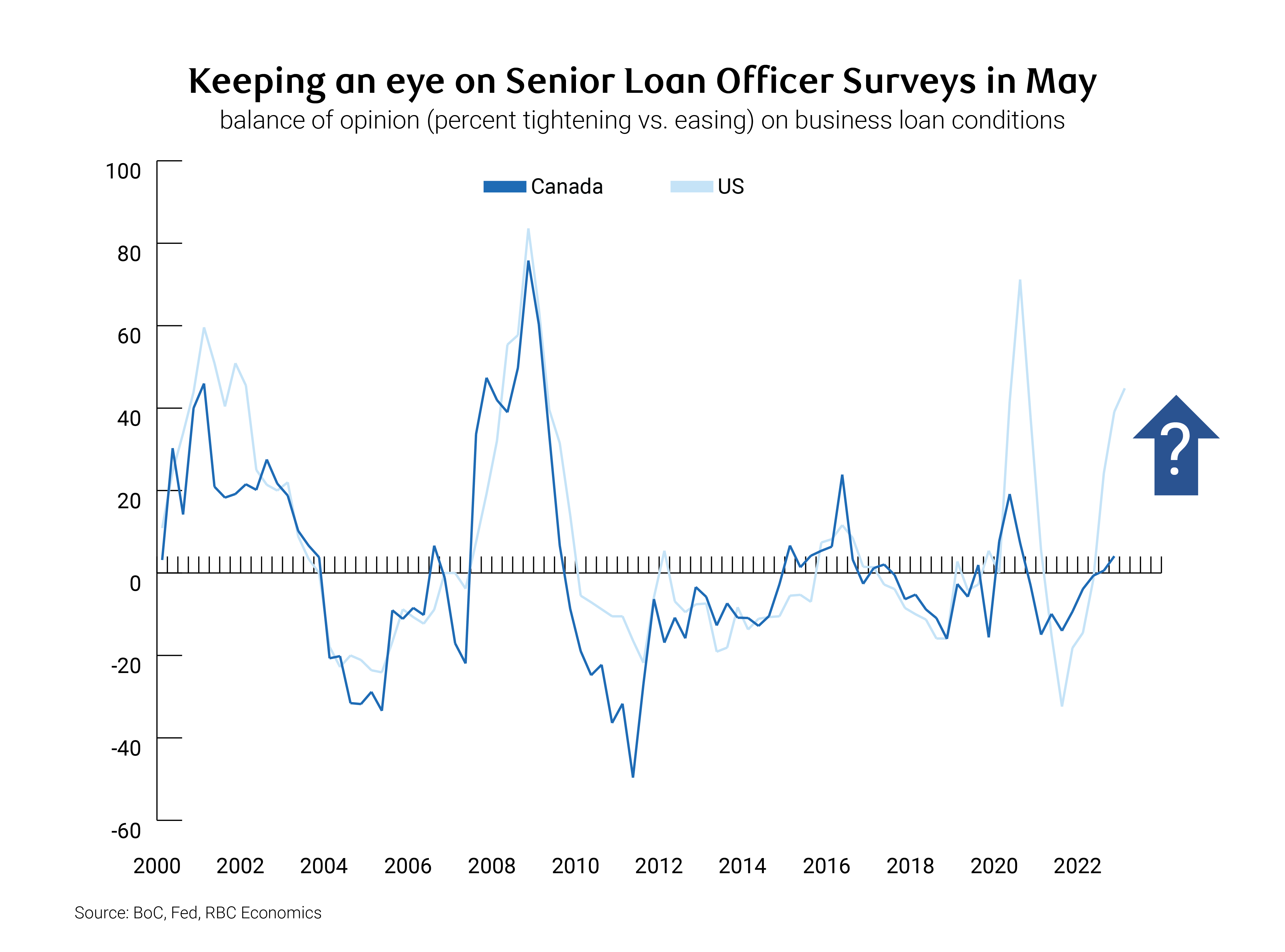

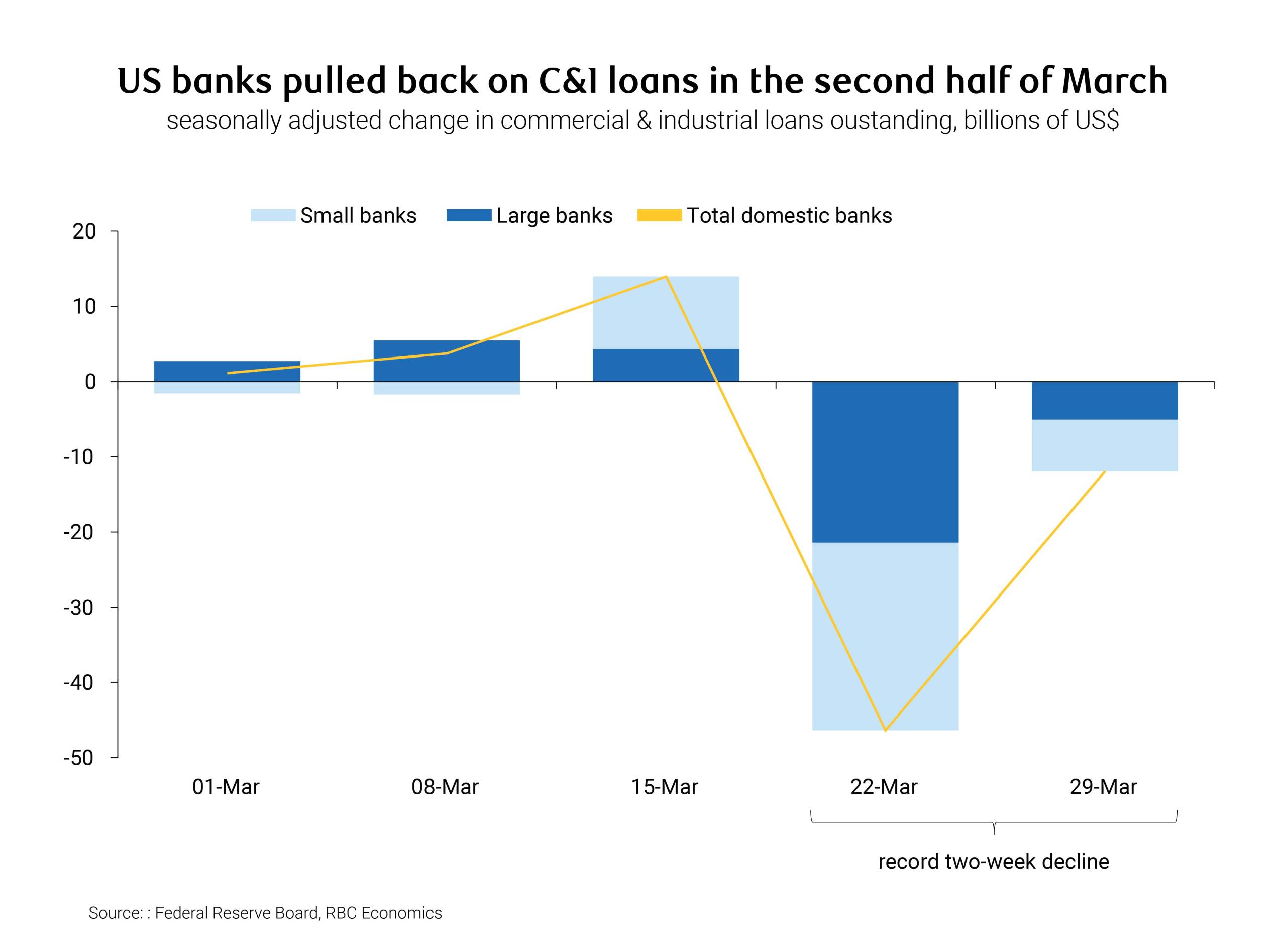

So we’re left waiting on several fronts. Banking sector concerns remain at the forefront, but calm has prevailed in recent weeks. Deposit outflows from smaller US banks have steadied, as has reliance on the Fed’s liquidity facilities. But even if the issues that have emerged thus far are the extent of it—a major assumption but one we’re making given our current knowledge—recent turmoil is likely to result in some tightening in lending conditions that could have the equivalent effect of further rate hikes. Early data has pointed to a pullback in U.S. commercial and industrial loans, and we’re anxiously awaiting quarterly bank lending surveys in the first half of May. At the same time, we continue to wait for the impact of significant rate increases over the past year to flow through to real activity. Economies and labour markets have generally remained resilient, but cracks are beginning to form and key sources of price pressure (including in some cases wages) are easing. While other central banks have yet to join the BoC in signaling a firm pause, we think most will soon conclude it’s time to move on from raising rates.

