EVs Hit Speed Bumps

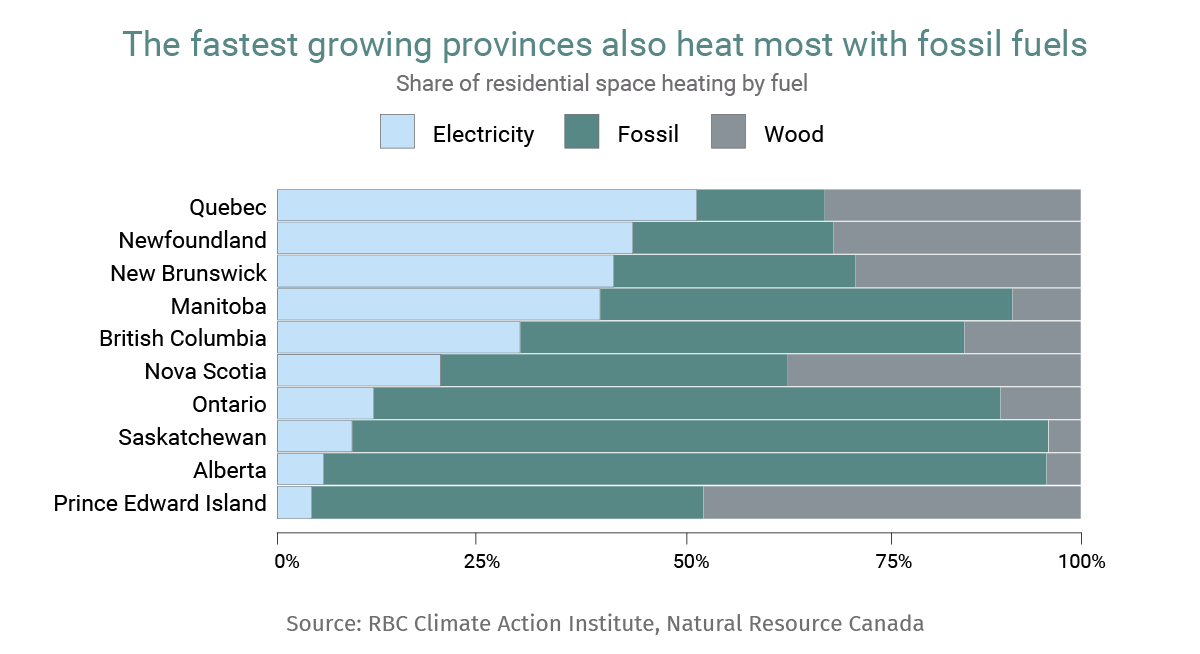

Clean energy investment at record levels in the U.S., electric vehicle growth stalls, and Germany is eyeing a hot new energy source from Canada.

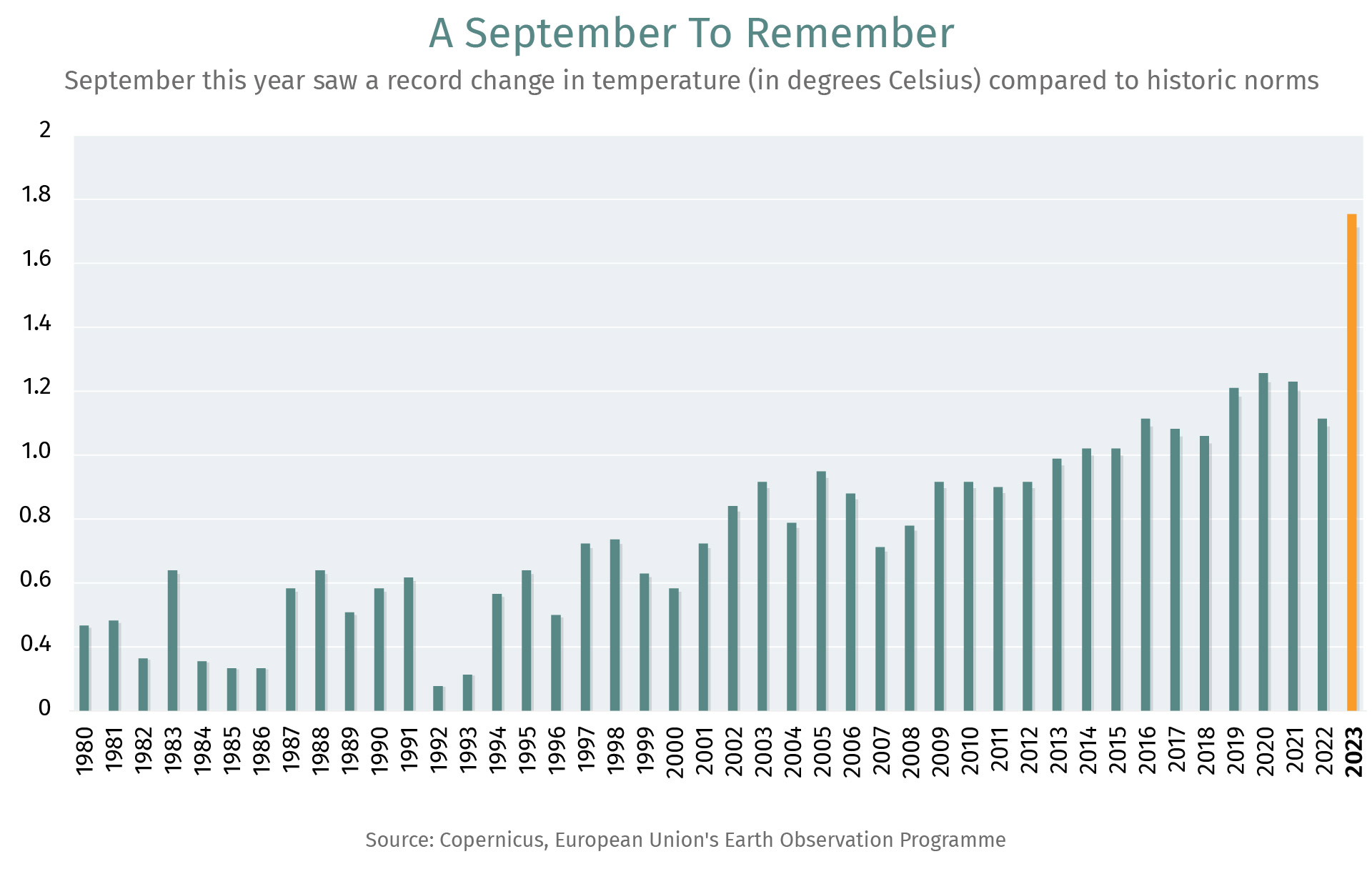

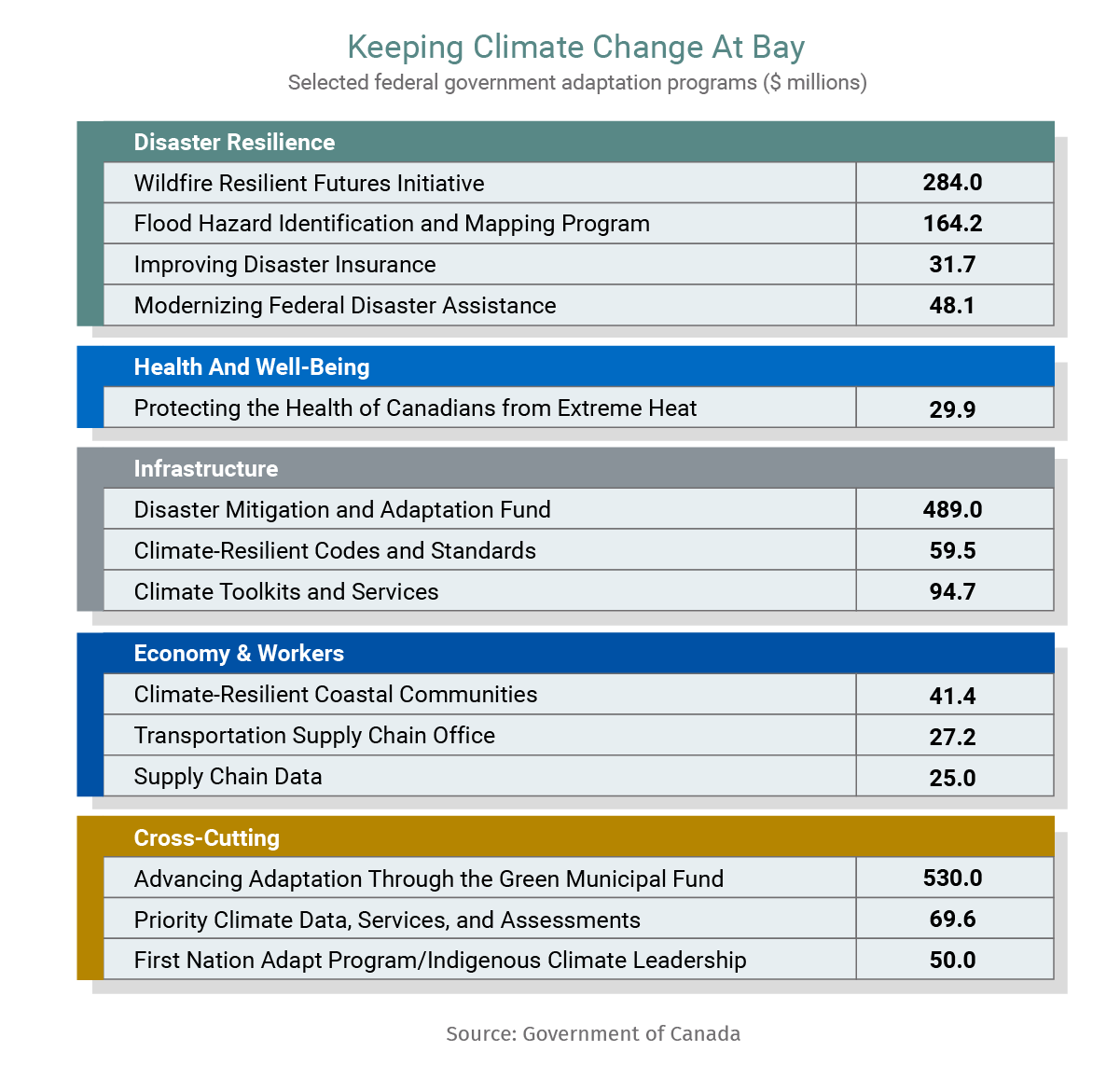

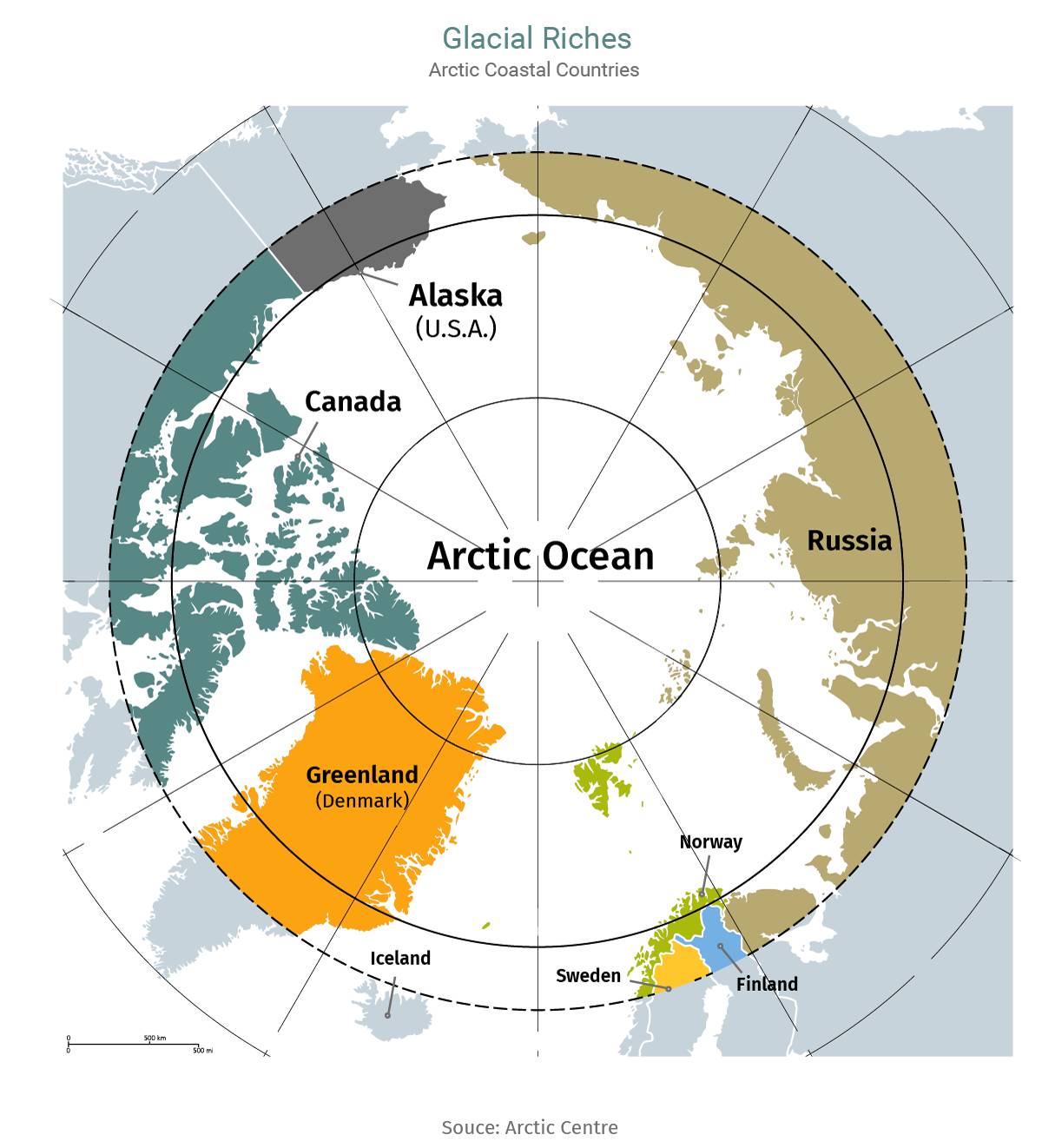

Climate change has exposed Canada’s Arctic border. That’s the RCMP’s stark assessment amid concerns rival nations could take advantage of the thawing ice to “expand their territorial claims” in the area to tap raw materials and new transportation paths. Other threats across Canada include extreme weather events and droughts that could disrupt production of key commodities and raise scarcity concerns among developed countries. The warnings were similar to the European Environment Agency’s analysis that suggested the continent’s not ready to address the spate of “cascading and compounding” climate risks.

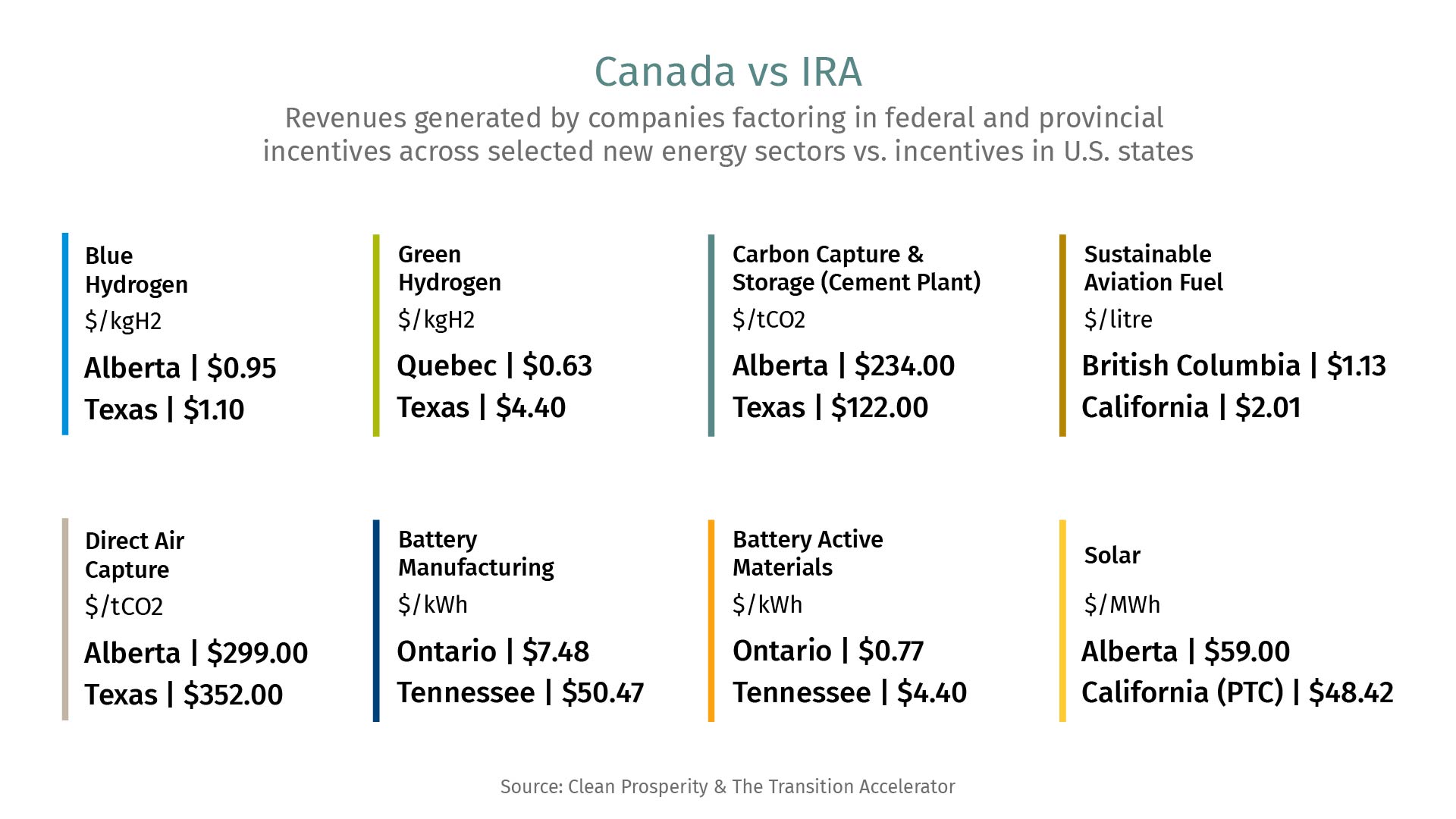

U.S clean energy investment set a record. An unprecedented US$67 billion was poured into the space in the fourth quarter of 2023, according to Rhodium Group and MIT’s Clean Investment Monitor. Federal government spending accounted for US$34 billion of the US$220 billion invested in the sector in 2023, mostly through the Inflation Reduction Act (IRA) tax credits. While Donald Trump’s advisors say the former president may gut rival Joe Biden’s landmark climate law if he returns to the Oval Office, five of the ten biggest recipients of IRA funding were states won by Trump in 2020.

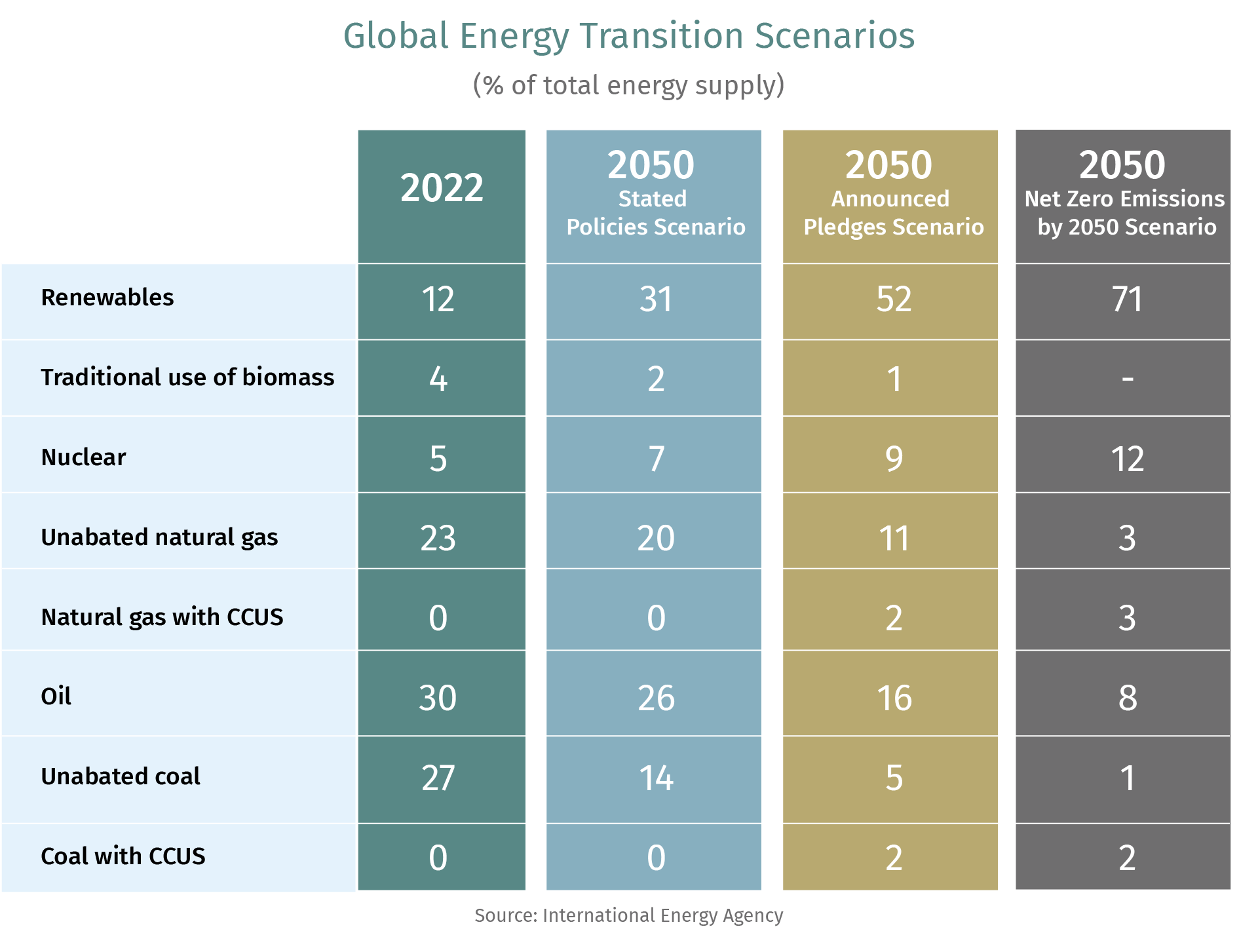

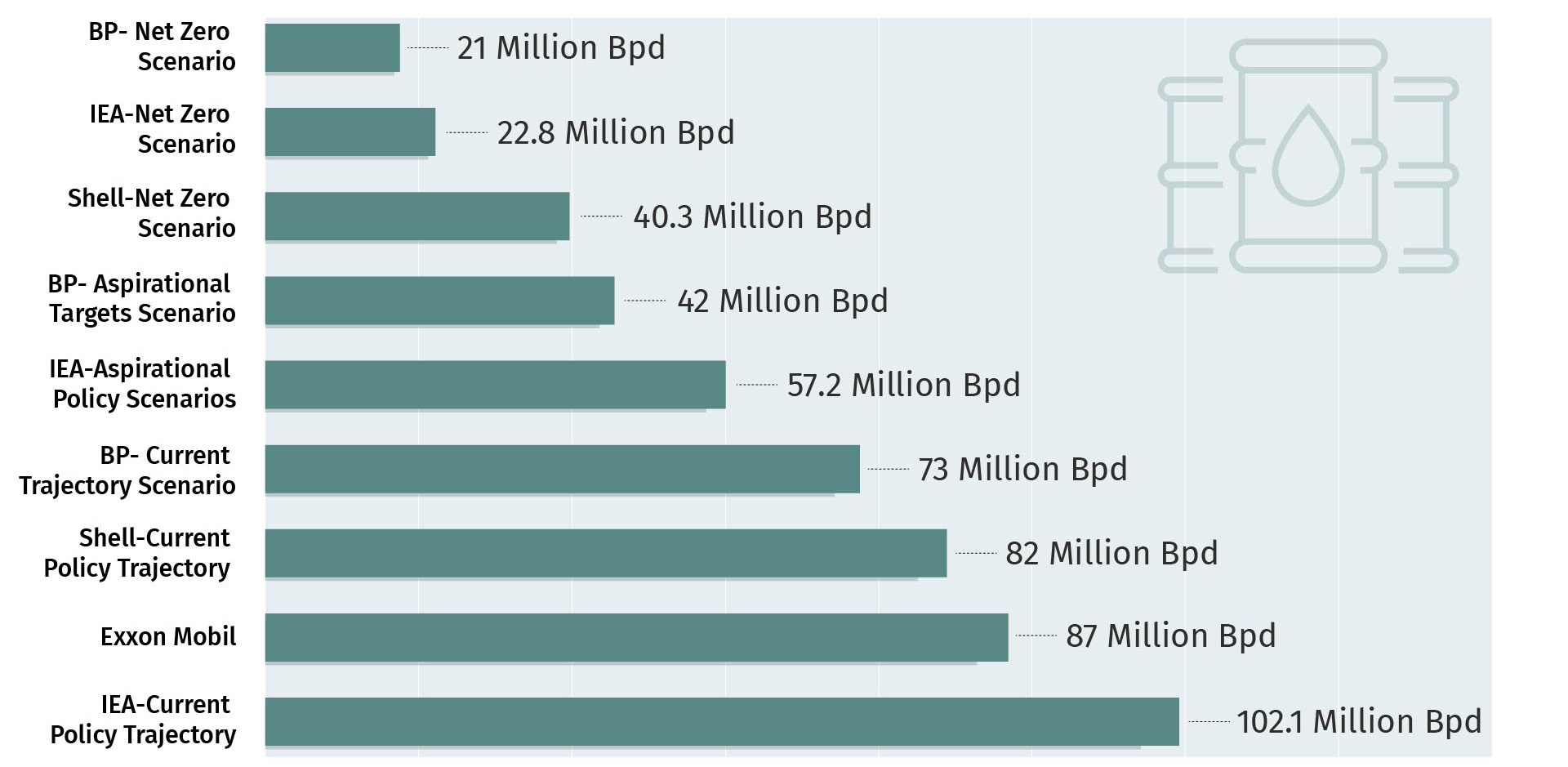

Shell watered down its emission targets. The energy giant is the now the third European oil major to cut back its climate ambitions, after BP Plc and Total Energies scaled back their targets last year. Shell said its operations will respond to the speed of energy transition, but warned that “if society is not Net Zero in 2050, as of today, there would be significant risk that Shell may not meet this target.” Despite heavy investments in clean energy, global fossil fuel demand remains resilient. The IEA raised its view on 2024 oil demand growth for a fourth time since November, and also expects strong gas demand.

