The energy transition presents a chance for Canada’s small, open economy to reset and recharge its global competitiveness.

The race is already on: As countries fuse their economic, environmental and geopolitical objectives, there is a growing imperative to link trade and climate policies. That pressure may grow as advanced economies turn to protectionism, including ways to reduce access for products made in countries with lower emissions standards. In the new trading paradigm, Canada has the opportunity to compete in the exports of low-carbon goods, while also navigating market disruptions caused by emerging clean tech innovations.

Luckily, Canada already has a head start in this low-carbon competition, with industrial carbon markets that can serve as building blocks of innovation, low-carbon economic growth and investment. By fine-tuning and crafting policy that delivers emissions reductions domestically without compromising our competitiveness, Canada can gain an advantage in the new low-carbon economy.

Indeed, industrial carbon markets can become central to Canada’s efforts to address new imperatives brought on by the energy transition. They can help us compete in low-carbon economies, build competitive advantages in international export markets, and decarbonize heavy industries—and get Canada closer to its Net Zero goals.

Yet Canada’s current system remains a patchwork, with nine industrial carbon markets—also known as Large-Emitter Trading Systems (LETS)—that price carbon for heavy industrial facilities. Each LETS has its own subtly different design elements and market conditions that operate within their provincial silos.

The fragmentation of these markets is undermining their potential, and hampering Canada’s ability to build low-carbon industries. Creating room for provinces to tailor their systems to regional priorities and politics makes sense—up to a point. But the current arrangement is hurting small markets with the presence of a few emitters raising transaction costs for firms operating in multiple provinces. As these companies trudge through different compliance rules, they are bogged down in an increasingly complex regulatory environment that slows investment decisions. The slowdown could lead to price volatility, limited participation, low trading volumes and a general lack of confidence in these markets.

Removing interprovincial trade barriers and integrating this patchwork of systems could offer considerable economic upside that could prove to be transformative for Canada’s energy transition.

Benefits Of Harmonization

Gaining efficiency, lowering costs

A firm producing basic chemicals with operations in Ontario and Alberta in Canada’s current system would need to employ two different approaches to calculate its emission limit, to ensure it complies with each province’s laws. That leads to duplication of systems and processes for record keeping, monitoring, reporting, and verification. It also entails greater administrative and compliance costs that will eventually be passed on to consumers. Harmonization could channel more investments in decarbonization and capital expenditures and less in the human capital required to comply with each set of regulations.

Harmonizing the governance can also make markets work better. A robust oversight regime including strong governance, disclosure, and enforcement of standards would contribute to market confidence. While studies examining the integrity and functioning of Canadian carbon credit markets is limited, studies of financial markets suggests that carbon credit markets with these characteristics would improve outcomes for market participants in the form of reduced transaction costs.

A deeper investment pool

Linking markets together is another key component of harmonization, enabling the development of larger markets with a greater number of buyers and sellers that can connect quickly, reducing transacting time and search costs. Robust linkages would also create a larger market for carbon credits that are fungible across different LETS, increasing the pool of potential buyers.

Corporate Canada’s Competitive Advantage

It’s hard to evaluate short-term, sector-level (let alone firm-level) implications of industrial carbon pricing. An industry’s competitiveness will heavily depend on its structure, including costs and profitability, long-term demand for its products, and the existence of cost competitive, low-carbon substitutes. It also depends on whether key trading partners have policies in place that give preferential tariff treatment to goods produced in jurisdictions with carbon pricing schemes. And this is without accounting for other forms of policy support.

