- The cost gap between clean technologies and fossil fuels has closed over the last decade.

- But rising rates are now pushing the price of some climate-friendly options higher and threatening to slow critical Canadian capital investments in cleantech. Solar power provides a useful case study.

- Canada’s recently announced Investment Tax Credit is a welcome boost. But as other countries also look to solar, wind and other tech to meet their climate targets, stronger measures are likely needed.

- The bottom line: Canada’s transition strategy needs to go past electric vehicles and critical minerals to incentivize critical investment in heat pumps and other cleantech—as well as the manufacturing capacity to support it.

High interest rates could hamper key capital investments in cleantech

The costs of clean technologies were once among the biggest strikes against them. But over the past decade, these costs have fallen dramatically—enough that wind and solar power can now compete with fossil fuels. Today, the same is happening with technologies like EVs, where sales grew 35% year-over-year in the second quarter of 2022, and spending on heat pumps, which jumped 80% (albeit from low levels).

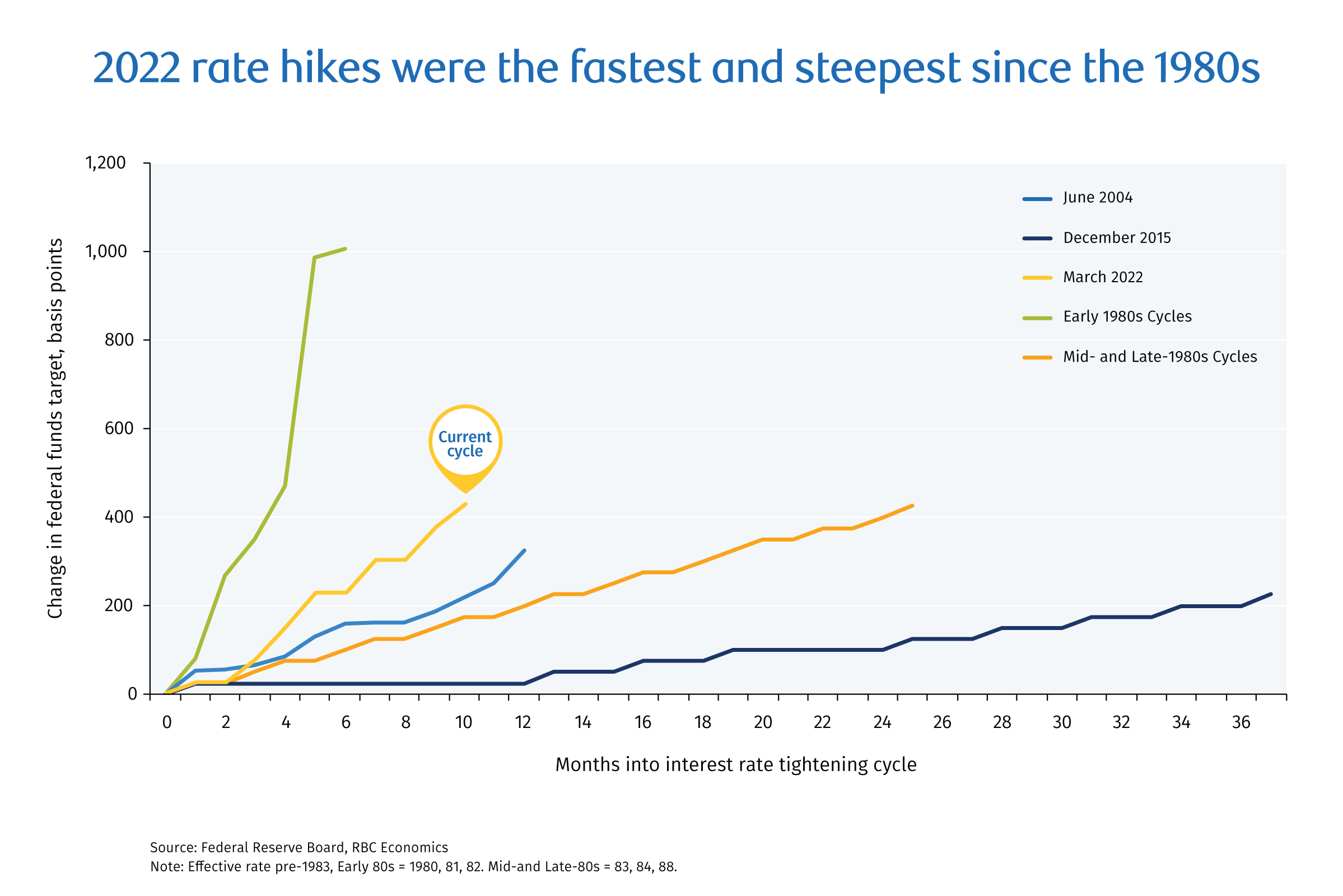

Is the world nearing a tipping point where climate-friendly tech becomes the obvious choice? We’re cautiously optimistic. But in a bid to cool inflation, central banks in the developed world are hiking interest rates more dramatically, and more quickly, than in any tightening cycle since the 1980s. That’s wreaking havoc on investment decisions.

Amid an ongoing shortage of workers, businesses will likely continue to invest in productivity-enhancing automation and machinery. We’re less sure they’ll invest in the climate-friendly technology we need to deploy over the next decade. In Europe, the potential of cleantech to combat energy insecurity and reduce reliance on Russian gas could be a powerful draw for investors. But in Canada, higher rates and talk of a recession could have a chilling effect.

The transition requires more hard technology than other recent economic growth trends—including building and buying heat pumps, solar panels and wind turbines. That’s going to require a lot more investment in manufacturing, equipment, and bespoke engineering than parts of Canada have attracted in the last few decades. What’s more, the returns on these technologies depend on buying equipment that‘s expensive up front, but costs less to run. For example, EVs cost more at the dealership, even if the electricity powering them is cheaper than gas. Historically, low rates have favored this switch, with low and stable financing costs offsetting high capital costs. Fast and large rate hikes have started to shift this dynamic.