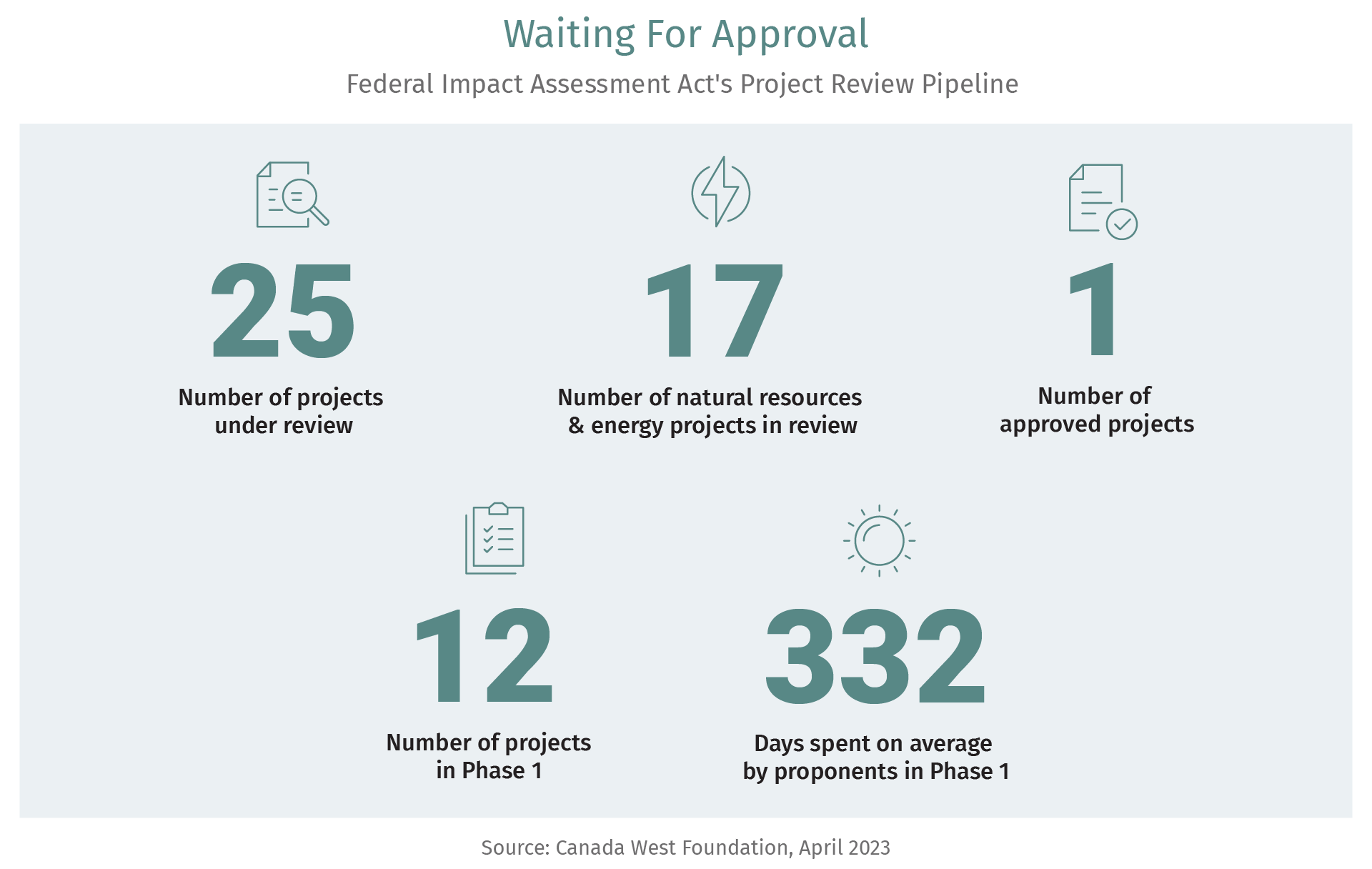

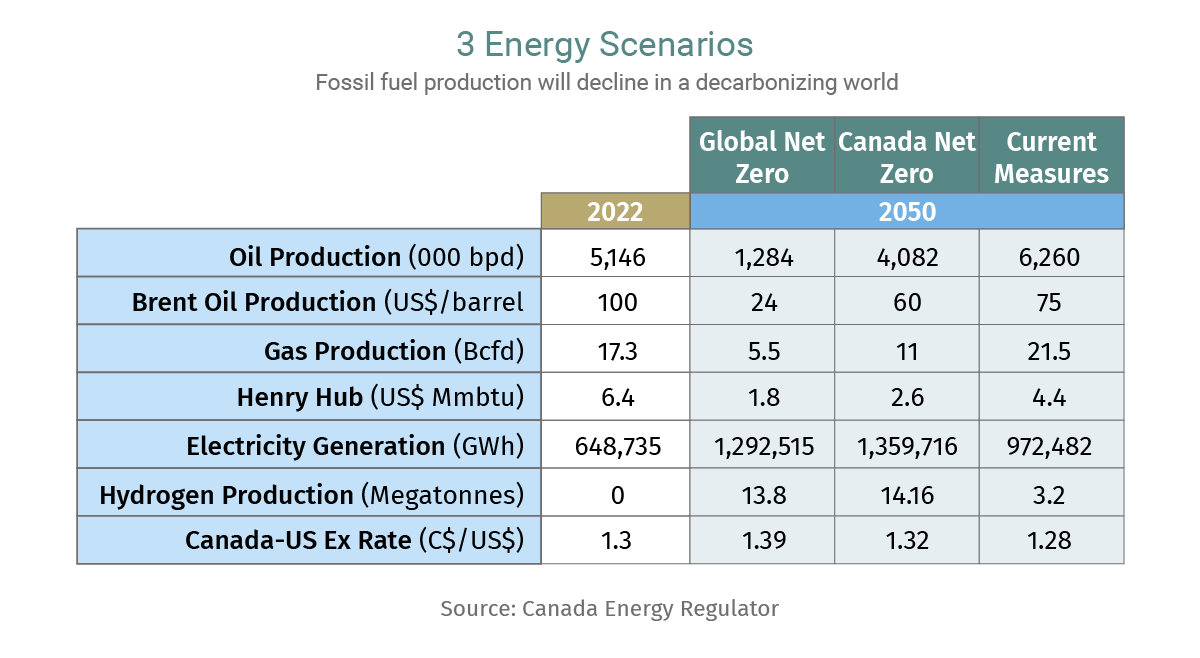

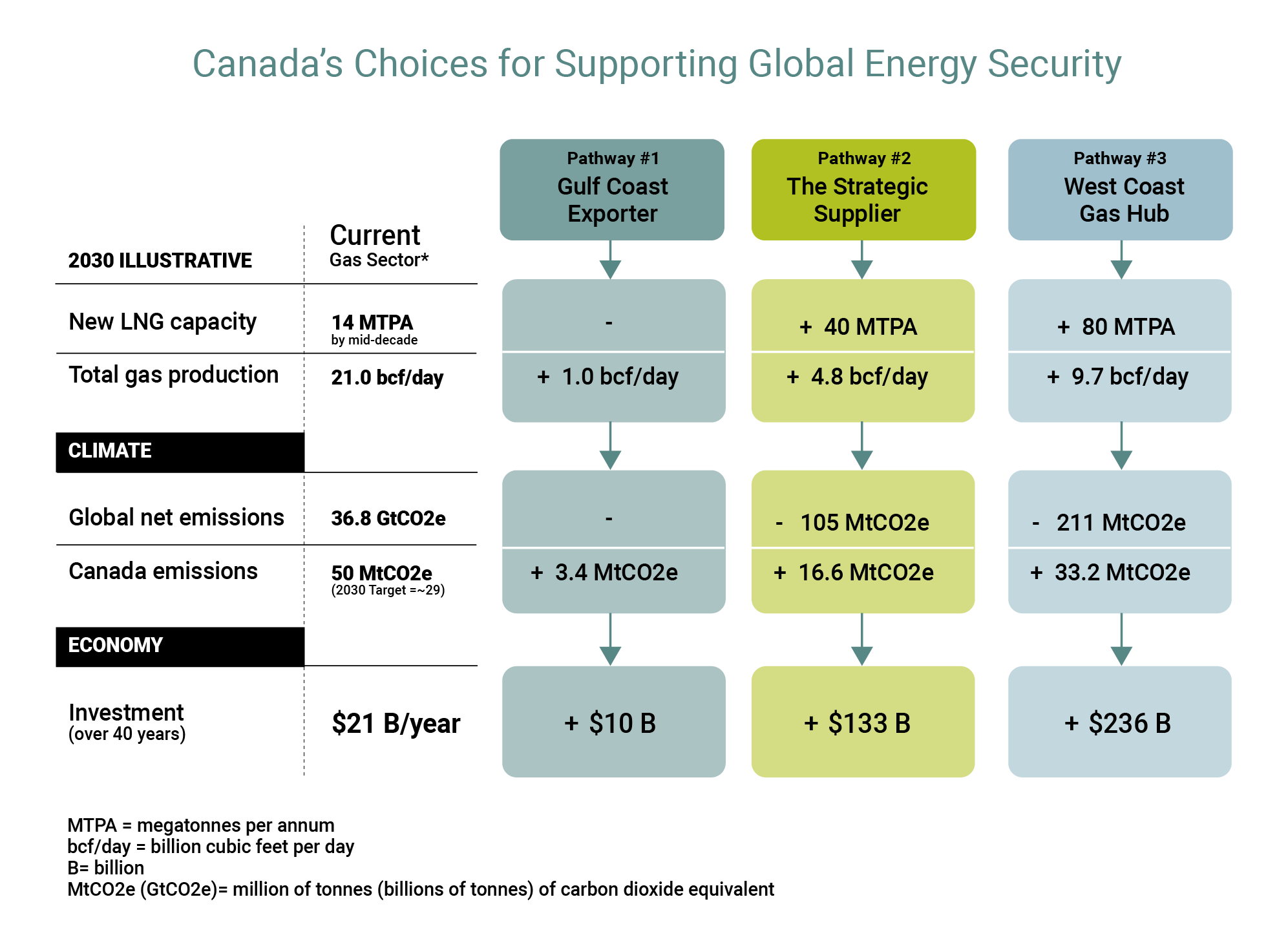

Hydrogen could emerge as Canada’s next major energy export. Ottawa signed a non-binding agreement with Germany to sell clean hydrogen from proposed projects in the East Coast. The overarching ambition is to wean Europe off Russian oil and gas imports with clean Canadian hydrogen. More than 80-low-carbon hydrogen projects have been announced in Canada with an estimated value of $100 billion, according to the federal government. Two Nova Scotia projects have cleared environmental assessment so far, while a wind-to-hydrogen project in Port au Port-Stephenville, Newfoundland is awaiting environmental approval. Germany plans to import up to 70% of its hydrogen demand by 2030 to decarbonize its hard-to-abate industrial sectors.

TRANSPORTATION

Speed Bumps ahead

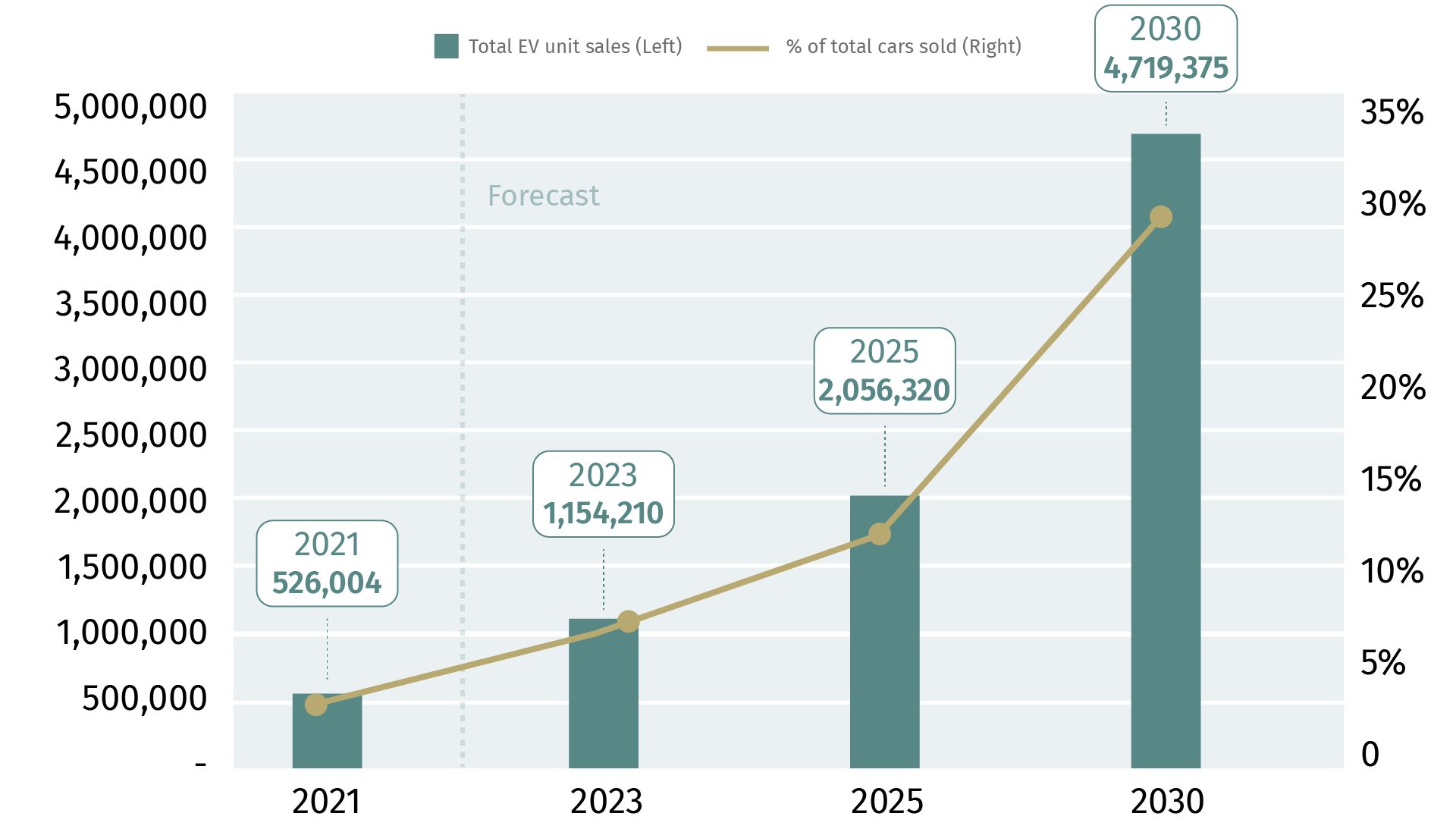

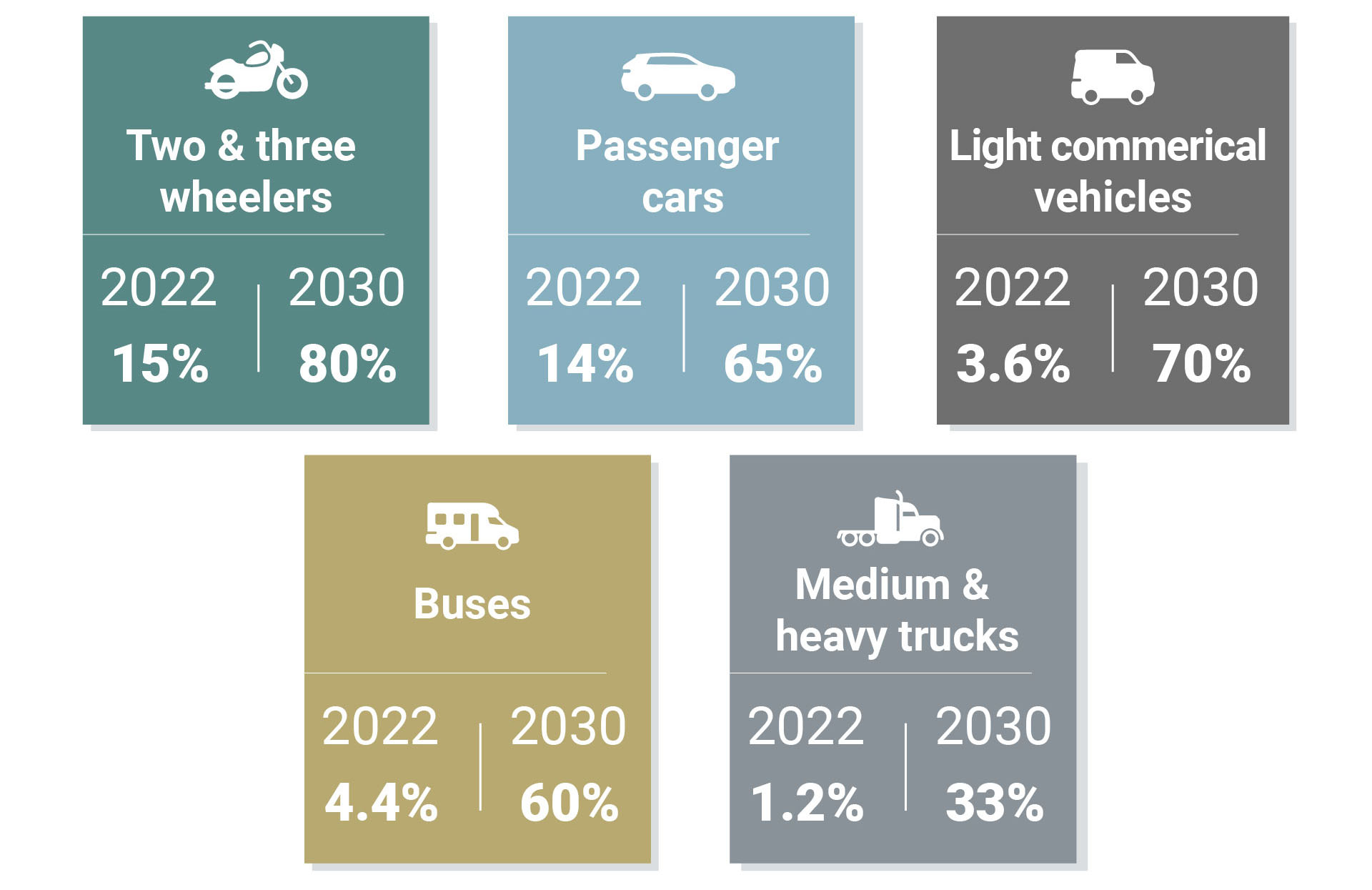

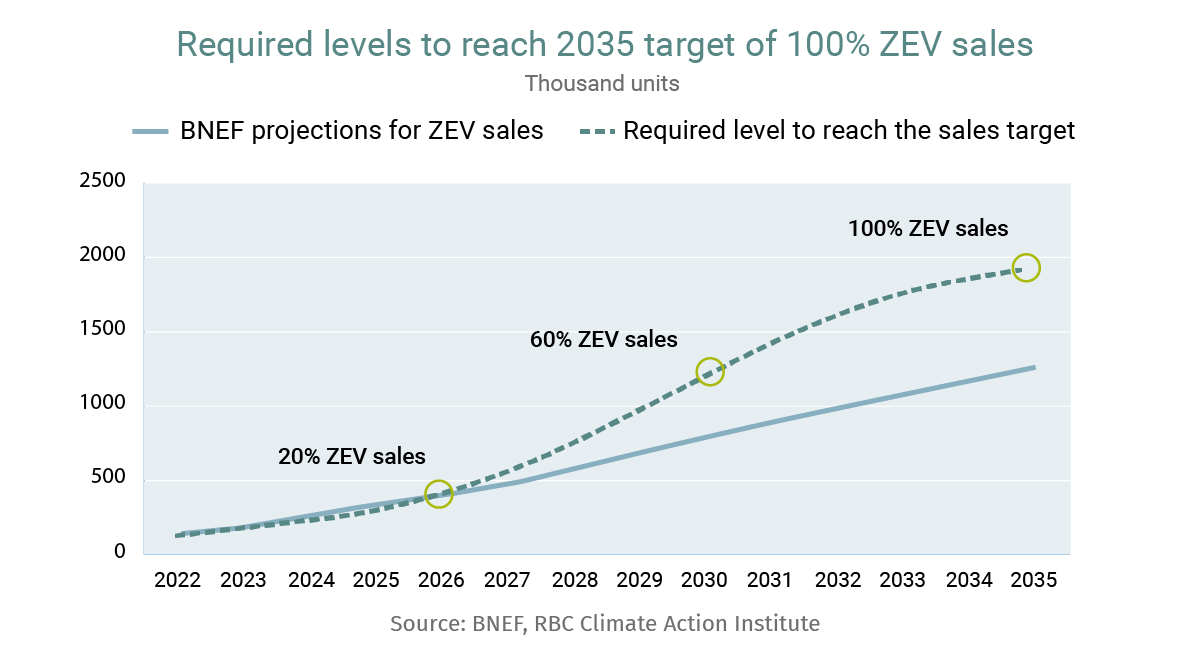

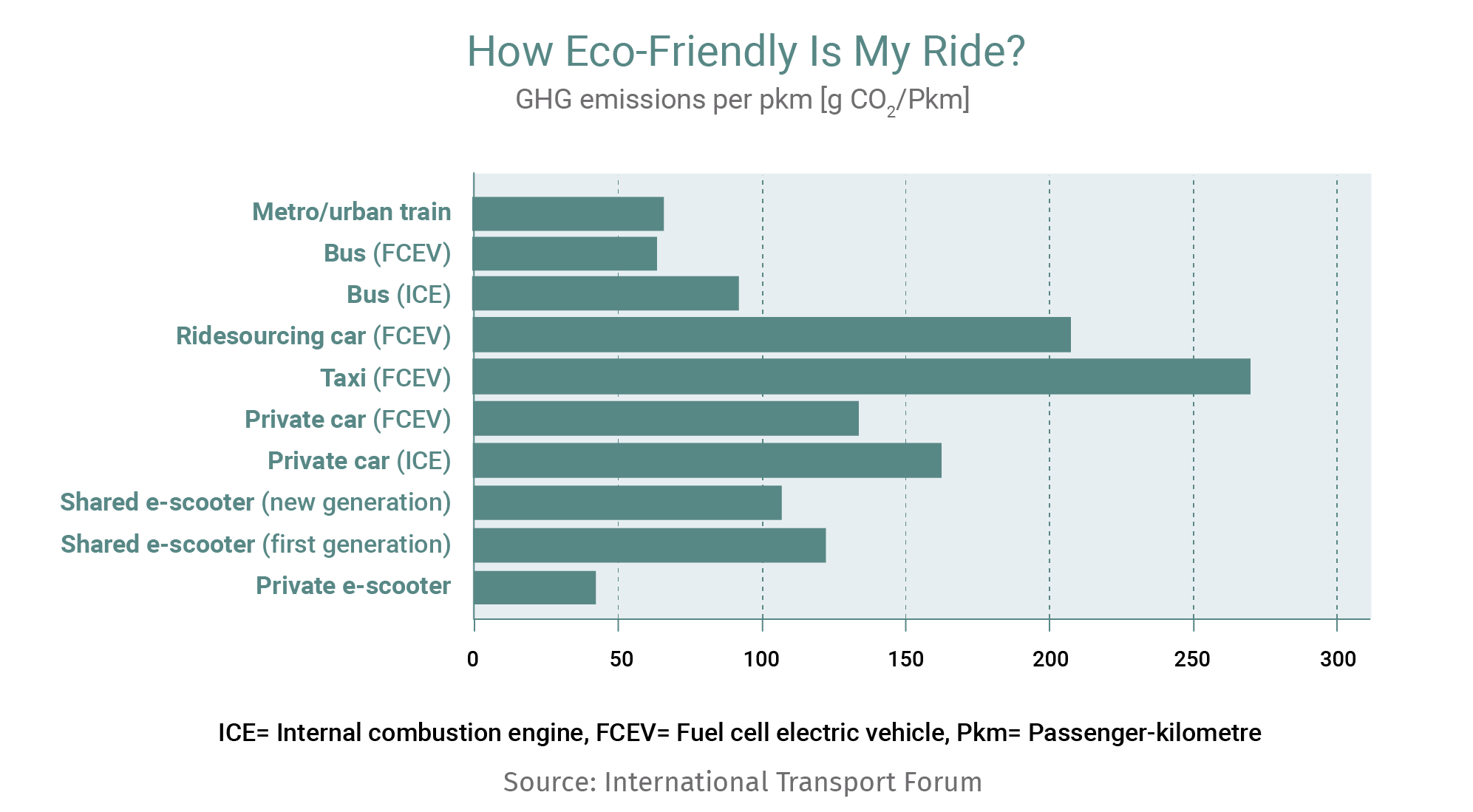

Are electric vehicles at a crossroads or is it a temporary slowdown? Often seen as one of the promising segments of energy transition, a few wrongs turn could disrupt the sector’s carefully paved path built on subsidies, incentives and consumer interest.

The spate of bad news in recent months is piling up. The number of EV models qualifying for tax credits in the U.S. fell from 43 to 19 in 2023—that could disrupt sales and force manufacturers to delay their EV plans. Meanwhile, EV manufacturers across North America are warning of rising costs and lower profitability, while China’s excess EV car capacity could be as much as 10 million a year. The CEO of car rental firm Hertz stepped down after making a bad bet on buying 100,000 Teslas and other zero-emission vehicles, but was forced to sell a third of its EV fleet amid lukewarm demand and costly repairs, while rival Sixt SE is phasing out Teslas entirely. EV startup Fisker is on the verge of bankruptcy.

In Canada, new battery EV registrations dipped 9.5% in the fourth quarter from the previous quarter, more than the 6.4% drop for all vehicles. Other headwinds hover over the horizon: Quebec, one of the provinces driving EV sales, plans to phase out EV rebates by 2027, and Alberta will impose a $200 registration tax on EVs starting in 2025.

