Monthly Housing Market Update

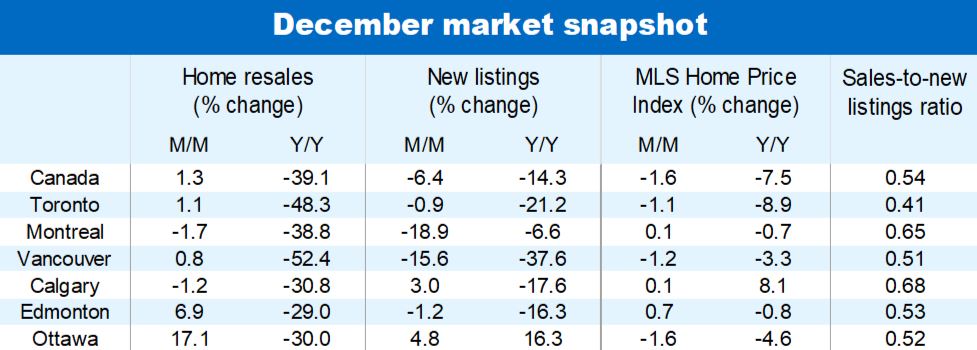

Home resales are now gradually stabilizing in most parts of the country after plunging through the spring and summer amid soaring interest rates. Nationwide activity even picked up slightly on a month-to-month basis for the second time in three months in December (up 1.3%). This is consistent with our view that a cyclical bottom is approaching—likely in early-2023.

It will take a little longer for prices to steady though. The MLS Home Price Index for Canada fell sequentially for the 10th-straight month in December (down 1.6% m/m). We think it will continue to slide until spring at the earliest as poor affordability continues to weigh heavily on buyers.

2022 a year of extremes

The swing in the market over the past year has been nothing short of spectacular. 2022 started extremely overheated as exceptionally low interest rates, changing housing needs and elevated investor involvement supercharged demand. But the Bank of Canada’s aggressive hike campaign beginning in March triggered a massive correction. It resulted in monthly activity falling nearly 40% to the lowest levels in more than a decade (excluding the pandemic lockdown period) by the fall.

Benchmark prices followed suit, dropping 13% from the February peak—representing the sharpest decline in the national MLS HPI on records dating back to the mid-2000s. On a year-over-year basis, the index swung from huge gains exceeding 30% in January and February to a 7.5% decline by December.

For the year as a whole, home resales plummeted 25% in 2022, entirely reversing outsized gains recorded in 2020 and 2021. British Columbia (-35%) and Ontario (-32%) experienced the steepest declines—both from sky-high levels in 2021. The correction was much less severe in Alberta where activity fell only 1.8%.

Recent stabilizing trend is widespread

Activity is levelling off in the majority of local markets, including Victoria, Vancouver (and the rest of Lower Mainland BC), Calgary, Edmonton, Toronto (and the rest of southern Ontario) and Atlantic Canada. Only a few pockets in the Prairies and Quebec maintained a lower trajectory in the latter stages of 2022. But for Regina and Saskatoon, home resales remain solid despite the softening, still tracking well above pre-pandemic levels.

Prices keep declining almost everywhere for now…

Property values have been under intense downward pressure across Canada. The national MLS HPI is down 13% since its February peak, with declines exceeding 20% is some Ontario markets (e.g. Hamilton, Kitchener-Waterloo, Cambridge, Brantford and London). Toronto isn’t far behind at -14%. Price drops have also been noteworthy in British Columbia (down 10% since the peak)—including Vancouver (-8%)—Nova Scotia (-9%), Saint John (-9%) and Winnipeg (-9%). Corrections so far have been milder in Quebec (-5%), Saskatchewan (-2%) and Alberta (-2%). Calgary is among the very few markets that have bucked the trend. St. John’s is another exception.

…and in the coming months

We expect prices to depreciate further in the near term. While the bottom for activity may be reached soon, buyers will continue to contend with poor affordability for some time. Another likely rate hike from the Bank of Canada later this month could make things even more challenging for some. Still, we think the pace of price declines will continue to ease gradually thanks to stable demand-supply conditions. These have in fact tightened slightly in December following a 6% m/m drop in new listings.

Supply side on our radar

This drop in new listings is unlikely to be the start of a trend. We expect more sellers to make their way to the market as signs of a bottom accumulate. Higher interest rates may also press a number of current owners to sell if mortgage payments become unmanageable. To date, mortgage delinquency rates have remained exceptionally low across Canada (at just 0.14%).

What’s coming after the bottom may disappoint

With the cyclical low point in sight, attention will soon turn to the market’s next chapter. We expect the upcoming recovery to be a largely muted affair at first. Higher interest rates and stretched affordability will continue to be huge issues for buyers throughout 2023—and possibly beyond. This is poised to keep activity quiet and limit any price gains. Strong population growth will eventually heat things up.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More