Sellers answered the call for more supply in March but, in the end, came well short of rebalancing Canada’s housing market. Buyers snapped up virtually all new listings, often following highly competitive bidding contests. This left the level of inventories at decades low, demand-supply conditions extremely tight and upward price pressure intense. Canada’s composite benchmark price (MLS Home Price Index) rose another $21,000 (3.1% m/m) last month, just shy of the $22,000 (3.3%) increase in February—the largest single-month rise ever recorded. Relative to a year ago, the benchmark price is up an astounding $120,000, or 20.1%.

Property values continue to soar in many smaller markets

Clearly this spring season has yet to sooth buyers’ fear of missing out. Many of them continue to flee to smaller markets in search of more affordable options. Yet they face very low inventories and soaring prices there too. Some of the larger increases in property values last month took place in smaller markets in Ontario and British Columbia, including Woodstock-Ingersoll (up $42,000 m/m), Southern Georgian Bay (up $37,000), the Niagara region (up $37,000), Cambridge (up $37,000) and the Fraser Valley (up $31,000). This extended—and in many cases accelerated—the massive price appreciation over the past year. Gains now top 30% y/y in three out of four markets in Ontario, with more than one-fifth exceeding 40% y/y.

Far into the stratosphere

Home resales reached an all-time high of 833,100 units (seasonally adjusted and annualized) in Canada in March. This pace was more than 50% above the record 550,300 units set in all of 2020. Activity was at, or near a record high in most of British Columbia, Manitoba, Central Canada and Atlantic Canada, and many markets in Alberta and Saskatchewan (including Calgary, Edmonton, Regina and Saskatchewan). Montreal, Toronto and a few other markets recorded small monthly declines though this largely reflected a dearth of single-family homes available for sale. The bottom line is the intense heat remains widespread across the country, fueled by exceptionally low interest rates, changing housing needs and high household savings. Rapidly-rising prices have also likely opened the door to speculative activity in several markets.

Supply increase isn’t nearly enough to rebalance the market

Soaring prices are poised to attract more sellers in the coming months. This is not to suggest they’ve been slow in coming in recent months. Quite the contrary. New listings rose back-to-back to a new record high of 1.0 million units (seasonally adjusted and annualized) in March. It’s just that they haven’t increased enough to meet demand and ease demand-supply conditions in a material way. These conditions still put pricing power squarely in the hands of sellers practically everywhere in Canada.

Demand side must cool if prices are to moderate

On its own, the supply response is likely to fall short in the near term given the degree of imbalance in many markets. Some cooling of demand needs to take place if price gains are to moderate. A gradual rise in longer-term interest rates, deteriorating affordability and the resumption of office work will eventually restrain demand but it’s difficult to know when that will be. OSFI’s proposal to tighten the stress test for uninsured mortgages on June 1—by raising the qualifying rate from 4.79% to 5.25%—will reduce the purchasing budget of some of the most financially-stretched buyers by a little more than 4%. A similar tightening for insured mortgages could be announced in the April 19 federal budget. Together, these measures would directly dial down the demand heat by a few degrees.

March market highlights

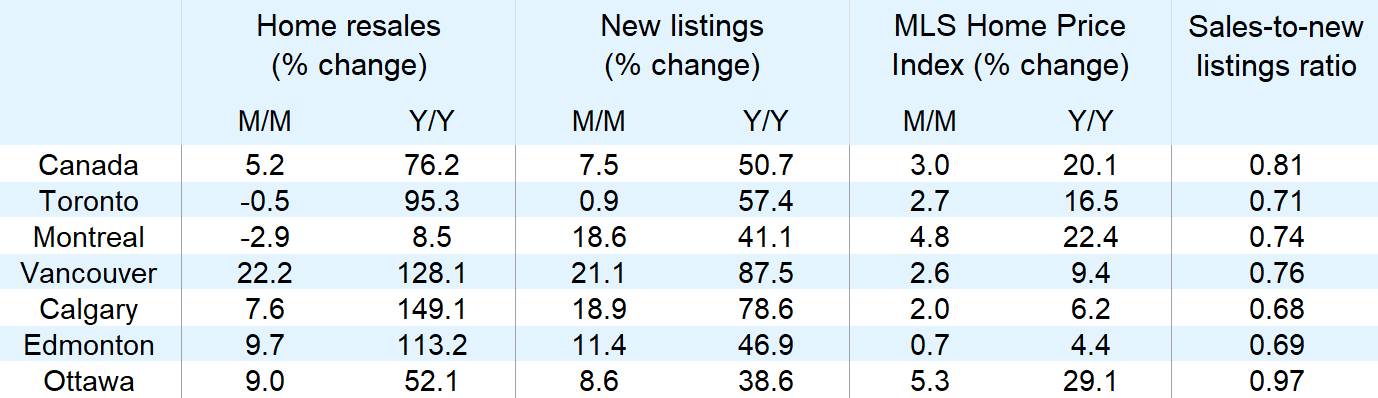

- Another month, another record high for home resales: They rose 5.2% to 833,100 units (seasonally adjusted and annualized) in Canada in March. The increase was widespread across the country, led by Vancouver (up 22.2% m/m), Saskatoon (up 17.0%) and Regina (up 13.7%). Montreal (-2.9%), Toronto (-0.5%) and Victoria (-0.3%) were among the few markets that recorded a drop—though activity stayed historically high in each case.

- Highest-ever number of sellers came to market: New listings picked up for a second-straight month, climbing 7.5% m/m to a new record high of 1.0 million (seasonally adjusted and annualized) in Canada. New listings rose in all but one local market (Victoria).

- Demand-supply conditions remained extremely tight: The sales-to-new listings ratio in Canada eased marginally from 0.82 in February to 0.81 in March—still indicating a strong seller’s market both nationally and virtually in all local markets.

- Home prices rocketing to new heights: Canada’s composite MLS Home Price Index blew by the $700,000 mark for the first time, rising 20.1% y/y to $715,000. This was the strongest rate of increase ever for the index, and a sharp acceleration from 17.2% in February. The single-family home index soared 25.4% y/y and the condo index accelerated for the second-consecutive month to 5.4%.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More