Canada’s economy seeing a firm start to 2023…

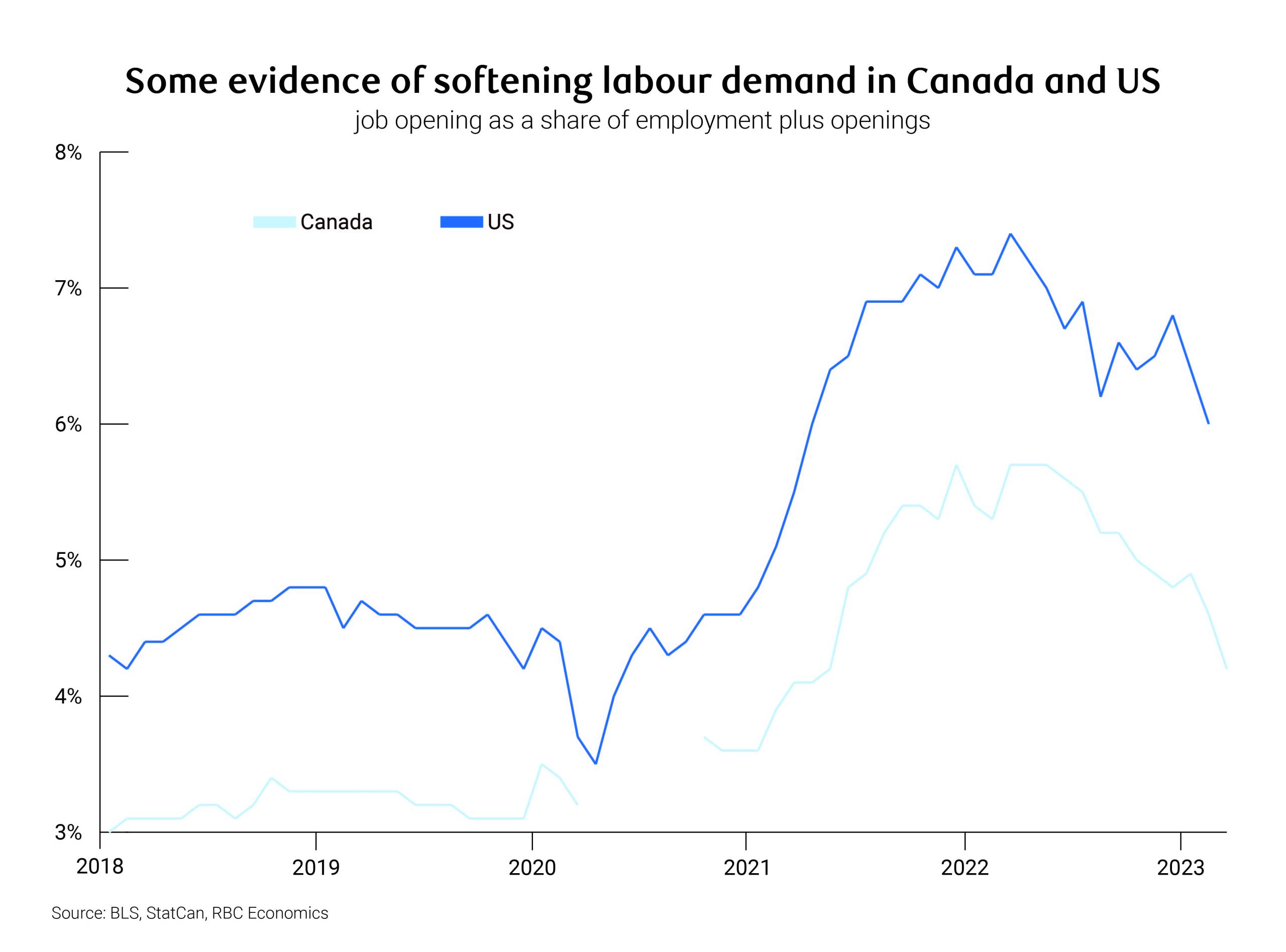

After a lacklustre end to 2022—Q4 GDP was flat—it looks like Canada’s economy regained some momentum early this year. GDP gains in January and February point to annualized growth of around 2.5% in Q1. That’s close to the economy’s potential, implying no further progress in reducing excess demand. Employment data remained firm as well, with job gains averaging nearly 70,000 per month in Q1, twice the average pace seen in 2022. Canada’s unemployment rate hasn’t budged from a near-record low of 5%, and year-over-year wage growth above 5% remains too strong for the BoC’s comfort. That said, monthly wage gains show some signs of slowing and moderation in job openings also suggests excess demand for labour is beginning to ease.

