Highlights

- Fed willingness to talk about interest rate cuts sent markets rallying to close out 2023.

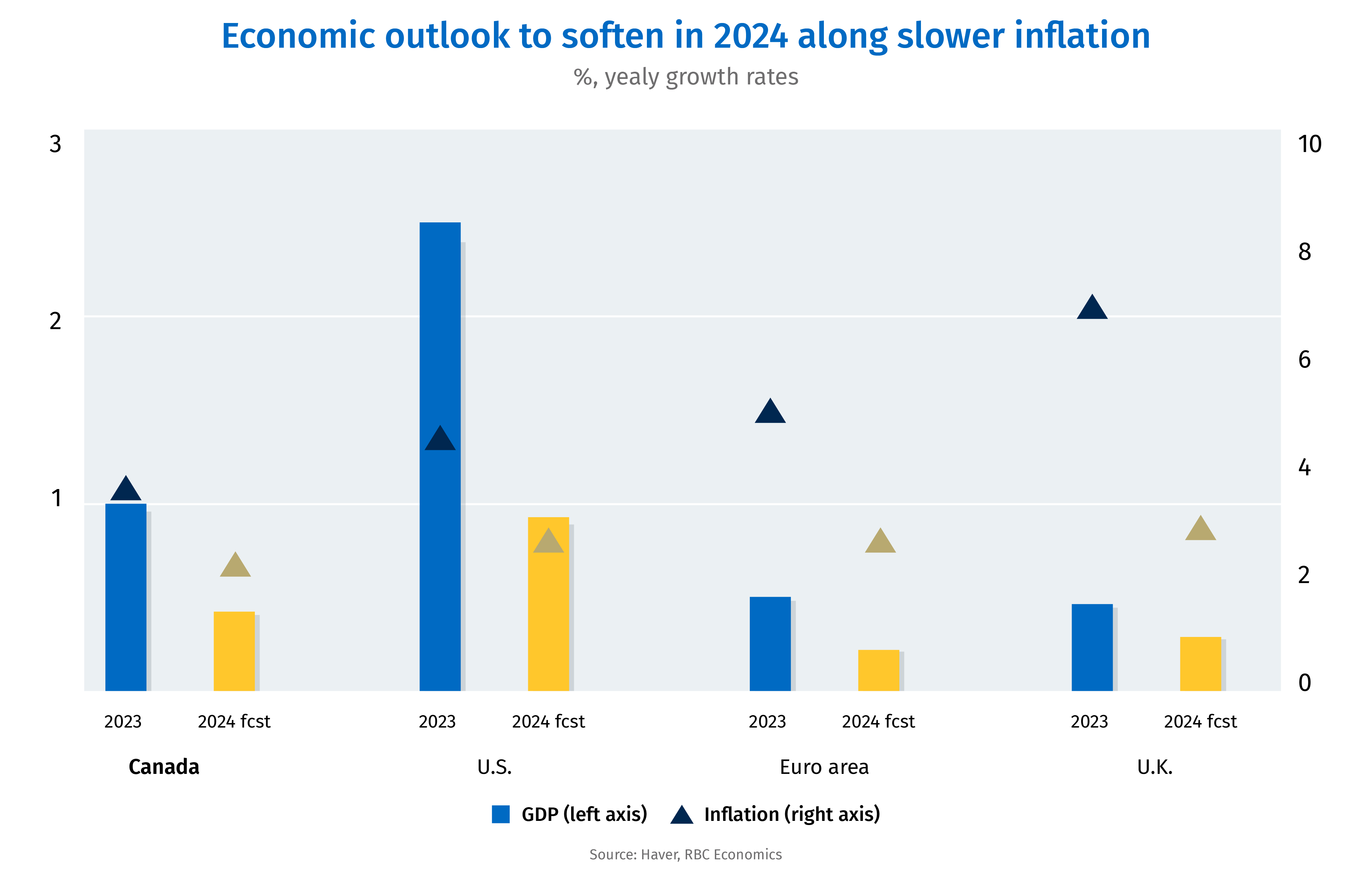

- Elevated interest rates will continue to exert pressure on aggregate demand – we expect subdued growth and softer labour market backdrop for global economies over H1-2024.

