Canadian Economic Outlook

Economic growth has been more resilient than feared in the wake of aggressive interest rate increases last year. Canada’s stalled toward the end of 2022 with a flat GDP growth reading in Q4 the first time the economy has failed to expand since a pandemic-related decline in Q2 2021. But output bounced back 0.3% in January alongside a surge in employment – making a small increase in Q1 look more likely than the small decline we previously expected. Global growth forecasts for 2023 have been revised higher with China emerging from pandemic lockdowns and economic growth in Europe firmer than expected despite the war in Ukraine. And labour markets remain ultra-tight with high (albeit easing) levels of job openings competing for a historically small pool of unemployed.

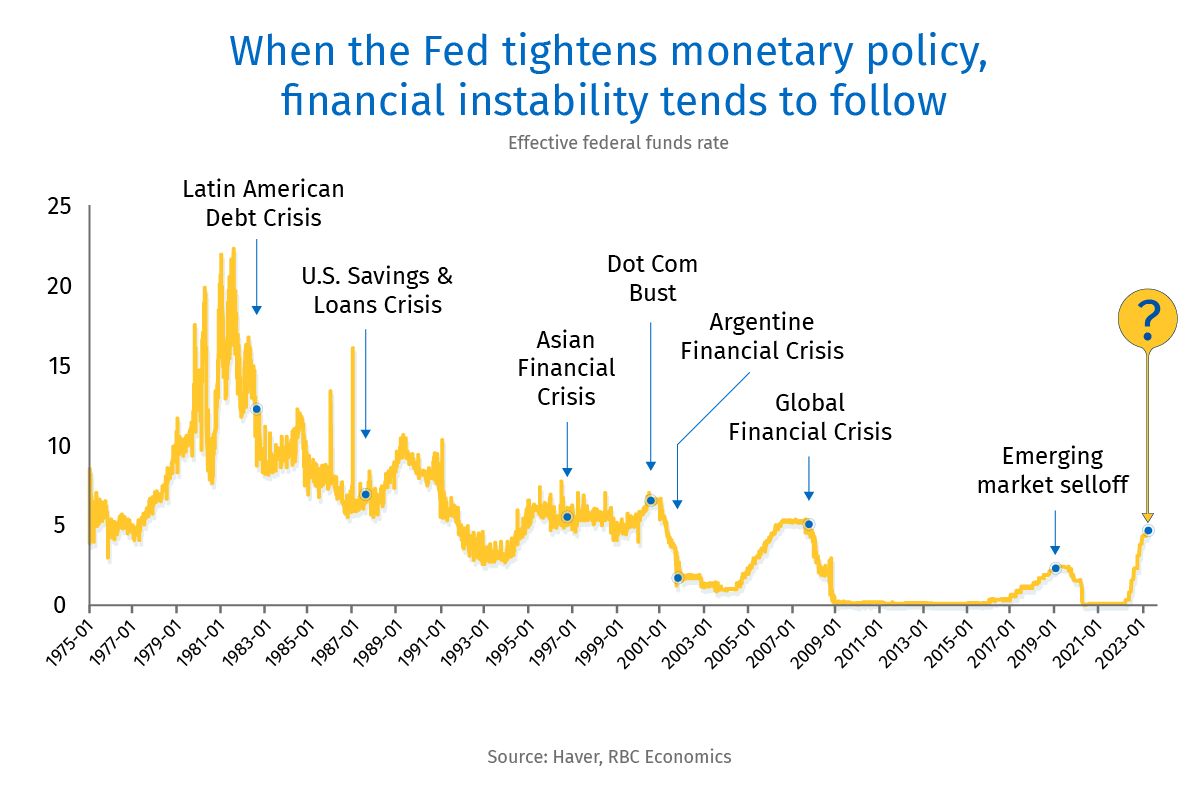

Still, interest rates impact the economy with substantial lags – and often end up having unintended consequences. Recent turmoil in financial markets has cast doubt on whether the Fed will continue to raise interest rates. The Bank of Canada already moved to the sidelines announcing a pause in rate hikes in January. But higher interest rates will continue to cut into household purchasing power with a lag. Housing markets have continued to retrench, both in Canada and abroad. The global manufacturing outlook has softened, and easing supply chain disruptions and lower (albeit still-high) commodity prices are helping to slow inflation. Against that backdrop, the most likely scenario is still that the U.S. and Canadian economies will both enter mild recessions over the middle-quarters of 2023.

More pain to come: softness in consumer demand and hiring is still on the horizon

So far, labour markets have been resilient, but it takes time for higher interest rates to hit consumers’ and businesses’ debt payments. A large share of household borrowing in Canada comes from fixed rate mortgages with payments that don’t reset until contracts are renewed.

