Overview

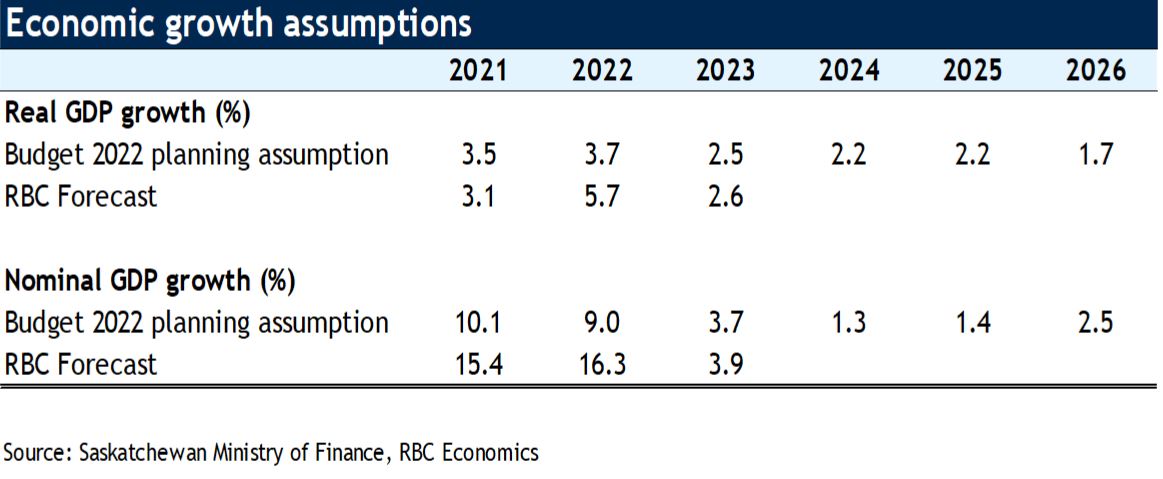

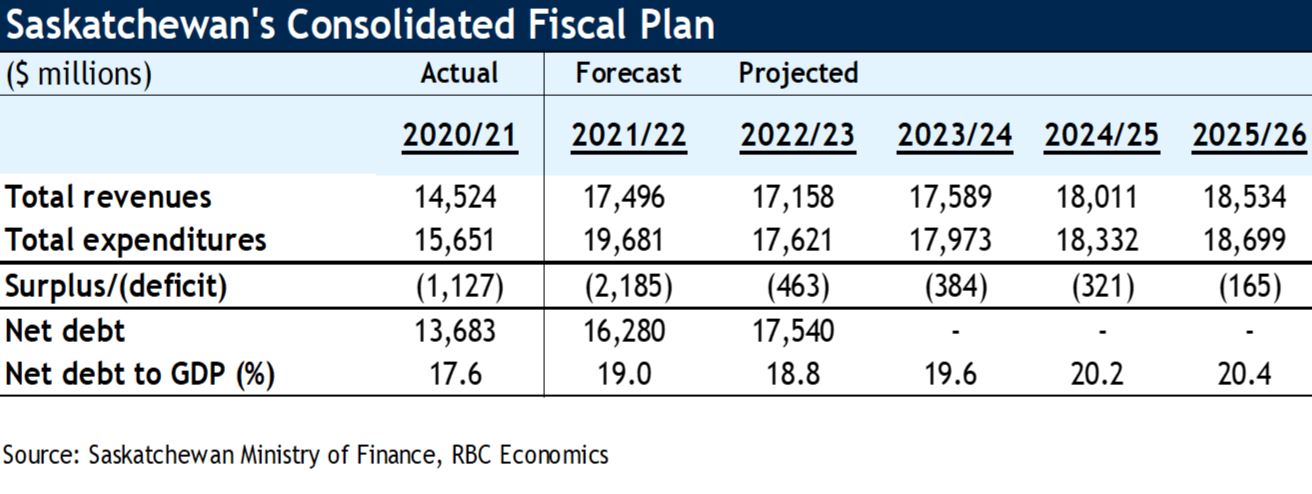

After two years of pandemic budgets, the tone of Budget 2022 was much more upbeat. The theme of the budget, “Back on Track” reflects a return to normalcy. Saskatchewan introduced a much smaller deficit of $463 million for FY 2022-23, $1.7 billion smaller than the $2.2 billion deficit now expected in FY 2021-22 (downwardly revised from $2.6 billion in Budget 2021). Embedded in its medium-term outlook is a plan to return to balance by 2026, with a 17% reduction in the size of the deficit over the next two fiscal years. Expenditures are projected to fall by $2.1 billion in FY 2022-23 (-10.5%) to $17.6 billion, as one-time crop insurance payouts and pandemic expenses fall off the books. Revenues will fall $338 million (-1.9%) to $17.2 billion, as one-time pandemic federal transfers and agricultural reinsurance recovery wind down. Saskatchewan’s debt-to-GDP level is expected to fall to 18.8% in FY 2022-23, the second-lowest level in Canada.