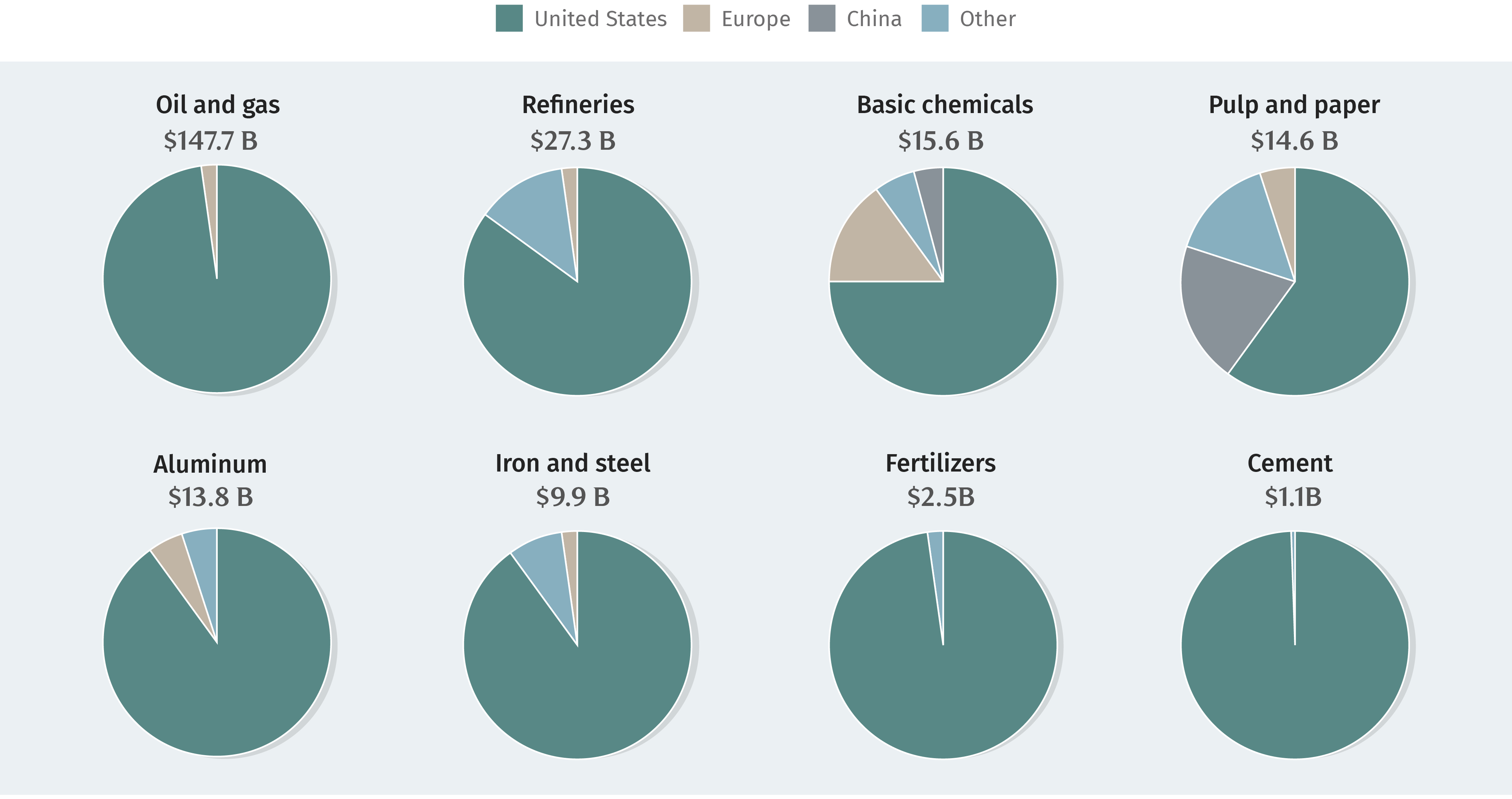

Canada’s carbon pricing scheme covers eight key Emissions Intensive Trade Exposed (EITE) industries. The goods produced by these industries, which last year contributed $232 billion to the Canadian economy, are exported to three key trading partners–the U.S., which is Canada’s largest trade partner, the EU, and China.