The share of household disposable income eaten up by debt payments was still below pre-pandemic levels at the end of last year, but will rise to record levels by the second half of this year. That will be compounded by a sharp pullback in household net wealth as housing markets continue to retrench. With households feeling less wealthy and higher debt payments and prices cutting into purchasing power, consumer spending is likely to slow later in 2023.

We continue to expect unemployment rates to drift higher – to 6.8% in Canada from 5.0% currently by early 2024.

The alternative to a ‘bumpy’ landing might not be pretty

The upcoming recession we expect still sits firmly on the ‘mild’ side of historical downturns. But we don’t expect a bumpy landing for the economy to be avoided altogether. Certainly, there is a chance that broader near-term consumer spending could be stronger and less sensitive to interest rate increases than expected. Labour markets have been very strong, and households accumulated a large amount of savings over the pandemic. But with the supply of goods and services already unable to keep up with demand, stronger spending would result in stickier inflation pressures—and higher interest rates. These rates will cut further into household purchasing power down the road, delaying but not preventing a downturn.

Recent inflation data has been encouraging, particularly in Canada, and the easing in price growth is diluting some of the larger downside risks to the macroeconomic outlook. But in reality, consumer demand probably needs to soften for inflation to return fully to central bank target rates. And the alternative to the relatively mild ‘bumpy,’ economic downturn we expect in 2023 could still look more like a crash landing down the road if substantially higher interest rates, and a larger pullback in economic activity, is required to get inflation fully back under control.

Central banks still close to (or at) the end of this hiking cycle

After launching one of the fastest rate hiking cycles in history in the beginning of 2022, central banks are now debating how much further interest rates need to go. The Bank of Canada moved to the sidelines in January, announcing a ‘pause’ in interest rate hikes to assess the impact of the 425 basis points worth of increases over the prior year (the fastest pace of hikes since the 1990s).

The U.S. Federal Reserve is nearing the end of its tightening cycle. Strong job growth, spending, and upside surprises on inflation had policymakers concerned that the 450 bps of hikes delivered thus far won’t be enough to cool the economy and curb inflation pressures. But recent financial turmoil is a reminder that aggressive interest rate hikes won’t come without costs, and not all of those costs are known or expected. Chair Powell was flagging a higher terminal rate just one week ago but that looks unlikely now given growing financial stability concerns.

GDP growth to resume late in 2023, but unemployment to remain elevated

An immigration-fueled surge in population growth in the wake of pandemic lockdowns will help fill some current gaps in labour markets and will add almost a million consumers to the Canadian population over 2023 and 2024. That boost the production (and consumption) potential of the economy and will help put a floor under economic growth with GDP growth to resume positive, but modest, growth after mid-year declines. Still, we don’t expect those initial increases to be large enough to push unemployment significantly lower in 2024 with central banks cautious about reverting from interest rate hikes to cuts too quickly.

Provincial Outlook

No parts of the country will be sheltered from the stiffer economic headwinds. We expect growth in all but one province (Newfoundland and Labrador) to slow down materially this year, with a few (Ontario, BC and Quebec) at risk of tipping into recession. We forecast Saskatchewan (+2.0%), Alberta (+1.9%), and Newfoundland (+1.6%) to come out ahead of the pack thanks in large part to strong global commodity markets. Exceptionally high population growth is projected to sustain spending and residential investment out east, keeping provinces in Atlantic Canada growing faster than the national average (+0.6%). Soaring household debt service costs and a sharp correction in the housing market will weigh heavily on the outlook for British Columbia (0%), Ontario (+0.2%), and Quebec (+0.3%).

Detailed forecast tables for the provinces are available here.

British Columbia – Consumers under pressure

Accounting for roughly 10% of GDP (2011 – 2021 average), the province’s residential investment has been a telling sign of how things will play out for B.C. this year. The sharp housing market correction has intensified pressure on consumers who not only face higher costs of living and debt service but also a loss in wealth arising from lower home prices. With rate cuts likely another year away, we don’t anticipate any significant respite for consumers this year. As such, the B.C. economy is projected to trail behind the Canadian average, with no growth at all this year.

In fact, British Columbians are already showing some restraints. Retail sales growth in B.C. has been the slowest among all provinces, rising less than 4% between Q4 2021 and Q4 2022 (before adjusting for inflation). But conditions shouldn’t get much worse. As the housing market correction nears its bottom and prices stabilize, the negative wealth effect is poised to subside later this year.

So far British Columbia’s labour market remains exceptionally tight. The unemployment rate is close to an all-time low—and among the lowest in Canada—and job vacancies are still sitting above their longer-term average. Nonetheless, the job vacancy rate has edged lower to 5.0% in the final quarter of 2022—possibly a sign that employers are cutting unfilled positions before resorting to outright layoffs. We expect the unemployment rate to rise from 4.6% in 2022 to 5.6% in 2023 as the cooling economy stalls job creation.

