- Canadian wage growth has been unusually high, but looks more modest when measured against surging inflation and relative to acute labour shortages earlier in the pandemic recovery.

- Now lagging productivity in Canada (along with a softening labour market backdrop) are threatening future wage gains.

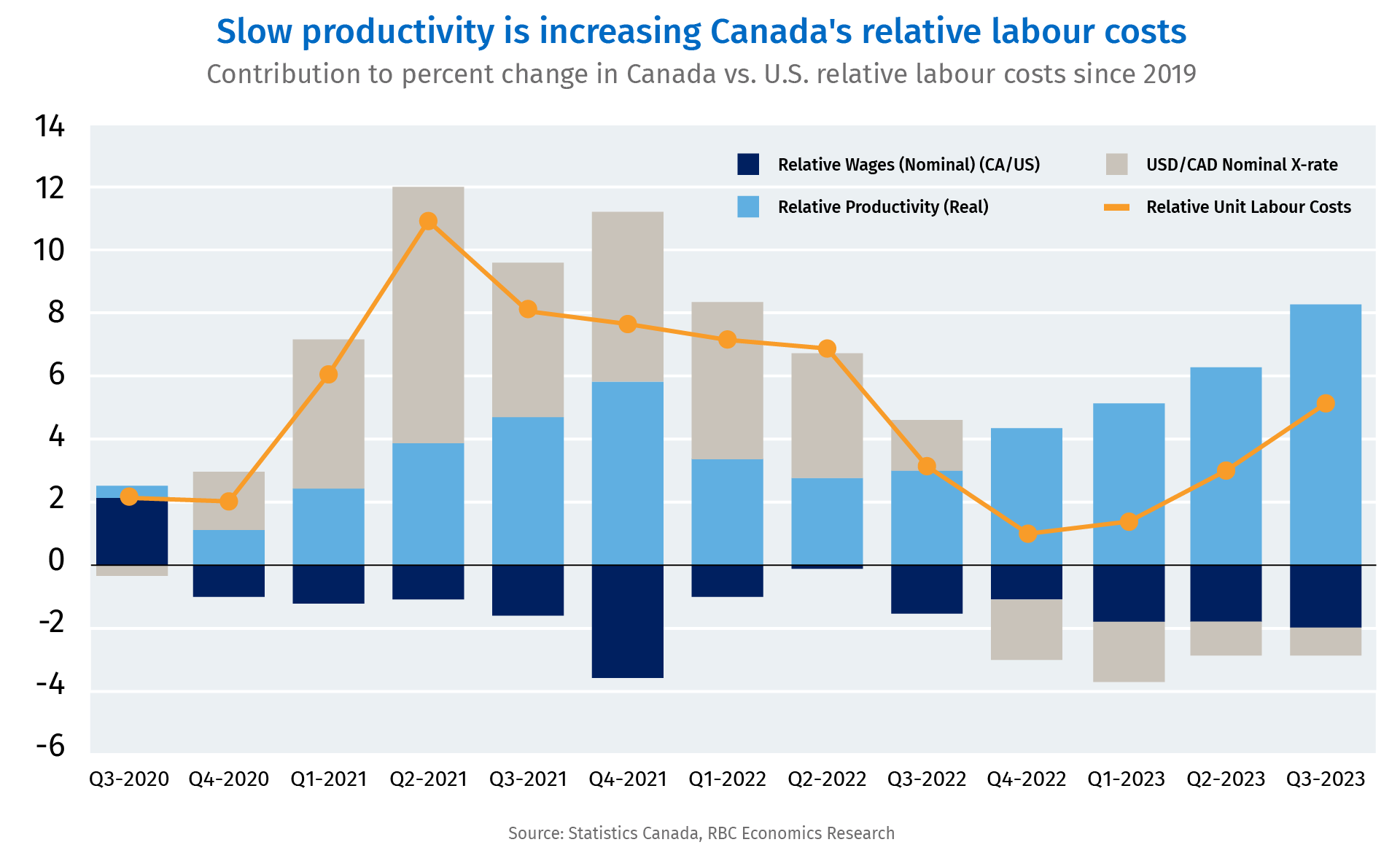

- Canada’s weak productivity growth has gotten worse since the pandemic, increasing unit labour costs without the same rise in wages—and strength in U.S. productivity is cutting further into Canadian wage competitiveness.