…but survey data show signs of cooling

While the BoC will find few signs of a cooling economy in those hard indicators, consumer delinquency rates have begun to move higher. And the BoC’s own Business Outlook Survey suggested higher interest rates are having their intended effect. Businesses expect slower future sales growth—particularly those more exposed to housing and consumer spending—and reported some easing in capacity constraints. Labour shortages are becoming less intense, input and output costs are slowing, and inflation expectations continued to moderate. Businesses also plan to return to more more normal pricing patterns, moving away from the large and/or frequent price changes associated with a high inflation environment.

Bank of Canada sticking to the sidelines, with a tightening bias

The Bank of Canada held its overnight rate steady at a second consecutive meeting in April, with the as-expected decision prompting little market reaction. But if anything we thought the statement and MPR leaned slightly hawkish, with the BoC seeming keen to emphasize its tightening bias and pushing back against market pricing for rate cuts later this year. As noted above, the latest Business Outlook Survey showed some improvement in inflation and wage expectations and price-setting behaviour, but the BoC clearly wants to see more of that in the coming quarters to be confident inflation will return fully to its 2% target.

The BoC continues to expect a slowdown in GDP growth in the coming quarters—gains averaging less than 1% over the remainder of the year after a firm start to 2023—but no longer characterized the economy as “stalling” and dropped an earlier reference to modest declines in quarterly GDP being as likely as modest increases. It downgraded its US growth outlook due in part to further tightening in credit conditions following recent stress in the banking sector. That is expected to spill over into Canada via softer exports and business investment, though there was little mention of potential tightening in credit conditions in Canada. Overall, the BoC’s April meeting leaves us comfortable with our forecast for the overnight rate to be held at 4.5% until early next year.

Box: How has banking stress impacted financial conditions in Canada?

Financial stability concerns caused significant market volatility in early March. Flight to safety and market pricing shifting from rate hikes to cuts put significant downward pressure on government bond yields. While that generally means easing financial conditions, it was more than offset by rising credit spreads and declining equity markets. On net, we think market moves in early March netted out to the equivalent of 1-2 rate hikes by the BoC. But with equities rallying in late-March and credit spreads coming off their highs, much of that net tightening was reversed by month end. It’s still notable, though, that even with government bond yields fallings sharply last month, we haven’t seen any easing in overall financial conditions.

And there could still be some tightening in financial conditions in the pipeline. One key indicator we’ve yet to see is the BoC’s quarterly Senior Loan Officer Survey (SLOS). The next release on May 12 will show the extent to which lending conditions have become more restrictive in the wake of global banking concerns. The latest (Q4) survey already showed some tightening in business lending standards, particularly on the price side (which measures spreads and fees, not outright interest rates). It’s safe to assume we’ll see some further tightening in that regard, though the extent is uncertain. In any case, we think tightening in Canadian bank’s lending standards will be less than in the US given the latter’s more direct exposure to banking turmoil. The Fed’s own SLOS already showed more significant tightening prior to recent developments, and we’ll be closely watching the next iteration in May.

On balance, we think some modest tightening in financial conditions in Canada, greater downside risks to the US outlook, and more awareness of financial stability risks raise the bar for the BoC to restart its tightening cycle. That said, conditions haven’t tightened so much for the BoC to close the door on further hikes if the data warrant it.

Fed hikes but leaves its options open

Two weeks of banking sector turmoil heading into the Fed’s March meeting shifted the conversation from a potential 50 bp hike to a possible pause. Ultimately the Fed delivered a dovish 25 bp hike, signaling uncertainty about future rate increases and leaving the dot plot largely unchanged (despite previously signaling terminal rate expectations were moving higher). The policy statement’s updated guidance—“some additional policy firming may be appropriate”—left it plenty of optionality to move to the sidelines if further stress emerged, or to continue hiking if banking fears calmed and incoming data warranted. With some key indicators (GDP, jobs, core inflation) remaining firm and calm generally prevailing in the banking sector since the March meeting, we think the Fed will opt for another rate increase in May.

