Canada’s job market continues to cool

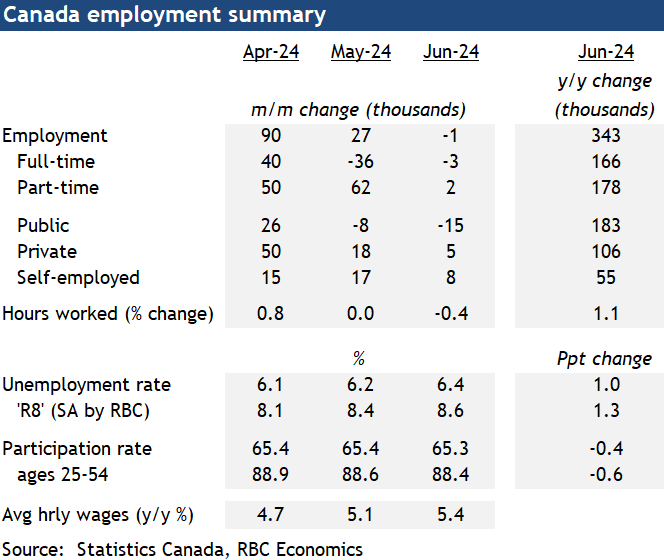

- Employment was little changed in June – edging down 1k with a 3k drop in full-time employment offsetting a small 2k rise in part-time work. Hours worked declined by 0.4%.

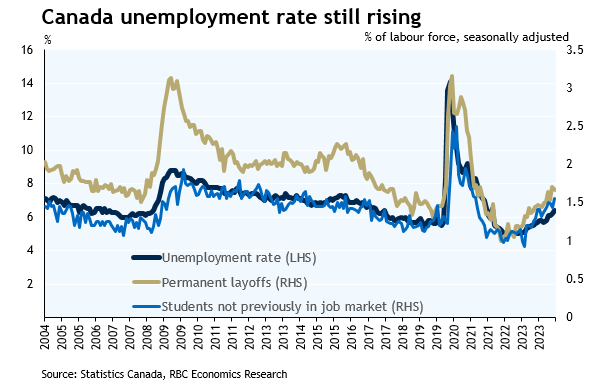

- But with population and labour force still surging that pushed the unemployment rate up to 6.4%, the highest reading outside of the pandemic shock since October 2017.

- A large share of the rise in the unemployment rate is still coming from students, in part due to a softer summer jobs market. But the rate of monthly layoffs has also continued to creep higher, and was up 20% from a year ago in June.

- Average hourly earnings remained firm, rising 5.4% from a year ago. Still, other wage measures derived directly from business payrolls (and typically viewed as a more reliable indicator) have been slower and are still running below the rate of inflation growth versus pre-pandemic levels.

- The BoC will be watching the potential inflationary impact of wage growth closely, but slowing hiring demand and rising supply of unemployed workers means that wage growth is most likely to move lower.

- Bottom Line: The dip in employment in June is small but layoffs are creeping higher under the surface. The unemployment rate is now up 1.6 percentage points from its post-pandemic lows (a larger increase than in some historical ‘recessions’) and a downtrend in hiring demand (lower job openings) has shown no sign of ending. The BoC will still be watching the next round of inflation data and their own Business Outlook Survey closely ahead of the next interest rate decision later this month (July 24th) but with interest rates still at restrictive levels, the bar to at least easing off the monetary policy brakes further in the near-term is lower. The June labour market data increases the odds that the central bank will cut rates in July.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More