- Slower economic growth to be viewed as necessary for inflation pressures fully subside. We expect rate cuts from the Fed and the BoC around mid-year, and the ECB and BoE in 2025.

- Interest rates will be slower to come down than they were to go up. Inflation scares over the last year(s) will warrant a gradual and more cautious easing cycle from the central banks.

There goes the dove

December 2023 saw the BoC, Fed, BoE, ECB and the RBA all holding key interest rates steady at their respective meetings. All central banks are also retaining the option to push interest rates higher if needed to get inflation under control. But that hiking bias looks increasingly like a formality with broadly-based easing in domestic inflation pressures in most regions calming central banks’ nerves.

Indeed, healthy developments on the inflation front towards the end of last year have left policy makers more confident that rates won’t need to move any higher than they already have. While most other central banks pushed back against an explicit discussion around easing, the Fed led with a pivot at its December meeting with Chair Powell acknowledging that the timing of interest rate cuts has become an active discussion point. Separately, the Fed’s dot plot showed that none of the participants expect interest rates to go higher this year – and all but two expect cuts. That sent markets on a rally before year end. U.S. 10-year bond yields fell another 50 bps in December to below 4% for the first time since last summer. Stocks indices extended their gains from November, and the USD continued to weaken.

Of course, underpinning a slowing inflation backdrop and discussions around interest rate cuts is a wobbly economic growth outlook. Output growth by our count is likely to have contracted slightly for a second consecutive quarter in each of Canada, the euro area and the U.K. in Q4 of 2023. Softness is expected to extend into 2024, as high interest rates continue to suppress aggregate demand by slowing consumer spending and business investment in these regions. In the U.S., economic growth still looks more resilient and there is still room for debate about exactly how hard of a landing the economy is going to have. Still, labour markets have ended 2023 with a weaker backdrop than the start of the year. And many headwinds such as the restart of student loan repayments and a continuation in softening labour markets still remain.

While inflation pressures have eased substantially and in some cases more than expected, they’ve not receded completely. Mindful of those risks and potentially large negative impact from a policy error, central banks will be wary about cutting rates prematurely. A moderately weaker economic backdrop is more likely to be viewed as necessary to bring inflation fully back to target than something that would prompt immediate rate cuts. We expect the BoC and the Fed to lead the easing cycle, with their first rate cuts expected at around middle of the year. The ECB and the BOE meantime are expected to stay on hold until easing in 2025.

Central bank bias

Central Bank

Current Policy Rate

(Latest Move)