That said, it looks like the Fed is closer to the end of its tightening cycle than previously thought. March’s policy statement noted recent developments in the banking sector, “are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation.” Chair Powell guesstimated that tightening financial conditions were “the equivalent of a rate hike or perhaps more than that.” We’ve already seen a significant pullback in commercial loans in recent weeks. With banking stress doing some of the Fed’s work for it, and emerging signs of economic softness warranting a pause in rate hikes, we think terminal fed funds is likely to be lower than we assumed a month ago.

Latest US data provides food for hawks and doves alike

US data remain mixed, showing sufficient signs of resilience to leave inflation hawks worried about an overheating economy, but also enough evidence of softness to support doves expecting a slowdown. Case in point, the March jobs data showed another healthy payroll gain and a tick down in the unemployment rate to 3.5% (just above the multi-decade low of 3.4% in January,) even as labour force participation improved. But wage growth continued to slow, with the pace over the past three months looking more or less consistent with 2% inflation. Other labour market indicators also suggest the employment backdrop is softening—both new and ongoing claims for unemployment insurance have been edging higher in recent weeks, and job openings fell sharply in February.

The growth backdrop early this year is similarly mixed. We are forecasting a 1.5% annualized increase in Q1 GDP, about half the pace seen in the second half of last year. But relative to Q4, the composition should be much better—we’re tracking a healthier increase in domestic demand, led by firmer consumer spending. However, indicators like retail and auto sales show some softening as the quarter progressed. And survey data point to less momentum going forward. Both the ISM manufacturing and non-manufacturing indices fell in March—the former moving deeper into contractionary territory amid slowing new orders and employment intentions, and the latter remaining in expansionary territory but with business activity and new orders growing at a slower pace.