Proofpoint: A further deterioration in Canada’s weak productivity performance since the pandemic is threatening the sustainability of wage growth, which has already been relatively modest when measured against surging inflation.

Wages are just now catching up with inflation

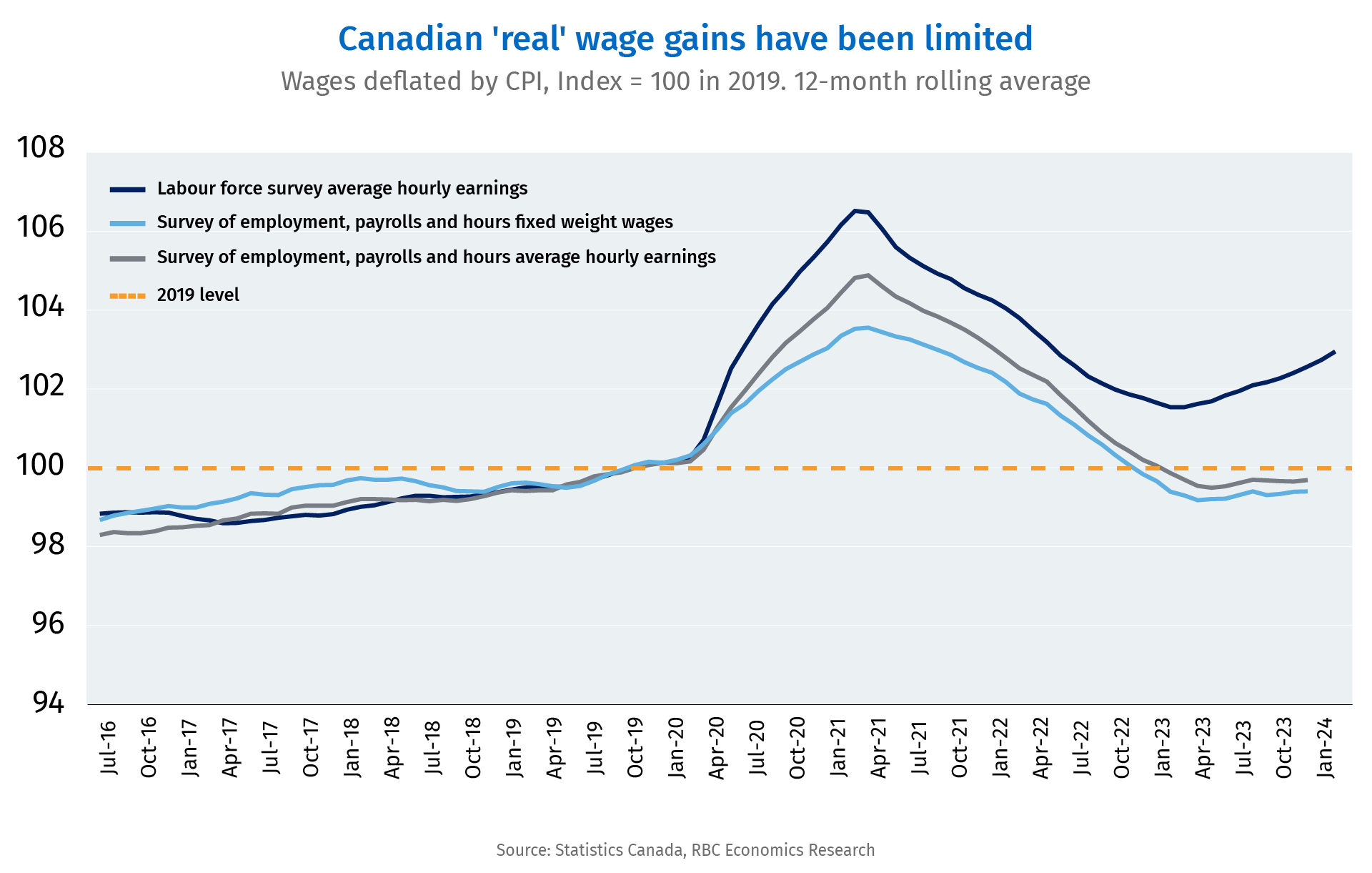

Average wages in Canada jumped higher during the pandemic, almost entirely because job losses were heavily concentrated at the low end of the earnings scale. When workers started to emerge from lockdowns, and inflation began to surge higher in 2021, wage growth lagged, cutting into household purchasing power. There are multiple different, and sometimes conflicting, estimates of average hourly earnings in Canada, and wage growth recently has been substantially stronger. But “real” (after adjusted for inflation) wages declined by about 1% in 2021 and 2.5% in 2022 before picking up in 2023.

Over the full cycle from pre-pandemic (2019) levels to now, estimates for average real wage growth per year range from an optimistic end of about 1%—not significantly different than typical pre-pandemic growth rates—to real wages running still slightly below pre-pandemic levels on the pessimistic side.

That real wage growth looks more modest when measured against the exceptionally tight labour markets early in the pandemic recovery when hiring demand was substantially outpacing the supply of unemployed workers and workers were in a historically strong bargaining position in wage negotiations.