Alberta – Maintaining positive economic momentum

Set against a rather bleak country-wide backdrop, Alberta’s economy fares relatively well. Energy production is on an upswing, and the strength in commodity markets is prompting oil and gas producers to boost capital spending significantly (by 29% to $24.6B in 2022, and a further planned 10% increase to $27B in 2023). Soaring in-migration also keeps the household sector (including housing) vibrant. We expect Alberta’s economy to be near the top of our provincial growth rankings this year with a rate of 1.9%.

Saskatchewan – Soaring capital investment to keep economy growing

Robust commodity markets and improved crop growing conditions have supported a solid upswing in Saskatchewan’s economy. The province led the country last year with an estimated growth of 5.8%. We expect a sharp increase in capital investment will keep the expansion going at a 2.0% pace in 2023. This would keep Saskatchewan leading our growth rankings for a second consecutive year.

Strong prospects for Saskatchewan export commodities are attracting significant investments in mining production capacity. Statistics Canada’s latest capital spending intentions survey showed Saskatchewan businesses plan to boost non-residential capital investment by 21% (or $3.1 billion) in 2023 – the largest increase among the provinces. More than half of the increase will come from the mining industry where the start of construction of the Jansen potash mine’s Stage 1 will generate considerable construction activity. This capital investment boom will broaden Saskatchewan’s economic expansion and help sustain it at a moderate pace.

Manitoba – Consumers’ resilience to be tested

With a solid year under its belt, Manitoba has stepped into 2023 with some spring in its heels. Although normalising supply chains and new trade agreements (such as the Black Sea Grain initiative) have taken some of the theatrics out of global commodity markets, the ongoing conflict in eastern Europe continues to leave a large share of global commodity supply offline. Well-diversified and bustling with in-demand goods, Manitoba’s economy’s is expected to fare middle of the pack this year (+0.8%).

Ontario – Soaring debt service costs to weigh heavily on households

Bearing the brunt of the economic downturn, Ontario’s economy continues to barrel down a bumpy road. With borrowing costs significantly higher than year-ago levels, businesses and households have begun to tighten their purse strings. We think this will lead to an economic contraction at some point this year. We forecast annual growth to be negligible, rising only 0.2% in 2023 before recovering modestly in 2024 (+1.0%).

Ontarians’ high indebtedness place them on the front lines of the Bank of Canada’s monetary tightening campaign. Soaring debt service costs will seriously constrain the spending power of many households—especially those who carry a variable rate mortgage. Alongside the dramatic housing market correction (which is weighing down on residential investment heavily), household consumption expenditures are showing early signs of softening. Spending on durable goods, in particular, dipped 6% between Q2 and Q3 2022. We expect Ontario consumers to retrench further in 2023, contributing to stalling the provincial economy.

Quebec – On the edge of recession

Slumps in residential investment and the manufacturing sector have caused Quebec’s economy to lose significant velocity since the middle of 2022. So far, other parts of the economy continue to exhibit impressive strength (e.g. the labour market, household consumption) though we expect the weakness will spread more broadly in 2023 as the full effect of higher interest rates hits home. We could even possibly see the economy contract at some point during the year. Our forecast calls for growth virtually stalling at 0.3% on an annual basis before picking up modestly to 1.3% in 2024.

One sector that’s likely to hold up well in the year ahead is non-residential construction. Businesses plan to boost capital spending by more than 10% in Quebec to a record-high $60 billion in 2023 with almost two-thirds of outlays allocated to the construction of non-residential structures. Public infrastructure (including transit, roads, and tunnels) will continue to take centre stage but spending by manufacturers and utilities will also represent significant shares.

The slump in residential investment is likely to persist until the latter part of the year. While we expect the housing market correction to bottom around spring, the recovery that will follow is poised to be slow. And we don’t see new home construction turning around until 2024.

Recessionary conditions globally—but especially in the United States and Ontario (Quebec’s largest export markets) —are poised to put a damper on demand for the province’s exports. Added to a more challenging outlook for consumers and businesses at home, we think this will keep many Quebec manufacturers on the defensive in the year ahead.

Recessionary conditions globally—but especially in the United States and Ontario (Quebec’s largest export markets) —are poised to put a damper on demand for the province’s exports. Added to a more challenging outlook for consumers and businesses at home, we think this will keep many Quebec manufacturers on the defensive in the year ahead.