Expenditures to fall 10.5% due to lower crop insurance payouts and pandemic expenses

Budget 2022 expects a material decline in expenditures in FY 2022-23, down $2.1 billion (10.5%) to $17.6 billion, as major one-time spending items in FY 2021-22 run off. The main item was the payment of crop insurance indemnities in response to drought conditions. Saskatchewan’s Economic Recovery Rebate and allocations to the Accelerated Site Closure Program are also set to come off the province’s books in FY 2022-23.

The majority of budgeted expenses in the coming year will go to health, education, and social services. Health spending, at $6.8 billion will account for nearly 40% of total spending. It is largely unchanged from FY 2021-22. Health spending in FY 2022-23 is geared towards operating costs and high-priority initiatives such as enhanced cancer services, addressing surgical backlogs, and rural emergency medical services. Education spending is set to increase $85.2 million to $3.8 billion. Notably, $309.6 million is earmarked for child care and early learning to create additional spaces and reduce average fees in licensed centres by 50%. Social services and assistance spending will reach $1.6 billion, with the majority of the 9.0% increase targeted to housing repair, development, and affordability under the National Housing Strategy Agreement.

Even in the face of the pandemic, Saskatchewan remains committed to its pre-pandemic Growth Plan goals for the 2020s. This includes $200 million for the Accelerated Site Closure Program (a federally-funded program to clean up abandoned oil and gas well sites), which will support over 2,000 jobs. Saskatchewan will also continue to devote funds ($175 million in FY 2021-22) to provide all SaskPower customers with 10% rebates on their power bills. Finally, $276 million is dedicated to Municipal Revenue sharing, as part of the province’s $465 million in municipal investment.

Revenues fall as federal transfers wind down

Total revenues in FY 2022-23 are expected to come in at $17.2 billion, $338 million below FY 2021-22 (a 1.9% decline). Declining revenues are largely an indication that a return to normalcy is taking place! Insurance revenue is set to fall by $324 million after drought conditions in FY 2021-22 triggered a sizeable reinsurance recovery for the Saskatchewan Crop Insurance Corporation. Moreover, federal transfers are projected to fall from FY 2021-22, down $187 million (5.5%) at $3.2 billion, as one-time pandemic support and drought assistance run off. A portion of the decline in federal transfers is offset by a $140.5 million transfer for affordable childcare.

Tax revenues are expected to fall slightly, to $8.1 billion, largely due to lower corporate and personal income tax revenues (due to large adjustments in FY 2021-22 that will not be repeated). Higher forecast provincial sales tax revenue will offset part of the decline, as the economic recovery continues.

Soaring prices and strong global demand for commodities will drive non-renewable resource revenues higher in FY 2022-23 to $2.9 billion. Higher prices have also meant that non-renewable receipts for FY 2021-22 are expected to be 83% above the levels initially estimated in Budget 2021. Saskatchewan expects potash prices will average US$407 per tonne in FY 2022-23, up nearly one-third from FY 2021-22, which translates to a 41% increase in royalties. Oil and natural gas royalties, however, are forecast to decline by $21.3 million based on Saskatchewan’s oil price assumption of US$75.75 per barrel (WTI) for FY 2022-23. We think the government is taking a conservative view. Our current assumption is an average closer to US$100. The government estimates a US$1 increase in the price of a barrel of oil adds $14 million in revenues.

Capital Plan back on track for $30 billion investment in infrastructure by 2030

Saskatchewan expects to invest $3.2 billion in FY 2022-23 as part of its Capital Plan. It will represent a solid step towards achieving its plan to invest $30 billion on infrastructure by 2030 as part of its Growth Plan outlined in 2019. Over the next four years, Saskatchewan is looking to invest nearly $12 billion in infrastructure, at which point the province will be two-thirds of the way towards reaching its goal. In this year’s capital plan, notable spending includes a record $1.1 billion allocated to Saskpower electricity system to improve reliability and replace aging infrastructure. Also notable is a nearly $480-million allocation to transportation infrastructure ($1.6 billion over the next four years) to expand highways and build bridges.

Debt-to-GDP remains one of the lowest in Canada

Saskatchewan’s debt-to-GDP ratio is expected to fall to 18.8% by March 2023. This will place Saskatchewan as the second-lowest net debt-to-GDP level nationally (only behind Alberta). The ratio is expected to drift higher in the following two years as nominal GDP growth moderates but level off near 20% over the medium-term—a level providing the province with fiscal flexibility against potential shock in the future. In the upcoming fiscal year, public debt will reach $30 billion, an increase of $2.9 billion or 10.5%. The largest contributor to this increase is debt related to Saskatchewan’s Capital Plan (accounts for $1.2 billion of the total increase in debt) in addition to government business enterprise debt. Financing charges represent 4.6% of total budget expenses at $812.0 million. Financing charges will grow by $57 million (7.5%) from the previous budget due to higher debt servicing costs as operating debt and debt related to the province’s capital plan grows.

Read report PDF

Carrie Freestone is an economist at RBC. She is a member of the macroeconomic analysis group and is responsible for monitoring key indicators including consumer spending, labour markets, GDP, and inflation. Carrie produces economic analysis that she delivers to clients and the public through publications and presentations. She holds a Bachelor of Arts in Economics from Queen’s University and a Master of Arts in Economics from the University of Ottawa.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More