Issue #02

➔ Quebec’s Northvolt-sized problem

➔ A made-in-Canada climate taxonomy to attract green capital

➔ Reimagining Canada’s industrial carbon pricing system

Hot takes

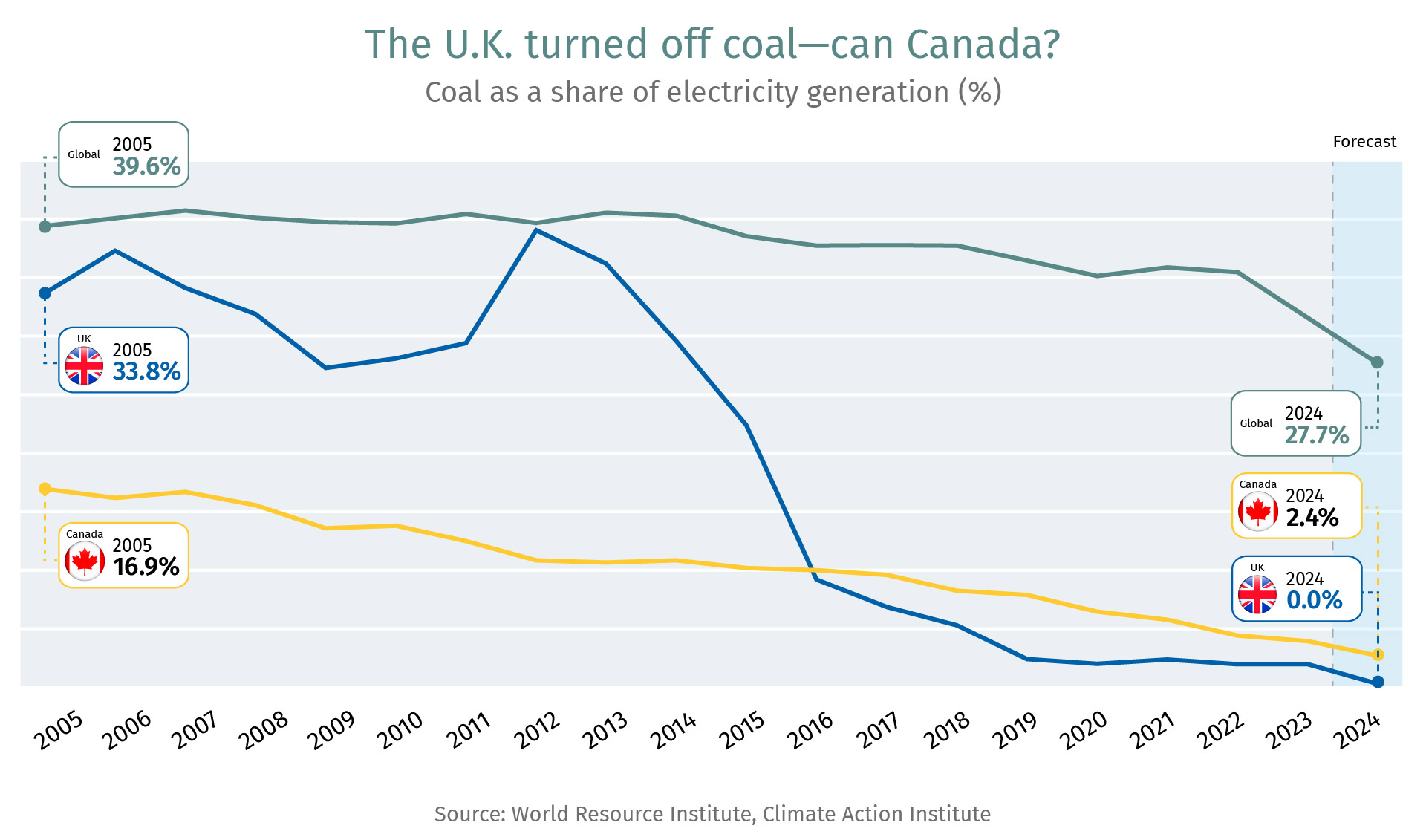

➔ King Coal’s rein ended in the U.K—the first G7 country to do. Here in Canada, Alberta banished coal-generated power this year, but Saskatchewan, Nova Scotia and New Brunswick are still figuring out ways to rid coal off their grids. Shaz Merwat, our energy policy lead, suggests the switch to renewables, coupled with battery storage and natural gas are preferred coal-switching solutions for the rest of the decade. The pursuit of Net Zero, however, will involve carbon capture adoption and the often thorny issue of greater inter-provincial connectivity.

➔ Canada advanced its guidelines for sustainable investments. The new climate taxonomy aims to guide investors, banks, and other stakeholders seeking clearly-marked “green” and “transition” economic activities. It’s an important step in Canada’s sustainable finance journey, especially as trillions of dollars of capital eyes verifiable green and transition investment opportunities. The Canadian taxonomy can help attract private capital, which is vital for economic growth and emissions cuts. While there’s much work to be done—including some important definitions of end-use for natural gas if it’s to be sold as a transition fuel—it’s a milestone in Canada’s Net Zero journey.