Canada’s Biggest Carbon-Intensive Exports

Canada’s top export destinations for its carbon-intensive products

Source: RBC Climate Action Institute analysis of Statistics Canada data

Competing with Trade Partners

The EITE industries expected to benefit from carbon pricing are those with significant trading activity with the EU and China—both have LETS of their own, with vastly different dynamics.

Canadian goods are anticipated to be cost competitive with those produced in the EU, given similar industry cost structures and stringency of the EU’s carbon pricing regime. The EU’s Carbon Border Adjustment Mechanism (CBAM), set to come into effect in 2026, is a tariff scheme that gives preferential treatment to goods produced in countries with carbon pricing will have limited impact in eroding the cost competitiveness of iron, steel and aluminum produced in Canada.

Exports destined for China will have a harder time competing on price, given China’s substantially lower cost structures compared to Canada. It’s an advantage that is supported by China’s extensive use of subsidies in key industries and an abundant supply of low-cost labour. China’s relatively lower carbon price of $19 per tonne of CO2e, compared to Canada’s $80 per tonne CO2e, would have limited impact on eroding the cost competitiveness of Chinese goods compared to Canadian goods.

At face value, industries exporting to the U.S. are also at a cost disadvantage since there is no federal carbon pricing regime stateside. Canadian goods with embedded carbon costs would have to compete with U.S. goods without this cost.

Part of this cost disadvantage for key industrial sectors can be offset through system design, as well as the revenues that firms can generate from carbon credits. Recent research from Clean Prosperity and the Transition Accelerator found that revenue generated by carbon credits is the largest policy incentive available to most sectors within heavy industry. They remain Canada’s lowest-cost policy option to attract low-carbon investment into the country. In the long-run, these investment flows can position Canada to be globally competitive in new low-carbon industries.

Beyond Industry Bottom lines

Cost competitiveness, however, should not be equated with profitability and the long-term viability of an industry. Profitability ebbs and flows with economic cycles.

The viability of any industry depends on long-term demand. Canadian exports to the U.S. are concentrated in three industries, with oil, natural gas and refined petroleum products, such as gasoline, accounting for 79% of all EITE exports. Greater electrification, including the shift from gas-powered to electric-powered cars, less reliance on natural gas for space heating and electricity generation, and energy efficiency improvements is changing the U.S. energy mix, and shrinking the long-term demand for oil and natural gas.

Falling demand and market size at the industry level does not necessarily lead to broader economic stagnation. A study of B.C.’s carbon market found that, in the aggregate, carbon pricing does not have an adverse impact on its economy or employment, with employment shifting from emission intensive industries to cleaner ones. A study of the French carbon market also found similar greening of employment—evidence that carbon markets are operating as predicted by economic theory.

Similarly, Germany, the European Union’s largest economy and heaviest emitter within the EU carbon market, was able to leverage carbon pricing to cut the emissions intensity of industries, by reducing consumption of natural gas and petroleum and improving the energy efficiency of industrial processes, according to a study. This was achieved without lowering employment, GDP growth or exports.

There are limited data and studies providing insights on how Canadian provinces have adjusted their economic development strategy to safeguard their EITE industries. Some jurisdictions such as Alberta have addressed this policy challenge by building regulatory compliance flexibility into its carbon pricing regime.

Such policies also aim to ensure industries are not fiscally penalized, in the short run, as they invest in low-carbon technology, which are costly long-term investments. Under Alberta’s Technology Innovation and Emissions Reduction Regulation (TIER) system, firms can seek regulatory relief if compliance costs exceed 3% of sales or 10% of profits. In these situations, firms can use a greater number of carbon credits to reduce their compliance obligations and/or seek a greater “free” emission allowance.

Businesses repeatedly cite regulatory uncertainty as an impediment to moving forward with investment decisions. Harmonization can provide investors and markets with the certainty they need to invest in the country’s energy transition.

