- Net debt-to-GDP ratio is lower than pre-pandemic levels in most provinces.

- Though pandemic support programs have ended, governments have yet to pare back their spending.

- As the Canadian economy braces for recession, higher rates and weaker fiscal balances are poised to deepen provincial indebtedness.

- Bottom line: the weight of debt servicing costs is manageable for now but is bound to increase in the coming years, taking spending room away from other items.

Provinces emerged from the pandemic in better fiscal shape than feared

In the height of the pandemic, governments doled out financial support to keep households and businesses afloat. This came alongside a drastic plunge in tax revenues in the face of mass services sector shutdowns, pushing the federal – and almost all provincial governments – into deep budget deficits. It seemed it would take many years for governments to return to more sustainable debt levels.

But the economy rebounded faster than expected. As high-touch sectors reopened and inflation soared, this set the stage for many revenue windfalls over the last two fiscal years. Provincial balances emerged from deficit territory into surpluses (and in some cases- hefty ones) which significantly eased government borrowing requirements.

And higher inflation meant exceptionally strong (nominal) growth, which meant provinces exited the pandemic with much better debt positions than previously feared. At last count, the net debt-to-GDP ratio was in fact lower than pre-pandemic levels in seven out of ten provinces. And for the provinces that have seen an increase (B.C., Alberta and Manitoba), pre-pandemic debt levels were generally low and manageable to begin with.

Alberta and New Brunswick have even reduced their net debt in absolute terms over the past two years.

Governments still increasing their expenditures at rapid clips

Improved fiscal balances are resulting primarily from huge revenue windfalls during the pandemic recovery (thanks to a swift economic rebound, higher commodity prices, and soaring inflation). But even though pandemic support programs have ended, governments have yet to pare back their spending. In fact, Canadian provinces have seen expenditures grow by nearly $50 billion (+10%) from FY 2021- which is more than the $40 billion (+7%) revenue windfall. Indeed, expenditures grew faster in FY 2022 (+9.6% y/y) than during the pandemic (+9.2% y/y in FY 2020) and more than two times faster than the average annual expenditure increase in the five years leading up to the pandemic (+3.8% annual average between FY 2015 and FY 2019).

Cooler economy and higher rates to challenge fiscal position

The favourable fiscal environment may be coming to an end. Weaker economic growth (and the likelihood of a recession), rising operating costs (including increasing wage pressures), and upward pressure on debt servicing costs, are poised to hold back further improvement in provinces’ fiscal position. They could in fact bring about deficits and heavier debt loads.

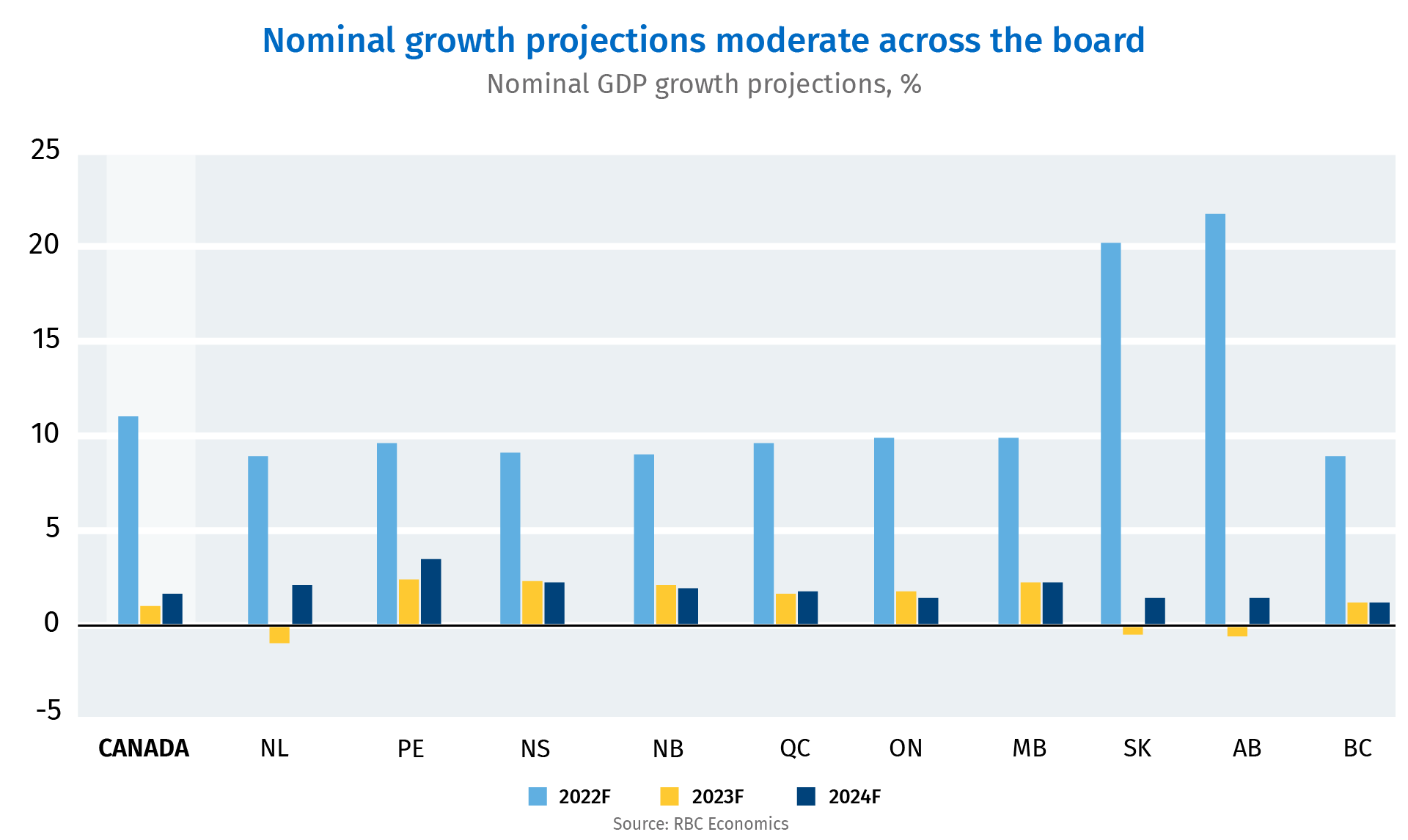

A sharp slowdown in nominal economic growth (as we project for all provinces relative to 2022) will significantly curb growth in government revenues in the period ahead.

