Canadian Housing Health Check

Read the full report for an assessment of key Canadaian housing market indicators.

Read full report

Moderation in resale activity since spring sets stage for soft landing: This winter’s frenzy raised significant concerns that extrapolative price expectations would drive up property values to excessive levels. With the market shifting to a more sustainable pace, the risk of an uncontrolled upward price spiral has considerably diminished. We expect prices to flatten by early next year.

Still-solid demand, low inventories keep odds of price collapse low: While down, resales continue to be historically strong—if anything, they’re restrained by a lack of inventories. Tight demand-supply conditions will maintain support for prices in the near term.

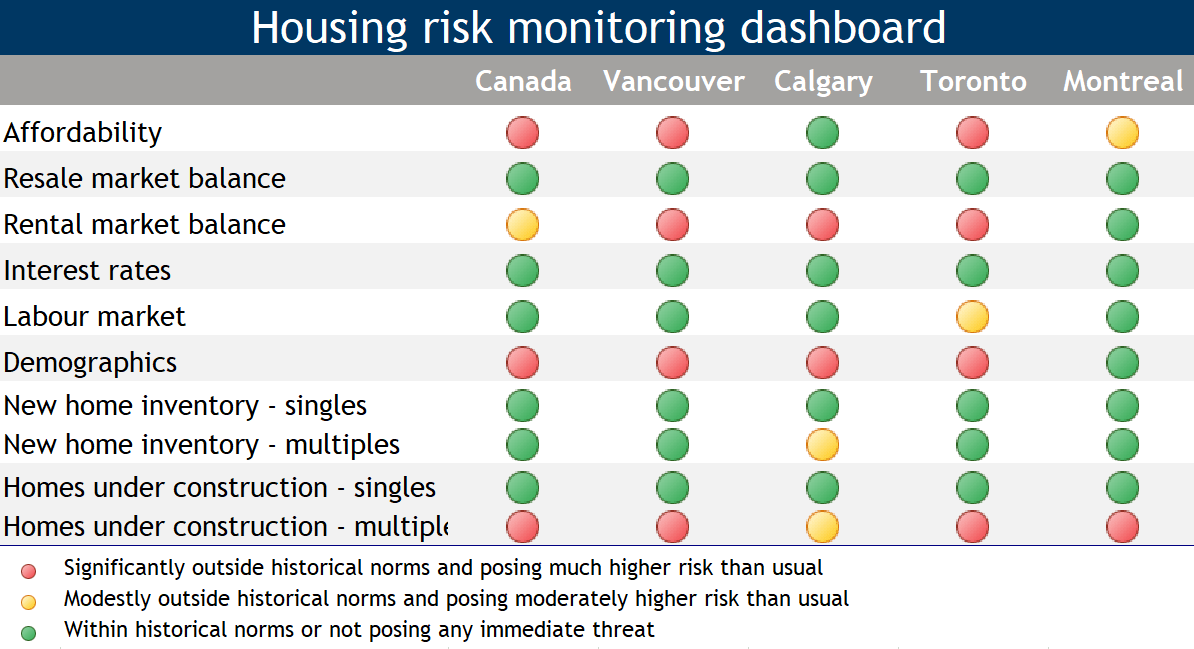

Soaring prices have worsened affordability issues, increasing vulnerabilities: Despite rock-bottom interest rates, homeownership costs have spiked across much of the country. The lack of affordability is severe in Vancouver and Toronto, and becoming more problematic in Montreal.

Pandemic’s threat is still present: The dangerous Delta variant is behind an emerging fourth wave that could create further volatility.

Interest rate risk could rise if inflation runs too hot: Exceptionally low rates have provided a powerful tailwind for the market during the pandemic. This wind could switch direction if inflation fears cause interest rates to rise.

Further possible policy intervention creates uncertainty: The recent tightening of mortgage lending criteria has strengthened household resilience. With all federal parties proposing changes to housing policies, the next federal government is likely to introduce additional measures, the impact of which is unknown.

Dip in immigration is unlikely to be sustained: The main impact has been on the rental market. Leasing activity has picked up this year, however.

Canada’s labour market has improved: The easing of restrictions in hard-hit sectors will further support the jobs recovery, and reduce risk to the housing market.

Elevated multi-residential dwelling construction isn’t a sign of overbuilding: It’s a response to low inventories in most markets. Still, it entails some absorption risks.

Largest four markets

Toronto

After reaching sky-high levels at the start of the year, activity has slowed since spring. But so have listings, which have kept the market extremely tight and prices under intense upward pressure. The heat has extended to the condo segment where prices are now firming. Overstretched affordability remains a significant issue and top vulnerability. A dip in population growth poses a risk though will be short-lived.

Montreal

The existing home market moderated to more sustainable levels this summer. While the pace of property value appreciation is now easing, there’s little risk of a sharp decline. Sellers still have the upper hand. Affordability is a moderate but growing strain. Elevated rental apartment construction warrants close monitoring.

Vancouver

The spike in activity this winter has since been partly reversed. Buyers continue to compete fiercely, however, as inventories have also softened, maintaining strong support of prices. The plunge in immigration will be temporary, tempering any potential risk it poses, including to the rental market. Despite improving since late-2018, housing affordability is exceedingly poor and a major source of vulnerability.

Calgary

The market has recovered solidly in the past year. Inventories of existing and newly built homes are no longer excessive and prices are rising moderately. Demand-supply conditions are in fact the tightest they’ve been in years, which points to further price gains in the near term. A high rental vacancy rate and drop in immigration pose risks though these are likely to turn around once travel restrictions ease.

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More