Canada’s incentives may not offset international competition

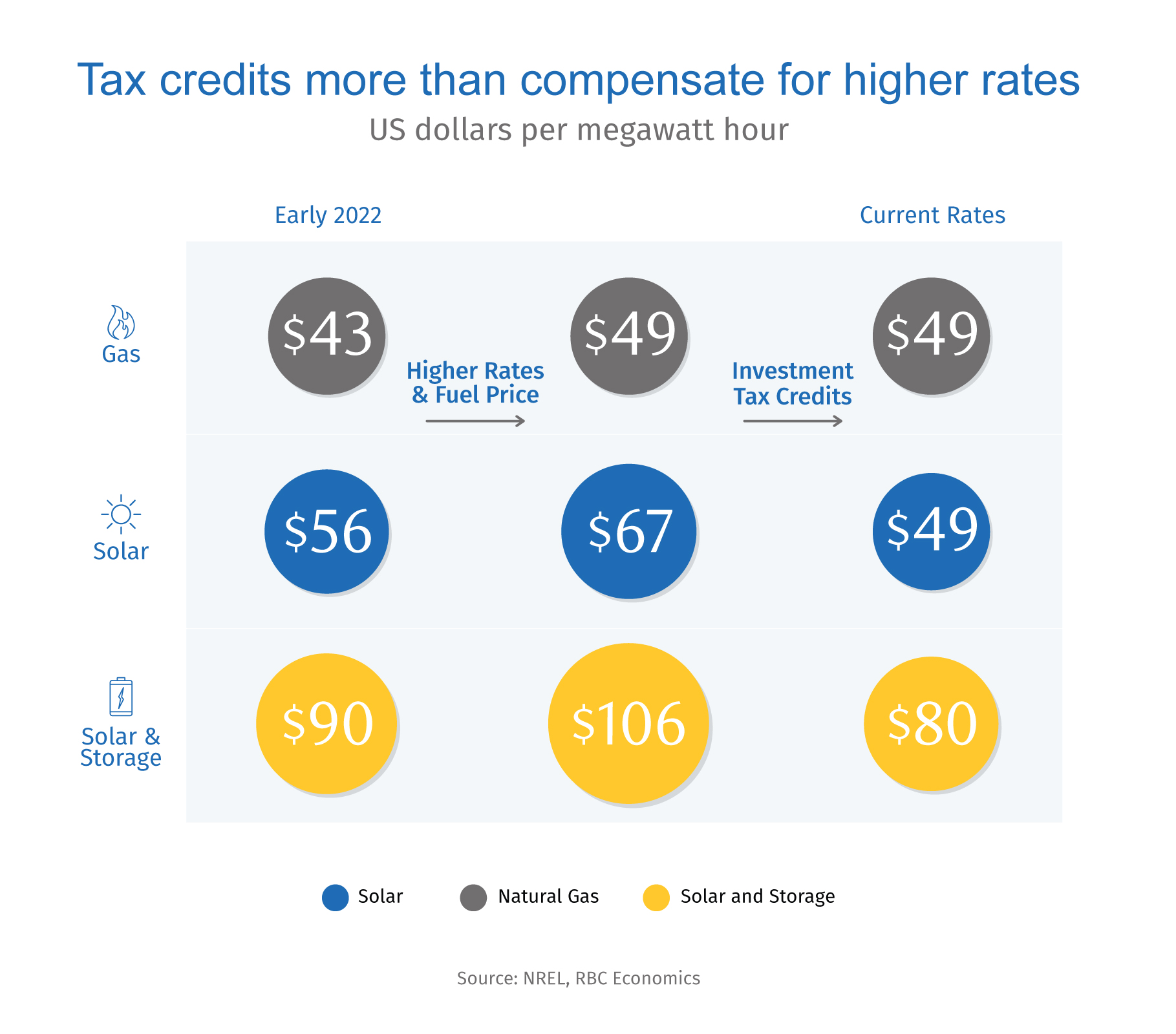

First, the bad news. Higher financing rates have pushed the relative price of solar power up by more than natural gas electricity, even with higher gas prices. We estimate the price of solar power will rise US$11/MWh or 19%. Meantime, combined cycle gas plant costs will rise just US$5 (13%). And energy prices may ease ahead of interest rates.

Now the good news: the federal government’s recent Fall Economic Statement included a 30% investment tax credit (ITC), which refunds capital expenditures. Once that’s factored in, solar—which has high capital costs but virtually no operating costs—can compete with natural gas. And other revenues, like regulatory credits via carbon pricing regimes or voluntary carbon offsets, might be enough to push them over the line. A whole electricity system based on renewables, using batteries to balance them, remains costlier.

But around the world, efforts to develop green electricity systems are accelerating. In the U.S., for example, 18 states and territories have standards that mandate a fixed share of renewable electricity—some by as early as 2025. Canada’s Clean Electricity regulations may similarly spur investment. For regions limited to green options, like solar, wind, hydro, and gas with carbon capture, the lowest cost system (i.e. unabated natural gas) is no longer the automatic choice.

New strategy must address more than EVs and critical minerals