All of these could be blips along the way due to wider economic concerns and supply chain issues that could smooth out over the quarters. Or not.

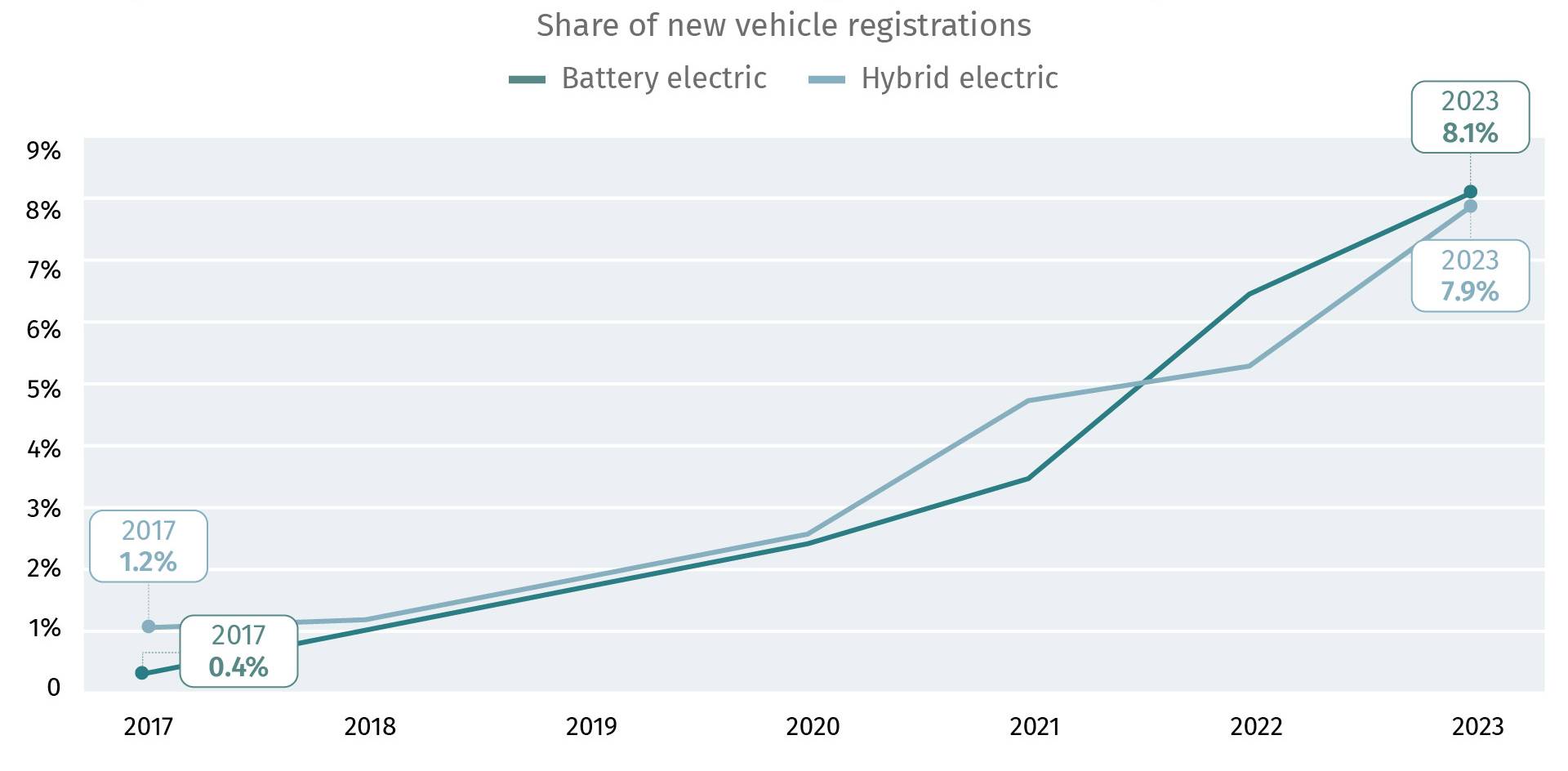

As the market recalibrates, hybrids—combining gasoline engine with battery power and offering better gas mileage—have emerged as a promising stop-gap solution to address customer skepticism around range and usage. EV sales in the U.S. hit a record 1.2 million last year, a 46% gain, but hybrid sales rose even faster, up 65% to more than 1.2 million, lifting their market share to 8% from 5.5%. Over the past year, new registrations of battery electric cars in Canada rose 41% compared to 67% for hybrids. Consumers appear to be taking a gradual approach to the transition, although purists believe hybrids could delay the industry’s Net Zero goals.

Hybrid EVs are catching up with battery-powered cars

Source: Statistics Canada, RBC Climate Action Institute

If the trend persists, some manufacturers, such as General Motors, that bypassed hybrids altogether could be caught off-guard. While others such as Toyota could see their hard-nosed pursuit of hybrid models pay off.

It’s too early to declare winners just yet or even EV’s direction of travel. In many ways the auto sector’s challenge is a microcosm of the wider energy transition: government incentives and promising technologies exist to practically wipe out emissions, but (a) scaling the new technologies is capital-intensive, and (b) there is not enough consumer/investor buy-in. Invariably, a bridging technology steps in as a compromise.

CHART OF THE WEEK

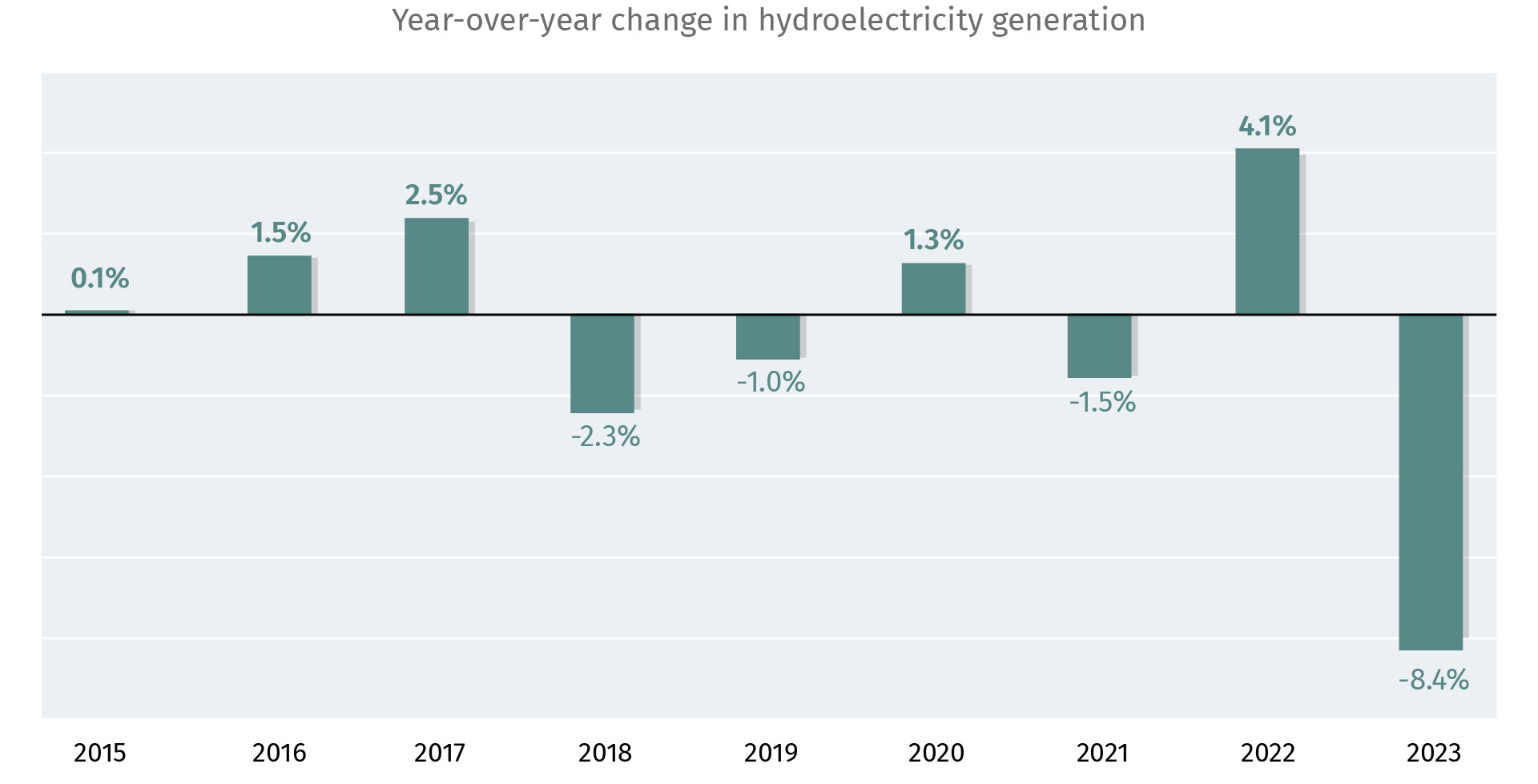

Hydro power runs dry

Source: Statistics Canada, RBC Climate Action Institute

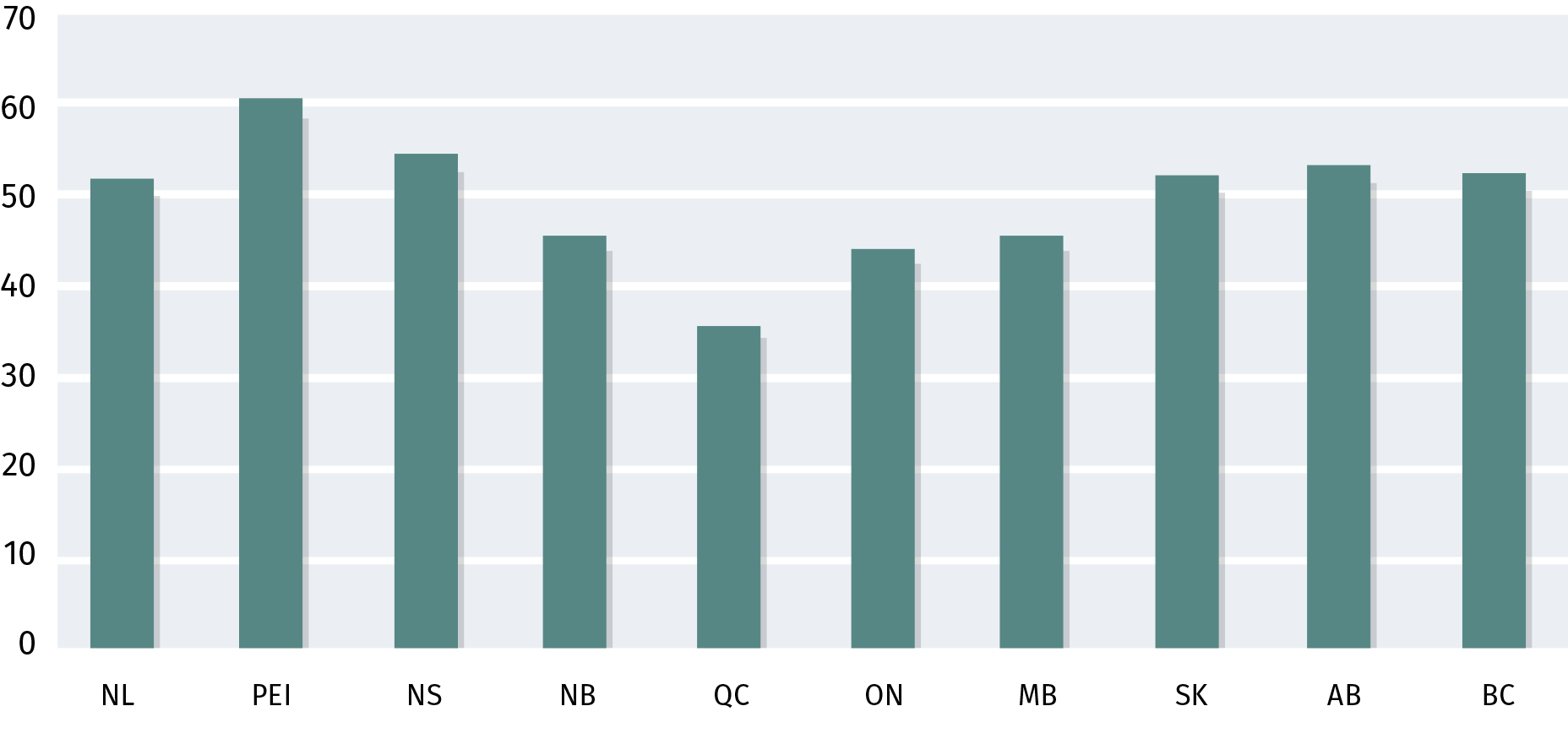

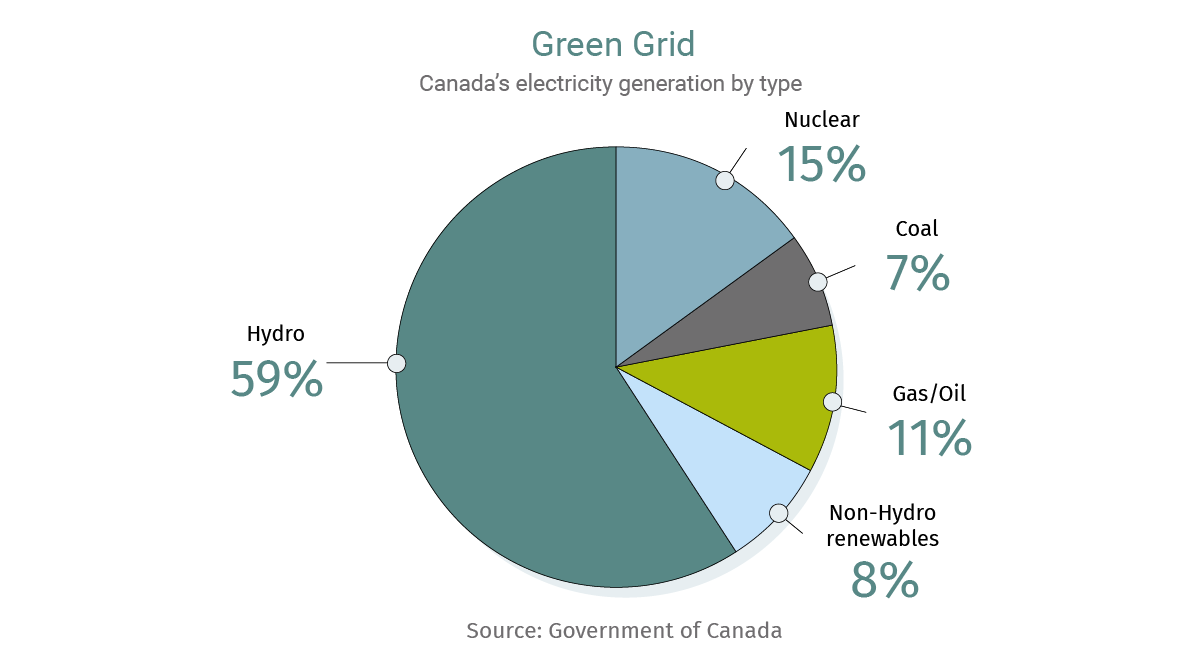

Droughts squeezed hydroelectricity in Canada last year. Three of Canada’s largest hydroelectricity generators, Quebec (-9.3%), British Columbia (-21.5%) and Manitoba (-12.1%), were hit by drought or abnormally dry conditions, according to Statistics Canada. With electricity demand set to more than double by 2050, the decline highlights the system’s resiliency challenge.

Peter Tertzakian and Jackie Forrest, energy experts and hosts of Arc Energy Ideas podcast, join host John Stackhouse to discuss ways private capital can help solve the climate challenge. Listen to the Podcast here

ZEROING IN

$80

The new federal carbon tax rate, from $65 per tonne of carbon emissions, starting April 1. Most Canadian families will also see a jump in rebates (rebranded as the Canada Carbon Rebate)—$64 more every quarter in Alberta and $36 more in Ontario, Manitoba and Saskatchewan. Ottawa is under pressure to pause the hike amid concerns over rising costs.

Climate Signals is curated by Yadullah Hussain, Managing Editor, RBC Climate Action Institute, with contributions from the Institute’s experts.

Previous Articles:

Alberta hobbles province’s renewable energy momentum, small modular reactors emerge on policymakers’ radars, and how Brian Mulroney solved his era’s biggest environmental crisis.

Thank Brian Mulroney for clearing Canada’s air. The country’s 18th prime minister, who died last week aged 84, picked a market model to tackle the biggest environmental crisis of his time. Acid rain—a potent cocktail of sulphur dioxide and nitrogen dioxide from industrial smokestacks and cars—was damaging biodiversity and wreaking havoc on thousands of lakes across North America. His persistence with different U.S. administrations led to the Canada-United States Air Quality Agreement in 1991. Mulroney’s solution? A pioneering “cap and trade system” that allowed companies to cap or trade their pollution allowances. The market-driven policy cleared up a major environmental crisis within a few decades.

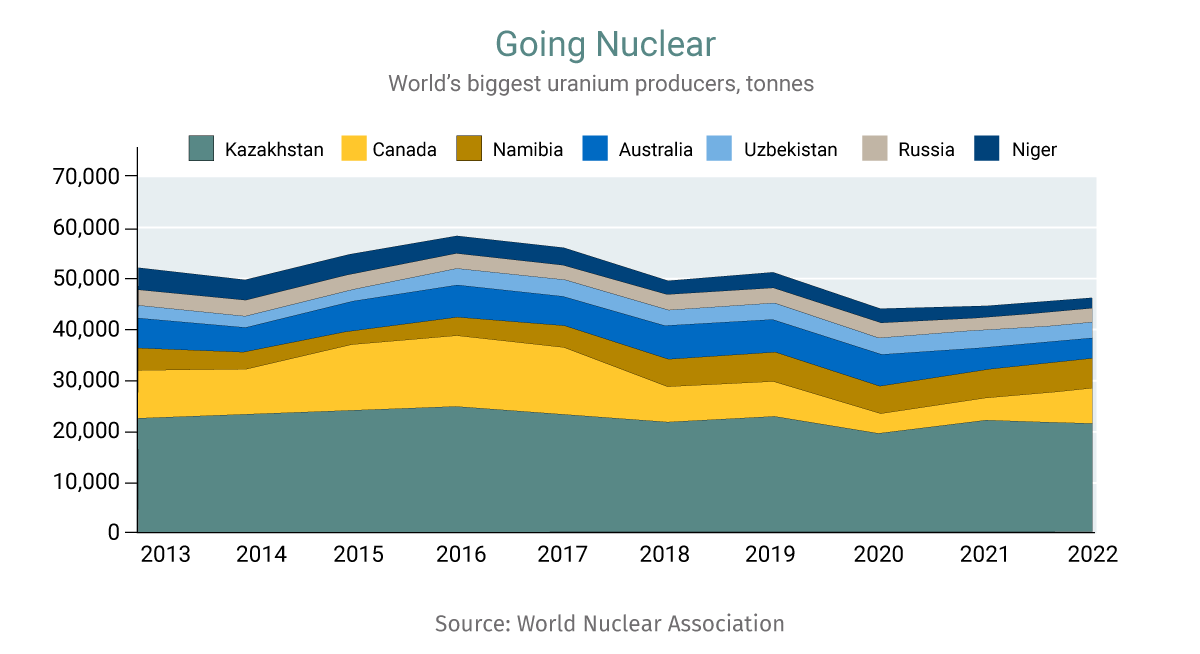

Nuclear’s winter is over. Scores of engineers, financiers, and policy makers from around the world descended upon Ottawa last week to discuss the prospects of a tried-and-tested tech, but with a new twist: small modular reactors (SMRs). While there’s a comfort level with SMRs as some are based off conventional technologies, they also carry a hefty price tag. Read the Climate Action Institute’s Head of Research Myha Truong-Regan’s insights from the invitation-only event here.

Climate change is disrupting Warren Buffett’s power business. The CEO of Berkshire Hathaway prides himself on picking boring-but-steady cash flow businesses like utilities. But Berkshire’s power company Pacific Corp.’s operations have been anything but in recent times. The public utility could be sued by the U.S. government for nearly US$1 billion in costs related to the 2020 wildfires in Oregon and California. That’s separate from the US$299 million paid to settle a lawsuit by 463 plaintiffs hit by devastating wildfires in Oregon. “America’s power needs and the consequent capital expenditure will be staggering,” but some utilities may face “survival problems” amid regulatory hurdles and climate change disruptions, Buffet warned in his annual shareholder letter.

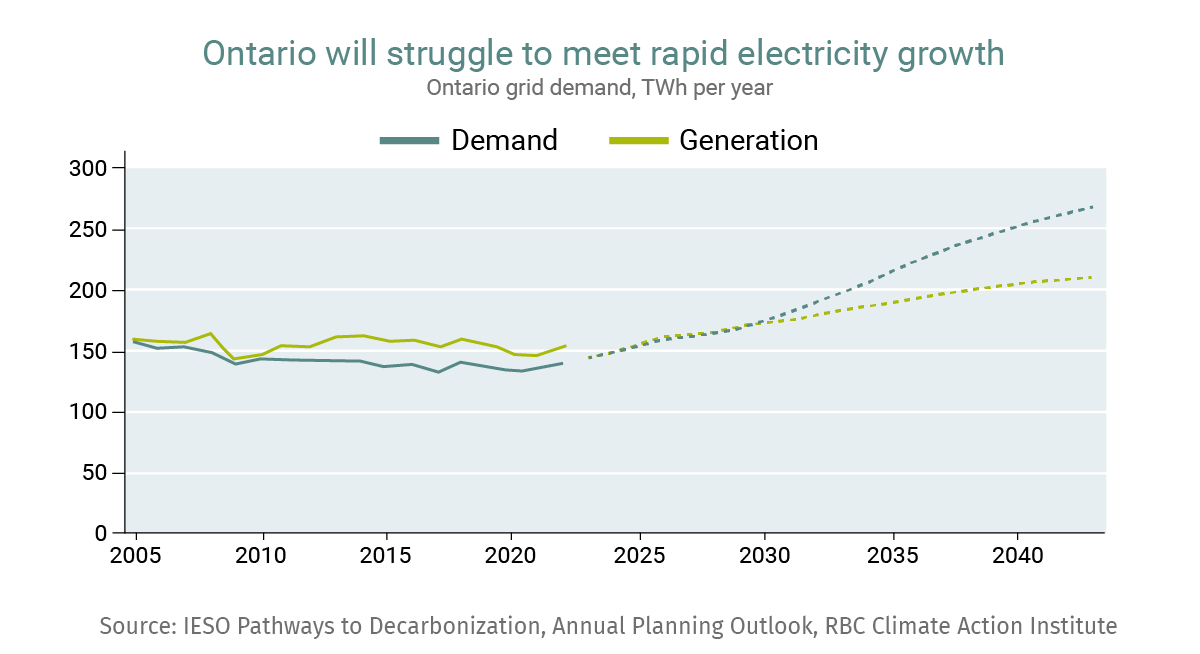

AI could give grids a big jolt. Nvidia’s new 1.5 million artificial intelligence servers will consume 85.4 terawatt-hours annually at full capacity by 2027, according to a new study. Microsoft-backed Open AI’s ChatGPT alone gobbles up 564 MW per day—equivalent to powering 20,000 households—to respond to 195 million queries a day. “There is a Dickensian quality to the use of AI when it comes to our environment: It can make our planet better, and it can make our planet worse,” said Senator Edward Markey, who is among a group of U.S. senators pushing for an environmental study on AI’s impact on electricity demand, carbon emissions, water supplies and electronic waste.

CHART OF THE WEEK

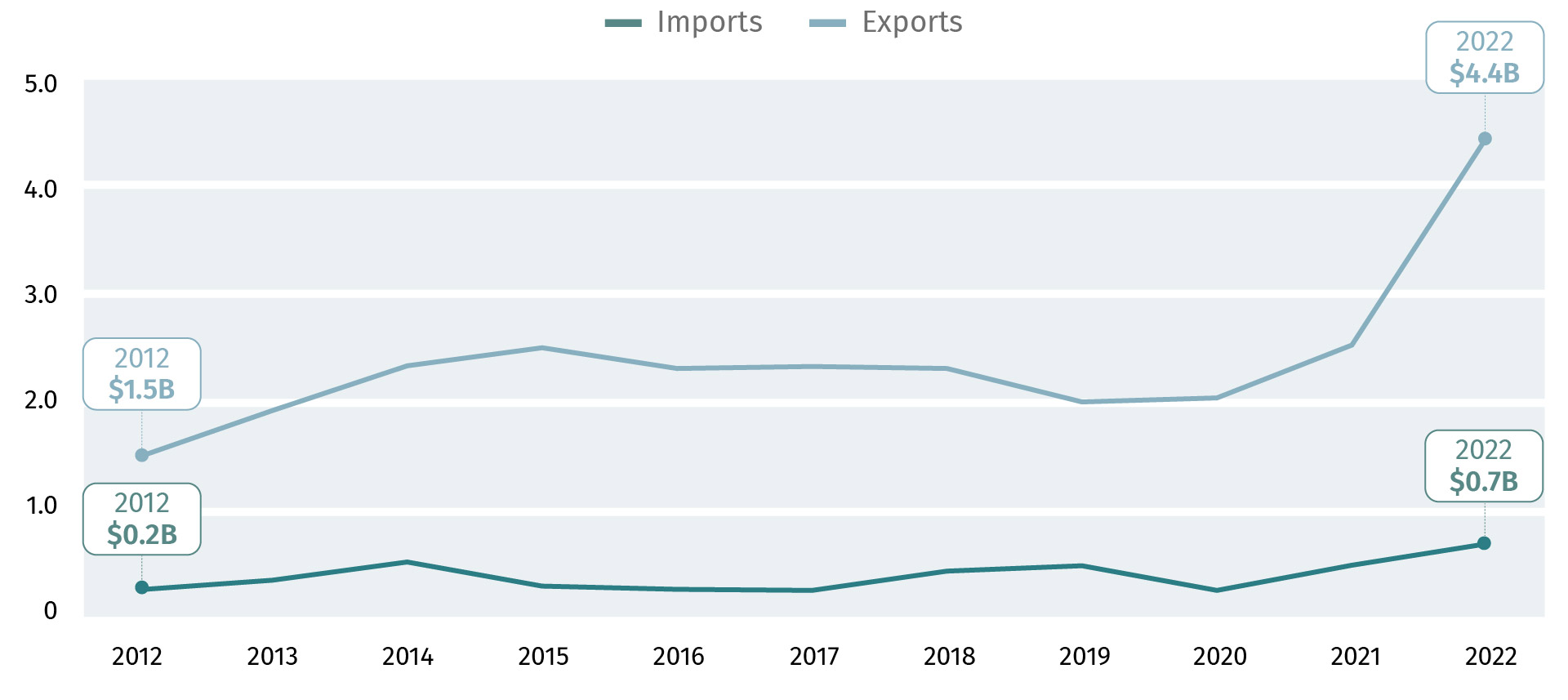

Canada’s Clean Energy Trade Flows ($ billions)

Source: Statistics Canada

Canada is a net exporter of clean electricity, from nuclear and renewable sources. Net exports increased to $3.7 billion or 174% since 2012. The size of Canada’s net clean energy exports is a fraction of its net conventional energy exports, which was $160 billion, in 2022.