Navigating politics

Despite the many economic and trade benefits, and industry’s appetite for less regulatory complexity, harmonization has not been pursued for two key reasons. For some provinces, there’s a perception that harmonization could lead to an erosion of provincial autonomy to make decisions that protect their key industries. Harmonization introduces the need for greater coordination and consensus building. Processes that some provinces fear could limit their regulatory responsiveness to changing global market and regulatory conditions, and which is required to keep the industries located within their borders competitive. Many of these concerns can be addressed through governance frameworks when harmonizing the country’s LETS.

How To Harmonize LETS

LETS in Canada are already harmonized in some rudimentary ways, primarily through the headline price of carbon, which currently stands at $80 per tonne. But most of the finer details of both market design and market function vary from province to province—most notably the rules around who can hold and trade credits.

Harmonizing LETS and removing these interprovincial trade barriers will require reconciling details across systems that are at different stages in their development and maturity.

Except for Quebec, which shares a cap-and-trade system with California, all provincial and territorial use LETS known as output-based pricing systems. These systems regulate facilities based on their emissions intensity, rather than on their total emissions as with cap-and-trade. We limit this analysis to harmonizing output-based LETS across Canada. Integrating cap-and-trade and output-based markets beyond the headline price would be a far more complex, long-term challenge.

On both the substance and process of harmonizing LETS, federal and provincial governments can lean on their experiences with domestic trade deals in the pursuit of harmonization.

We outline two broad approaches.

All Parties Model

Harmonization through the All Parties Model requires strong central leadership with common standards across all provincial LETS. The Canada Free Trade Agreement (CFTA) offers a useful analogy for this more “top-down” approach to removing trade barriers. In the CFTA, the federal government and all provinces and territories have agreed to a shared set of provisions, definitions, rules, exceptions, institutional arrangements (e.g. dispute resolution), and exceptions, with a stated objective to “reduce and eliminate, to the extent possible, barriers to the free movement of persons, goods, services, and investments within Canada and to establish an open, efficient, and stable domestic market”.

Canada’s current approach to LETS, under the umbrella of the federal Greenhouse Gas Pollution Pricing Act (GGPPA), is but one possible version of the All Parties Model. Under the GGPPA, provinces are encouraged to establish and administer their own LETS.

On a rolling five-year basis, Environment and Climate Change Canada (ECCC) evaluates the performance of provincial LETS and negotiates with the provinces regarding the “equivalency” of their performance to federal standards. ECCC assesses equivalency every five years, with the next review coming in 2026. This will be the first review for some of Canada’s youngest LETS, most notably British Columbia, Saskatchewan, and Ontario.

Willing Partners Model

The Willing Partners Model offers a roadmap for any two (or more) provincial governments to harmonize their carbon markets. An analogous, “bottom-up” approach to removing trade barriers is the New West Partnership Trade Agreement (NWPTA). Through this effort, signatory provinces—British Columbia, Alberta, Saskatchewan and Manitoba—engage in a mutual effort to “liberalize trade, investment and labour mobility”. The provinces continue to amend, expand and update the agreement, most recently in 2022.

The Willing Partners Model is fundamentally an opt-in model. In the NWPTA, provinces agree to six shared criteria: definitions, obligations, rules, provisions, dispute resolution mechanisms, and exceptions to the agreement. Establishing shared criteria would be a starting point for any iteration of the Willing Partners Model for LETS. Fewer negotiating parties with a model that is voluntary can lead to an agreement with stronger shared criteria with a clearer value proposition for participating provinces.

A Willing Partners Model can also coexist alongside an All Parties Model. Just as any province can exceed the federal standards for LETS set out in the GGPPA, the NWPTA also defers to the Canada Free Trade Agreement (CFTA), where the provisions of the latter are “more conducive” to liberalization of interprovincial trade.

Degrees of harmonization

Beyond broad design details like the headline carbon price, there are many program elements of LETS that are not harmonized. Integrating these systems does not have to happen all at once. This gradual, step-by-step harmonization is also known as degrees of harmonization.

Two Components Of Harmonization

There are two core components to market harmonization. Governments can pursue each subcomponent individually or as part of a larger effort toward full harmonization.

