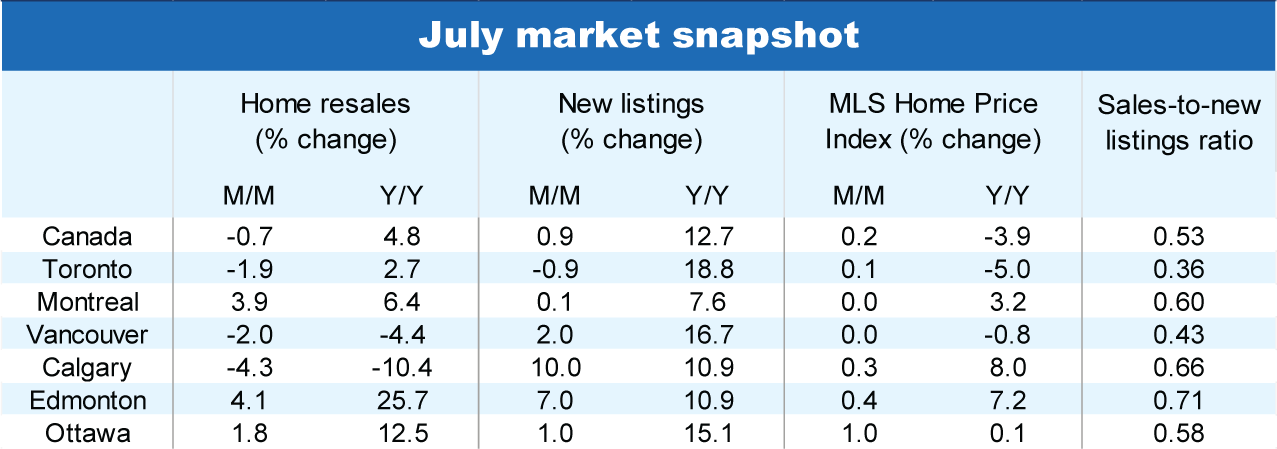

The latest interest rate cut from the Bank of Canada came at the end of July, doing little to entice buyers into the housing market. Resales pulled back modestly—dipping 0.7% between June and July at the national level—partially offsetting a 3.5% advance in June.

Home resales remain largely static with softness concentrated in the Ontario and B.C. markets after the solid gain recorded in June. However, markets in the Prairies remain the exception to trends seen at the national level, and continue to report historically high activity across many cities.

Home resales retreat back to March levels

Buyers didn’t come to market with the same enthusiasm seen in the past this July. They retreated back to the sidelines after a solid sales pickup in June.

Aside from solid June activity, the market has seen relatively small month-to-month fluctuations since the spring—keeping activity around the level recorded in March. This has, particularly, been the case in Canada’s more expensive markets of Toronto and Vancouver, where some buyers are waiting for clearer signs of market direction.

Still, clearer signs of market recovery are forming in other Ontario and B.C. cities. Hamilton-Burlington, Ottawa, Guelph, and Kitchener-Waterloo have all recorded a second consecutive increase in monthly sales on a seasonally adjusted basis this July. It’s possibly a sign of renewed buyer appetite.

In B.C., Victoria and the Okanagan posted two consecutive upticks in activity—alongside East Coast cities Halifax, Moncton, and Saint John.

The Prairie provinces continue to be a hotspot for activity, even though slower resales were recorded in most major markets last month. Buying in Edmonton, Regina and Winnipeg continues to top activity recorded a year ago. Resales are still historically high in Calgary and Saskatoon as well.

New listings increase hit a 10-month high

The sting of high interest rates still seems to be forcing the hand of some sellers. Rate cuts may also be enticing more sellers to list their homes in anticipation of renewed demand.

This, alongside a consistent flow of new supply from recently completed residential units, is keeping inventories up in Canada. New listings increased for a fourth consecutive month in July (0.9% m/m), hitting a 10-month high.

Markets in Ontario are largely fueling the national rise in new listings—with the Greater Toronto Area accounting for a growing share of new listings.

New listings continued to rise in Vancouver and the Fraser Valley as well, which accounted for most of the supply increase in B.C. Static sales and growing inventories have kept price deteriorations concentrated in these markets.

Calgary also recorded a sizable increase in new listings last month (10%). Still, the sales-to-new listings ratio remains deeply in favour of sellers in this market, keeping prices on the rise.

Tight supply-demand conditions continue to fuel prices in Quebec, particularly Quebec City, and the Prairies including Winnipeg, Saskatoon, and Edmonton.

This is a stark contrast to the stagnant prices seen at the national level. The 0.2% gain recorded in July was the largest month-over-month increase recorded this year—which is still 0.1% above the MLS composite benchmark price in March.

Slow recovery expected

More interest rate cuts are likely to stimulate homebuyer demand across the country. But, we expect this will be gradual. Significant reductions in rates will be needed to make a noticeable difference in ownership costs—especially in Canada’s priciest markets.

Consequently, we expect a slower housing market recovery with a potential acceleration towards the end of 2024 and into next year as both short and long-term rates decrease more substantially.

We see prices heating up slowly as well, though some markets, like Toronto, could face another wave of price drops if inventories continue to rise significantly.

Download the Report

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.