POLICY

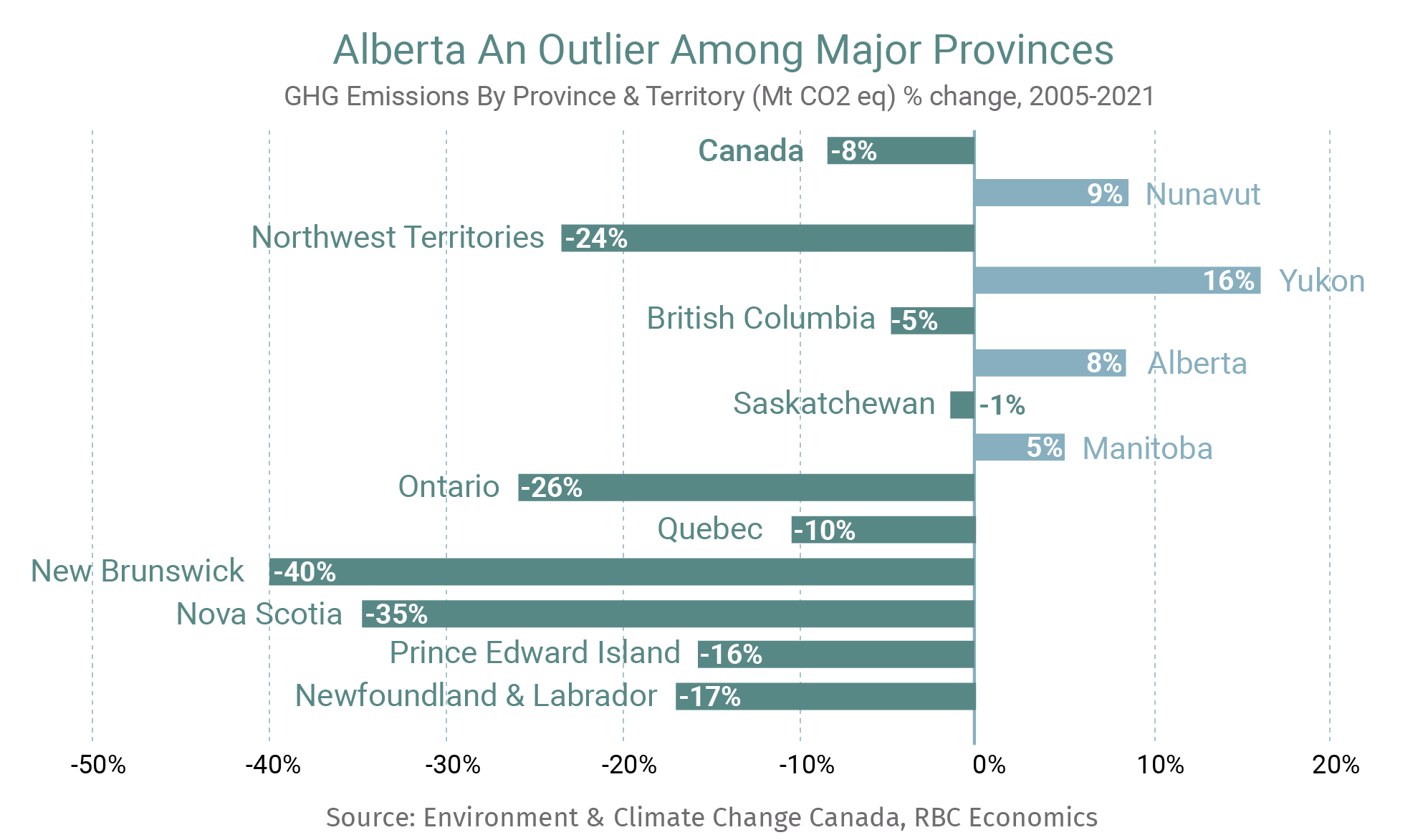

Alberta’s Zero Sum Game

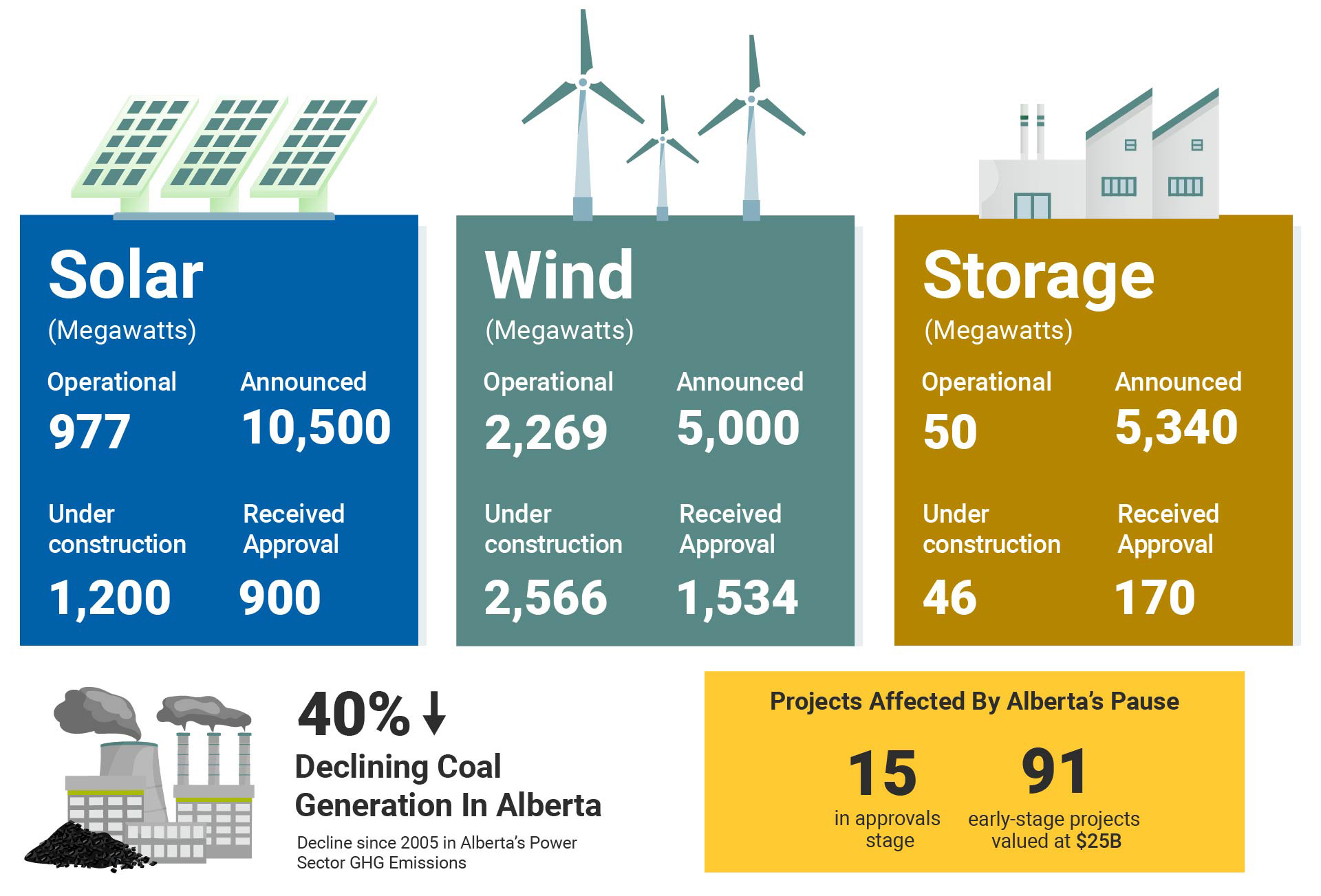

Alberta now has a renewables-second strategy.

New provincial rules now restrict renewable energy power projects on prime agriculture land, in what it calls an “agriculture first” approach. Renewable power projects can’t also be built within 35 kilometres of a protected area (which Pembina Institute estimates could be 76% of southern Alberta), or areas that offer “pristine viewscapes,” with some exemptions. It’s a blow to the burgeoning renewables sector. The move also makes it harder for Canada’s largest emitting province to rein in emissions and interrupts its nation-leading growth in building clean energy power. How will the renewables’ sector react? More details are expected in the near future but proposed projects worth $36 billion are at stake.

The Alberta budget last week also had few details on the government’s plan for energy transition that builds on the Emissions Reduction and Energy Development Plan announced in 2023.

The government is allocating $597 million over three years from the province’s Technology Innovation and Emissions Reduction (TIER) fund to support programs that reduce emissions and support cleantech development.

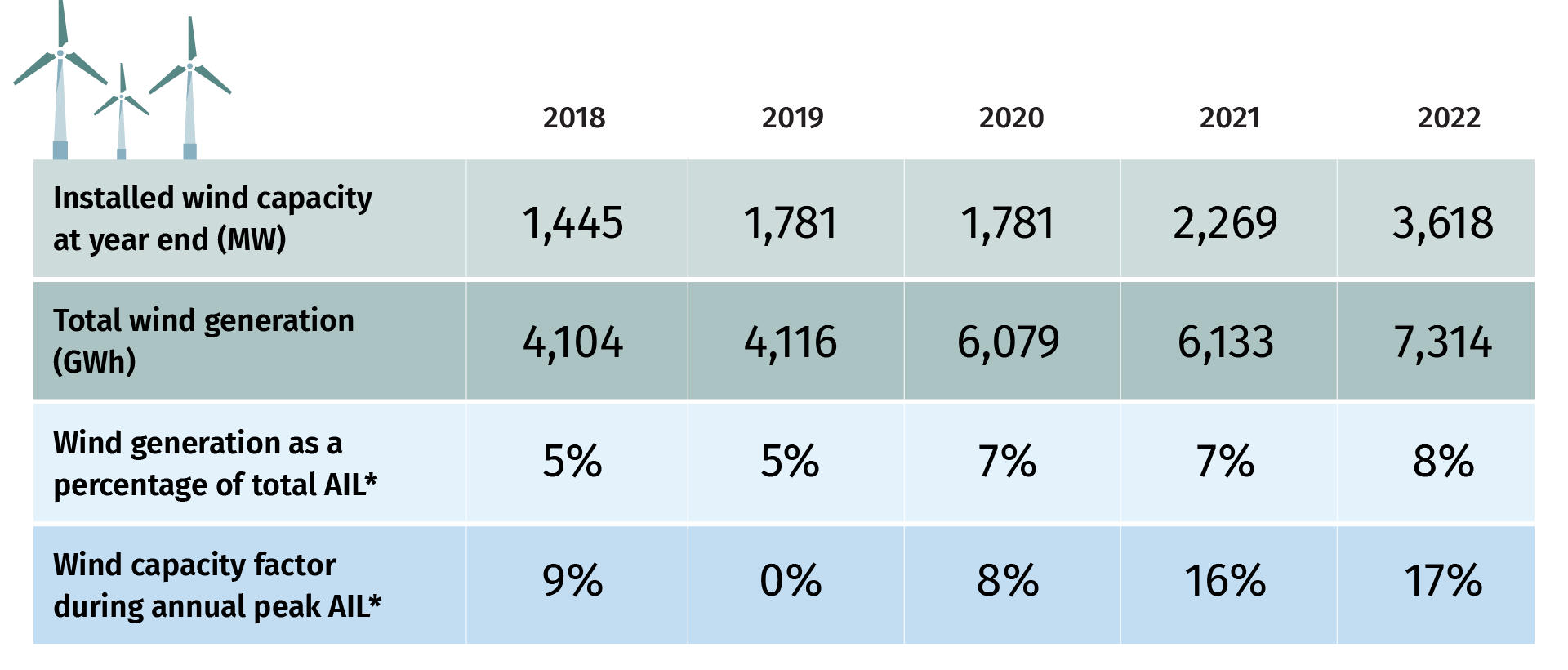

Wind Was Picking Up In Alberta

Source: Alberta Electric System Operator. * Alberta Internal Load (AIL)

Still, the province’s hobbling of the renewable energy injects investor uncertainty in what was turning out to be a new revenue stream for municipalities and other levels of government.

While the government’s move addresses concerns from some rural communities, there is a feeling that Alberta might be missing out on a wave of energy transition dollars waiting to be deployed. The province is an enviable position to maintain its conventional energy strength and build out a new clean power system in parallel. Alberta can do both—pursuit of Net Zero need not be a zero sum game.

To mark International Women’s Day today, John Stackhouse and co-host Alison Nankivell, the incoming CEO of MaRS Discovery District, discuss ways to inspire the next generation of women entrepreneurs with three that are on the frontlines of cleantech.

Listen to the Podcast here

ZEROING IN

28.6%

The percentage of workers in Canada’s environmental and clean technology sector in 2021 that were women—that’s lower than the national average of 47.5% across all sectors.

Ottawa’s green grid roadmap makes more room for natural gas, Alberta was Canada’s renewable energy star last year, and why climate skeptics need not apply to the ECB.

Alberta led Canada’s renewable energy growth last year. The province accounted for 92% of national growth in renewable energy and energy-storage capacity last year, industry data shows. Alberta’s temporary pause on approvals of renewable energy projects, which is set to expire on February 29, had little impact on projects in 2023 or project pipeline flow for this year. Overall, Canada’s wind, solar and energy storage capacity grew 11.2% last year, a shade higher than the 10.5% jump in 2022.

The latest B.C. budget is big on fighting wildfires and droughts. The government is spending $405 million—part of a $1.3 billion clean economy package—to prepare for climate emergencies, amid reports of 92 fires still smouldering in B.C. in the dead of winter. Heat pumps and EV public charging infrastructure also secured some funding as part of a $435-million spending plan on mostly grants and rebates programs. David Eby’s NDP also unveiled a $1-billion Indigenous loan-guarantee program, and $24 million to support collaboration with First Nations for its critical minerals strategy. Still, 2024 budget is more about affordability rather than climate in an election year.

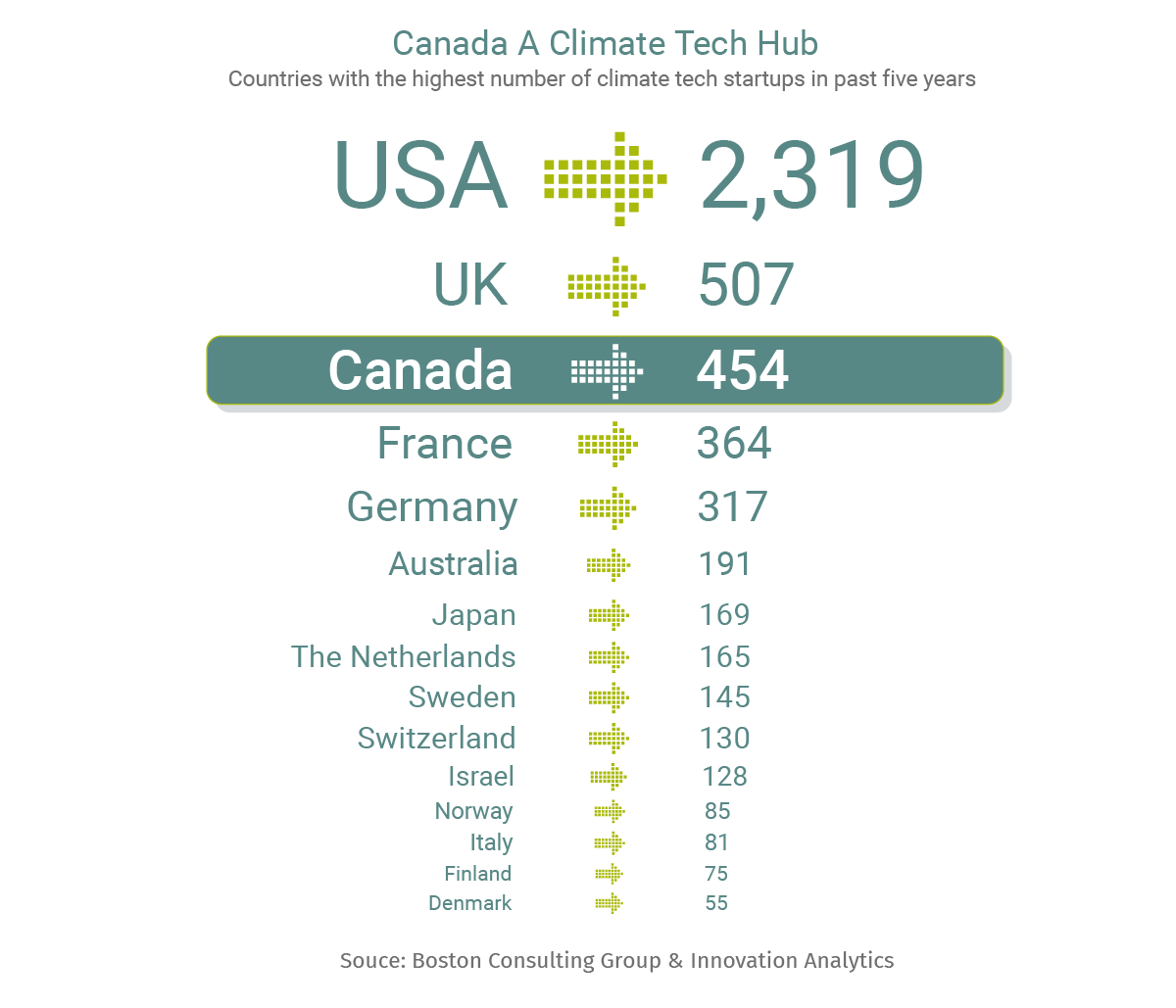

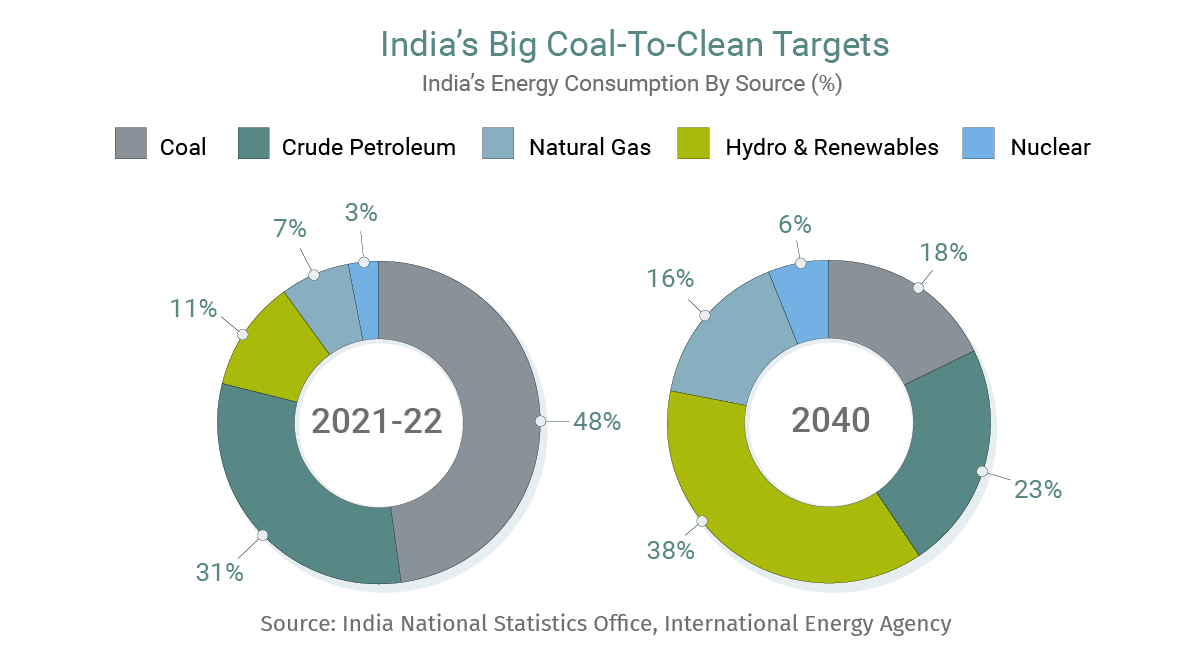

Look east and south for growth. That was among the 10 key takeaways from a recent RBC Climate Action Institute event that brought together more than 100 climate thinkers and business CEOs to discuss the findings of the Climate Action 2024 report. Many of the technologies needed in the fast industrializing markets of India, Brazil and Indonesia are made in Canada: from carbon capture to satellite monitoring. With most of the world’s new emissions coming from emerging markets in the next few decades, the opportunity is clear—as is the benefit to global emissions. Read more about the 10 quick actions Canada can take on climate here.

The European Central Bank doesn’t want green skeptics on its payroll. “Why would we want to hire people who we have to reprogram?,” Frank Elderson, ECB’s climate czar and one of its six board members, reportedly asked in a meeting. The comment has raised questions whether central banks should focus on keeping prices stable or expand their mandate to include the climate crisis. The International Energy Agency is also facing criticism from an ex-White House advisor for “straying” from its core mission as an energy-security watchdog and giving in to “zealous green censors.”