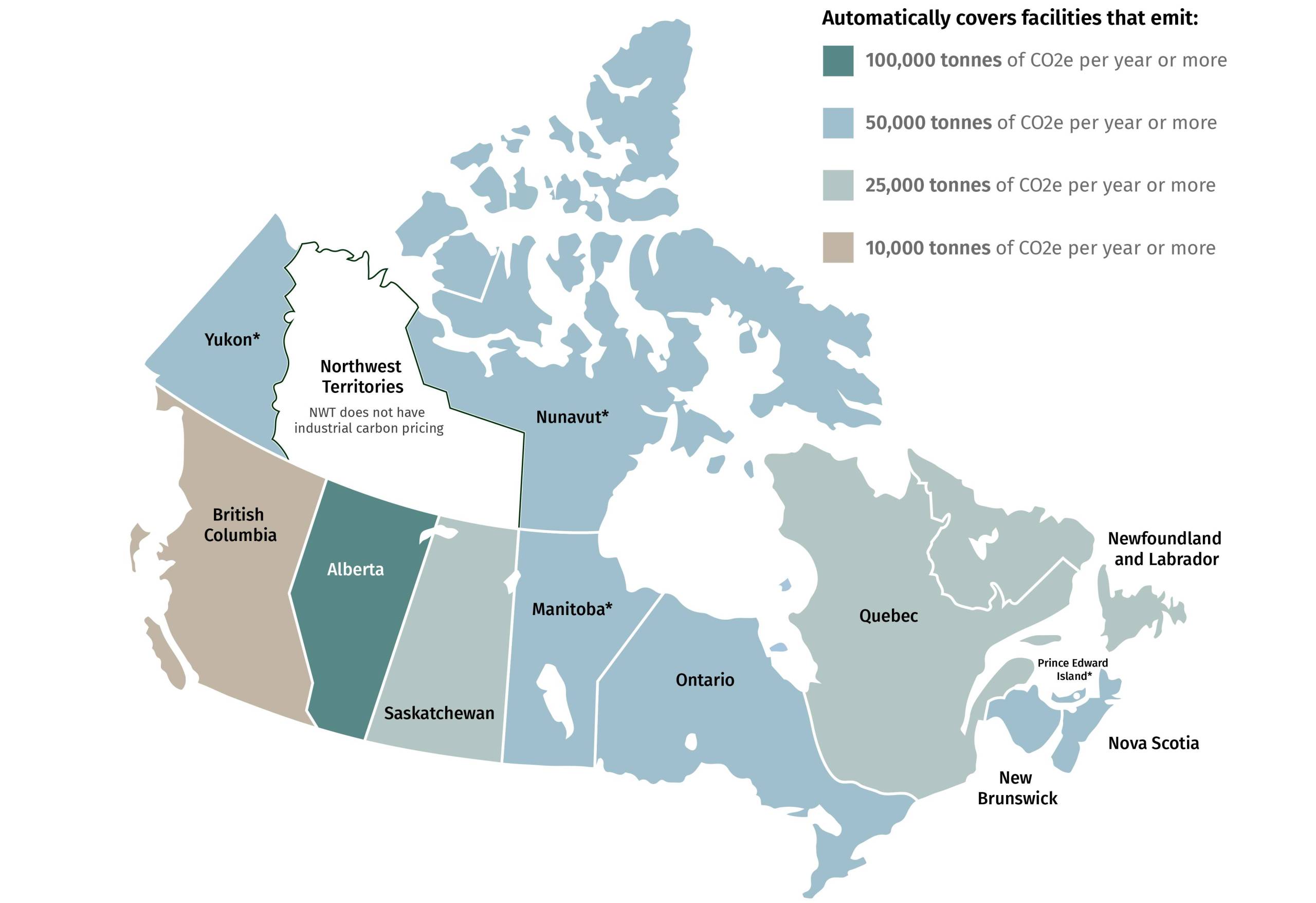

Harmonizing market design

LETS market design involves decisions around how the carbon market will legally operate. This include what sectors will be covered by the program, the price of carbon and how exposed emitters will be to that price, who can hold carbon credits and under what conditions, and rules around monitoring, reporting and verification (MRV), including enforcement and non-compliance penalties. To take just one example, facilities that emit above a certain amount are automatically covered by LETS, but this coverage standard varies widely from province to province. Most LETS also allow smaller facilities to opt into and benefit from the program, but this standard also varies from province to province.