Next move

BoC

BoC

5.00%

+0 bps in Dec-23

0 bps

in Jan-24

Fed

Fed

5.25-5.50%

+0 bps in Dec-23

0 bps

in Jan-24

BoE

BoE

5.25%

+0 bps in Dec-23

0 bps

in Feb-24

ECB

ECB

4.00%

+0 bps in Dec-23

+0 bps

in Jan-24

RBA

RBA

4.35%

+0 bps in Dec-23

+25 bps

in Feb-24

BoC in no rush to ease off the brakes

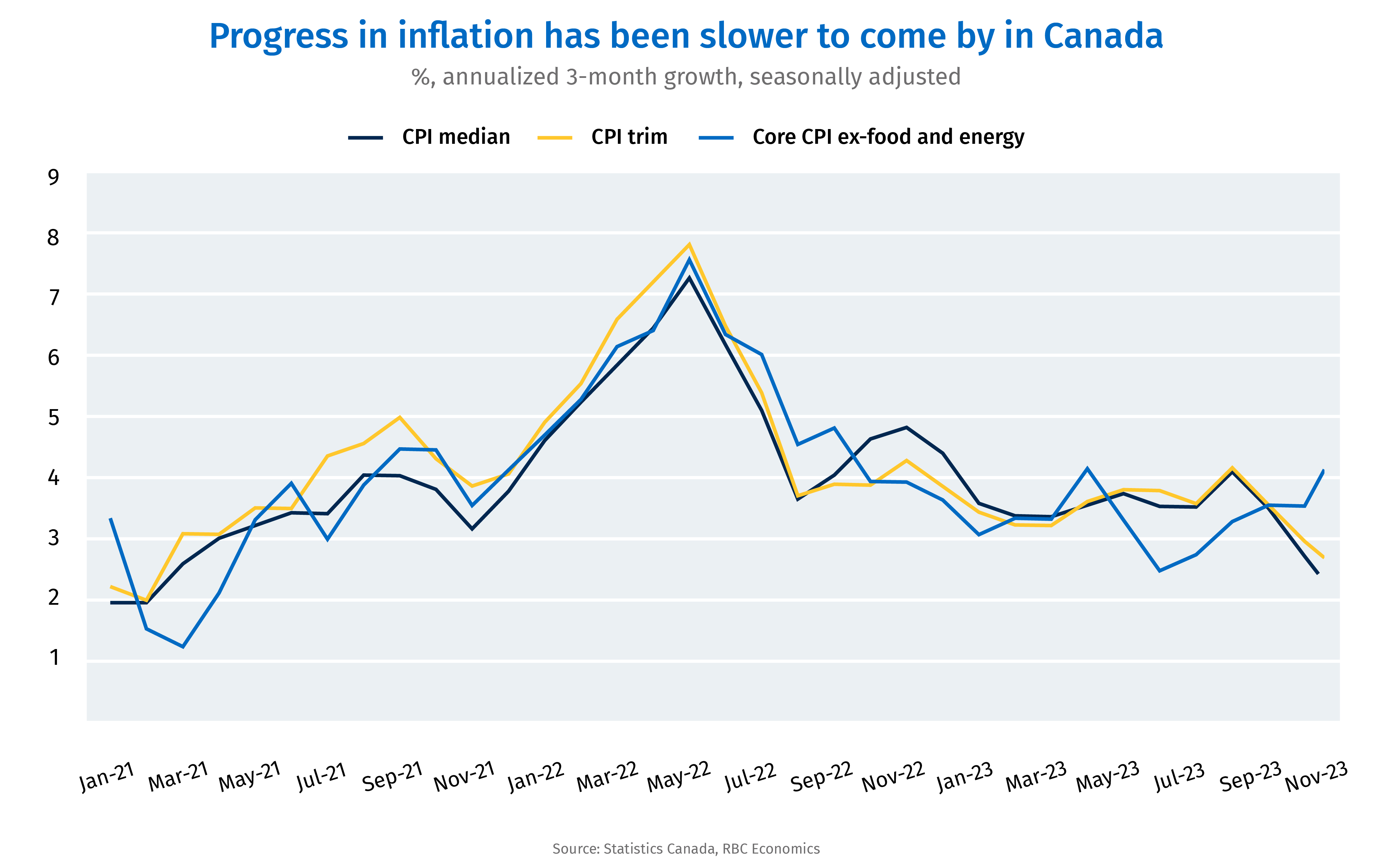

It has been about 6 months since the BoC last hiked rates (in July). The economic growth backdrop since then has slowed substantially. Controlling for surging population growth, GDP per-capita in Canada declined for a fifth straight quarter in Q3 2023 and will almost certainly post another sizable decline in Q4. Meantime, evidence has also been gathering that inflation is trending back towards the 2% target. Month-over-month increases in the BoC’s preferred core inflation measures (CPI trim and CPI median) had both dropped back within the 1% – 3% target range when calculated on a three-month annualized basis.

Already in Q4, BoC estimated that ‘excess demand’ in the economy was already essentially depleted. That is unlikely to be the last of weak GDP growth, as the full impact of interest rate increases have yet to be felt across the economy. 60% of Canadian mortgage holders are yet to face higher payments with the wave of renewals of fixed rate mortgages at higher rates set to stretch into 2025 and 2026. In the near-term, GDP growth is expected to continue to trend at levels that are well below potential. That means an increasingly negative output gap and, from the BoC’s perspective, much greater likelihood that slowing inflation will persist.

