Highlights

Summary

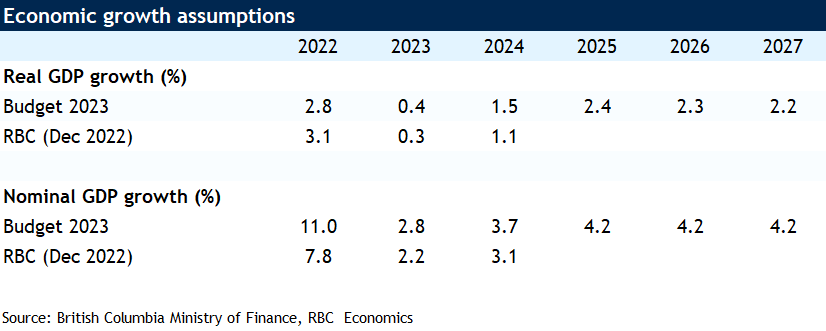

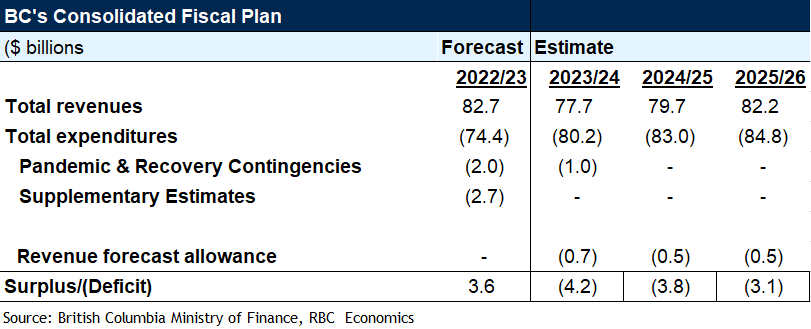

Quick to spend last year’s surplus, an uptick of $5.8B (+7.8%) in expenditures alongside a drop of $5B (-6.1%) in revenues brought the budget for FY 2023 – 24 back to deficit. Softening economic activity and weaker commodities are poised to bring down revenues while large investments in healthcare ($31B) and education ($17.6B) bring overall expenditures (including pandemic recovery contingencies) to $81.2B in FY 2023 – 24. Reflecting the higher interest rate environment, the nearly $400M (+13.2%) increase in debt charges represents another large increase to expenditures relative to the 2022 – 23 FY. With growth in spending projected to outpace revenue growth, B.C. is planning for deficits over the entire budget horizon with no guidance on returning to balance.

Expenses: Quick to spend last year’s surplus

Spending on improvements to healthcare, education, and social services were notable priorities for the B.C. government this year. Accounting for the largest share of operating expenses (38%), a much needed $30.9B has been allocated to the province’s health and mental health services. Recognizing the acute labour shortages – particularly among healthcare professionals – the B.C. government has allocated $1B over three years for new health workforce strategies which focus on retention, recruitment, and training for staff. An additional $1.1B has been set aside for a new compensation model for family practitioners as well. Despite increasing by a whopping 10.6% from FY 2022 – 23 forecasted spending, health expenses weren’t the fastest growing expenditure category for the B.C. government. At 13.2% ($400 M), debt servicing costs had this category beat. Soaring in the higher interest rate environment, the annual increase to debt servicing costs grew at its fastest rate in 8 years. Other notable items on the expense list included the $2.2B in operating funding over three years towards Affordable and Attainable Housing in the province.

Revenues: Muted by housing market downturn and lower lumber prices

As the recession inches closer, the B.C. government continues to face downside risk to revenues. In the fiscal year ahead, B.C. projects revenues of $77.7B – a 6.1% dip from FY 2022 – 23 as the province’s corporate tax base shrinks, one-time tax settlements fall off the books, and commodity prices trend lower. Total tax revenue is expected to shrink 10.6% and natural resource revenues will likely fall 21.4% from the previous year’s forecast. Large dips in taxation revenue from corporate (-$4.6B) and personal income (-$1.8B) taxes are mostly responsible for the $5B pullback in total revenues. That, however, isn’t the only sore spot. Amid the steep housing market correction in B.C., revenues from property transfers have declined 20% ($500M) from the previous fiscal year estimate. And lower lumber prices and harvest volumes have cut the projected forestry revenues for FY 2022 – 23 in half from the prior fiscal year. Despite a projected contraction in revenues this year, total revenues for B.C. are still well-above FY 2021 – 22 actuals, with an upward trajectory in revenue growth of nearly 3% per year over the fiscal horizon.

Capital Plan: Investing in education, health, and transportation

Budget 2023 included the province’s highest taxpayer supported infrastructure spending ever. The plan includes a commitment of $37.5B over three years which is to be allocated to various infrastructure and capital projects. Included in the capital spending plan is $3.4B over three years towards the replacement and construction of secondary and elementary schools; the plan also allocates an additional $5.5B over three years to build capacity for post-secondary institutions. An $11.2B investment for health facility upgrades and $13.3B for transportation network improvements over the budget horizon are other notable capital investments.

Debt-to-GDP: B.C. Provincial debt burden still among the lowest in Canada

After reaching its lowest level in 14 years, B.C.’s net debt-to-GDP ratio is expected to tick up sharply. Despite growing from 16.4% in FY 2022 – 23 to 23% in FY 2025 – 26, B.C.’s net debt-to-GDP is still on track to be among the lowest of all provinces. At $3.2B, debt servicing costs will represent 4% of total operating expenses – the same share as the previous fiscal year. Notwithstanding the heavier debt burden, B.C.’s finances are still tracking a sustainable path forward.

Rachel Battaglia is an economist at RBC. She is a member of the Macro and Regional Analysis Group, providing analysis for the provincial macroeconomic outlook and budget commentaries.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More