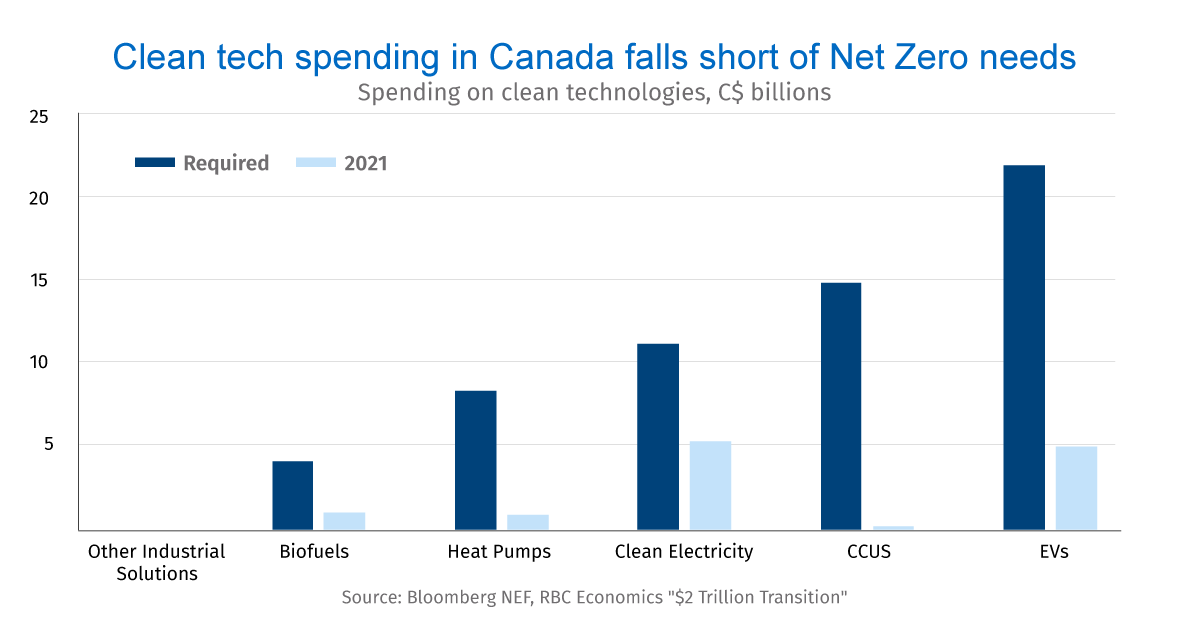

- In previous work, we found that Canada needs to spend at least $60-80 billion each year to reach Net Zero by 2050.

