February offered valuable clues on the direction Canada’s housing market is taking. Improving sentiment among buyers and sellers—no doubt stoked by growing expectations the Bank of Canada’s next move will be a rate cut—halted the series of monthly price declines since last summer. But this more upbeat outlook isn’t yet translating into a steady recovery in activity. The sharp loss of affordability during the pandemic still firmly restrains buyers.

We think February’s developments point to a bumpy ride for the market in the months ahead. While the tightening of demand-supply conditions since December has paved the way for modest price appreciation, resales are likely to bounce around amid a standoff between buyers and sellers.

Two steps forward, one step back

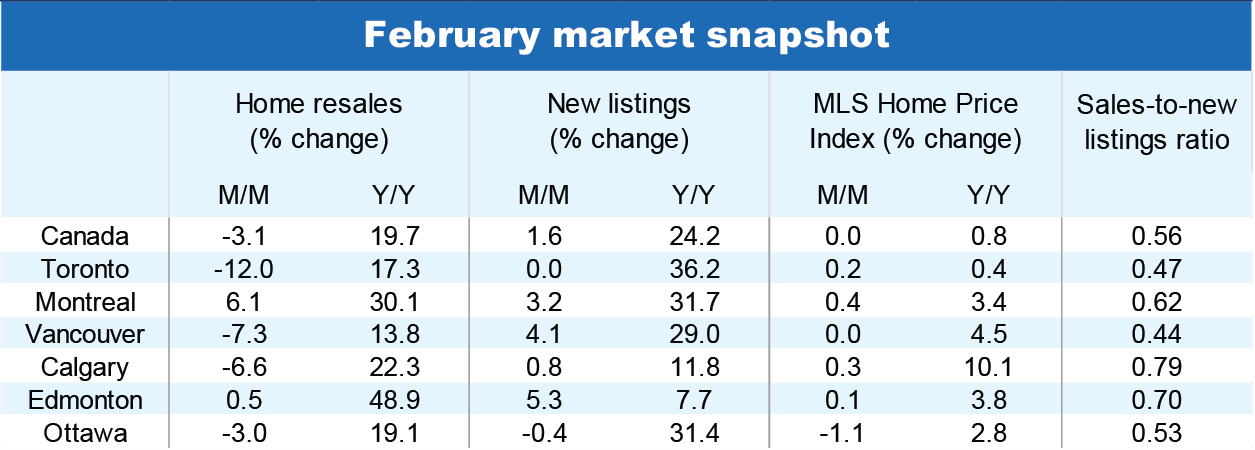

Home resales fell 3.1% across Canada between January and February, reversing about a quarter of the 12.7% increase in the previous two months. The general state of affairs remains subdued with the 461,000 units sold (seasonally adjusted and annualized) in February some 11% below the 10-year average. Declines were widespread in provinces west of Quebec. Toronto (-12.0% m/m) led the way, followed by Kitchener-Waterloo (-10.8%), the Fraser Valley (-10.3%), Vancouver (-7.3%) and Calgary (-6.6%). It was however a busier month in Montreal (+6.1%), Quebec City (+5.3%), Saint John (+12.4%) and Fredericton (+27%).

Activity continues to be brisk in Calgary despite the backstep last month, as home resales were more than 60% above pre-pandemic levels.

More sellers enter the market

A second consecutive rise in new listings hints that sellers feel increasingly confident about sales prospects. We suspect some of them were among those who took a pass in the fall, and instead opted to get an early jump on the spring market. The wider selection homes for sale may have contributed to the stronger pace of transactions in Montreal and Quebec City last month but generally failed to spark much action in the rest of Canada. That said, new listings in most markets are still below levels last summer.

Prices stabilize, signaling an end to the correction

The national composite MLS Home Price Index benchmark was essentially unchanged from January at $719,400. This marked the first time since August it didn’t fall on a month-over-month basis. And with demand-supply conditions having rebalanced significantly since December, we think prices may have reached an inflection point—at least nationally. The local picture varies considerably, though. Declining trends still prevail in many B.C and Ontario markets, including Victoria, the Fraser Valley, Ottawa, Cambridge, Kitchener-Waterloo, Windsor and Barrie. The MLS HPI was flat in Vancouver last month and inched marginally higher in Toronto (+0.2% m/m). For the most part, markets experiencing rising price trends (e.g. Calgary and Edmonton) didn’t see an acceleration in February—Saskatoon (+2.5%) is an exception.

Standoff between sellers and buyers this spring?

We believe sellers and buyers will approach the spring season with very different perspectives. We suspect sellers will come in with firm price expectations, seeing tighter demand-supply conditions and the end of the price correction as evidence they hold a stronger hand in negotiations. Buyers remain very much budget-constrained, however, and will have limited capacity to bid up prices. We expect these positions will lead to a standoff between the two parties in many markets, keeping deal making subdued until interest rate cuts boost buyers’ purchasing budget later this year.

See PDF with complete charts

Robert Hogue is an Assistant Chief Economist at RBC responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More