Even if good policy equalizes the cost of green technology with fossil alternatives, there’s no guarantee we’ll get the panels and turbines we need, especially if they’re manufactured abroad. As more and more countries green their grids, limited manufacturing may tighten availability or bid up prices. This could deprive Canada of the tech it requires to combat power shortages, and potentially delay overall climate action.

Canada can’t afford to have these challenges slow the pace of transition. Generous support like the 30% ITC is needed, but so too is ensuring support is available to the right market players (including non-taxable entities), at the right time (e.g., production tax credits), and addresses long-term risks like under-investment in manufacturing capacity. We look to Budget 2023 to outline a strategy on investments in transition manufacturing that goes beyond EVs and critical minerals, to residential and industrial heat pumps, electricity system components, and other critical technologies. This will increase the likelihood Canada can smoothly transition to a cleaner economy.

Colin Guldimann joined RBC in 2019 as an economist. He holds a Bachelor’s degree in Economics from the University of Ottawa, and Master of Arts in Economics from the University of British Columbia. Prior to joining RBC, Colin worked on mortgage, housing, and economic policy at the Department of Finance Canada.

Proof Point is edited by Edited by Naomi Powell, Managing Editor of RBC Economics & Thought Leadership.

- The cost gap between clean technologies and fossil fuels has closed over the last decade.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More