2021 was a record year for Canada’s housing market. That we already knew back in October when year-to-date home resales surpassed the annual all-time high set in 2020. We just learned by how much 2021 sales beat their 2020 mark. In the end, 667,000 transactions took place last year, up an astounding 21%, or 114,000 units. For context, the previous record in 2020 was set by a margin of only 12,000 units. Market activity started 2021 with a bang and stayed incredibly strong all year. By December, home resales still ran at a 652,000-unit pace (seasonally adjusted and annualized), or 18% above the prior annual record, and little changed from November. In other words: still torrid. And even more transactions could have easily taken place had it not been for a 3.2% m/m drop in new listings. Despite the historical boom in activity, we believe there continues to be unmet demand in the market—the lack of supply is holding many buyers back.

Sellers firmly in charge

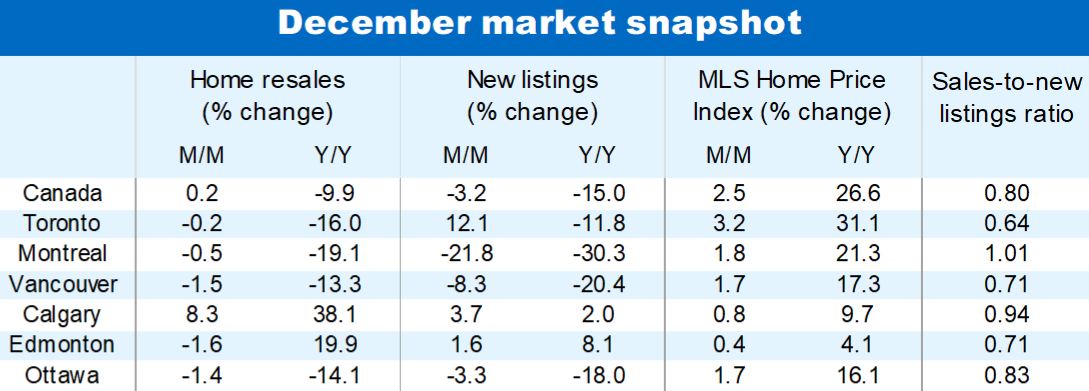

Demand-supply conditions remained exceptionally tight at the end of 2021. A very high sales-to-new listings ratio (at 0.80 nationwide) in December attests to sellers maintaining a strong bargaining power at this juncture. This is true in virtually every region of the country, including Alberta where conditions have tightened considerably through the fall.

Record spike in prices

It’s no surprise, then, to see home prices escalating further. Across Canada the MLS Home Price Index (HPI) jumped another 2.5% m/m in December (to $812,000), following gains of 2.7% in both October and November. The latest three-month spike (totaling 8% on a compounded basis) is the sharpest on record (matching the February-April, 2021, run-up). Compared to a year ago, Canada’s MLS HPI is up a record 26.6%, or nearly $170,000.

Price escalation is widespread

Rates of increase exceed 30% in large parts of British Columbia, Ontario and Atlantic Canada, with some markets (e.g. Chilliwack, Bancroft, Brantford and North Bay) even registering greater than 40% y/y gain. During the pandemic we’ve seen rapid price escalation as demand surged in smaller markets, often outpacing appreciation in larger centres like Vancouver, Toronto and Montreal by wide margins—though Toronto prices have accelerated significantly (up 12%) over the past three months. The Prairies and St. John’s have yet to experience a high degree of frenzy. Properties in these regions generally continue to appreciate at modest rates. That may change if demand-supply conditions stay tight in the coming months.

Expected interest rate hikes to alter the market’s course

Canada’s housing market therefore enters 2022 in broadly the same way that it did in 2021: under the scorching heat of supercharged demand running against historically low inventories. We don’t expect that heat to dissipate quickly. Intense buyer competition should keep prices on a steep upward trajectory in the near term. However, we believe interest rate increases will alter the market’s course later this year. We expect the Bank of Canada to raise interest rates materially starting this spring—taking its overnight rate up 150 basis points in less than a year and a half. Our view is the anticipation of higher rates is already impacting the market: currently bringing some activity forward as buyers hurry to lock-in lower rates. This phenomenon should reverse by mid-year and work to cool demand. Higher interest rates will further erode already-poor housing affordability in Canada’s major markets.

Housing policy wildcard

Another development that could alter the market’s direction this year is housing policy changes. Pressure is intense on governments and regulators to address affordability issues. At the federal level, the new minister responsible for housing is looking at a series of measures to tamp down speculative activity and boost supply. The Ontario government has set up a task force to recommend additional measures. We expect new policy initiatives will be announced this year. Our view is expediting new supply should be a priority though it’s unclear what policymakers will ultimately do and when. We’ll continue to monitor the situation closely.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More