The fall season started on a high note. Despite the distraction of a federal election and earlier signs of fatigue, home resales and prices picked up slightly nationwide in September, marking a deviation from the cooling trend that got under way this spring. What didn’t change is exceptionally low inventories across most of the country. Demand-supply conditions continue to heavily favour sellers, forcing buyers to stretch their purchasing budget further to win (highly competitive) bidding wars. The uptick in resales last month is further evidence that a lot of pent-up demand—fuel in the market’s tank—remains out there. We believe this will keep activity hectic in the period ahead though still expect some gradual moderation to take place as rapidly deteriorating affordability increasingly weigh on demand. With prices gathering a bit more steam in September, it will take longer for upward pressure to dissipate than we previously thought. We now expect prices to flatten in the second half of 2022 instead of the early part of the year.

Hot September in smaller Ontario and Quebec markets…

Results were uneven from coast to coast last month. Ontario accounted for most of the 0.9% m/m increase in resales across the country. A 0.7% rise in the Greater Toronto Area certainly contributed but it was stronger advances in Barrie (up 11%), Cambridge (up 10%), Windsor (up 8%), Brantford (up 6%), Ottawa (up 3%) and other smaller markets that moved the needle more. Quebec also saw a boost in activity last month led by markets other than Montreal. These included Trois-Rivières (up 11% m/m) and Gatineau (up 10%). Strong buyer interest in smaller markets amid scarce inventories produced some of the larger price gains in Ontario. The MLS Home Price Index jumped 3.4% m/m in Kitchener-Waterloo, 3.2% in Woodstock, 3.1% in the Kawartha Lakes area and 2.7% in Barrie—all surpassing the rise of 2.6% rise in the GTA and 1.7% nationwide.

…but even steamier in New Brunswick

Yet activity revved up the most in New Brunswick in September (all proportions considered). Home resales shot up more than 10% m/m, with Fredericton (up 36%) and Moncton (up 6%) recording outsized increases. Clearly the province’s good affordability standing continues to draw buyers into the market, including many from outside the province. New Brunswick has seen strong positive interprovincial in-migration so far this year (see A Regional Renaissance: More Canadians drawn to live on the Atlantic Coast during pandemic). Markets within the province are among the most affordable in the country despite prices soaring in the past year (Moncton’s MLS HPI is up 35% y/y).

Markets still flying high in BC and the Prairies

While trends varied in September, activity generally remained elevated in Western Canada. Scarce inventories continue to be the focal point though to a lesser degree in certain parts of Alberta and Saskatchewan where buyers are under less pressure to bid prices higher. Property values further appreciated last month in BC—including a strong 2.1% m/m jump in the MLS HPI in the Fraser Valley—and Winnipeg (up 0.5%) but stayed relatively flat in Alberta and Saskatchewan.

September market highlights

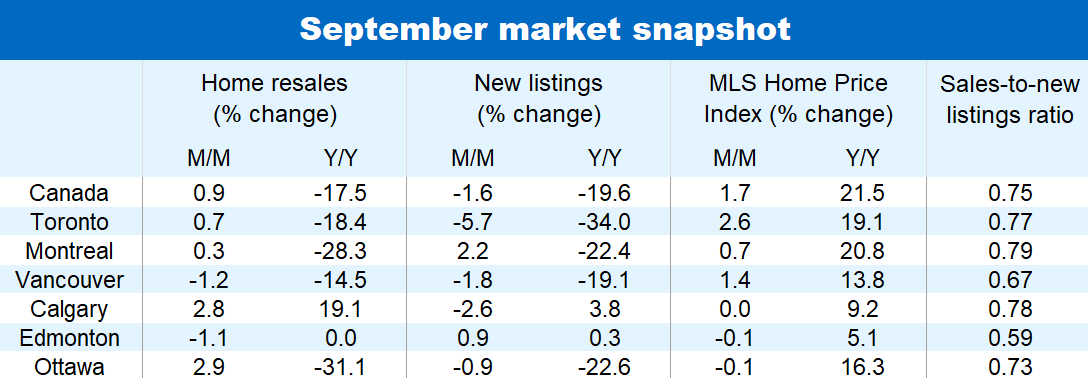

- Price gains ticked higher: Canada’s composite MLS Home Price Index was $750,400 in September, up 1.7% from August and 21.5% from a year ago. Both represented slight accelerations (the m/m rate averaged 0.9% in the prior three months and the y/y rate was 21.4% in August). Prices rose faster in many BC and Ontario markets.

- Small decline in new listings: They fell 1.6% m/m —more than reversing the 0.8% increase recorded in August—and 19.6% from a year ago nationwide. Trends were similar in the vast majority of local markets. Windsor (up 7.9% m/m), Regina (up 1.4%) and Edmonton (up 0.9%) were among the few exceptions.

- Slim increase in resales: Activity in Canada rose 0.9% from August to a historically-strong 587,400 units (seasonally-adjusted and annualized). This further marked a break from the cooling that took place this spring. The strength last month was concentrated in smaller markets in Ontario and Quebec, as well as in New Brunswick. While still solid, activity fell slightly in BC, Saskatchewan, Manitoba and Nova Scotia.

- Sellers still firmly in control: Already-tight demand-supply conditions firmed up some more. The national sales-to-new listings ratio got deeper in sellers’ market territory, rising from 0.73 in August to 0.75. The number of months’ sales in inventories, at a tiny 2.1, also points to sellers holding significant sway on pricing. This was generally the case across the country with only the degree of sellers’ advantage varying from market to market. More balanced conditions have emerged in some Prairie markets, including Regina and Edmonton.

See PDF with complete charts

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More