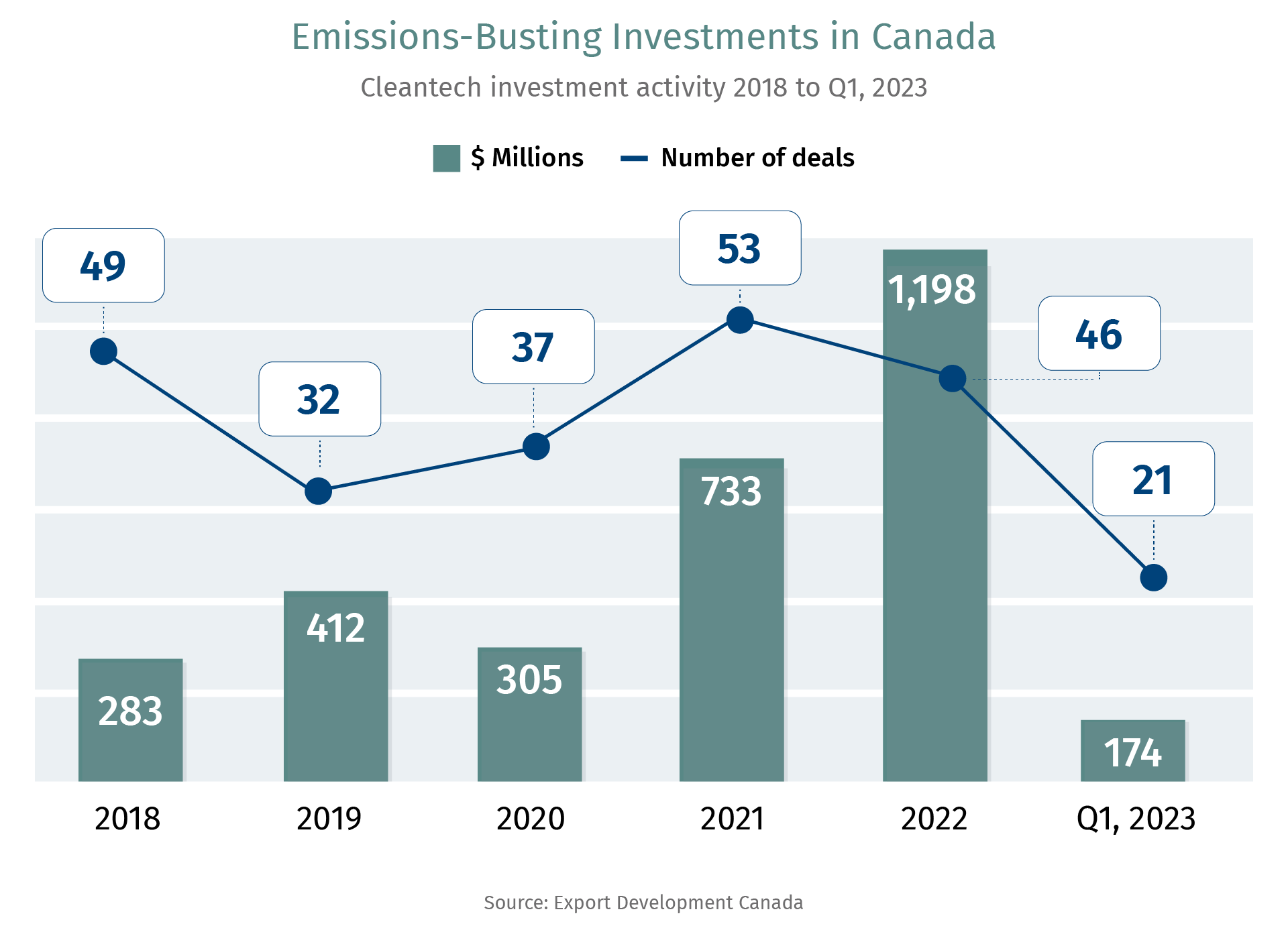

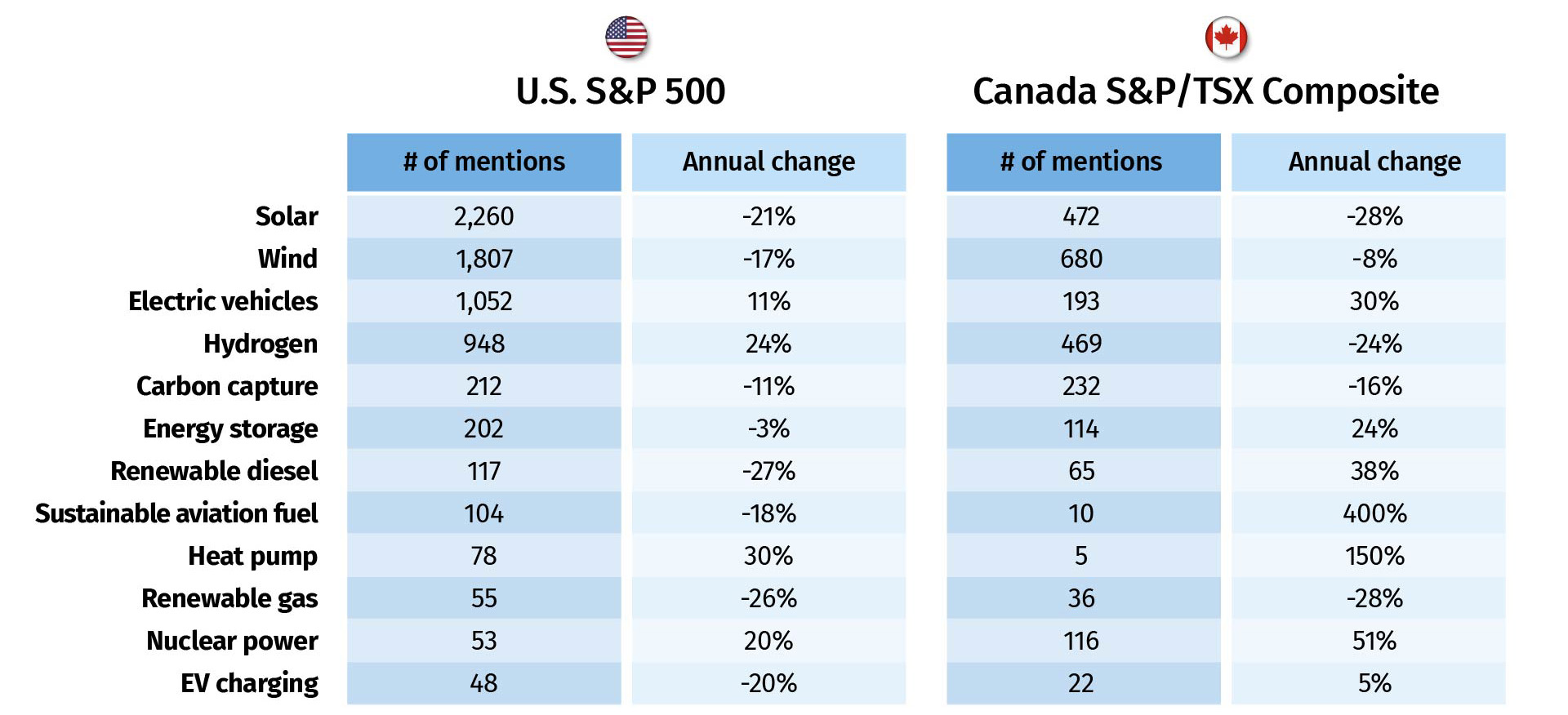

Bumpy Weather Ahead For Cleantech

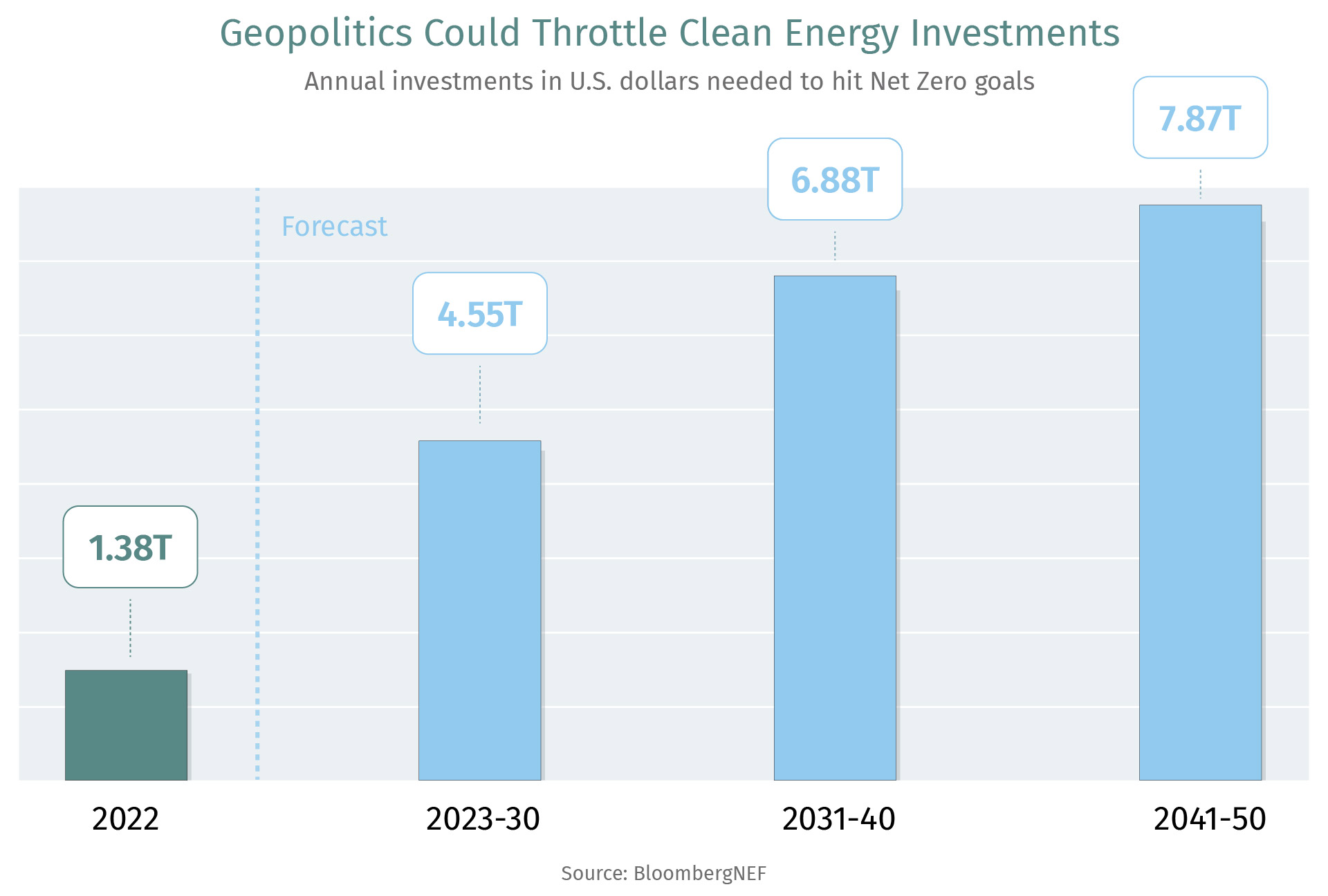

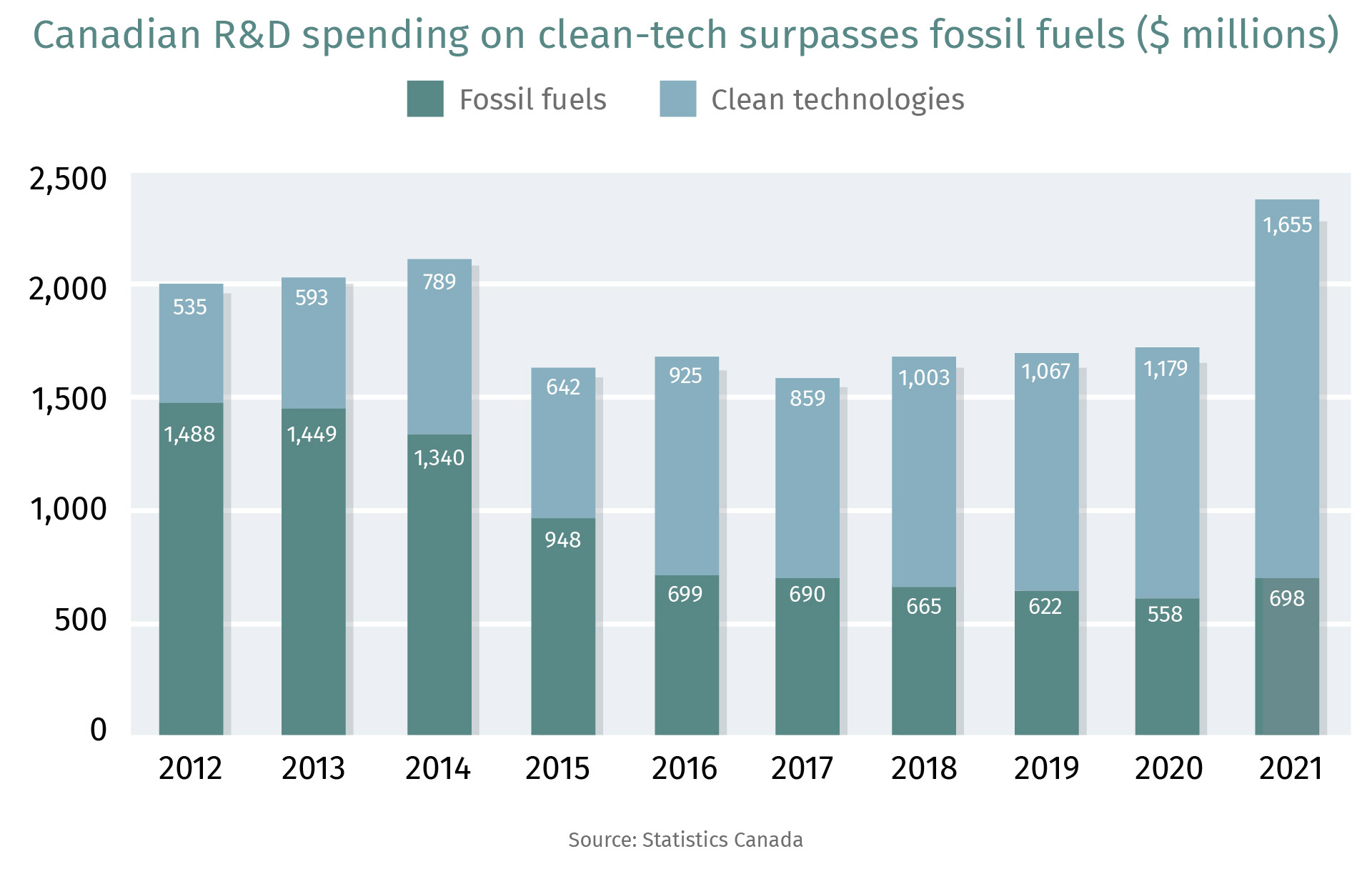

Few signs hail the arrival of spring in Canada more than government budgets. (Ok, shattered Stanley Cup dreams count, too.) British Columbia kicked off the cycle this week, with an election year budget that signals where other provinces and Ottawa might also go over the next two months. Support for consumers and homeowners is in vogue; industrial strategy and climate spending is not. Our recent Climate Action 2024 report anticipated as much, but not with despair. Governments have carried the load on climate for nearly a decade, and it’s time for private capital to step up. That won’t be easy, as we’ve heard from business leaders and investors. Higher interest rates have clobbered cleantech investing, and forced corporates to scale back on discretionary spending. The global economy needs up to US$9 trillion a year in climate-related investments, and yet last year it hovered around US$1.2 trillion, with half that being spent in China.

I spoke this month about the cleantech challenge at the Globe Forum, a leading biennial conference in Vancouver. Our research shows Canada needs to increase climate spending to $60 billion a year if we’re to get to Net Zero. Private capital increased nicely last year, including venture capital, but it’s got a long ways to go. And as I heard from cleantech entrepreneurs and investors in Vancouver, this year is looking hard. Many investors feel burned by higher interest rates and slow results from new technologies, whether it’s carbon capture or battery storage. The revenue models just aren’t there yet. One indication of concern: the leading iShares global fund for clean energy stocks is down more than 40% since 2021. That kind of sentiment will make it tougher for cleantech companies—especially ones selling hardware—to raise capital. Yes, lower rates will help make those investments more competitive, as will investments from large corporates seeking to decarbonize their portfolios. But for those hoping for an early spring in climate investment, a bit more patience may be required.

John Stackhouse

ELECTRICITY

3 Insights From CER Update

The federal government’s latest Clean Electricity Regulations (CER) update shows it’s softening its position on sharply cutting emissions from natural gas-fired power plants by 2035. Here are some insights from Keigan Buck, CAI Energy Policy Lead:

- It’s a major win for Ontario, and it also gives Alberta and Saskatchewan more leeway in how they manage their transition to cleaner energy sources.

- The proposed changes are not expected to compromise the 2035 Net Zero target set for the electricity sector if the regulations for offsets are included.

- The devil will be in the details, as the update provides few insights on what the regulations could look like when finalized.

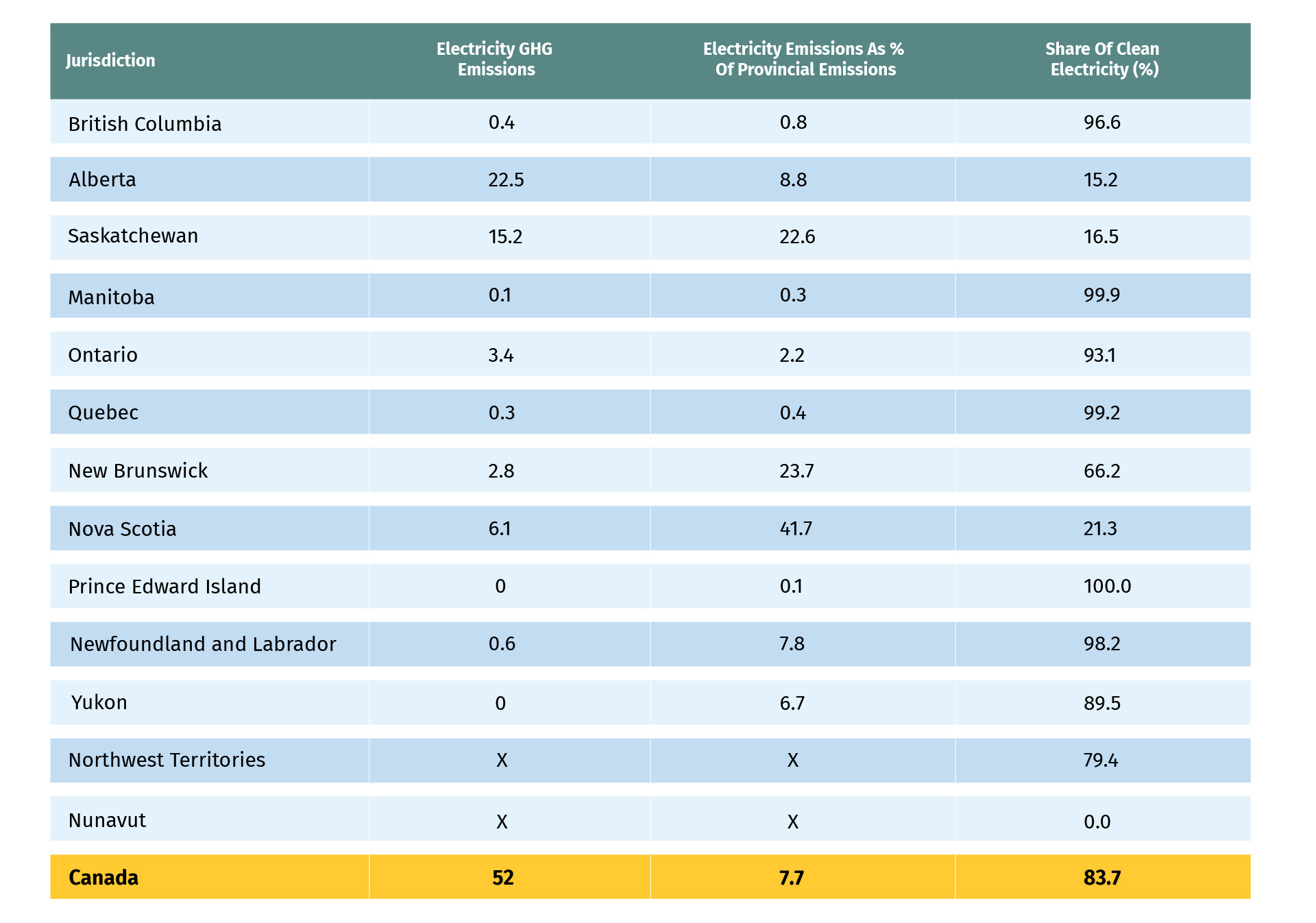

Some Provincial Grids May Struggle To Hit 2035 Net Zero Target

2021 GHG emissions in electricity sector by jurisdiction

Source: Environment & Climate Change Canada, RBC Climate Action Institute

Read the full analysis here.

CHART OF THE WEEK

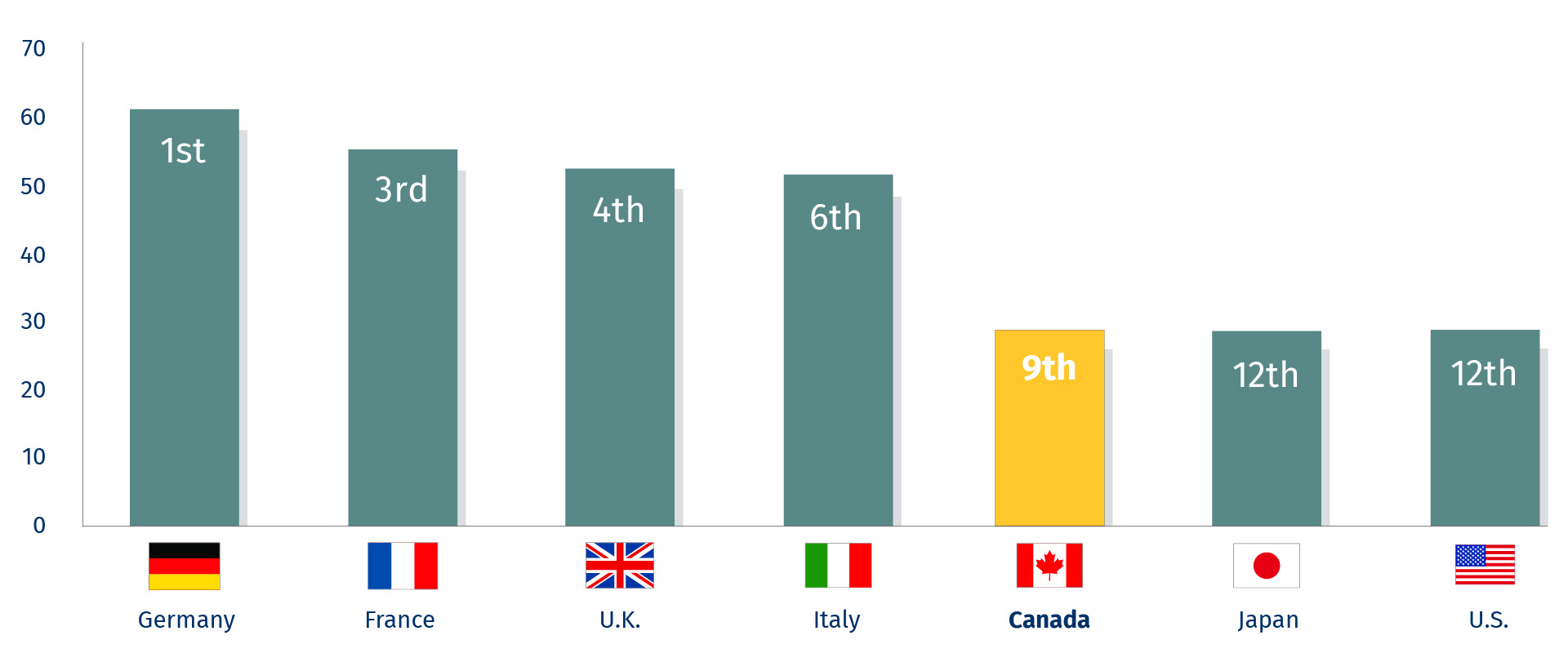

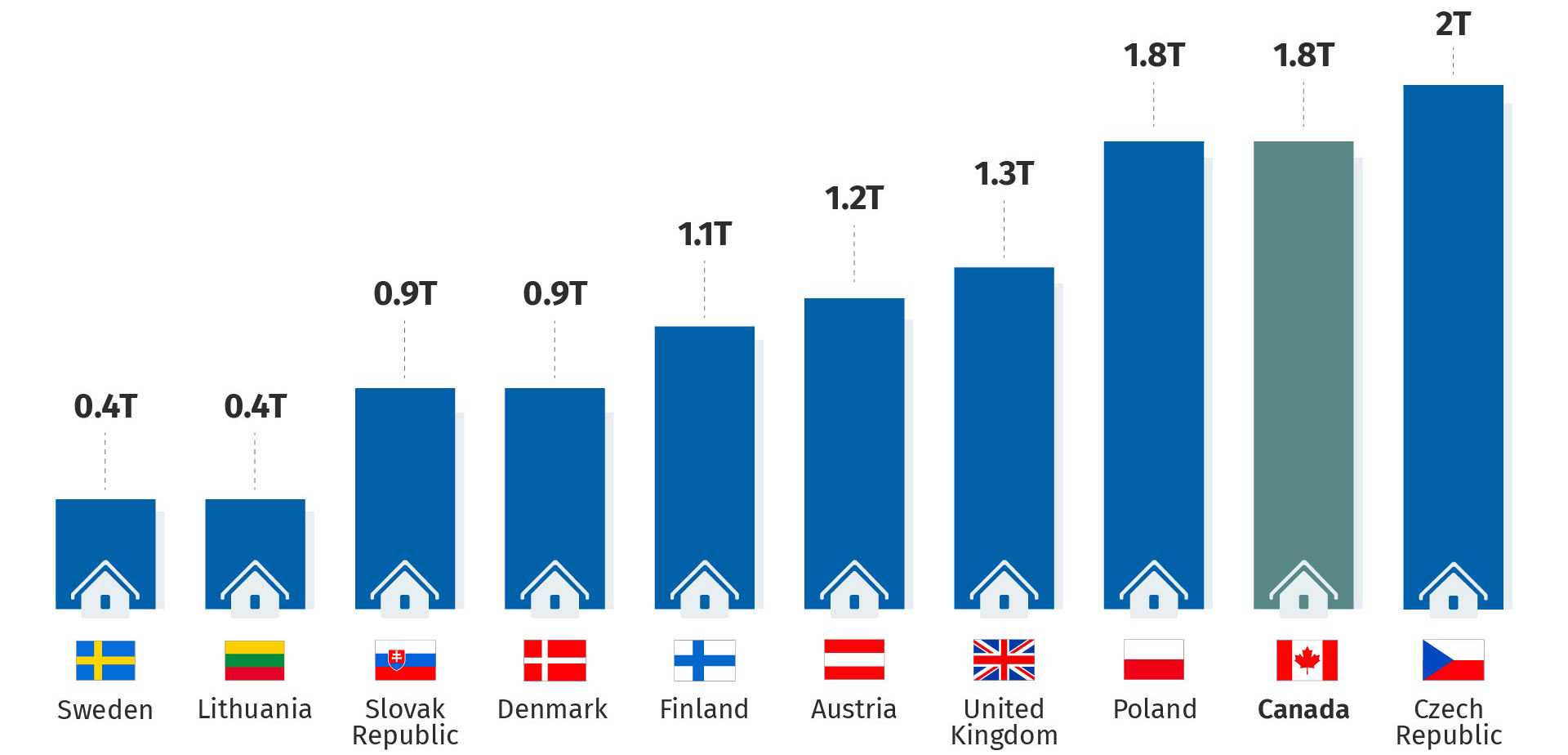

Canada Lags Peers In Building Retrofit Policies

Retrofit Index Score (/100)

Source: 3 Keel, Global Retrofit Index Report, RBC Climate Action Institute

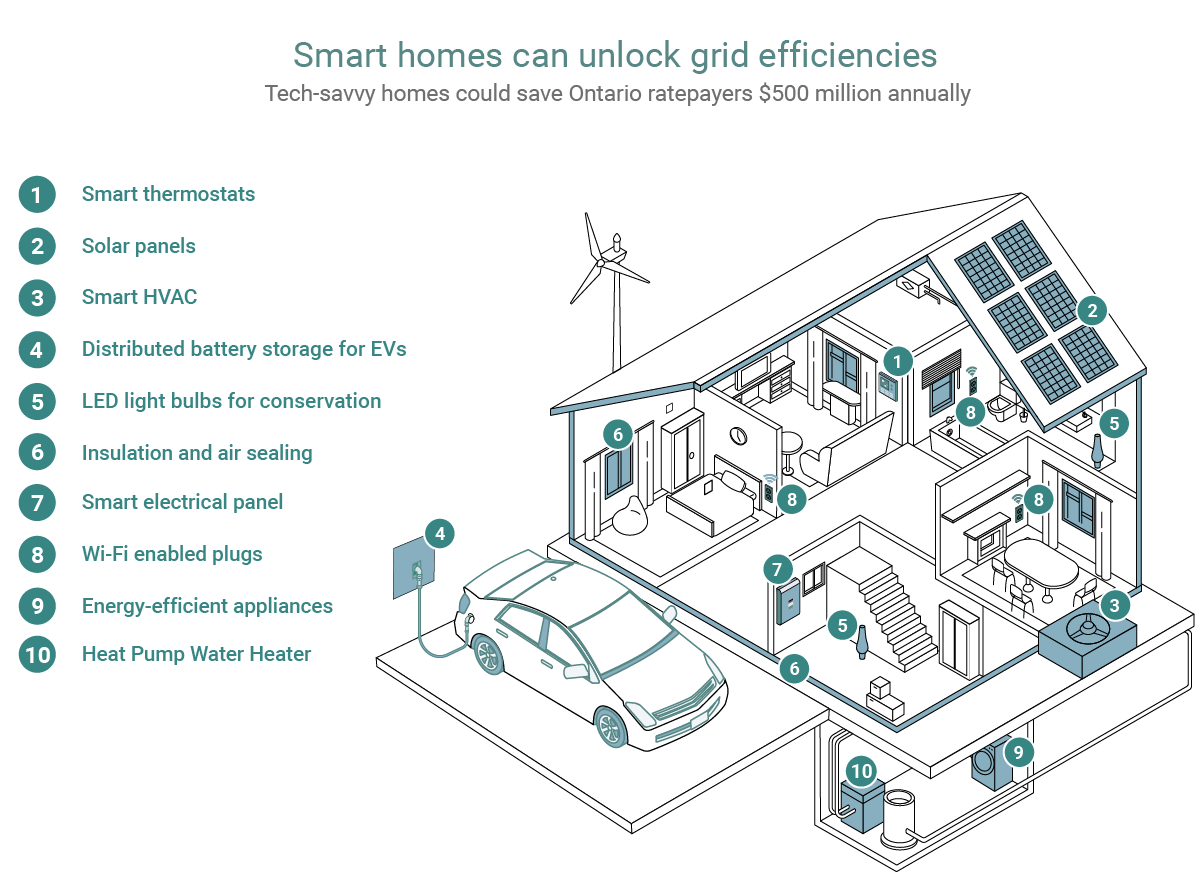

Canadian home builders’ slow adoption of climate smart technologies compared to their global peers could pose a challenge to decarbonizing the sector. Buildings are responsible for 13% of national emissions and a home-building spree and rising populations could drive up the sector’s emissions. Dive deeper into the building sector’s emissions challenge here.