➔ There’s a new energy in Calgary. Institute head John Stackhouse found the city fired up as he attended the Energy Disruptors Unite conference recently. Some of his top observations: Nuclear is back, ESG isn’t dead, and Indigenous equity is the new gold standard of engagement. Read John’s 10 takeaways here.

➔… Speaking of new energy…: TC Energy’s spin-off of its oil pipeline business to pivot to lower-energy carbon sources is a new iteration for the 70-year-old Calgary firm. Natural gas and power and energy solutions , “driven by nuclear, pumped hydro storage and new energy opportunities,” gives the firm exposure to utility-like assets. Another energy-transition plus: the potential expansion of the 4,800-megawatt nuclear capacity at the Bruce C project at its existing Bruce Power site in Ontario.

- ➔

Express your climate change frustration with an emoji. Dead tree emojis are coming to smartphones soon as regular folks channel their climate angst. Hurricane Helene and now Milton are just the latest weather events supercharged by climate change. Since 2019, virtually every Canadian province and U.S. state has been slammed by a costly disaster. Yet, progressive climate change policies are fast becoming political liabilities from Ottawa to Vienna to Washington.

Express your climate change frustration with an emoji. Dead tree emojis are coming to smartphones soon as regular folks channel their climate angst. Hurricane Helene and now Milton are just the latest weather events supercharged by climate change. Since 2019, virtually every Canadian province and U.S. state has been slammed by a costly disaster. Yet, progressive climate change policies are fast becoming political liabilities from Ottawa to Vienna to Washington.

➔ Bi-Weekly Climate Action Award: To Shane Gross of B.C., who won the prestigious Wildlife Photographer of Year award from the U.K.’s Natural History Museum. Check out his Swarm of Life photograph below of tadpoles in a lake near Vancouver Island that won him the prize.

Copyright Shane Gross

➔ Bi-Weekly Climate Fail Award: A new University of Cambridge study that advocates reducing flight speeds by 15% to reduce emissions—raising transatlantic travel times by 50 minutes.

