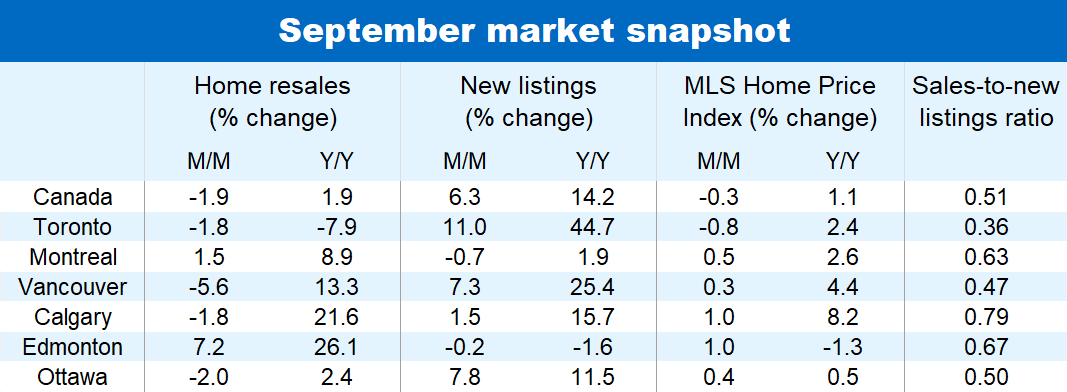

The fall season is shaping up to be a relatively quiet period for Canada’s housing market. Early evidence in September confirmed that higher interest rates continue to restrain real estate activity across most of the country—with Alberta once again bucking the trend with its sustained vigour. Home resales fell 1.9% m/m nationwide, marking the third consecutive monthly decline.

This retrenchment takes place at a time when more sellers are coming to market. New listings have increased in each of the last six months, and in September surpassed their pre-pandemic level by 10%.

A sharp easing of supply-demand conditions since summer has brought most markets into better balance, while tipping Ontario into a buyer’s market. This has relieved the upward pricing pressure that built in the spring. Canada’s aggregate MLS Home Price Index in fact fell slightly month-over-month in September (-0.3%) for the first time since March. We expect prices to soften further through the remainder of this year and possibly into early next as market conditions continue to tilt in favour of buyers.

Sales retreat across most provinces

Sales declines were widespread last month with few markets reporting advances. Even Calgary—currently Canada’s housing hotspot—recorded its first dip (-1.8% m/m) in six months in September.

Among Canada’s larger markets, the pullback was sharpest in Vancouver (-5.6% m/m). Though the latest backstep in Toronto looked comparatively modest at -1.8%, the fall since this spring’s peak is substantially more pronounced (-22.4%) than in Vancouver (-13.7%). Sharp declines in markets surrounding the GTA—including the Niagara region (-14.5% m/m) and Hamilton-Burlington area (-7.1% m/m)—further weighed on provincial activity in Ontario. Winnipeg (-1.0% m/m) and Saskatoon (-3.9%) were also among the markets experiencing slower activity last month in Western Canada.

The few markets where resales picked up in September included Edmonton (+7.2% m/m), Halifax (+5.9%), Montreal (+1.5%) and Quebec City (+1.1%).

New listings tip Ontario into buyers’ market

September marked another month of easing supply-demand conditions. Muted sales activity alongside an uptick in new listings brought the sales-to-new listings ratio down to a 14-month low at the national level (51%)—a level that is considered balanced.

The ratio, however, points to conditions now favouring buyers in Ontario, and more clearly so in the Greater Toronto Area, the Niagara region, and Barrie. But many other markets (including Kitchener-Waterloo, Hamilton-Burlington, and London) teeter on the brink of falling into this category as well.

Though less stark than Ontario, stalling sales amid an influx of new listings has worked to rebalance markets in B.C. and most of the Maritime region. Supply-demand conditions in New Brunswick and Canada’s prairies, on the other hand, remain tight. Still, we expect souring market sentiment will soon impact these markets too to some degree.

Prices softening

The sharp swing in market conditions in recent months has significantly dampened upward price pressures across the country. The slight fall in the aggregate MLS HPI for Canada in September may be a sign of things to come. Look no further than Ontario for evidence of renewed price weakness. Ontario markets in and around the GTA posted the largest month-to-month declines in September, while price growth in other areas of the province remained relatively flat.

Though still better supported than in Ontario, prices in B.C. and Quebec further moderated their rate of appreciation last month. Between August and September, price gains were less than half as large as the ones recorded in August in Vancouver (+0.3% m/m) and Victoria (+0.6%). A similar moderation took place in Montreal (0.5%) and Quebec City (-0.8%).

With the exception of Regina (-0.6% m/m), home prices in the Prairies continued to climb at a solid pace—reaching record-highs in Edmonton, Calgary and Saskatoon. Likewise, prices out east stayed on an upward trajectory, entering all-time high territory in Newfoundland & Labrador, Moncton and Saint John.

Market cooling expected to further restrain price growth

Higher interest rates, affordability challenges and economic uncertainty are likely to keep homebuyer demand muted in the near term. At the same time, higher interest costs may also exert increasing pressure on existing homeowners to sell, keeping the flow of new listings going. Together these trends would hand buyers more pricing power in the months ahead, driving prices further down in Ontario while restraining gains elsewhere in the country.

See PDF with complete charts

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More