ZEROING IN

100,000

The estimated number of Manitobans that depend on water from aquifers near a proposed silica sand mining project that was rejected by Premier Wab Kinew last week, as governments balance the need for new energy supply chains and protecting the environment. The sand is used to produce solar panels and new batteries. The NDP government recently approved a different silica mine near Lake Winnipeg.

Our first annual report on Canada’s climate progress has some surprising discoveries, why EU farmers are not mucking around, and read our hot Valentine tip.

Time To Double Down

Taxonomy. The “green seal of approval” used to classify sustainable investments was the word that was buzzing on the lips of attendees at yesterday’s launch event for Climate Action 2024, the Institute’s inaugural flagship report on climate. Mark Carney (above), Chair of Brookfield Asset Management, and astronaut Chris Hadfield were in attendance to support the Institute’s first look at the country’s climate progress in six key sectors and ideas on the path forward.

Climate action is happening across the economy, but it’s just not fast enough. Accelerating it would require Canada to double the $35 billion that governments, businesses, and consumers are pouring into climate action annually. Governments are hitting a fiscal cliff. The onus on sustaining and accelerating climate action, in this decade, will fall on businesses.

For their part, businesses are bullish on their climate ambitions. There was consensus among attendees that there’s plenty of domestic and global capital available to finance the country’s transition to a greener economy. Tapping into this pool of money remains a challenge, without a federal taxonomy for green and transition financing. Money flows where it is easiest and where there’s regulatory certainty. The current federal government’s term ends October 2025, but some are predicting perhaps elections could come sooner. In any case, the year before an election is often a lame duck period for pushing initiatives forward that do not lead to a photo op involving the presentation of a novelty cheque. Without a final green and transition financing taxonomy in place before then, Canadian businesses will find it increasingly difficult to access or attract lower cost financing they need to realize their climate ambitions. There’s not a moment to lose as this must be the decade Canadians—governments, businesses and consumers—need to double down on climate action. — Myha Truong-Regan

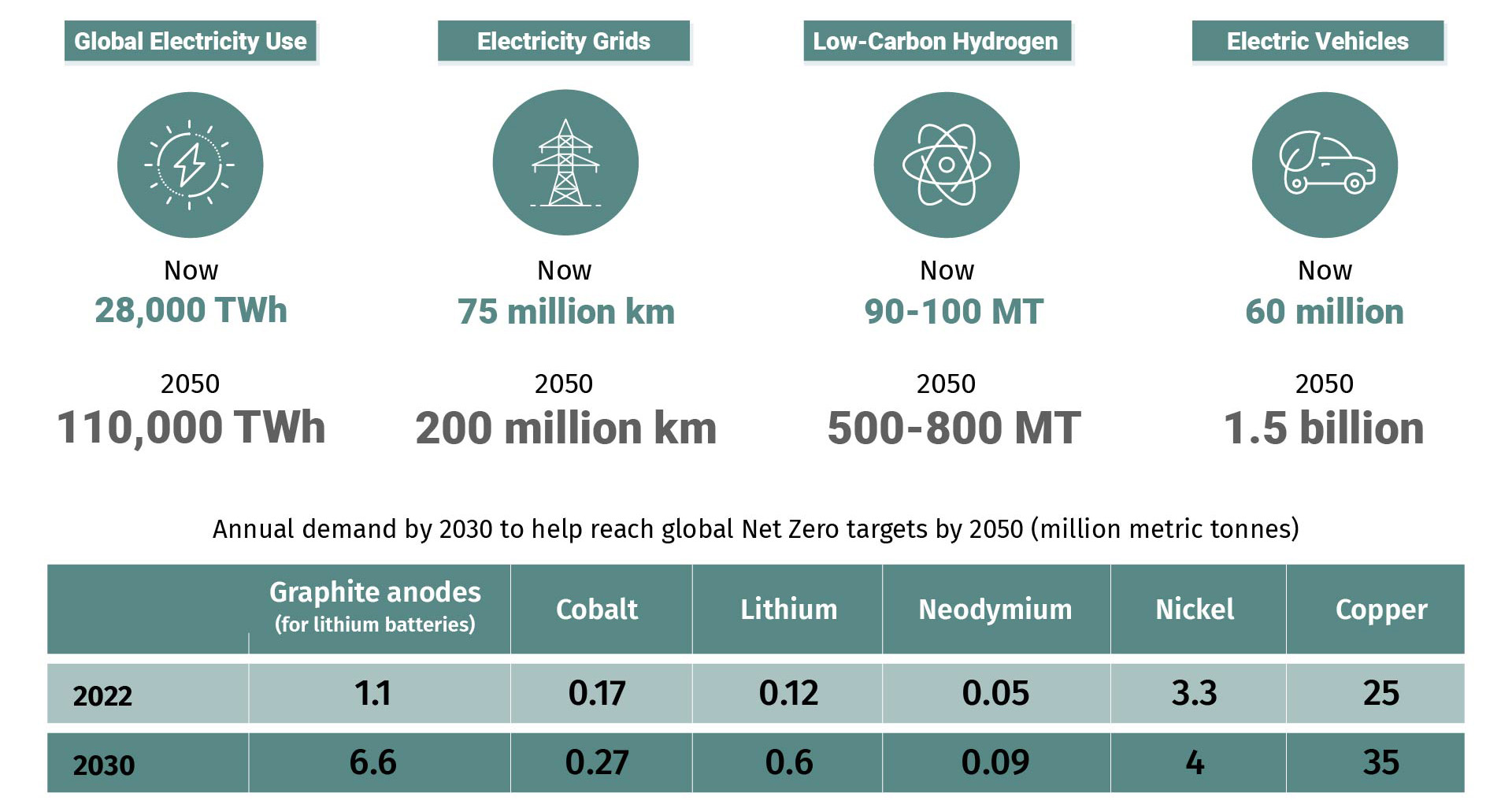

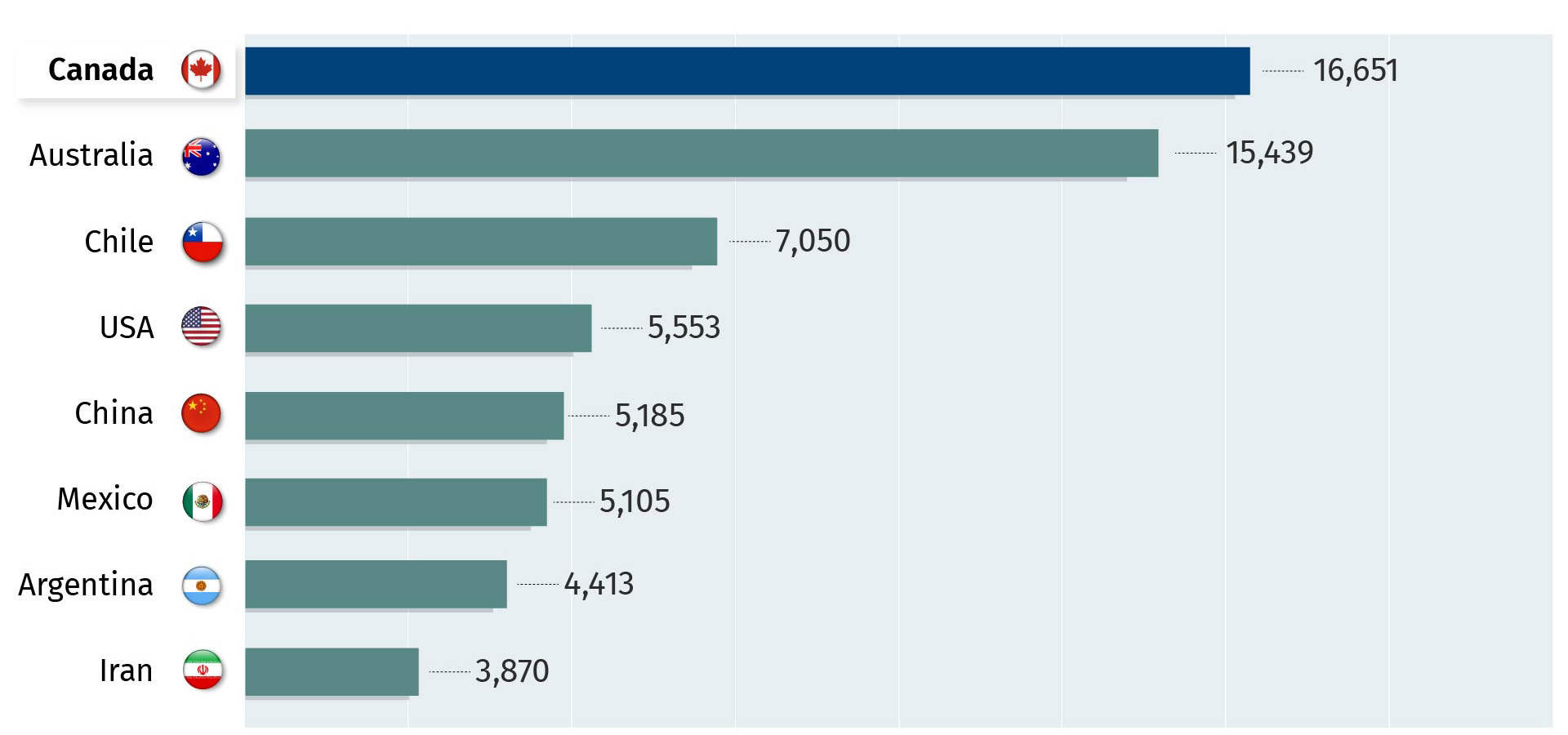

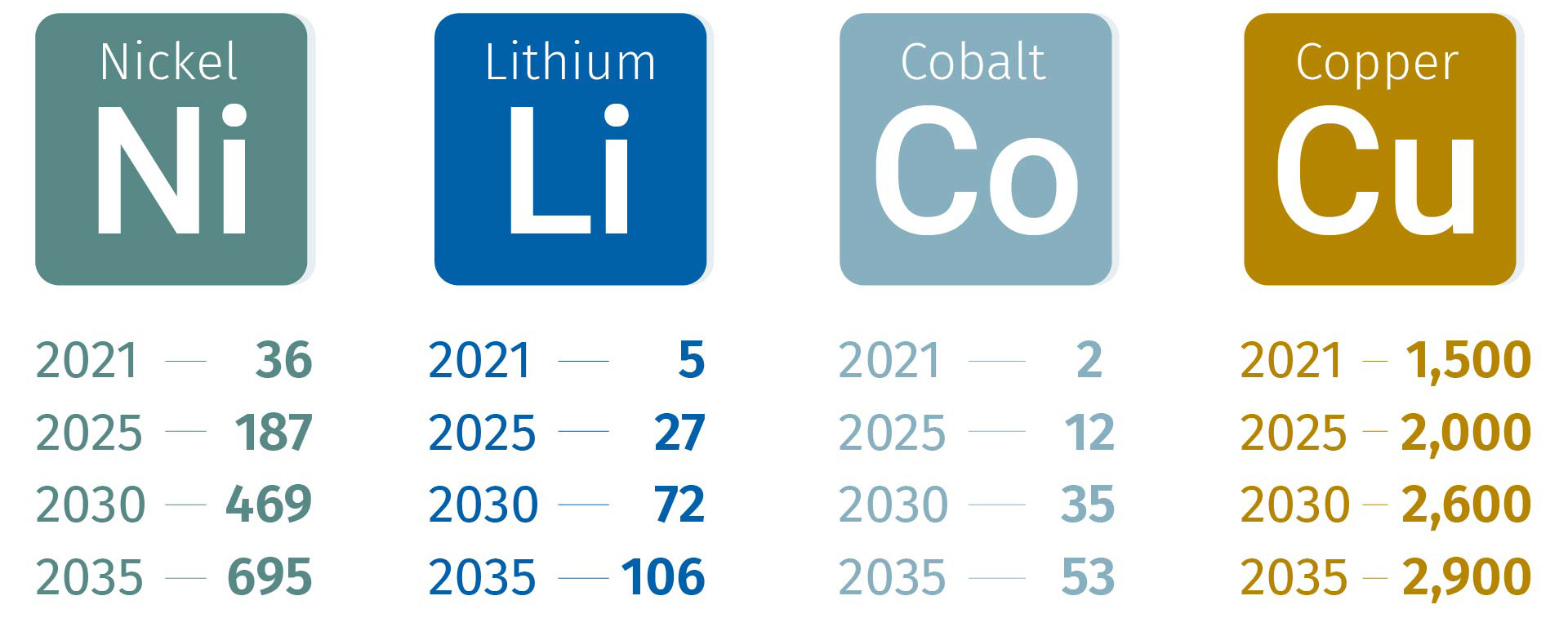

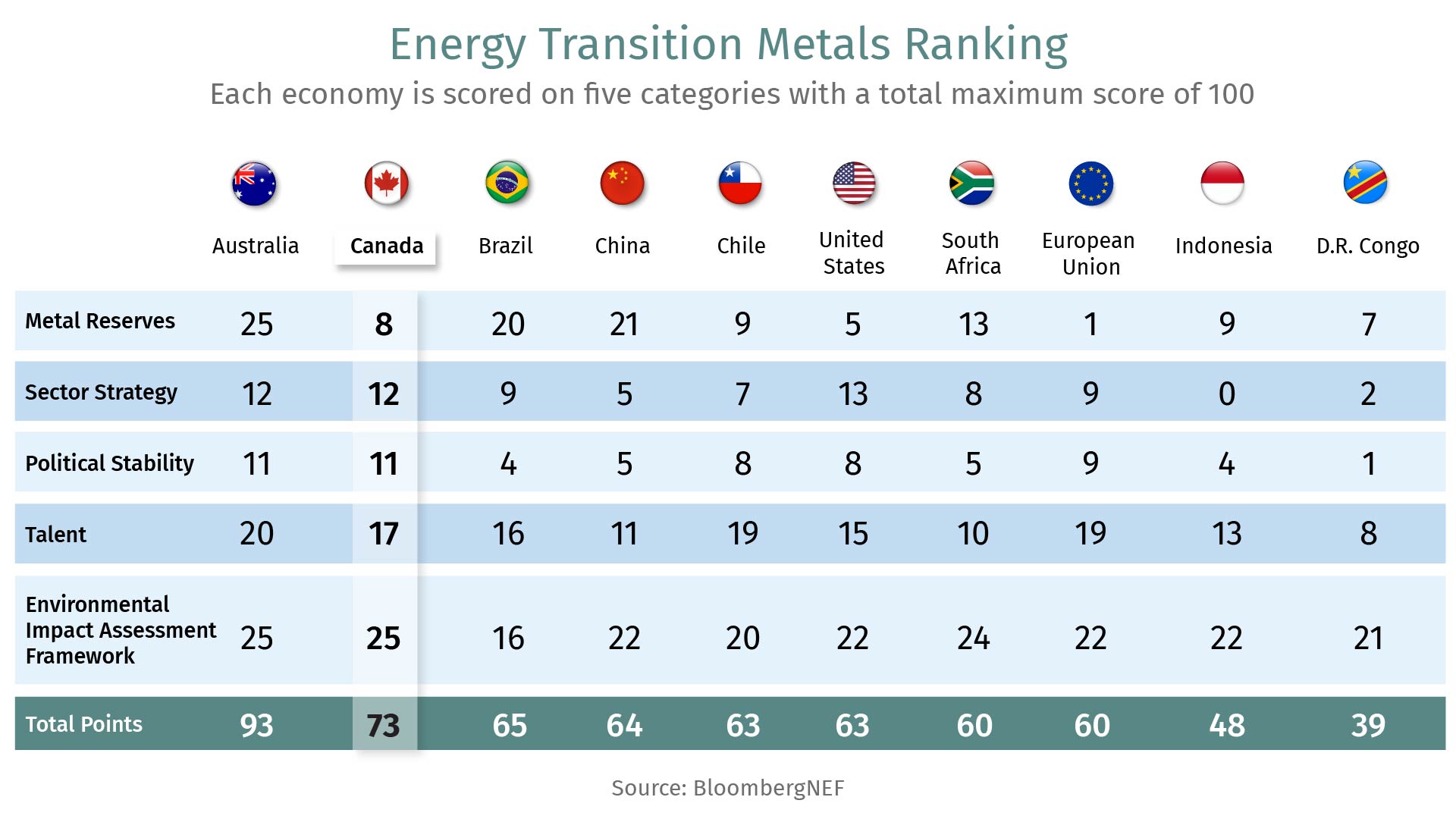

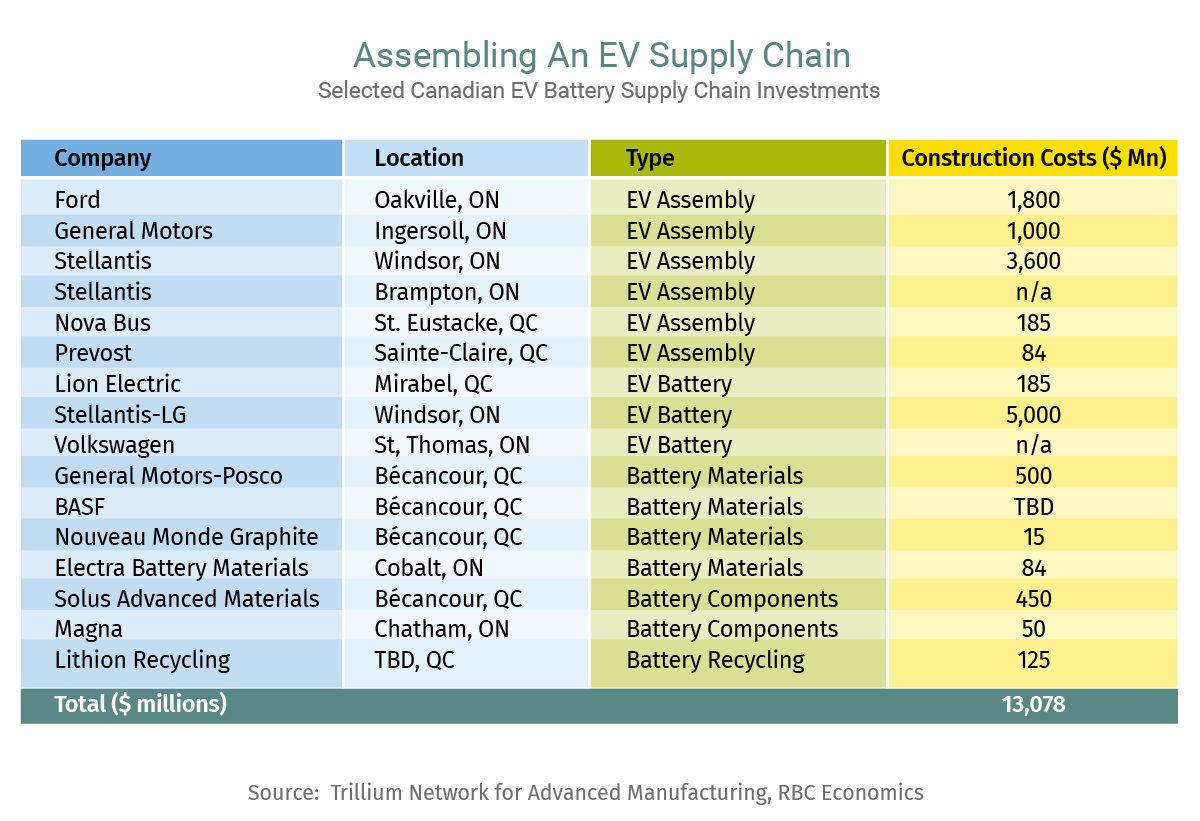

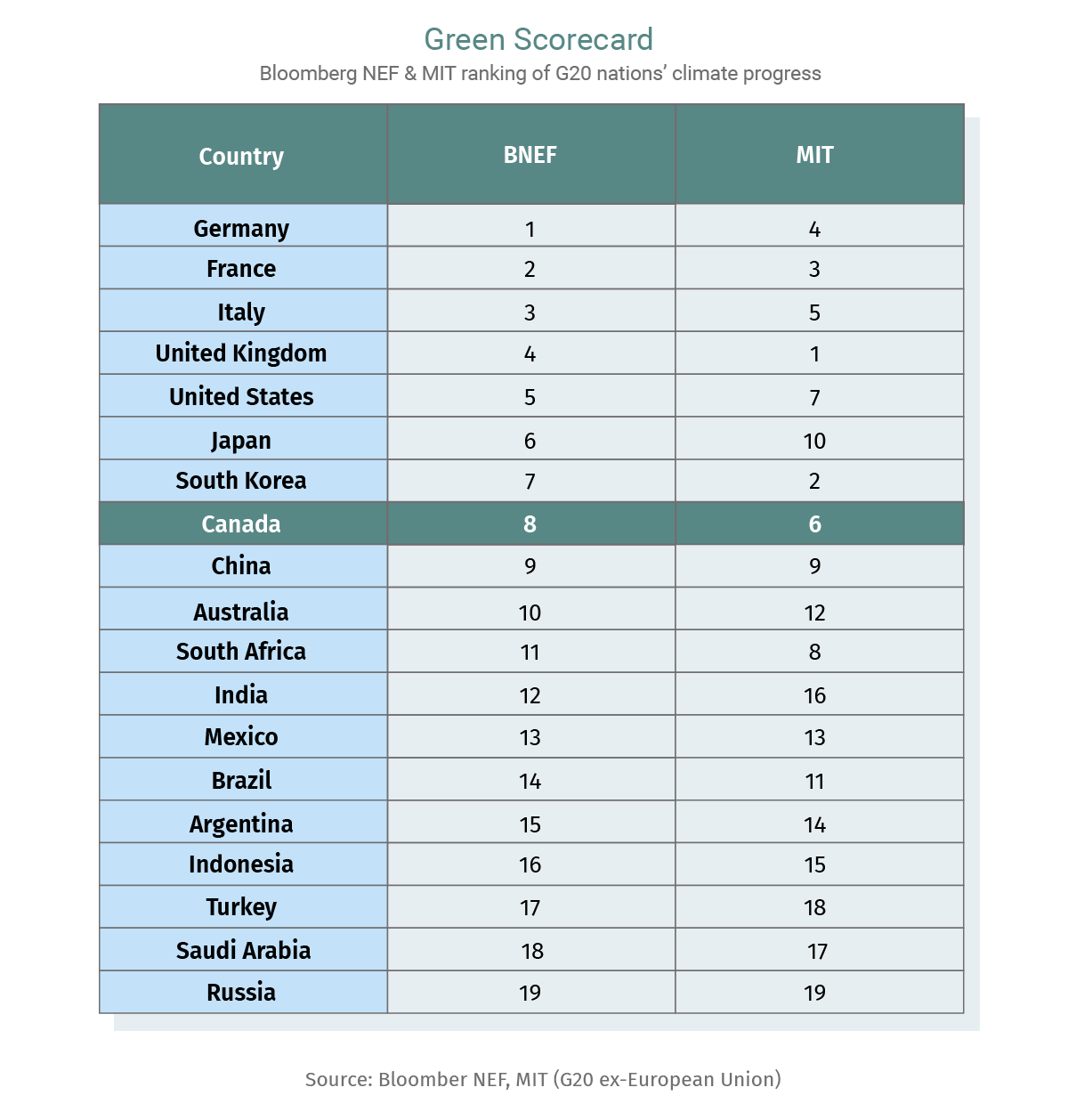

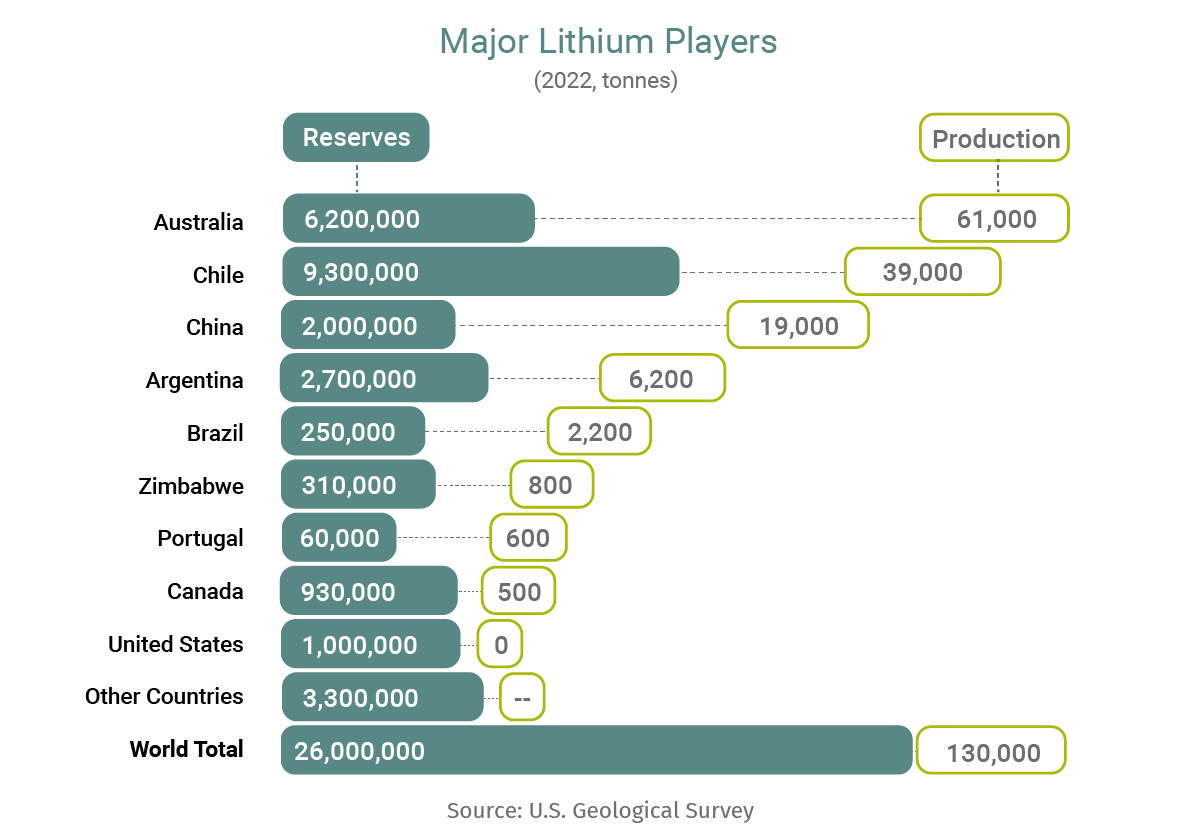

We are #1! Canada displaced China as the world’s best place to build a battery supply chain, according to a new BloombergNEF ranking. The 30-country survey cited Canada’s manufacturing and production advances, robust federal and provincial climate commitment and strong integration with (third-ranked) U.S.’s automotive sector as an ideal location for the global auto sector. While China still boasts the world’s strongest supply chain, BNEF relegated the country to second place due to concerns around the sustainability of its lithium-ion batteries.