A Patchwork Of Carbon Coverage Standards

Canadian jurisdictions have different coverage threshold for large emitters

*Covered under federal framework

Source: RBC Climate Action Institute

Bringing markets in synchronicity

Full harmonization of market function includes full removal of interprovincial trade barriers, with fungible credits that are tradeable across provincial borders.

There are several elements of market design that need to be harmonized before this can occur. Some LETS have many different types of credits with unique properties. Alberta’s TIER system, by far the largest and most mature provincial carbon market, makes use of many different types of carbon credits to facilitate growth in different sectors. For instance, Alberta has two types of carbon credits with features that are specifically designed to encourage adoption of carbon capture technologies. Most other systems have a single credit type, and are more restrictive on who can hold carbon credits and participate in the market. These rules would need to be relaxed to facilitate harmonization of market function.

Beyond the mechanics of credit trading, true fungibility would also require harmonizing decisions around governance and review, including shared processes for evaluating the efficacy of different markets and the competitiveness performance of the firms participating in these markets.

Different provinces have very different industrial profiles and therefore face different competitiveness challenges. There is an urgent need for research detailing the opportunities and risks facing Canadian heavy industry as it seeks competitive advantages in a carbon-constrained world.

Canada’s current governance model for LETS—reviews in five-year increments—is sluggish. Provinces have the discretion to review and adjust benchmarks as needed, but have not done so to date even with looming risks of credit oversupply. Harmonized markets would need to make greater use of proactive strategies that can stabilize expectations around credit prices, respond to rapid or disruptive change in global markets, and reduce regulatory uncertainty for investors and operators. These strategies could include but should not be limited to policy tools such as carbon contracts and adaptive benchmark tightening.

Lastly, a shared commitment to measuring the outcomes of harmonization and the effects on provincial economies could help ensure data-driven decision-making around LETS moving forward. Provinces could also share digital infrastructure, registries, and programs that allow for credit tracking across participating provinces to maximize transparency to the broader public.

A Chance For Policy Alignment

Securing Canada’s economic future requires seizing every competitive advantage available. Many provinces have spent the better part of a decade (or more) standing up their LETS as a central plank of their decarbonization and low-carbon economic strategies. But the country’s fragmented approach to LETS presents significant opportunities for improvement. Taking stock of global market dynamics and trends towards protectionism, nearshoring and decarbonization, it may be time for a dialogue about what the next decade should look like for LETS in Canada. Harmonization, as part of a broader vision of economic competitiveness, should top the list for discussion.

Harmonization could help ensure that LETS play an outsized role in advancing Canada’s economic, environmental and geopolitical objectives. Global economic competitiveness, investments in technology and innovation, reduced regulatory red tape and costs: These and other benefits arising from harmonizing LETS are too numerous to ignore.

As policymakers shift their attention to the back half of the 2020s, and a more fragmented world, a fresh approach to our carbon markets could strengthen both trade and climate policies, and foster a new cycle of lower-emissions growth.

Contributors:

Myha Truong-Regan, Head of Climate Research, RBC Climate Action Institute

Brendan Frank, Director of Policy and Strategy, Clean Prosperity

Dale Beugin, Executive Vice-President, Canadian Climate Institute

Yadullah Hussain, Managing Editor, RBC Climate Action Institute

Caprice Biasoni, Graphic Design Specialist

Related Reading

For more, go to rbc.com/climate.

Download the PDF

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More