New Brunswick– No signs of weakening… yet

In spite of recession talks in Canada, New Brunswick’s economy hasn’t showed signs of weakening just yet. Exceptionally high levels of in-migration and a solid labour market have supported residential investment and household spending. Nevertheless, we expect the sharp rise in interest rates and contractionary conditions in export markets will cools things down this year, slicing GDP growth in the province in half from 2.0% in 2022 to 1.0%.

The province’s booming population has supported labour force growth in recent quarters, which has eased (albeit slightly) labour market conditions. The provincial unemployment rate is up more than a percentage point since reaching an all-time low of 6.2% in June. But upward pressure on wages remains intense after increasing the most on record (+7%) in 2022. We believe the rising cost of labour will eventually incentivize employers invest in machinery and equipment (to boost productivity) and cut back on hiring. For now, though, businesses continue to focus on addressing their worker shortages. Employment in New Brunswick soared 4.8% in the 12 months ending January, representing one of the largest gains among the provinces.

Our forecast calls for the economy to recalibrate to a lower growth trajectory in 2023. With goods purchases to be among the first to contract during a recession, New Brunswick’s manufacturing sector is likely to be a sore spot in 2023.

Nova Scotia – Strong demographic trends to cushion economic downturn

Nova Scotia’s economy has so far taken massive interest rate hikes in stride. But it won’t be entirely immune to the rate-induced slowdown across Canada. We expect both domestic activity and export-oriented sectors to soften in the year ahead. This will cause growth to decelerate materially though staying positive at 1.0% this year from 1.6% in 2022.

Overall, we expect Nova Scotia to fare better than the national average thanks to low levels of household debt and strong demographic trends.

Prince Edward Island – Landing softly

After leading the country with a growth of 7.9% in 2021, P.E.I.’s economy saw its pace moderate markedly in 2022 to an estimated 2.9%. We forecast it will slow down further to 1.3% this year—still more than double the 0.6% rate for Canada as a whole. A booming population and lower-than-average sensitivity to steeper interest rates should keep the expansion going at a respectable clip.

Thanks to outsized wage increases (+6% in 2022) and a milder interest rate shock (arising from relatively low debt burdens), islanders aren’t as pressured to alter their spending habits as other Canadians. Indeed, retail sales growth (+9% year-over-year in the fourth quarter of 2022) lately has been among the strongest in the country. We don’t think that will be sustained, though. For one, Hurricane Fiona relief funding—which supported consumption spending and repair work last year—has largely run its course. Also, we expect the labour market to loosen by a few degrees, which is likely to put households on the defensive. All considered, we think retail sales are set to decelerate sharply to a 1.9% advance in 2023.

The provincial manufacturing sector is poised to face stiff headwinds as the global downturn weighs on export markets. P.E.I manufacturers had a solid year in 2022 with sales soaring 17%. That’s unlikely to be repeated this year. In fact, sales may have peaked last spring. Tourism, on the other hand, has continued to grow at an impressive clip, welcoming 63% more visitors from year-to-October 2022. Despite performing well, we don’t expect this sector to grow much in the year ahead as consumers claw back on discretionary spending.

Newfoundland and Labrador – Capital investment boost to kickstart the recovery

After another challenging year, we’re hopeful 2023 will bring some relief to Newfoundlanders and Labradorians. Strong commodity markets have spurred capital spending intentions in the province, boding well for the local labour market. The 1.6% growth we project from Newfoundland this year will represent a welcome uptick from 2022 (downwardly revised to -0.4%), leaving Newfoundland as the only province to buck the slowing trend.

Significant developments in the industry include the return of the Terra Nova oil field – which is expected to resume oil production in Q2 of 2023, reaching full production capacity by the end of the year. But that’s not where the biggest gains are set to come from. Representing a 28% increase from 2022 capital expenditures, a total of $231 million has been allocated to transportation and warehousing projects in 2023 – nearly all of which ($225 million) will be dedicated to highway construction as part of the Provincial Government’s Multi-Year Roads Plan. The injection of investment dollars is poised to support employment (+1.1%) and real GDP (+1.6%) growth to be among the highest in Canada this year.

Detailed forecast tables:

Canada and US Economic forecast details

Provincial Economies

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies.

Nathan Janzen is an Assistant Chief Economist, leading the macroeconomic analysis group. His focus is on analysis and forecasting macroeconomic developments in Canada and the United States.

Claire Fan is an economist at RBC. She focuses on macroeconomic analysis and is responsible for projecting key indicators including GDP, employment and inflation for Canada and the US.

Rachel Battaglia is an economist at RBC. She is a member of the Macro and Regional Analysis Group, providing analysis for the provincial macroeconomic outlook.

- 1. Composite index comprised of high-frequency data from seven macroeconomic variables: employment, retail sales, wholesale trade, manufacturing shipments, international imports, international exports, vehicle sales.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Learn More

Learn More