The tumultuous year just ended had one more shocker in store: a new record-high for Canada’s housing market. Last month, home resales surged past the 700,000 units (seasonally adjusted and annualized) mark for the first time. Activity was at, or near an all-time high in eight provinces. Clearly, new restrictions to contain the second wave of COVID-19 in many parts of the country have not—at least, not yet—slowed down momentum. Demand remains supercharged. And while new listings increased modestly in December, supply is as tight as it’s ever been, especially for single-family homes. That’s keeping home prices on a solid upward trajectory and sets the stage for even larger gains in the near term.

2020 the strongest year ever—who would have thought?

The scorching hot finish capped off the most unusual, roller-coaster year in memory for the market. Activity swung dramatically: first plummeting in the spring when COVID-19 ground everything to a virtual halt, then roaring back in the summer and fall when pandemic restrictions eased. In the end, the strength of the summer-fall rally more than made up for the spring setback. Home resales totaled 551,400 units nationwide in 2020—a new record high. Demand-supply conditions stayed generally tight all year because supply also plummeted in the spring. This sustained strong upward pressure on property values. In fact, home price increases accelerated almost continuously (except for a short hiccup in the spring). The rising heat has been widespread, often more intense in smaller markets. The downtown condo segments of Canada’s largest cities were the main exceptions as a surge in inventories took the wind out of condo prices.

More upside in 2021

We see little that will stop activity or prices from reaching new highs in 2021. Historically low interest rates, changing housing needs, high household savings and improving consumer confidence will keep demand supercharged. A dearth of supply will maintain the heat on prices. That said, we expect the market to cool gradually over the course of 2021. We believe low supply will become a growing constraint, pandemic-induced market churn (resulting from changes in housing needs) will wane, and a slight rise in longer-term interest rates and material erosion of affordability will chill demand by a few degrees later in the year. Low immigration could also slow things down a little. Please see Canada’s housing market headed for another record year in 2021 for a more detailed discussion of our year-ahead outlook.

December market highlights

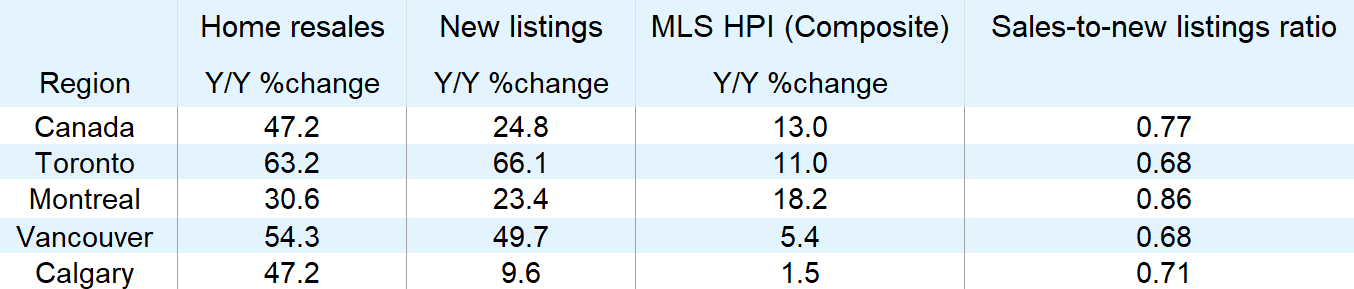

- Home resales eclipse September’s record high: Sales surged 7.2% m/m to 714,500 units (seasonally adjusted and annualized) Canada-wide in December, well above the previous high-water mark of 683,700 units set in September 2020. Relative to a year ago, activity was up an astounding 47.2%. The vast majority of local markets had a strong finish to the year, led by the Greater Toronto Area (up 22.1% m/m), Greater Vancouver Area (up 21.0%) and Saint John (up 15.8%). Other markets reporting monthly sales increases included Victoria (6.7%), Calgary (9.5%), Edmonton (1.2%), Winnipeg (5.2%), Hamilton (9.2%), Ottawa (2.8%) and Montreal (0.9%).

- More homes listed for sale during the month… but not enough: A 3.4% m/m rise in new listings gave buyers more than 30,000 new units (seasonally adjusted and annualized) to fight over. Buyers scooped them up quickly. New listings rose in Vancouver (7.4% m/m), Calgary (1.1%), Winnipeg (5.8%) and Toronto (10.1%) but fell in Edmonton (-3.4%), Ottawa (-7.7%), Montreal (-4.3%) and Halifax (-1.4%). Local real estate boards earlier reported the larger new listing increases were for condo apartments in Toronto and Vancouver.

- Sellers rule—demand-supply conditions are super tight: The Canadian Real Estate Association indicated active listings in Canada fell below 100,000 units for the first time in more than 30 years. At the current pace of sales, this represents just 2.1 months of inventory—the lowest on record—tipping the scale squarely in favour of sellers. A sky-high sales-to-new listings ratio (at 0.77 nationwide in December) provides further confirmation that sellers hold a strong hand when it comes to setting prices. This is the case almost everywhere in the country.

- Home prices are rising at a faster and faster clip: The rate of increase in Canada’s aggregate MLS Home Price Index more than doubled over the past six months to 13.0% y/y in December. The strength is concentrated in single-family homes where prices ran 16.4% above year-ago levels. Condo apartment prices were up a more modest 4.2%. Property values are appreciating most in Ontario and Quebec—especially in smaller markets and around Toronto and Montreal—as well as parts of Atlantic Canada.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More