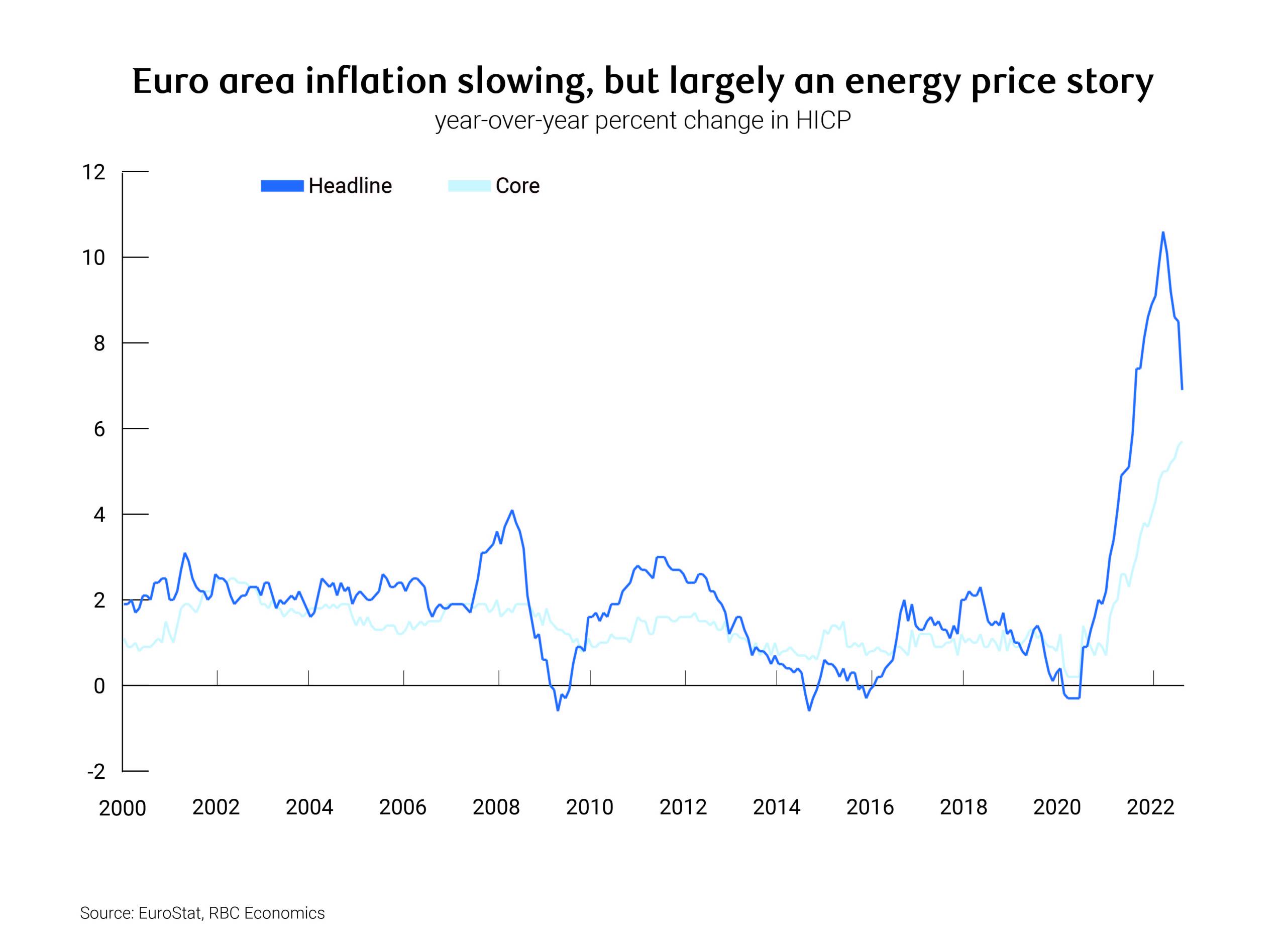

ECB goes ahead with planned rate hike

Euro area inflation surprised to the downside in March for the fourth time in the past five months, as the currency bloc’s energy price shock continued to ease. Headline HICP inflation dipped below 7% year-over-year for the first time since Russia’s invasion of Ukraine, and energy prices were below year ago levels for the first time in more than two years. But there has been little let-up in broader price pressure with core inflation continuing to climb to fresh highs. The rising cost of living has kept a lid on consumer confidence (despite some improvement in recent months) and retail spending has been soft alongside. PMI data have been sturdier with the euro area’s composite reading rising to a 10-month high in March. A jump in the services index more than offset a pullback in manufacturing, though the latest industrial production data show some evidence of manufacturers benefitting from lower energy prices.

The ECB looked through banking sector concerns in March, delivering a promised 50 bp rate hike. But unlike at recent meetings, it didn’t give firm guidance on the path ahead, instead stressing a “data dependent” approach. That includes financial data and the transmission of monetary policy, though President Lagarde was keen to emphasize that the ECB has the tools to address financial stability concerns if necessary, freeing up interest rates to manage inflation concerns. Given that separation, and with core inflation showing few signs of slowing, we expect the ECB will continue to hike at its upcoming meetings, lifting the deposit rate to 3.75% by July. By then we think core inflation will have peaked, giving the central bank room to hit pause and assess the impact of a full year of steep interest rate hikes and slowing loan growth which could be compounded by banking turmoil.

BoE opts for a status quo 25 bp increase

The BoE followed the ECB with its own 25 bp rate hike in March, and similarly gave limited guidance on the path from here. There was no dovish pivot as February’s mild tightening bias and 7-2 vote split were maintained. While the Bank noted stronger activity and employment growth, inflation and wage growth are falling somewhat faster than previously expected. The MPC didn’t speculate on the potential impact of recent banking sector volatility on the UK economy, simply saying it would monitor credit conditions closely and incorporate any effects in its May forecasts. With limited guidance from the central bank, we maintain our call for March’s hike to have been the last of this tightening cycle. The market, though, thinks the Bank isn’t done quite yet, pricing in one to two further hikes by the end of the summer.

RBA hits pause, for now

The RBA was already weighing up a pause in its tightening cycle after hiking in early March, and subsequent banking sector volatility provided plenty of cause to take a pass on raising interest rates in April. The policy statement included a watered-down tightening bias, suggesting further rate hikes “may well be needed” (previously “will be needed”). There seems to be little urgency to resume tightening, with the steady decision giving the RBA “more time to assess the state of the economy and the outlook, in an environment of considerable uncertainty.” The policy statement also pointed to tightening financial conditions from global banking sector issues, further evidence of policy rate traction, and a range of indicators suggesting inflation has peaked. While that all lent the statement a dovish tone, we maintain our forecast for a terminal cash rate of 3.85% (+25 bps from its current level) as inflation is likely to be stickier than the RBA expects.

Download full PDF report including forecast tables:

Josh Nye is a senior economist at RBC. His focus is on macroeconomic outlook and monetary policy in Canada and the United States. His comments on economic data and policy developments provide valuable insights to clients and colleagues, and are often featured in the media.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More