EU farmers have a beef with EU’s green rules. Farmers lined up tractors on the streets of Brussels and threw eggs and muck around the EU capital to show frustration at the bloc’s flagship sustainable food policy. Protests have spread across the continent. A key gripe is the EU’s “farm-to-fork” strategy that producers say hurts their competitiveness against imports. The EU has relented, scrapping a plan to halve pesticide use. Agriculture was also excluded from a new EU blueprint to cut the bloc’s emissions by 90% by 2040.

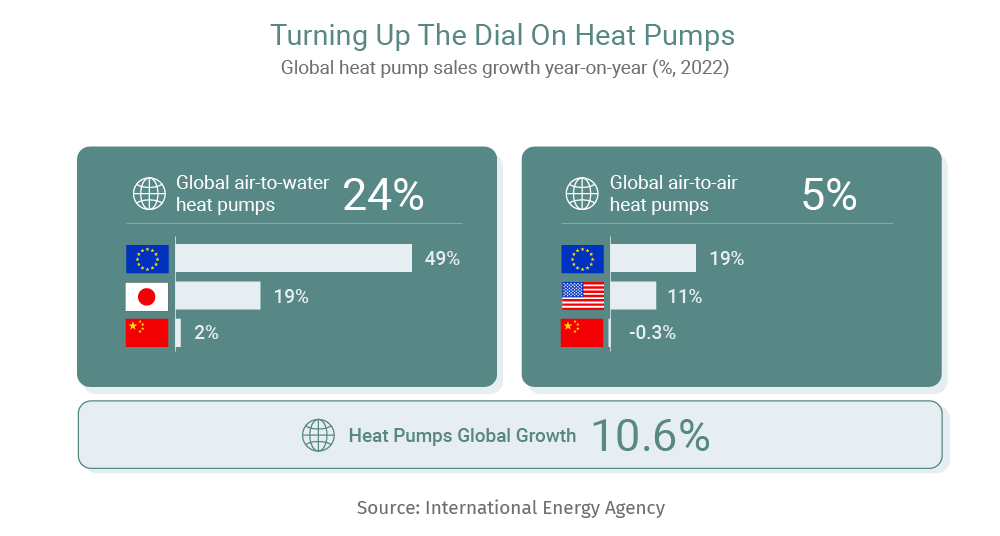

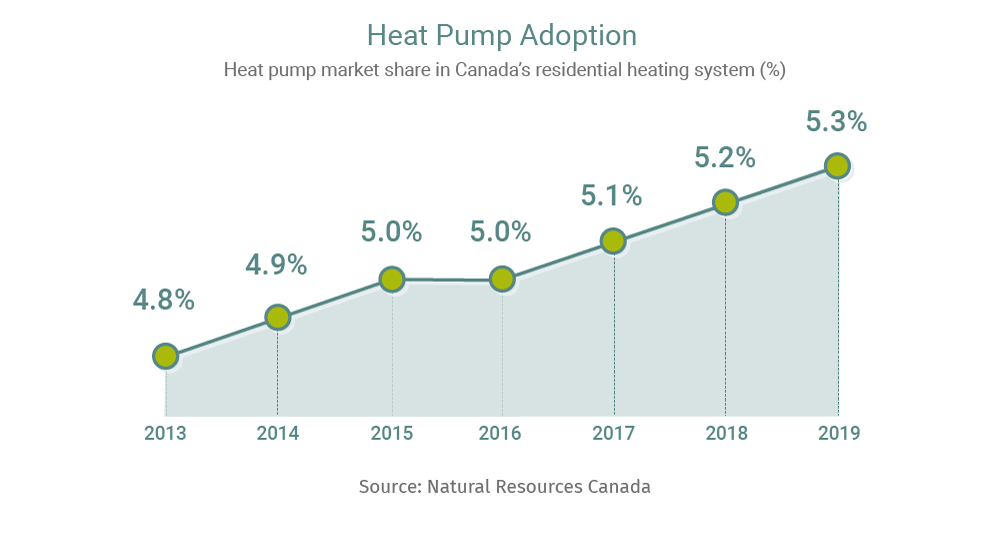

Canada Greener Homes Grant is being reset. The program that runs out in two weeks has aided more than 165,000 households install heat pumps and other home energy improvements. The new phase will target low and median income Canadian households to address concerns that the program favoured those in higher income brackets. By 2027, the program is expected to help up to 550,000 households save an average of $386 on their energy bills annually and have the impact of removing 185,000 cars from roads each year.

Clean energy propped up the Chinese economy in 2023. The sector contributed a lion’s (dragon’s?) share of US$1.6 trillion to the world’s second largest economy, according to Carbon Brief. Without clean energy growth, the country’s GDP would have sputtered to a relatively muted (by China’s standard) 3.3% than the actual 5.2% in 2023. Electric vehicles were among sectors that drove growth, with Shenzhen-based BYD recently surpassing Tesla in car sales. But Chinese authorities have recently warned of an overcrowded domestic EV market as global growth cools.

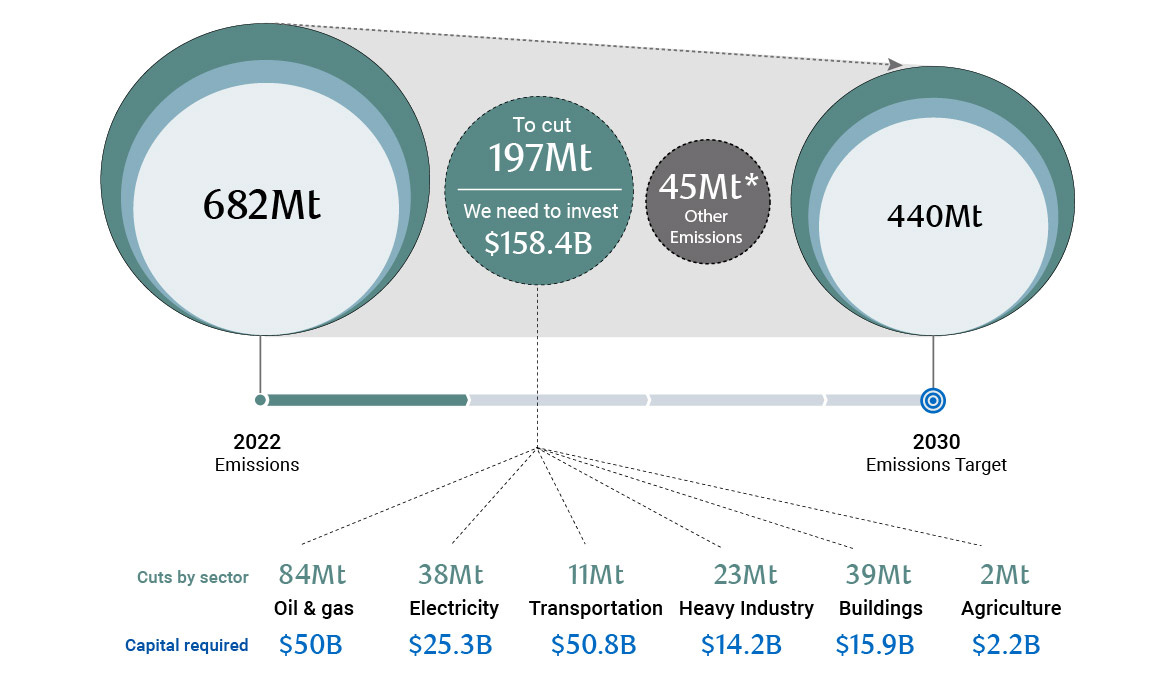

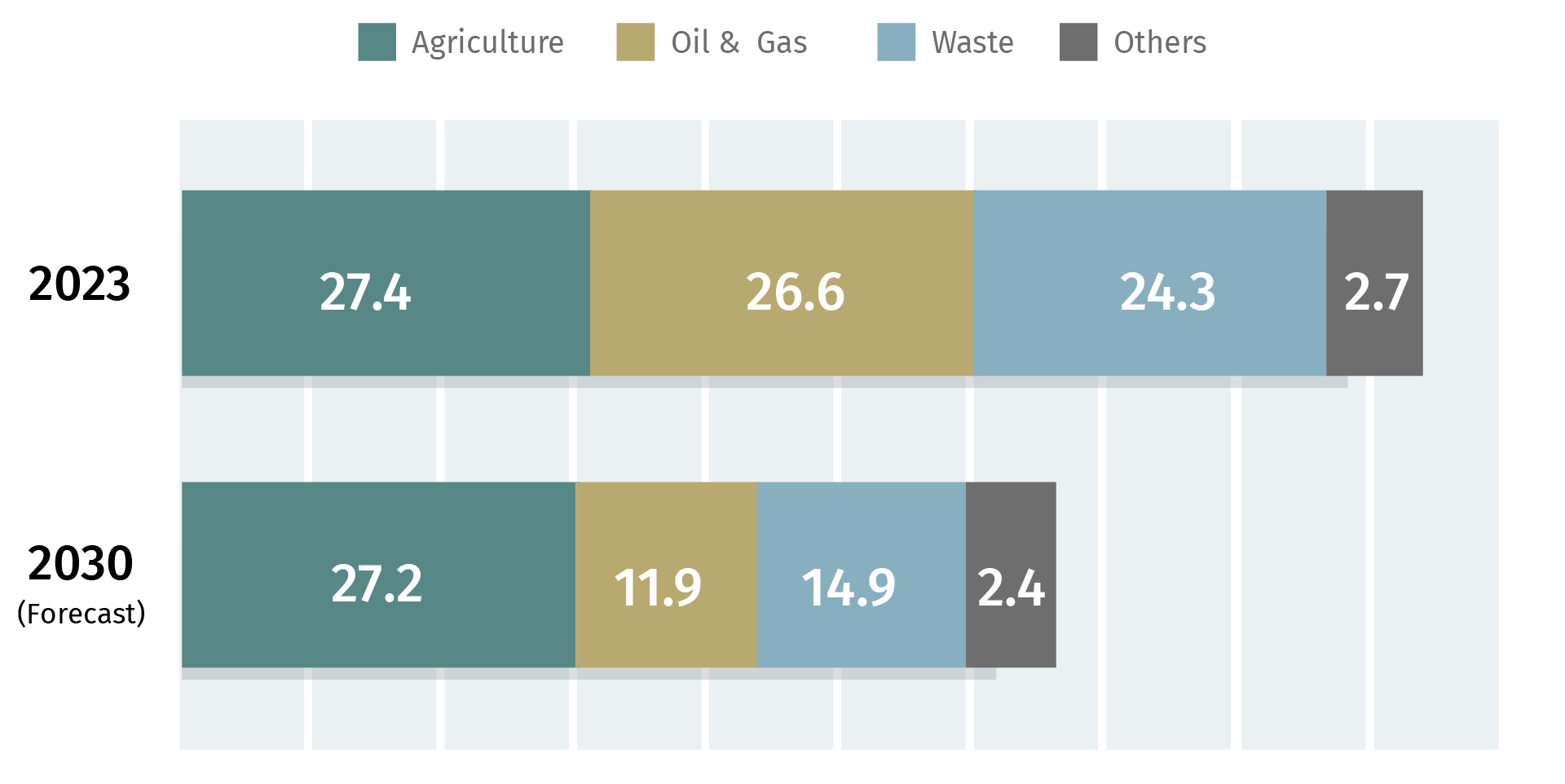

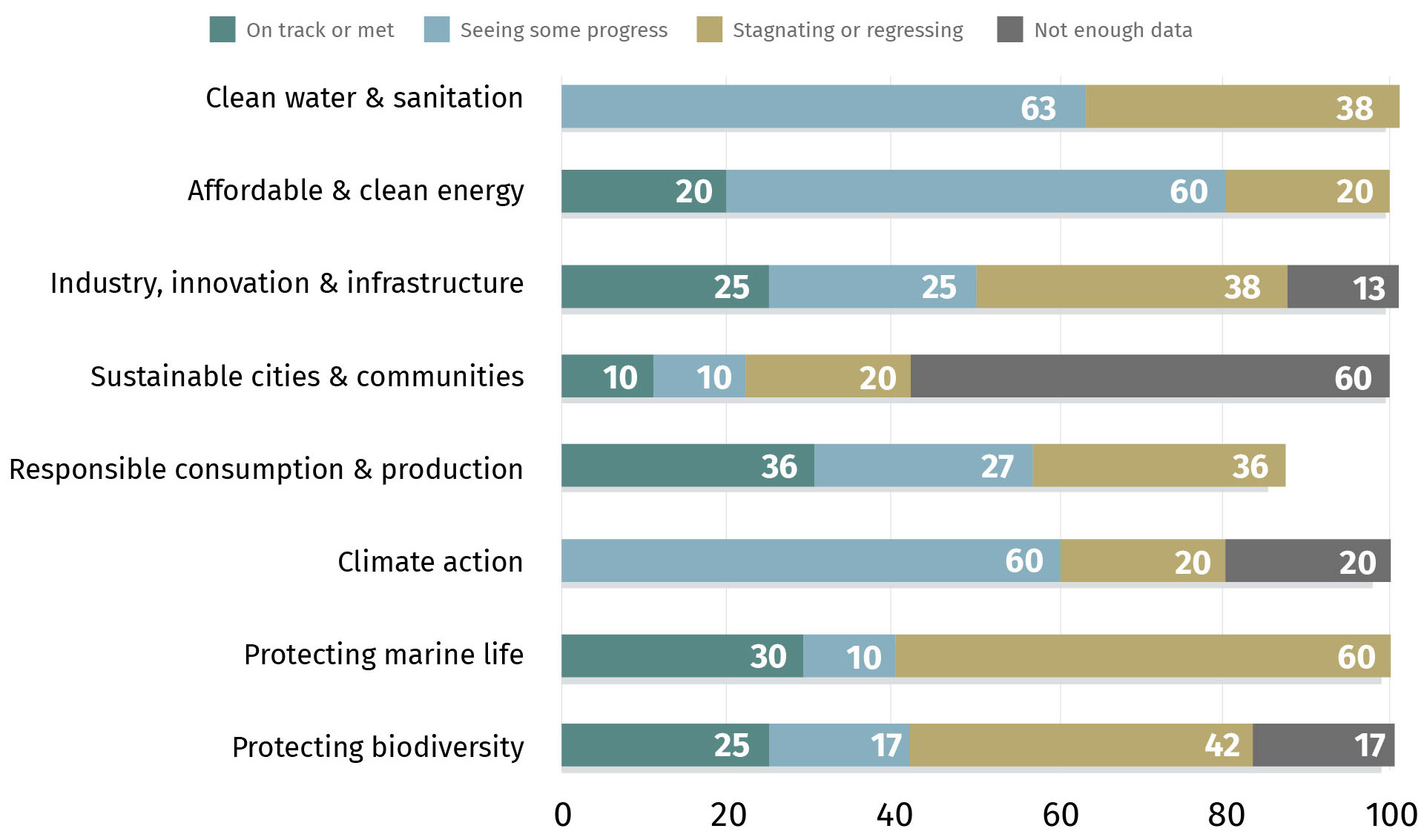

5 (More) Takeaways From The Climate Action 2024 Report

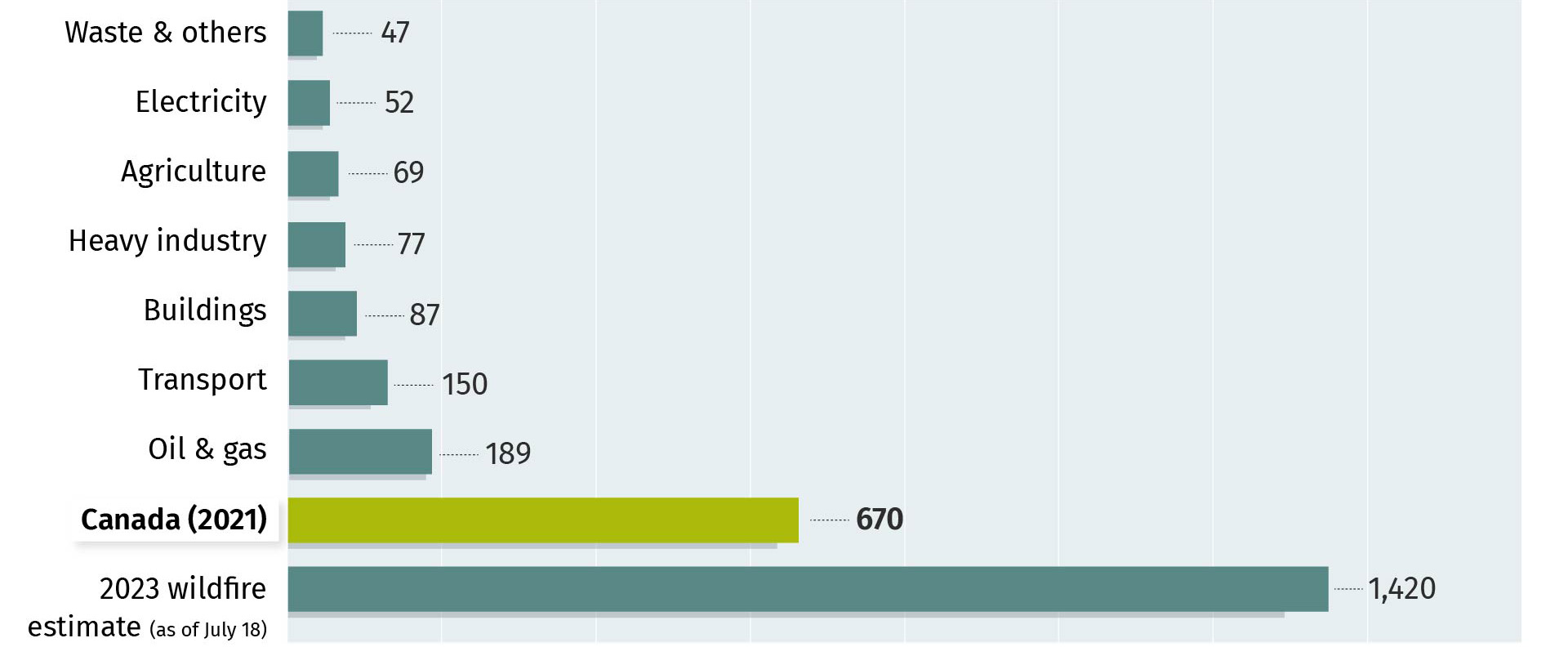

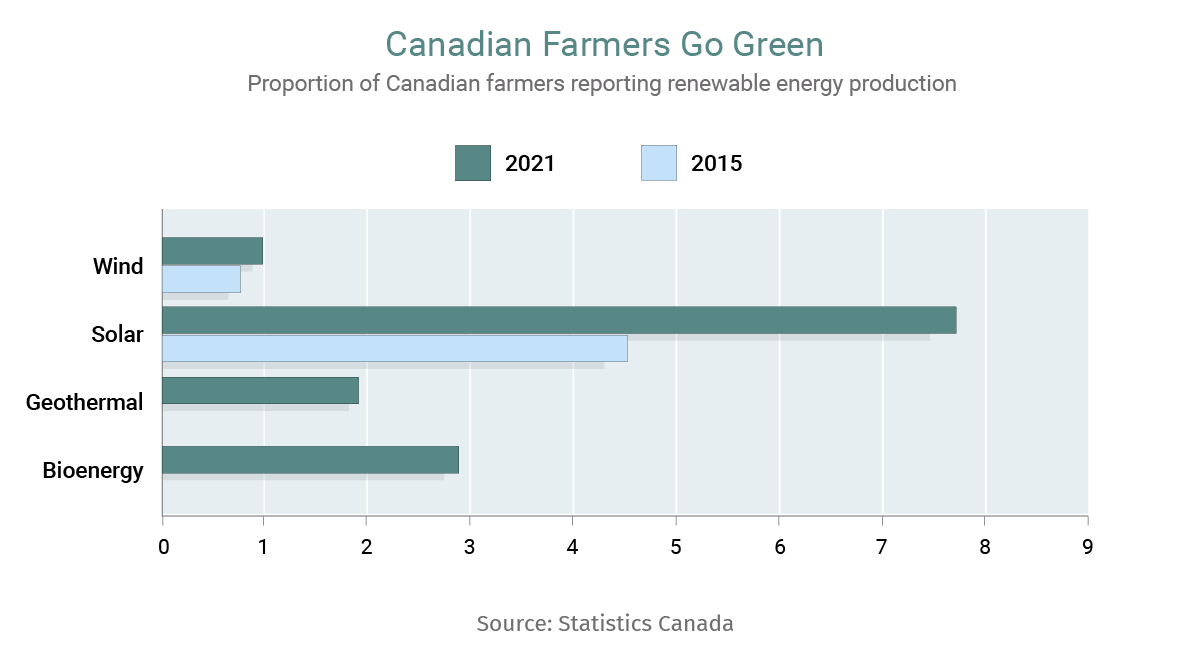

Our first ever report on Canada’s climate progress is an annual health check on the state of climate action in the country. While there are pockets of progress, all the key sectors—oil and gas, buildings electricity, transportation and heavy industry—must do more. Only agriculture is set to surpass its 2030 climate goals, but even farmers have their work cut out for them.

The Capital and cuts needed to hit Canada’s 2030 goals

*Other emissions include waste and

LULUCF (Land use, land-use change and forestry)

The report’s key findings are here, but here’s an alternative list of discoveries I found surprising:

- Only 6% of the necessary new wind generating capacity is under construction to meet the goal of a Net Zero electricity grid by 2035. And we may struggle to build more as Ontario recently gave local communities more power to reject wind projects. Nimbyism, or Not In My Backyard, fear is real.

- Only one in 10 Canadian commuters drives longer than 70 kilometers a day to and back from work—sufficient with a single electric vehicle charge each week. Yet range anxiety is real among Canadians. Is that holding back EV sales?

- Around 40% of the world’s heat pumps are manufactured in China, which is both a leading exporter and domestic user of the technology. Could that pose supply chain challenges as global demand heats up?

- While Canadian farmers worry that new climate friendly practices won’t yield adequate returns, roughly a fourth are also very concerned about lack of labour. As we wrote in a report last year, 40% of farmers are set to retire by 2033.

The world appears to be getting a handle on tackling oil and gas’s methane emissions. But maybe we aren’t measuring all of it. In Canada, seven of the 130 projects focused on methane abatement do not track emissions.

Read the full report here.

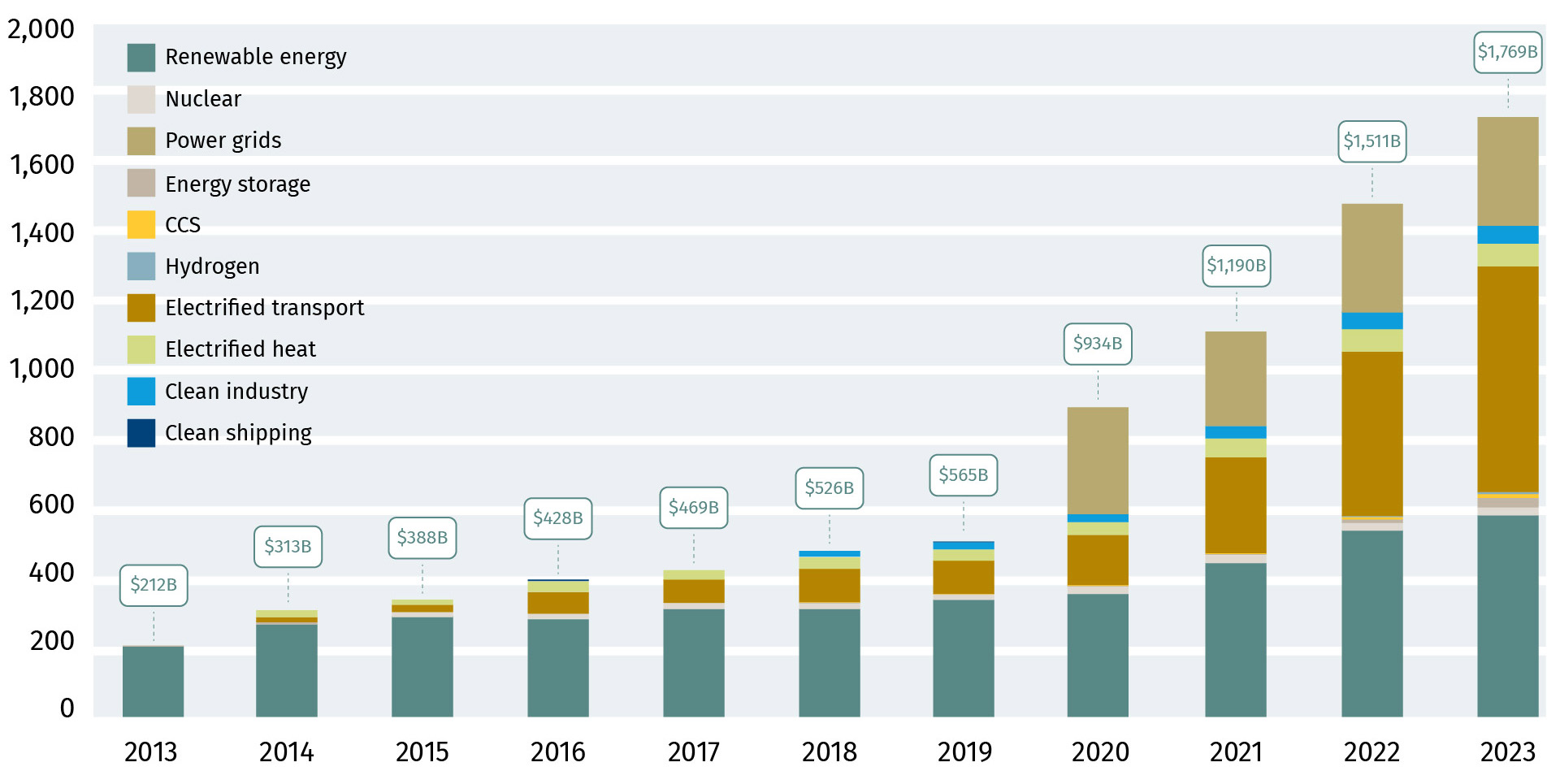

CHART OF THE WEEK

Energy transition saw a record investment of US$1.76 trillion in 2023, BloombergNEF data shows. But it’s not enough: investments will need to rise 2.7x to US$4.8 trillion from 2024 to 2030 to reach BNEF’s Net Zero scenario.