At the same time, an economic downturn would also impact expenditures. Governments typically step up to provide support and stimulate the economy during recessions. Moreover, we see the expenditure side still feeling the heat of high inflation for some time. New contracts with public servants – or for the procurement of goods and services – are bound to come with heftier price tags.

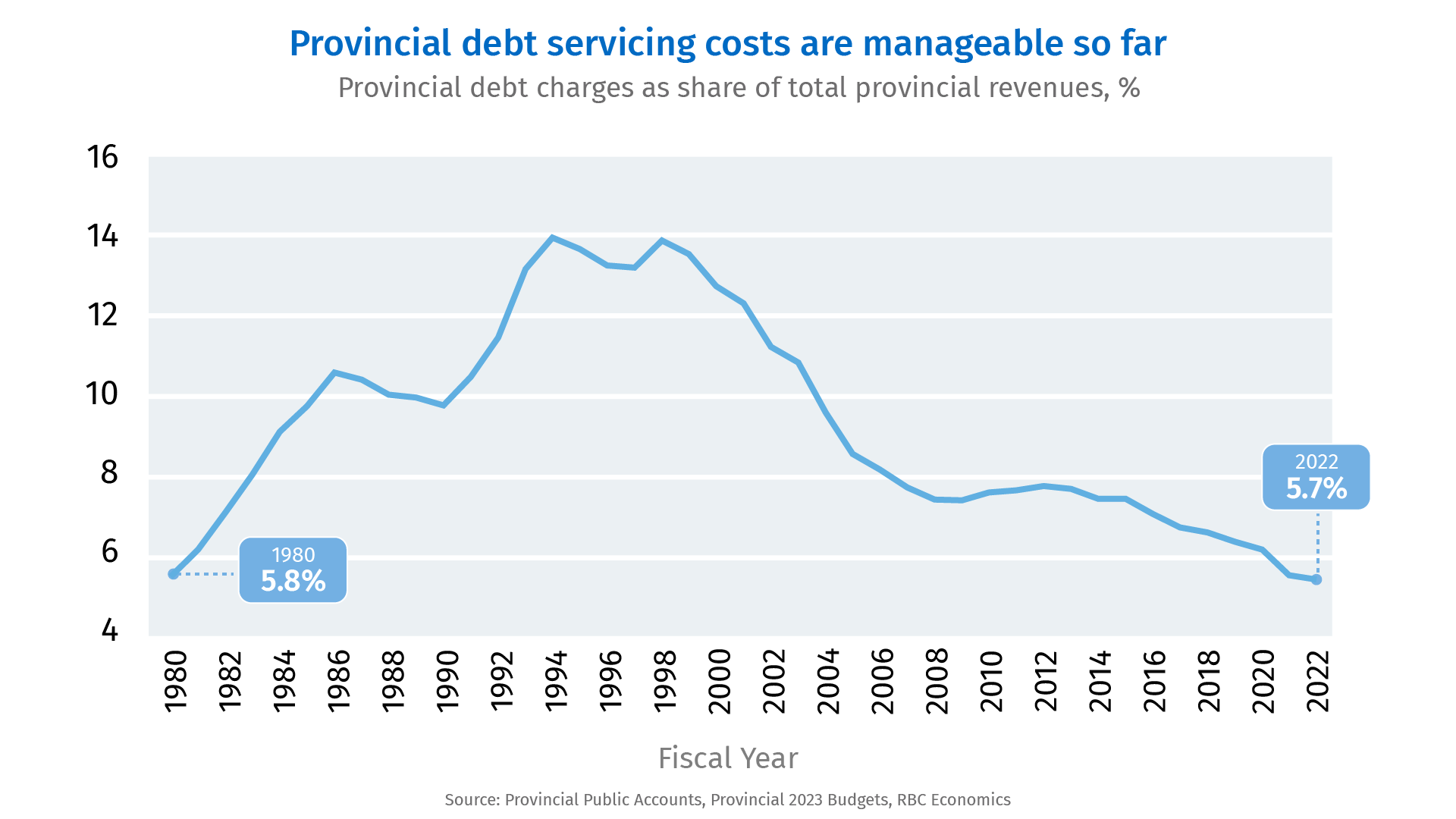

Higher interest rates will weigh on financing costs. Soaring debt during the early stages of the pandemic have already sent debt charges on a steep upward trajectory. They grew by 6.8% in FY 2021 and 5.4% in FY 2022, representing their fastest rate of increase in over a decade. The impact of higher interest rates will gradually kick in as governments borrow new funds.

For now, the weight of debt servicing costs is manageable. Provincial governments spend an average of $5.70 for every $100 they take in in revenue to service their debt. That share is bound to increase in the coming years amid higher interest rates, taking spending room away from other items like healthcare.

Rachel Battaglia is an economist at RBC. She is a member of the Macro and Regional Analysis Group, providing analysis for the provincial macroeconomic outlook and budget commentaries.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More