All evidence points to the Bank of Canada’s rate tightening cycle starting to have an impact, as recent data released from Canada’s four largest housing markets show early signs of softening demand.

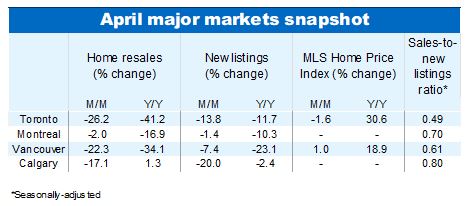

Home resales have fallen in major markets since February’s eleven-month peak, as buyers rushed to get into the market ahead of rising interest rates. Sales declined in Toronto (down 26% relative to March), Calgary (-22%), and Vancouver (-17%). Apart from the early pandemic shock, Toronto’s decline in home sales was the sharpest single-month decline since the market correction in the late 80s.

As prospective buyers begin to move to the side-lines, price growth has started to cool. Composite benchmark prices still rose another 1% in Vancouver, but that is half the average pace over the prior 6 months. Prices outright declined in Toronto – the first drop since the Great Recession of 2008/09). While we expect to continue to see prices trend higher, the pace of growth will slow, and we are already seeing this in Toronto and Vancouver. Both regions appear to have achieved peak growth in January.

Fewer Canadians are listing their homes and those that are, are seeing them sit on the market for longer. But sales-to-listings ratios still declined across three of the four major markets, most notably in Toronto and Vancouver, but also in Montreal, as the pandemic buying frenzy eased. A ratio of 0.6 or higher indicates a seller’s market. Toronto’s price plunge has now positioned the market into a more balanced territory while the other two markets trend in this direction. Calgary is the exception to the rule, where the ratio is rising higher into seller’s market territory pointing to further upward price pressure.

We previously pointed to a moderation in the rate of growth of Canada’s composite house price index growth as the first hint of a market shift. Early April data provides additional support that this shift is taking place. With the Bank of Canada continuing to hike rates quickly and aggressively, we may have already reached peak prices in Toronto (and will soon be showing signs of prices trending down in other major markets). Affordability issues will persist in Canada’s most-expensive markets as the burden of higher mortgage rates pushes many would-be buyers out of these markets.

Read the full report

Read full report

Carrie Freestone is an economist at RBC. She is a member of the macroeconomic analysis group and is responsible for monitoring key indicators including consumer spending, labour markets, GDP, and inflation. Carrie produces economic analysis that she delivers to clients and the public through publications and presentations. She holds a Bachelor of Arts in Economics from Queen’s University and a Master of Arts in Economics from the University of Ottawa.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More