2021 promises to be a better year with the discovery of a vaccine against COVID-19 set to restore both our health and the economy. The timing of the recovery is still uncertain given the logistical challenges of the manufacture and distribution of the vaccine. Uncertainties about its effectiveness and durability will also dictate how quickly the losses from the pandemic are recouped. The surge in infections in recent months and the re-imposition of containment measures set up for a soft start to 2021 to be followed by a healthy rebound as the vaccine becomes widely available. On net we look for the US and Canadian economies to post gains of 4.4% and 5% respectively.

The near-term outlook for many countries including Canada remains clouded by the resurgence in infections and lockdown measures which are weighing heavily on economic activity. While Canada and the US are expected to cross the finish line of 2020 with gains, the Euro-area and UK economies are projected to contract given more expansive lockdown measures. Substantial monetary and fiscal policy support will underpin modest growth in all four economies in early 2021 with the momentum building as more people are vaccinated, restrictions ease and confidence improves.

Virus surge slows US economy but 2-speed recovery slogging on

After reversing two-thirds of the losses experienced in the first half of the year, the US economy’s momentum held up relatively well over the course of the final quarter of 2020 despite surging infections and fading government support. While many sectors continue to improve, the hospitality sector remains under severe pressure accounting for a whopping 35% of the almost 10 million shortfall in jobs relative to pre-shock levels. Negotiations on the passage of another stimulus bill to support workers and businesses hurt by the second wave of infections continue although it looks increasingly likely this won’t materialize until early next year. The Federal Reserve’s support conversely has been unwavering with policymakers keeping the Fed Funds target range at 0-0.25% with purchases of government securities limiting increases in longer-term interest rates.

The rise in COVID-19 infections in late 2020 resulted in a slowing in the labour market recovery after rapid gains through the summer. The unemployment rate continued to inch lower although this in part reflected workers exiting the workforce stoking worries about the longer-term impact of the crisis. The expansion of COVID-related restrictions late in the year is expected to put the US economy on a slower growth trajectory in early 2021.

Vaccine rollout key to full recovery

Our forecast assumes that the vaccine will be sufficiently distributed to substantially and sustainably reduce the need for restrictions over the summer. Low interest rates, elevated savings and job creation will support consumer spending and housing. Business spending is also forecast to rise as companies restock inventories and invest to expand their capacity. By year-end 2021 we expect the US economy will be operating with little economic slack and expect inflation to be running around 2.0%. Even with a more hopeful medium-term outlook, we expect the Federal Reserve to maintain a very stimulative policy stance. The near-term economic backdrop is still very challenging, and there is still uncertainty about the roll-out of vaccines. The Fed’s decision to adopt a flexible inflation targeting regime and broaden its employment goal earlier this year means they have the latitude to keep rates very low to support parts of the economy that lag in the recovery.

Canada’s economy to recover to pre-COVID levels in 2021

The economy posted a very strong gain in the third quarter sufficient to reverse – by September – almost three-quarters of the 18% drop in activity in the spring when lockdown measures were greatest. The resurgence of infections in the fall led to more limited restrictions which tempered growth but didn’t lead to a full retrenchment. As is the case south of the border, some areas of the economy remain under severe pressure including the hospitality, recreation and travel sectors. Almost half of those still off-work compared to pre-shock levels are in the accommodation & food services industries. Others, like manufacturing, are much closer to their pre-pandemic levels. Housing has more than fully recovered. Retail sales also bounced back quickly, although the closure of non-essential retailers in some regions late in the year likely tempered sales. While lockdowns will restrain the economy’s growth in late 2020 and early 2021, our forecast assumes a stronger and sustained recovery in activity once the vaccine is more widely distributed. By the end of 2021, we project the GDP will be back to pre-shock levels.