Canada & Quebec’s Big Charge

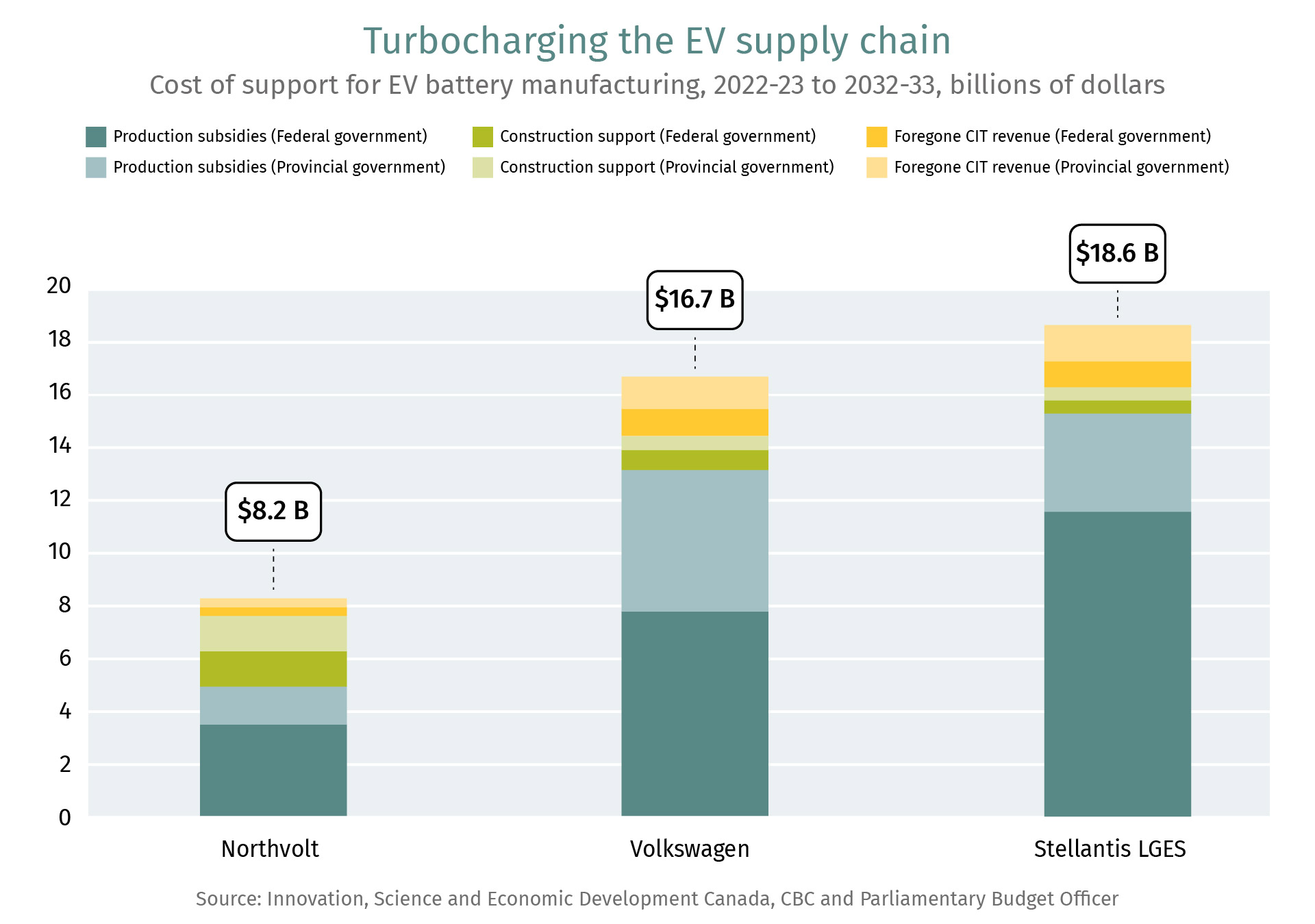

Ottawa and Quebec have a Northvolt-sized problem. Europe’s biggest battery maker had it all: US$15-billion in funding from auto industry, banks and European governments, and was eyeing an electric vehicle battery plant near Montreal, backed by Quebec and Ottawa.

But EVing is hard. The company is struggling against cheaper and better-performing Chinese EV batteries and a slowdown in European automakers’ EV plans. That could delay its Quebec factory plans by at least 18 months.

➔ The Quebec government called the project the “greenest electric battery factory in the world,” when it was launched a year ago. Now it sees it as a “calculated risk.”

➔ That’s a lot of calculated risk-taking of public money: In addition to federal funding (see table), Northvolt received a $240-million guaranteed loan from Quebec for land near Montreal to build its plant. Quebec also plunked down another $270 million in its Swedish parent company Northvolt AB, with a further $200-million investment from Quebec’s pension fund manager.

➔ The delay to Northvolt’s plans could gum up Canada’s burgeoning EV supply chain. The Parliamentary Budget Officer estimates that of the three massive EV projects (including the Volkswagen and Stellantis-LGES plants in Ontario), Northvolt was closest to break-even, i.e. by 2037. But the company’s potential delays could mean Canada and Quebec would have few economic benefits to show for their billions in EV investments until 2040 at the earliest.

➔ The project was going to be Canada’s answer to Chinese EV battery behemoths. Now the nascent industry is just left with more questions.

Carbon Pricing In Transition

Canada’s industrial carbon markets can serve as building blocks of innovation, low-carbon economic growth and investment, according to a new joint report by Climate Action Institute, Canadian Climate Institute and Clean Prosperity. But Canada’s patchwork of nine siloed carbon pricing systems are barriers to unlocking these benefits.

➔ Harmonization of the country’s carbon markets would help ensure they play an outsized role in advancing Canada’s economic, environmental and geopolitical objectives, the report argues.

➔ As policymakers shift their attention to the back half of the 2020s, amid a more fragmented world, a fresh approach to our carbon markets could strengthen both trade and climate policies, and foster a new cycle of lower-emissions growth, the three institutes state.

➔ Read the full report here.

The Institute In Action

➔ We’re in Ottawa on Oct 10. for Net-Zero Edge, Canada’s largest climate conference, hosted by the Canadian Climate Institute and the Net-Zero Advisory Body. John Stackhouse sat down with Sir Alok Sharma and Candace Laing from the Canadian Chamber of Commerce to discuss Canada’s carbon competitiveness. Follow that conversation on John’s LinkedIn here.

➔ Catalytic capital. That was among the topics Myha Truong-Regan, our Head of Climate Research, and Ravinder Gill, Managing Director and Head of Sustainable Finance at RBC, discussed at a Food for Thought Climate Perspectives series, starting in Toronto. Read some of their top observations here.

➔ What’s on the team’s reading/listening list: Prophet Song (by Paul Lynch), It Can’t Happen Here (by Sinclair Lewis), A World Of Three Zeros (Muhammad Yunus), What If We Get It Right? (by Ayana Elizabeth Johnson).

Curated by Yadullah Hussain, Managing Editor, RBC Climate Action Institute.

Climate Crunch would not be possible without John Stackhouse, Myha Truong-Regan, Sarah Pendrith, Farhad Panahov, Lisa Ashton, Shaz Merwat, Vivan Sorab, Caprice Biasoni and Frances Dawson.

Have a comment, commendation, or umm, criticism? Write to me here (yadullahhussain@rbc.com)

Climate Crunch Newsletter

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More