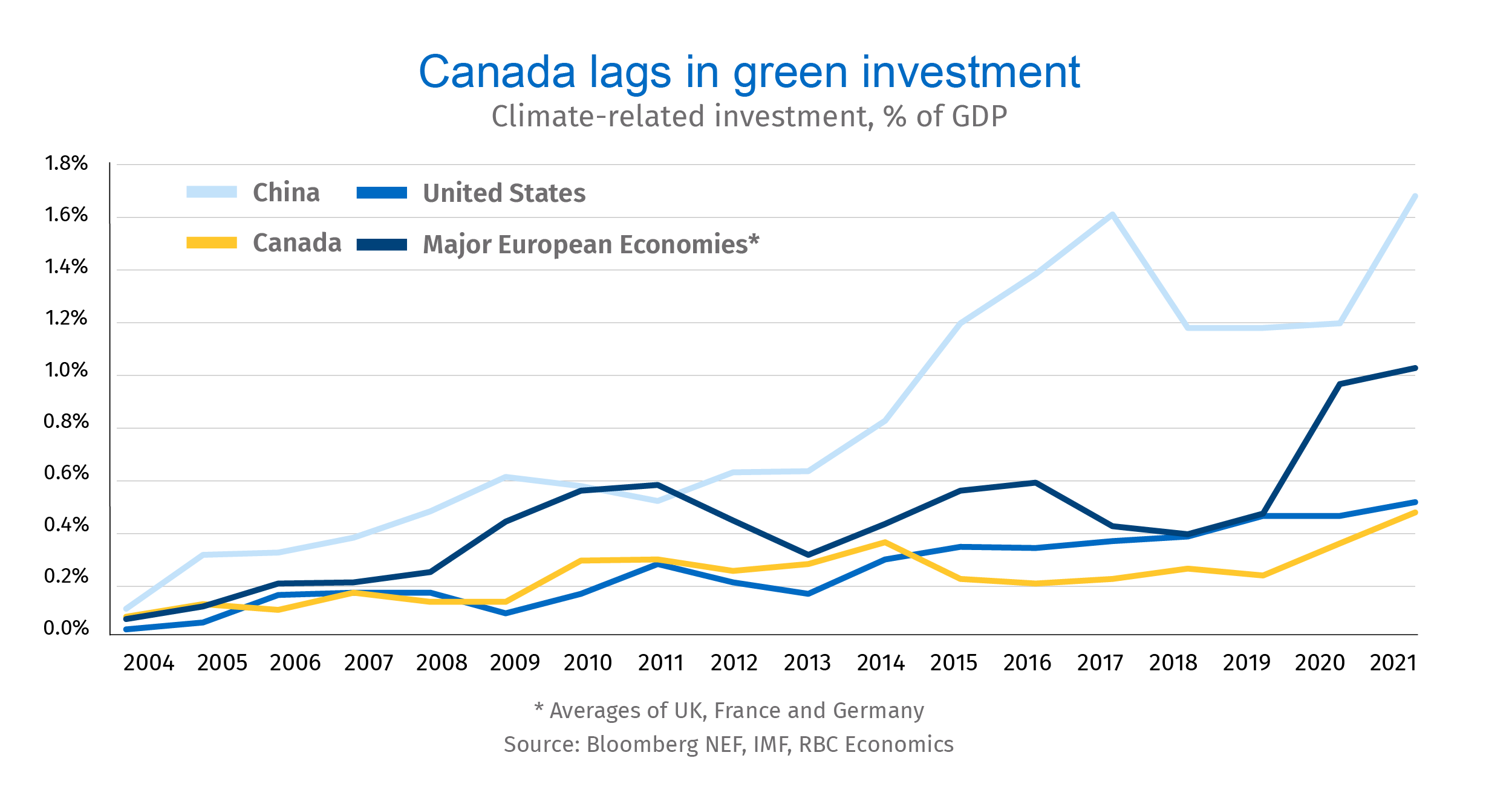

- Though Canadian green spending has hit consecutive records in the last two years, it remains well behind other nations. As a share of the economy, our spending is a third of China’s and half of Europe’s.

- That gap will potentially widen as the U.S. Inflation Reduction Act pumps US$370 billion into clean investment.

- To keep pace (and hit our own targets), Canada will need to significantly boost spending on electric vehicles, heat pumps and carbon capture facilities, among other technologies.

- The bottom line: Policy has a role to play in accelerating investment. The U.S. offers a good example of this, particularly when it comes to electric vehicles and building decarbonization.

Canada’s green investment lags other major economies

Across the globe, green investment is picking up speed. That’s good news, since annual spending is an eighth of the US$6.5 trillion needed to transition the global economy away from fossil fuels. Across the OECD, investment in climate-friendly technologies has doubled in five years, and grown twelve-fold since 2005.