Weak productivity growth threatens future gains

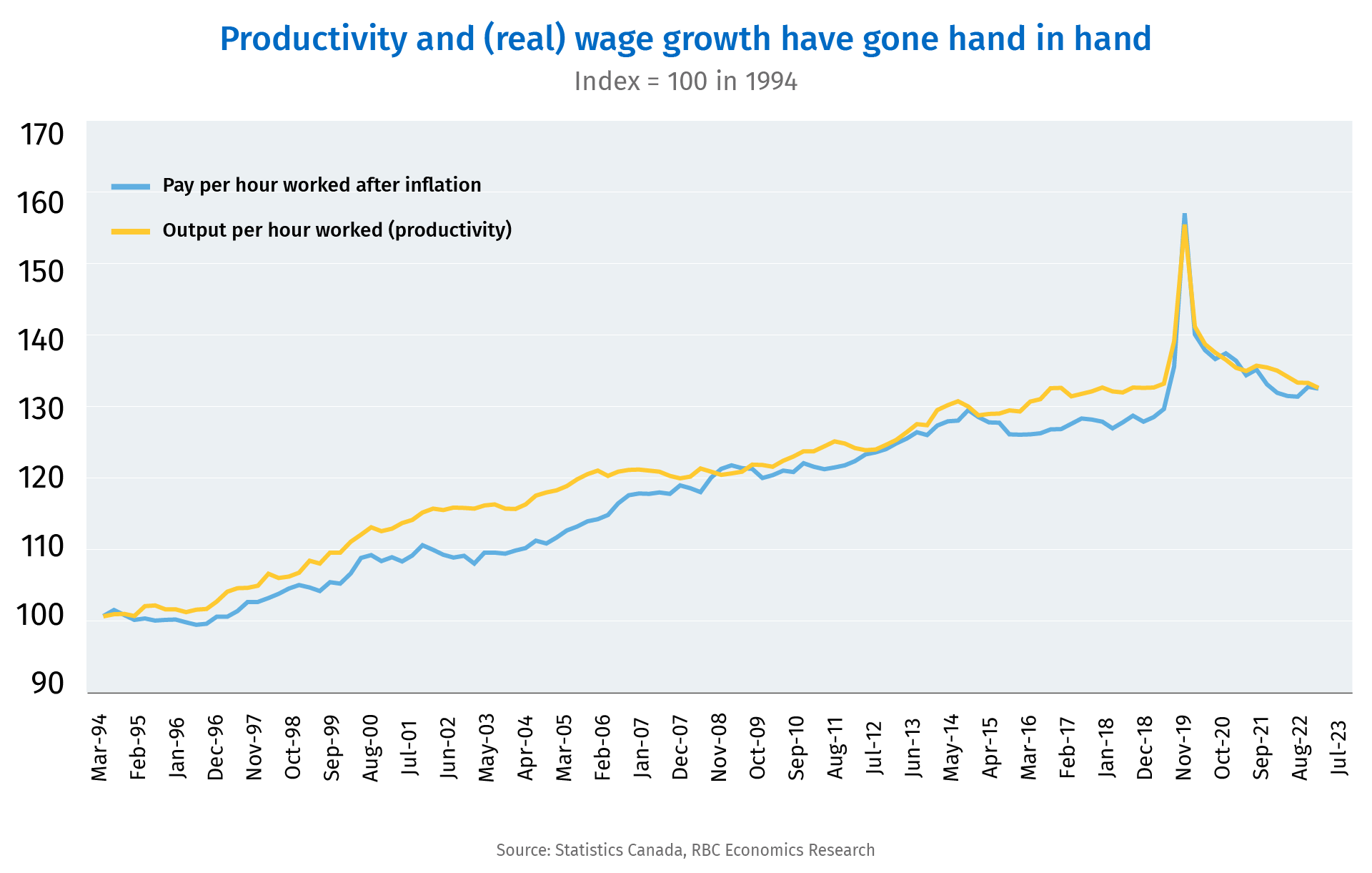

Worker productivity (output per hour worked) is inextricably linked to worker pay over time, and Canadian productivity estimates have been among the more worrying statistics in the post-pandemic economy after already underperforming for decades before.

When productivity rises, it means that more output is generated with the same number of hours worked. That boosts profit for businesses but also creates room for wage growth without lowering businesses’ bottom lines. Productivity normally increases over time as businesses innovate, buy new equipment, and workforce skills improve.