While evidence is building that higher interest rates in Canada have served their purpose of reigning in price growth, BoC officials have remained cautious about concluding enough has been done. That’s not surprising – although inflation slowed through 2023, the pace of improvement did drop off significantly after the initial sharp deceleration after peaking in the summer of 2021. Near-term inflation expectations among consumers are still relatively elevated. And the consequences of easing too soon are still too large to ignore. Overall, we expect the BoC to keep treading cautiously, with the first cut to the overnight rate by mid-year.

Fed officials still threading the needle

In the U.S., consumer spending has held up strong with households largely shielded from the impact of higher interest rates by ultra-long 30-year mortgage contracts, and their income bolstered by pandemic savings and a solid labour market rebound. Growth in the U.S. economy in Q4 is expected to have slowed but that still leaves GDP growth in 2023 as a whole at a remarkable ~2.4%, compared to just 1% for Canada and even lower 0.5% and 0.3% increases expected in the Euro area and the U.K., respectively. Against that backdrop, moderating inflation pressures in the U.S. have come as a surprise and have left the economy walking the narrow path to a historically elusive “soft landing”.

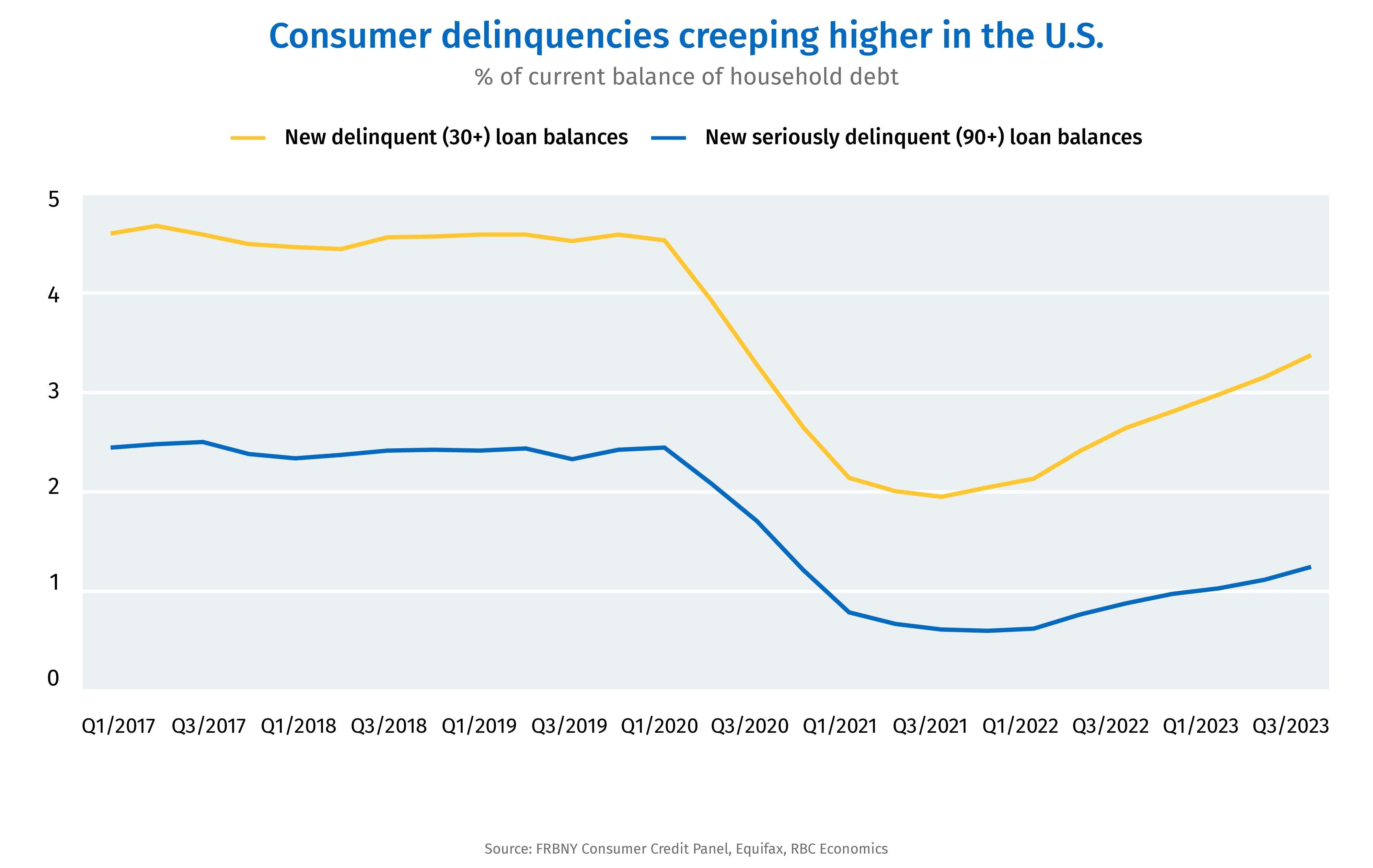

Still, we don’t expect the U.S. economy’s adjustment to higher interest rates to be entirely painless. Inflation pressures are expected to keep moderating but so is aggregate demand. Abnormally low savings rate (around 4% in Q4 2023 vs. 7.5% in pre-pandemic 2019) means households on average are utilizing a larger share of incomes than normal to support current levels of spending. Delinquencies in consumers loans in the U.S., especially for auto and credit card borrowing have already edged higher in 2023. Meantime, receding labour demand has been slowing labour market activities, with a further drift up in the unemployment rate still expected over the first half of this year. Both hiring and quit rates in the U.S. have now fallen to levels well-below pre-pandemic. Overall, we expect the U.S. economy to stall in Q1 and slow in Q2 of 2024.

Still, moderately slower growth (if it finally comes) will likely be viewed as positive by a Fed that has repeatedly had to question the sustainability of low U.S. inflation readings against a still overheated consumer spending backdrop. Those concerns have grown quieter with each release of CPI that showed further easing / narrowing in domestic inflation pressures. But they also remain present given still-elevated shelter costs and wage growth, both of which are expected to soften more into the new year alongside easing in consumer spending and hiring activities. We expect the first rate cut from the Fed to come by mid-year this year.