Generous fiscal policy and low interest rates

Government support measures implemented to contain the impact of the virus on households and businesses will remain in place in the first half of 2021. Those measures will not likely be sufficient to save all businesses, and the near-term economic backdrop is still very challenging. But wage subsidies, rent relief and loans guarantees have been extended to help bridge businesses through the crisis. A variety of income supports are underwriting household incomes. In sum, the federal government’s COVID economic response plan is slated at $282 billion with an additional $50 billion planned for next fiscal year. The Bank of Canada’s substantial support also remains in place. We expect the bank to maintain a policy rate of 0.25% throughout 2021 and continue to purchase securities, albeit at a gradually reduced pace, to keep longer-term rates low for borrowers. These measures have already supported a historically rapid rebound in the housing market. The large pool of savings amassed by Canadian households during the crisis will be a key driver of the economy in 2021. We estimate that household savings surged $160 billion as lockdown measures prevented spending on many services and government programs helped offset wage losses. As the economy fully reopens, we look for consumer spending to remain strong as they pare down savings and return to work.

Businesses will remain cautious

Investment and inventory rebuilding are expected to begin in 2021 although given the uncertain global backdrop and changes to consumer demand, the recovery may be slow. This is particularly true in the energy sector with oil prices likely to remain below pre-pandemic levels. Purchases of machinery and equipment and intellectual property are projected to return to pre-crisis levels by the end of 2021 as businesses increase capacity and upgrade their processes to align with shifts in demand that evolved during the pandemic.

Low rates to keep housing market hot

Canada’s housing market rebound was extraordinary in 2020 and although it is likely to slow in 2021, we still expect sales activity and prices to remain historically elevated. The combination of low interest rates and elevated savings balances underpinned the surge in sales in mid-2020. These conditions will remain in place in 2021, though slower population growth and deteriorating affordability argue for sales to pullback somewhat.

Lingering excess capacity to cap price pressures

After dipping into negative territory during the deepest days of the crisis, Canada’s inflation rate firmed as the economy started to recover. Both the Bank of Canada’s preferred measures and inflation expectations also ticked higher though remained below the 2% target. Inflation rates are likely to move modestly higher in 2021 as the recovery gains momentum although excess capacity will limit the rise.

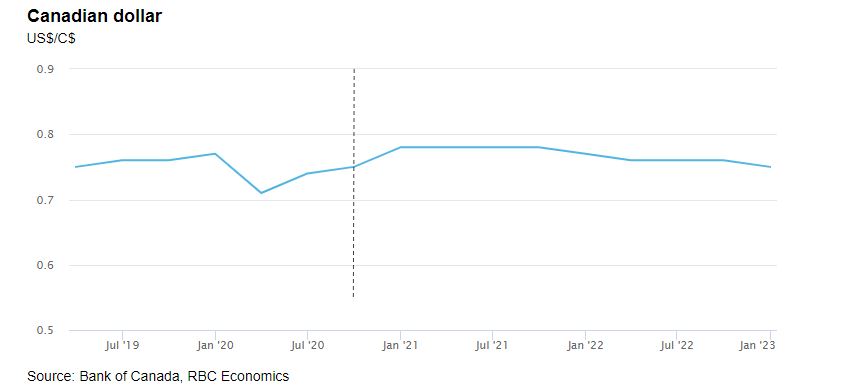

Canadian dollar to hold steady in 2021

The Canadian dollar recovered its pandemic related losses against the US dollar as risk appetite improved. The rebound in equity and non-energy commodity prices supported the Canadian dollar’s rise. The currency is expected to hold onto its gains in the first half of 2021. As the year progresses however we expect the US dollar will start to regain ground with markets likely to look for the Federal Reserve to pare back stimulus ahead of other central banks, including the BOC.

Read full outlook

About the Authors

As Chief Economist, Craig leads a team of economists providing economic, fixed income and foreign exchange research to RBC clients. Craig is a regular contributor to a number of RBC publications and is a key player in delivering economic analysis to clients and the media through the Economics Department’s regular economic briefings.

As Deputy Chief Economist, Dawn Desjardins contributes to the macroeconomic and interest rate forecasts for Canada and the U.S. Before joining RBC, Dawn worked as a reporter for Bloomberg Financial News in Toronto covering the Canadian bond and currency markets. She also spent ten years as the Canadian bond market strategist for a major U.S. bank.

Nathan Janzen is a member of the macroeconomic analysis group. His focus is on analysis and forecasting macroeconomic developments in Canada and the United States.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More