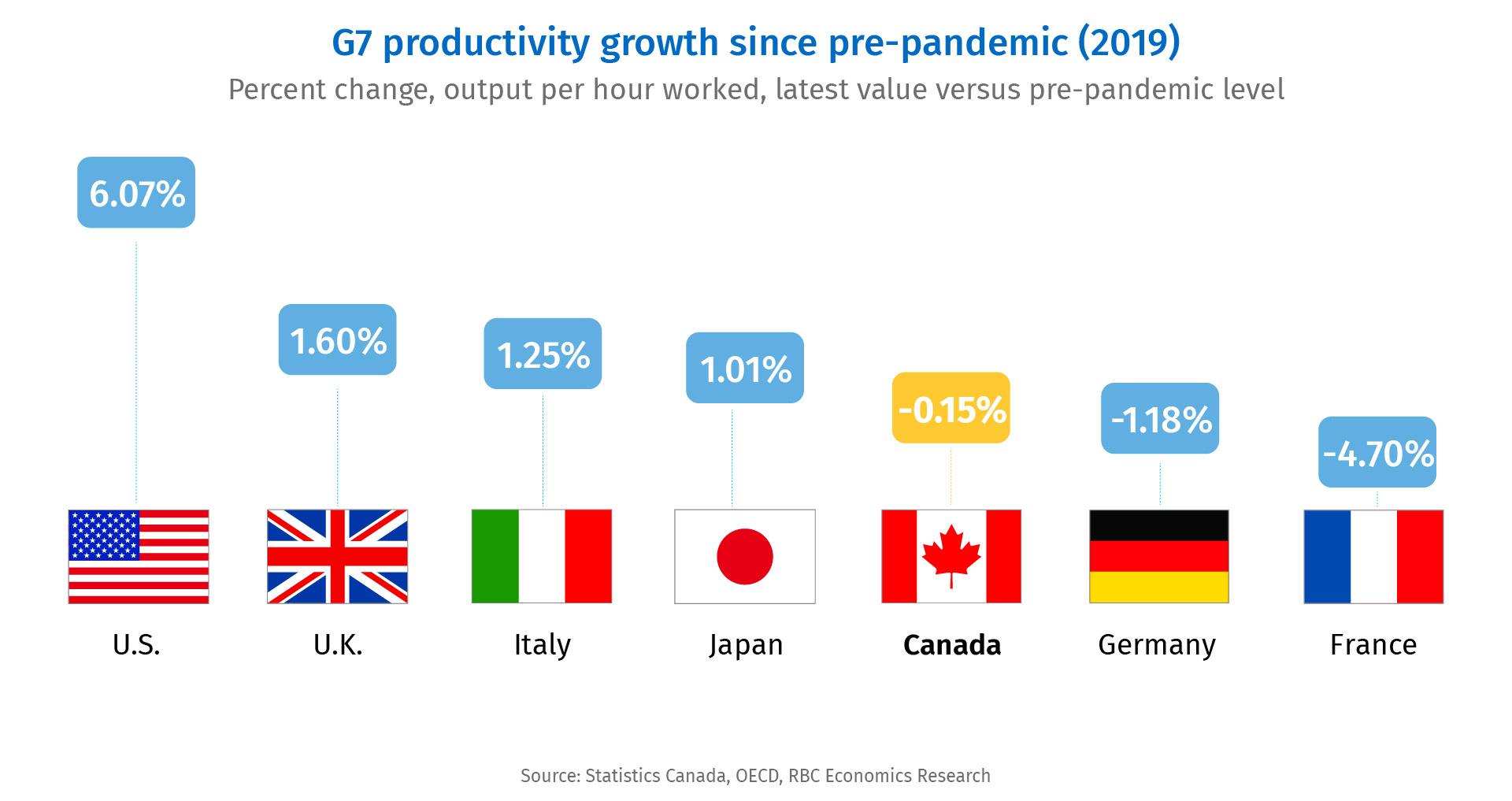

Slow productivity growth is not a new issue for Canada, but has gotten worse since the pandemic. The level of output per hour worked in Canada at last count (Q3 2023) was below average levels four years earlier in 2019. That ranks Canada 5th among G7 economies for productivity growth over that period, and well behind a 6% surge in the United States. More than a decade of low business investment is likely part of the problem but Canada also has a poor track record of fully utilizing the skills of new immigrants.

Near-term fluctuations in supply and demand for labour also have an impact on the distribution of business revenues between owners and workers—and an aging population means labour shortages could persist over the longer run. But sustained growth in wages typically doesn’t happen without sustained increases in worker productivity. Over the last 30 years, real worker pay per hour has moved largely in lockstep with productivity growth.

Wage growth to be uneven but broadly expected to slow

Near-term labour market dynamics have already been shifting the balance of power in wage negotiations away from workers. The availability of workers has increased with the unemployment rate, up 0.7 percentage points from a year ago. Hiring demand is also down sharply with job openings running 25% below year-ago levels. Businesses are reporting less widespread and intense labour shortages. Furthermore, productivity underperformance versus the U.S. has increased relative unit labour costs in Canada by about 5%. That makes Canadian production relatively more expensive and erodes competitiveness.

In the long run, productivity growth is the main driver of improvement in living standards. It’s essentially the only way that business profits and worker wages can sustainably rise at the same time. But, there is little reason to think that productivity growth will substantially accelerate in the near term. Capital investment has remained relatively weak. Productivity growth coming from the service sector—typically less dependent on new machinery and more on human capital (i.e. skills and education)— has also lagged. Output per hour in the professional services sector (historically a relatively high productivity and high wage industry) has declined 10% from pre-pandemic levels, according to Statistics Canada estimates.

There are some obvious solutions to these problems such as encouraging more productivity enhancing business investment and improving the poor track record in Canada of utilizing the skills of new immigrants, for example. However, sustained growth in worker pay significantly above the rate of inflation over the longer run—which is critical to ensuring living standards continue to improve—will also depend on ensuring that the weak productivity performance does not persist.

Nathan Janzen is an Assistant Chief Economist, leading the macroeconomic analysis group. His focus is on analysis and forecasting macroeconomic developments in Canada and the United States

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More