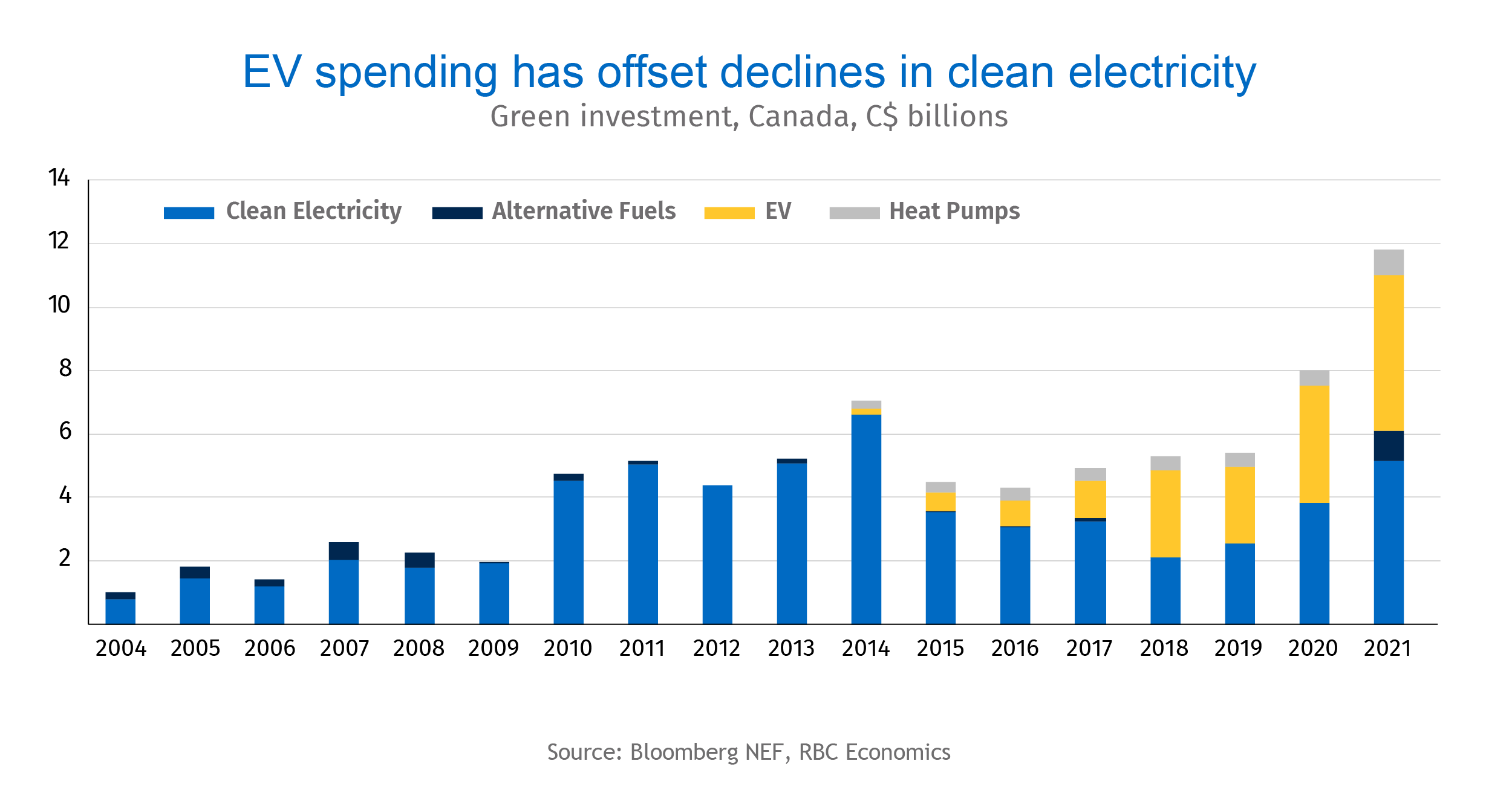

But in Canada, we’ve lagged since 2014, when spending on clean technologies fell sharply. Though we’ve made up some ground in the last few years, the pace of spending is still about half that of other major economies. China leads the pack, spending about 1.5% of GDP on green investment each year. In some key industries, it’s the undisputed global leader, dominating solar panel and battery manufacturing, accounting for 40% of the world’s nuclear reactors under construction, and recently overtaking Europe in the share of electric vehicles sold.

Historically a leader, Europe spends around 1% of GDP on green investment. The U.S., Australia and Japan are further behind. But a major shift is coming south of the border. The recently passed U.S. Inflation Reduction Act will pump US$370 billion into clean investment, and leverage additional money from the private sector.

Without change, Canada could be left behind

Canada will need to adjust its policies, or risk falling even further behind major economies. After a decade of investment, we’re still not spending enough on clean electricity, which needs $200 billion in investment by 2035 to meet current green grid goals, and more thereafter to accommodate rapid growth in electricity demand.

That said, we’re much closer to spending enough on green electricity than in any other sector: investment there needs to merely double. Spending on electric vehicles (EVs) will need to grow from about $4 billion to nearly $22 billion annually while spending on heat pumps to decarbonize buildings will need to grow more than 8 times over current levels. And Canada’s heavy industries, including the oil and gas sector, need to break ground on carbon capture facilities. Though carbon capture has received little funding, it could be one of the single most powerful tools we have decarbonize the Canadian economy.

Policy can help Canada close the gap

Canadian investment in the green economy is much broader than it used to be. Electric vehicles and their related infrastructure now account for some 40% of energy transition investment, up from nil as recently as 2013. Heat pumps also look poised to grow rapidly, with spending up 67% last year from 2020. And unlike renewable electricity, EV and heat pump adoption is still in its early days, and could accelerate significantly. Most technology adoption occurs slowly at first, and rises rapidly as more consumers adopt new tech. That means EV spending could be approaching a tipping point: it rose from a little over 5% on average in 2021 to 7.7% in Q1 2022, a welcome change.

If both EV and heat pump adoption rapidly expand, Canada could start closing the gap to what’s needed for the green economy. But policy has a role to play in making that happen faster. Looking to the U.S. for inspiration on how to accelerate EV and building decarbonization would be a good starting point.

Colin Guldimann joined RBC in 2019 as an economist. He holds a Bachelor’s degree in Economics from the University of Ottawa, and Master of Arts in Economics from the University of British Columbia. Prior to joining RBC, Colin worked on mortgage, housing, and economic policy at the Department of Finance Canada.

Naomi Powell is responsible for editing and writing pieces for RBC Economics and Thought Leadership. Prior to joining RBC, she worked as a business journalist in Canada and Europe, most recently reporting on international trade and economics for the Financial Post.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More