Monthly Housing Market Update

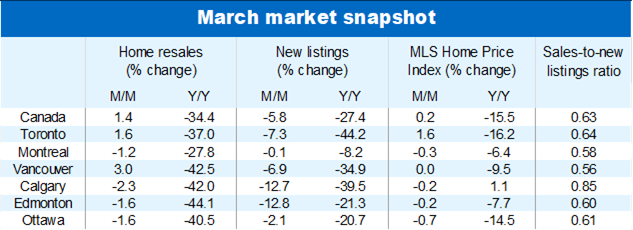

The year-long winter in Canada’s housing market appears to be ending. There were clear—albeit still tentative—signs of spring in March as more buyers stepped back into the fray. Home resales rose 1.4% from February and perhaps more importantly (benchmark) prices went up m/m for the first time in over a year across Canada. Sellers, on the other hand, have yet to come out of hibernation: new listings are still trending lower, falling in four of the past five months.

In fact, Canada’s housing market could be potentially busier at this stage were there more homes for sale. Back-to-back drops in inventories have tightened demand-supply conditions, pitting more buyers against each other in bidding contests in parts of the country (e.g. Toronto, Vancouver).

We think developments in March are evidence that a cyclical bottom is now forming nationally and in many local markets (including in Ontario and British Columbia). The trough won’t be far behind in other areas.

Activity stabilizing but still exceptionally quiet

No doubt the Bank of Canada pausing its aggressive rate hike campaign earlier this year is inspiring some buyers to return to the market. We suspect many had been waiting on the sidelines for such a signal. But continued affordability issues is significantly limiting the influx. At 406,000 units (annualized) in March, home resales are still near their lowest level in more than 13 years in Canada (excluding the lockdown period).

Sellers wanted

More supply could certainly get things rolling a little faster though it’s hard to know when would-be sellers will be ready to take the plunge. Growing evidence of a market inflection point this spring and stabilizing prices might do the trick in the coming months. Of course, the longer sellers hold back (or the more they retrench), the tighter demand-supply conditions are likely to get—and quicker upward price pressure are likely to build.

Narrowly-based price gain in March

Tighter conditions over the past two months are already having an impact on property values. The national composite MLS Home Price Index rose 0.2% m/m in March for the first time in 13 months. Toronto (up 1.6% m/m) and a few other Ontario markets including Sudbury (up 3.1%), North Bay up 1.5%), Kitchener-Waterloo (up 1.0%) and the Niagara region (up 0.5%) led the increase. Yet year-long declines continued in the majority of other markets across Canada, including Calgary (-0.2%), Edmonton (-0.2%), Regina (-2.1%), Ottawa (-0.7%), Montreal (-0.3%) and St. John’s (-1.4%). Vancouver’s MLS HPI was unchanged from February.

Local trends to diverge

We expect diverging trends to persist in the near term. It’s likely to take a little longer in many markets—especially those that overheated the most earlier in the pandemic—for demand-supply conditions to firm up sufficiently to stabilize prices. Still, we think it will be just a matter of few more months in most cases. Turning points are generally in sight.

Sharp rebound unlikely

Reaching the cyclical bottom doesn’t mean activity and prices are about to rebound sharply immediately thereafter. In fact, we see the recovery phase starting slowly later this year as affordability issues and a weaker economy continue to hold back buyers. The pace should progressively pick up in 2024 once the economy clears its soft patch, inflation returns to target and the Bank of Canada reverses part of the massive rate increases it’s imposed since March 2020.

Booming immigration will fuel demand through the medium term (and possibly beyond), raising the odds of deep supply shortages in the future if homebuilding fails to pick up materially. See Canada’s housing market outlook: The bottom of the downturn is in sight for our latest housing market forecast.

See PDF with complete charts

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More