ECB & BoE on hold, for now

Three consecutive months’ worth of downside surprises in inflation readings in the euro area was enough to warrant a shift in the tone of ECB’s more recent communications, including one where Bank of France Governor François Villeroy de Galhau confirmed the possibility of rate cuts this year. Growth in the area in the meantime continues to look sluggish, with PMIs data suggesting a second consecutive decline in GDP in the fourth quarter of 2023 but also early signs of “bottoming out” in activities.

As of the last meeting ECB president Largarde stood firm on a more hawkish stance, contrasting the pivot from the Fed. She also highlighted the importance of incoming data over the first half of 2024, especially those on wage negotiations for deciphering the path of future inflation in the euro area. That suggests a more conservative approach from the ECB, who still wants to see a lot more evidence accumulate before making a a more definitive pivot towards lower interest rates. We expect the ECB to keep the deposit rate steady through 2024 and start cutting in the year after. That is unless more data can point to persistent unwinding in wage growth as well as a reliable path for core inflation to return to target, which could bring those cuts forward.

Similar to the euro area was a soft growth backdrop in the U.K. towards the end of 2023 as well as what felt like a turnaround in economics activity, as suggested by the PMI releases. The services PMI in the U.K. expanded unexpectedly in December on early signs of a rebound in consumer demand. Manufacturing activity meantime was still sluggish. And labour market conditions have also looked weaker, with the level of job vacancies (one of the few reliable indicators from the reduced labour force reports) trending persistently lower but to still elevated levels comparing to pre-pandemic.

More importantly, inflation data showed persistent easing in Q4 but at 4.2% in November was still the highest among all advanced economies that we track. Regular wage growth among private sectors that was highlighted as a key indicator by the BoE also stayed at high levels and well outside of the central bank’s comfort zone. Of all the central banks, the BoE sounded the firmest when it comes to defending its high for long message through communications in the December meeting and thereafter. Without a more significant weakening in private sector wage growth and further easing in inflation readings we don’t expect a quick pivot from the BoE, and expect the bank rate to be held at current levels through the end of this year.

Download full PDF report including forecast tables:

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More