That required acceleration is identical to what Canada needs: 2.7 times to $60 billion annually during that period, according to our Climate Action 2024 report.

Record Investments Injected In Global Energy Transition (US$ Bn)

Global investment in energy transition by sector

Source: Statistics Canada, RBC Economics Research

ZEROING IN

78,000 cars

The equivalent of emissions generated by Colombian roses and other cut flowers flown to the U.S. during Valentine’s Day (in 2018). Colombia was the top source of cut roses in Canada last year. Hot Valentine tip for next Wednesday: look for locally-produced perennials and tell your friendly florist to drop the plastic wrapping.

In this week’s edition: The world—kinda, maybe—agreed to move away from fossil fuels in oil town, more Canadians Googled about climate anxiety than ever before, and Ottawa sets its sight on lowering climate-fouling cow burps.

Climate Signals is going on a short break. We will back on Feb 16, subscribe here to ensure you don’t miss an issue. Happy holidays!

Circus in the Sand: COP28 And Climate’s Midlife Crisis

By John Stackhouse

The business COP. The oil COP. The pragmatic COP. The sellout COP. There were almost as many labels thrown at COP28 as there were people (100,000) at the climate conference in Dubai. But one thing’s for sure: the annual UN gathering may never be the same. There were electric bikes and scooters to ferry people around the vast Dubai Expo site, retractable outdoor shades to protect them from the sun and acres of indoor trade show pavilions showcasing everything the Middle East is doing in the new economy. And in the end, there was a remarkable, if flawed, agreement to push the world away from fossil fuels.

Did the end of the oil age just happen in one of the world’s wealthiest oil cities? Or was this more diplomatic show than strategic will? Either way, the 28th Conference of the Parties to the UN climate agreement will be seen as a turning point in climate diplomacy. Perhaps a midlife crisis. Perhaps a coming of age. Here are some of the trends I spotted:

Climate Action Is Now Big Business: Dubai was a good metaphor for the COP conundrum, with a can-do business culture focussed on Net Zero. The host United Arab Emirates made no apologies for a business-focused conference, placing it in a massive trade park that normally houses some of the world’s biggest festivals of capitalism. Many of the business leaders spent more time at lavish side conferences and events in Dubai’s celebrated swanky hotels, where US$37 billion in commitments were announced, including US$7 billion for climate-smart food systems.

It’s A Long Way From Paris: While the ink is still drying on the final communique, COP28 will likely be remembered as the fork in the road that started in Paris in 2015. Back then, COP21 was all about ambition as the world pledged to cut greenhouse gas emissions significantly and quickly enough to prevent catastrophic climate impacts. Progress from Paris has been patchy, as was reflected in a “stocktake” exercise in Dubai. The conference’s theme—Unite, Act, Deliver—spoke to a more pragmatic tone that may soon see the world concede that the Paris goals that were updated at COP26 in Glasgow may not be possible, at least not in the time given.

It’s About The Oil, Stupid: The COP host, Sultan al Jabbar, also runs UAE’s main oil and gas company, and is a serious player in OPEC. So, it was a big deal when he kicked off the conference with a commitment from 50 oil majors, representing 40% of global production, to decarbonize by 2050, and then ended the conference with the first commitment ever by the world to transition away from fossil fuels. The when, where and how of that remain unresolved, but COP28 drew a line in the sand.

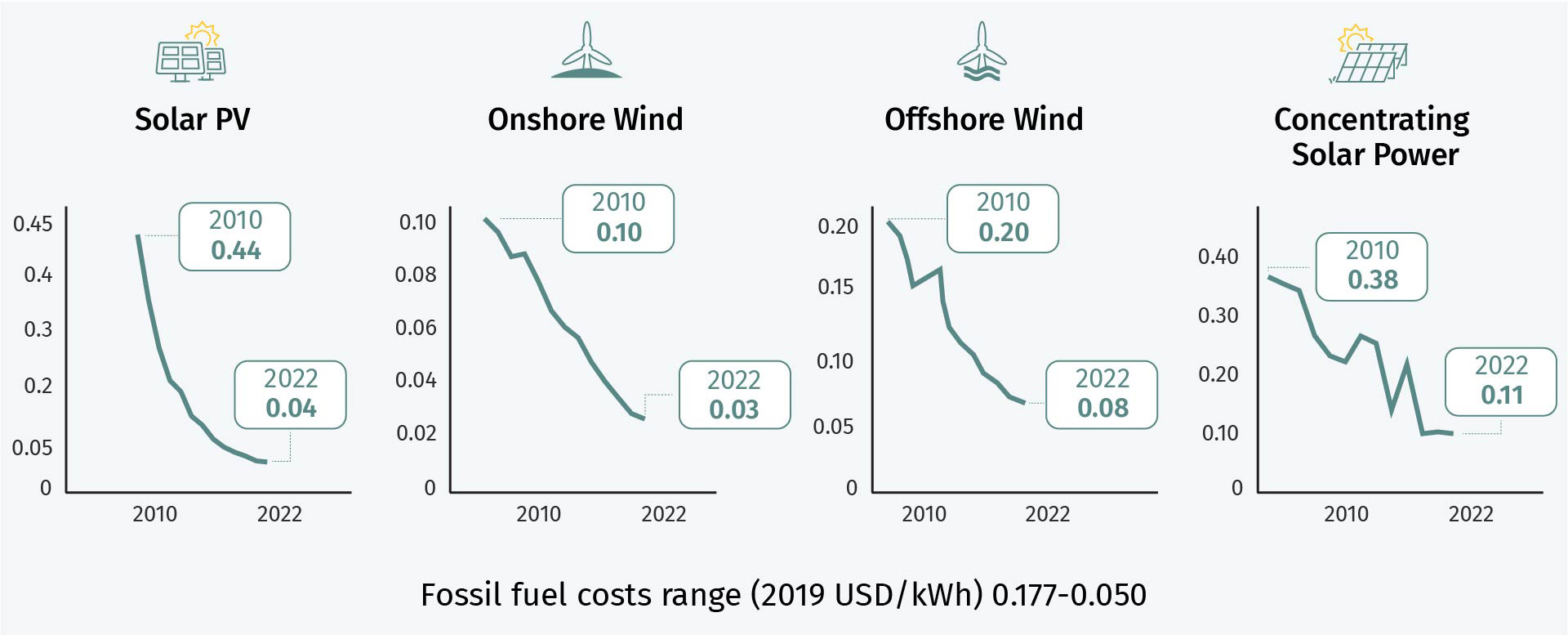

No, It’s About Renewables: One strong sentiment at COP28 was around the irreversible rise of renewables. The conference committed to tripling renewables by 2030 while doubling energy efficiency. Wind and solar can be seen everywhere in the UAE, which fancies itself as a renewables powerhouse. Green hydrogen was also the talk of the conference. That’s the hydrogen created by wind or solar power and usually converted into ammonia to be shipped to energy-hungry markets. Who will be the big supplier? The Saudis and Chinese are working together across Asia to establish an early grip, while the U.S. is considering a more ambitious hydrogen export strategy. With the right incentives to compete with fossil fuels, Texas hydrogen could be the Sino-Saudi alliance’s biggest rival. And then there’s Canada, with proposals in Newfoundland, Nova Scotia and Quebec. A green hydrogen race is on.

Or Is It About The Mix?: Energy security is not a popular expression at COP, but it’s clearly top of mind for the Biden administration. Yes, John Kerry still gets most of the podium time at these conferences, with his Al Gore-inspired jabs at Big Oil. But away from the mic, other officials laid out a more pragmatic view rooted in national security. They don’t want to be dependent on a single supplier of anything, which means the U.S. and its allies will need to produce a wider array of energy, even if that costs the economy a bit more. That could include a lot more nuclear: 20 countries, including Canada, came to COP to commit to tripling nuclear production by 2050. That will require 100 gigawatts of extra nuclear power—10 times current levels—to get to Net Zero.

For more on John’s post-COP insights, read his full dispatch from Dubai here.

Listen to the Podcast here

Where’s the next COP? Baku, capital of Azerbaijan, is confirmed as the host of COP29. It was all very geopolitical: it was an Eastern European country’s turn (that included former Soviet states) to host the annual UN climate summit, but Bulgaria was forced to drop out after Russia threatened to veto any bid from an EU country because of the bloc’s support of Ukraine. Armenia, a fierce rival of Kremlin-neutral Azerbaijan, also withdrew partly to resolve its conflict with its bigger neighbour. The decision means the annual climate conference will be held in an autocratic fossil-fuel producing nation for the third year in a row.

Canadian renewables are set to bounce back after a tough few years. That’s RBC Capital Market’s 2024 forecast for an industry that’s struggled due to a combination of supply chain constraints, higher interest rates and significant project cost inflation. However, a new dawn could break in 2024 as government subsidies and tax credits accelerate renewable deployment. “We believe 2024 tailwinds for the sector include lower interest rates, moderating inflation, and a slowdown in economic activity (improves labour availability),” the report noted.

Carrots for ag, sticks for oil and gas. Fresh from releasing an emissions cap proposal on oil and gas, Ottawa unveiled a greenhouse gas offset credit draft system to encourage beef cattle farmers to cut enteric methane that’s emitted during the digestive process of cows and is released into the air when cows burp. If finalized, it could prove significant as agriculture accounts for 31% of Canada’s methane emissions.

Feeling climate-anxious? Google searches for climate anxiety shot up this year globally, with search queries in English around “climate anxiety” in the first 10 months of 2023 around 27 times higher than six years ago, while searches in Chinese, Arabic and Portuguese were also on the rise. Google Trends combines eco anxiety with climate anxiety. Queries around climate change (up 120%), adaptation (up 120%), greenhouse gas emissions (up 120%) and sustainability (up 40%) were also popular over the past year.

CHART OF THE DAY

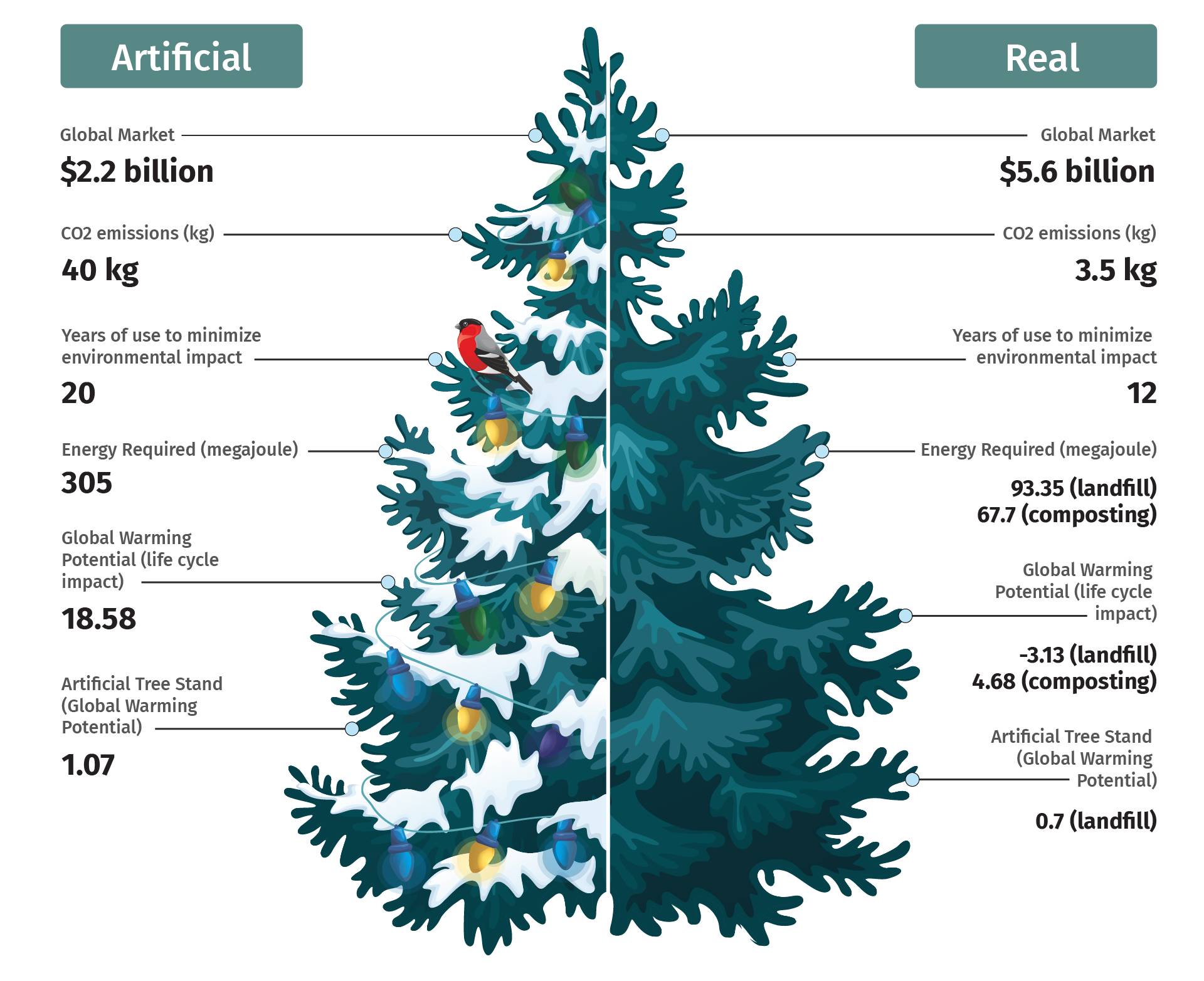

Christmas Tree Debate: Fake Or Real Fir?

Life cycle impact after one year prior to disposal of artificial and real Christmas trees

Source: RBC Climate Action Institute, Mordor Intelligence, Cognitive Market Research, PE Americas

We don’t want to come across as the Grinch who dampened your holiday cheer, but the festive season can lead to a bit more wastefulness (or is that waist-fulness?) as we indulge and splurge more than usual. Christmas trees present themselves as decorations that could do with a bit more climate thoughtfulness. While real trees seem to be the sustainable choice—if disposed of responsibly—there are no wrong answers: if you prefer the artificial variety, just make sure you roll it out year after year.

ZEROING IN

12th

Vancouver’s ranking in a global survey of top global cleantech hubs. The Toronto-Waterloo region was ranked 13th and Calgary was a distant 31-35th in the Startup Genome survey. Silicon Valley, London and Amsterdam-Delta, in that order, were ranked as the world’s top three cleantech hives.

In this week’s edition: Climate summit president backtracks on controversial fossil fuel comments, ‘tripling’ is the new buzzword at COP, and why a heavier lift is needed to fund the new energy economy.

COP28 president faces backlash for ‘no science’ comments. Sultan Al Jaber, president of this year’s UN Climate Change Conference in Dubai, was forced to defend his country’s commitment to climate change after he was quoted as openly doubting the connection between fossil fuels and global warming at a pre-COP meeting. Jaber claimed his comments were “taken out of context,” but it has reignited criticism of the host, including by UN Secretary General Antonio Guterres. The UAE is among countries that risk losing half their income if fossil fuel demand plummets, according to Carbon Tracker.

Under pressure oil companies pledge to decarbonize by 2050. Fifty oil companies, including 29 state-owned companies such as Saudi Aramco, committed to decarbonize by 2050 and cut upstream methane emissions to near-zero by 2030. The move comes as COP negotiators consider calling for a formal phase-out of fossil fuels as part of a final deal. Ex-U.S. vice president Al Gore remains skeptical of the oil majors’ pledges: “They’re much better at capturing politicians than they are at capturing emissions.” Critics also worry about the rising number of fossil fuel lobbyists at this year’s event.

Some are calling it “world-leading” draft rules on methane. Flanked by U.S. Climate Envoy John Kerry at the COP28 summit in Dubai, Environment Minister Steven Guilbeault announced new draft methane rules that set a target of reducing Canadian oil and gas methane emissions by at least 75% from 2012 levels by 2030. Domestic dissension has already taken off with Alberta vowing to challenge the “costly, dangerous and unconstitutional” measures.

A Prince Edward Island-born teacher won a climate award at COP28. Lucas Olscamp, a teacher at Pearson College UWC on Vancouver island, won the Burjeel Holdings-Oxford Saïd Climate Change Challenge in Dubai for his work on embedding Indigenous beliefs in his course. Olscamp was the only Canadian finalist among 600 entries. The course, “Narrative Ecology, Selfhood and Thinking,” now in its second year, is part of the school’s Climate Action Leadership Diploma program.

CLEAN TECH

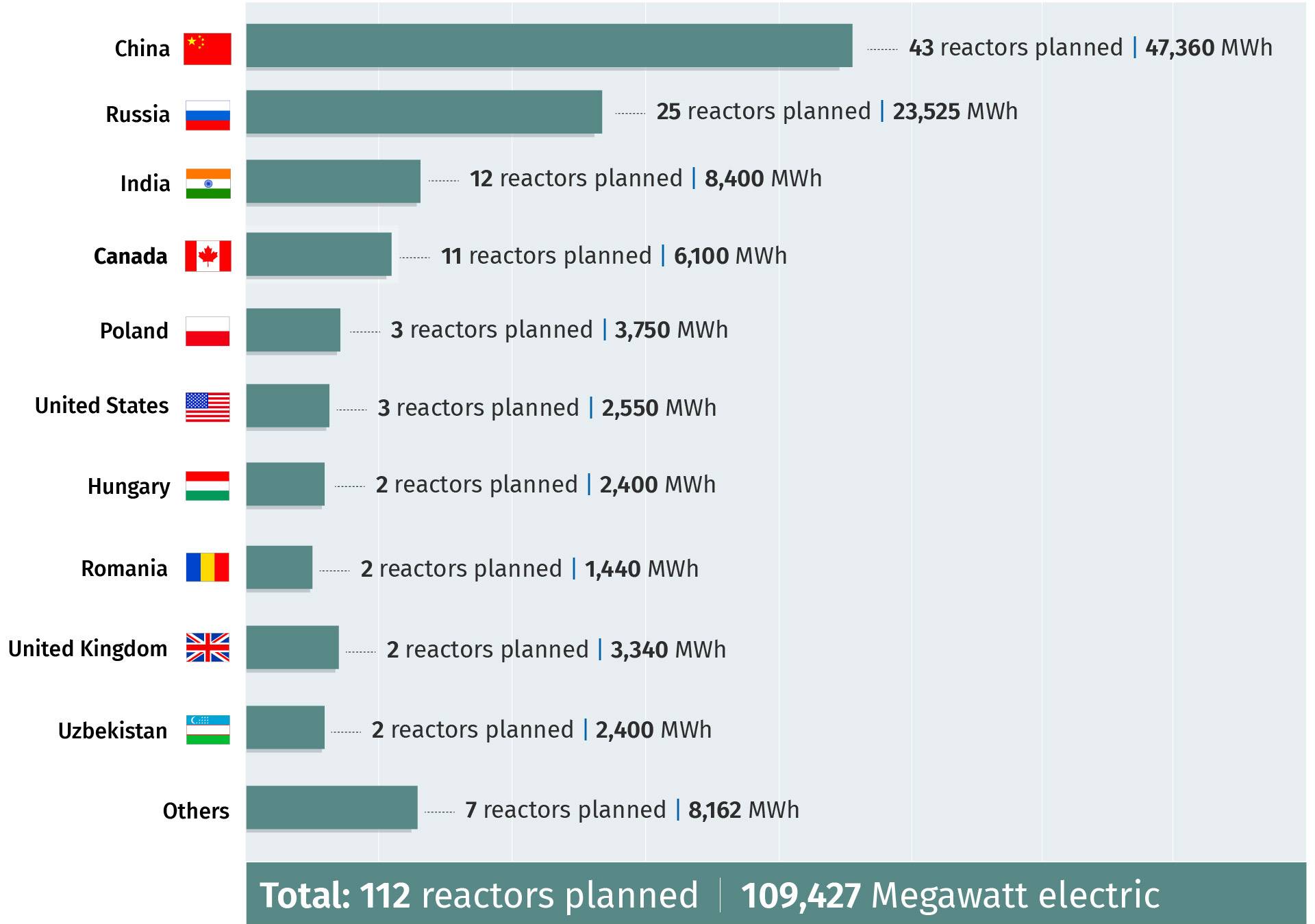

Nuclear’s Make Or Break Moment

Ontario must feel chuffed. Earlier this year, the province embarked on Canada’s biggest-ever expansion of nuclear with a doubling of capacity at Bruce Power—already the world’s largest nuclear reactor. The province also envisions the construction of 17,800 megawatts of new nuclear power, roughly equivalent to building another Bruce nuclear plant, two more Darlingtons and an additional Pickering. Plus, its eyeing three more small modular reactors.

Months later, as many as 22 countries, including Canada and the United States, pledged to triple nuclear capacity at COP28 this week.

Much-maligned nuclear appears to back in the fold. Once a central figure of hate among environmental groups, the energy source’s low-carbon credentials and decades-long track record of clean dispatchable baseload power has put it firmly in the climate plans of most countries. Nuclear’s energy security advantage has also made it irresistible for some in these geopolitically charged times.

Nuclear Ramp Up

Source: World Nuclear Association

Currently, nuclear generates around 10% of the world’s electricity, with 60 reactors under construction and 110 more planned. Thirty countries, including Bangladesh, Egypt and Turkey, are considering nuclear energy first time, to add to the roster of 33 nuclear-powered countries.

For Canada, it’s an opportunity to extend its lead and leverage its technology internationally. Federal investment tax credits of 15% on the construction of emission-free electricity systems could also provide the much-needed momentum to the energy source.

But the industry is not without its challenges in Canada and globally. In the past a single high-profile accident (Fukushima, Three Mile Island) has set the industry back decades, although it is working hard to raise safety standards.

The International Atomic Energy Agency says financing, economic considerations, and supply chain complexities, such as uranium supplies, persist and could also hamper the industry’s growth, while much remains to be done to deploy small modular reactors safely. The industry feels it can take these challenges on. It has been fighting against public perception for years, but solving technological problems are more in its wheelhouse.

CHART OF THE WEEK

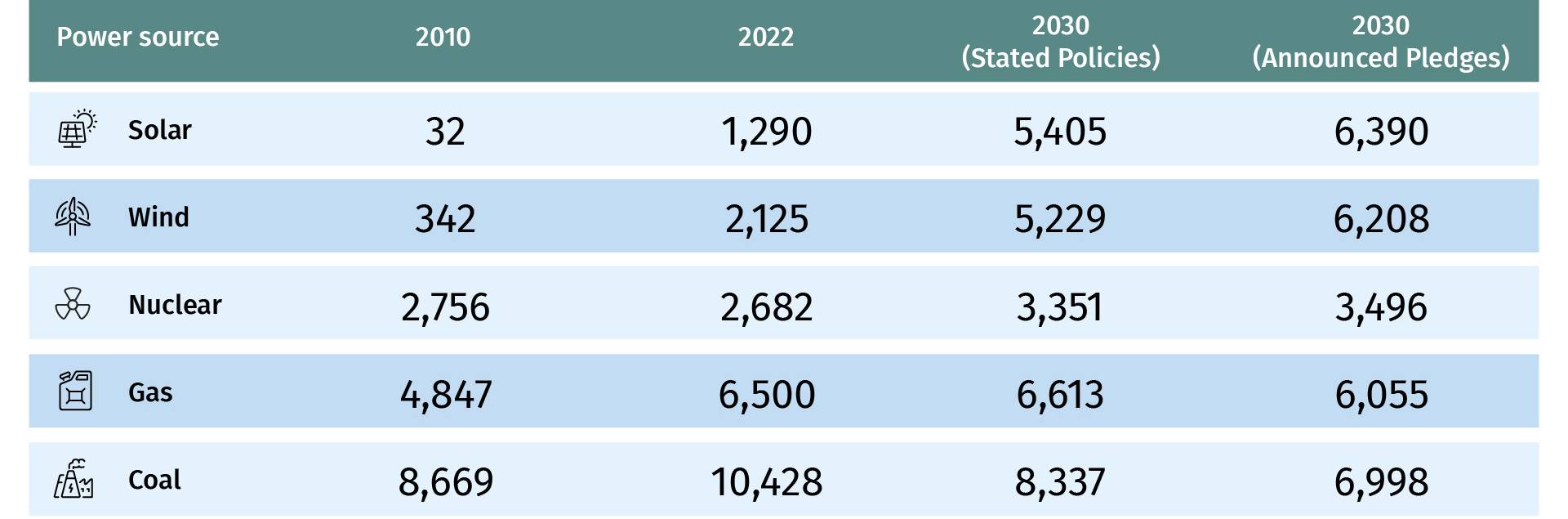

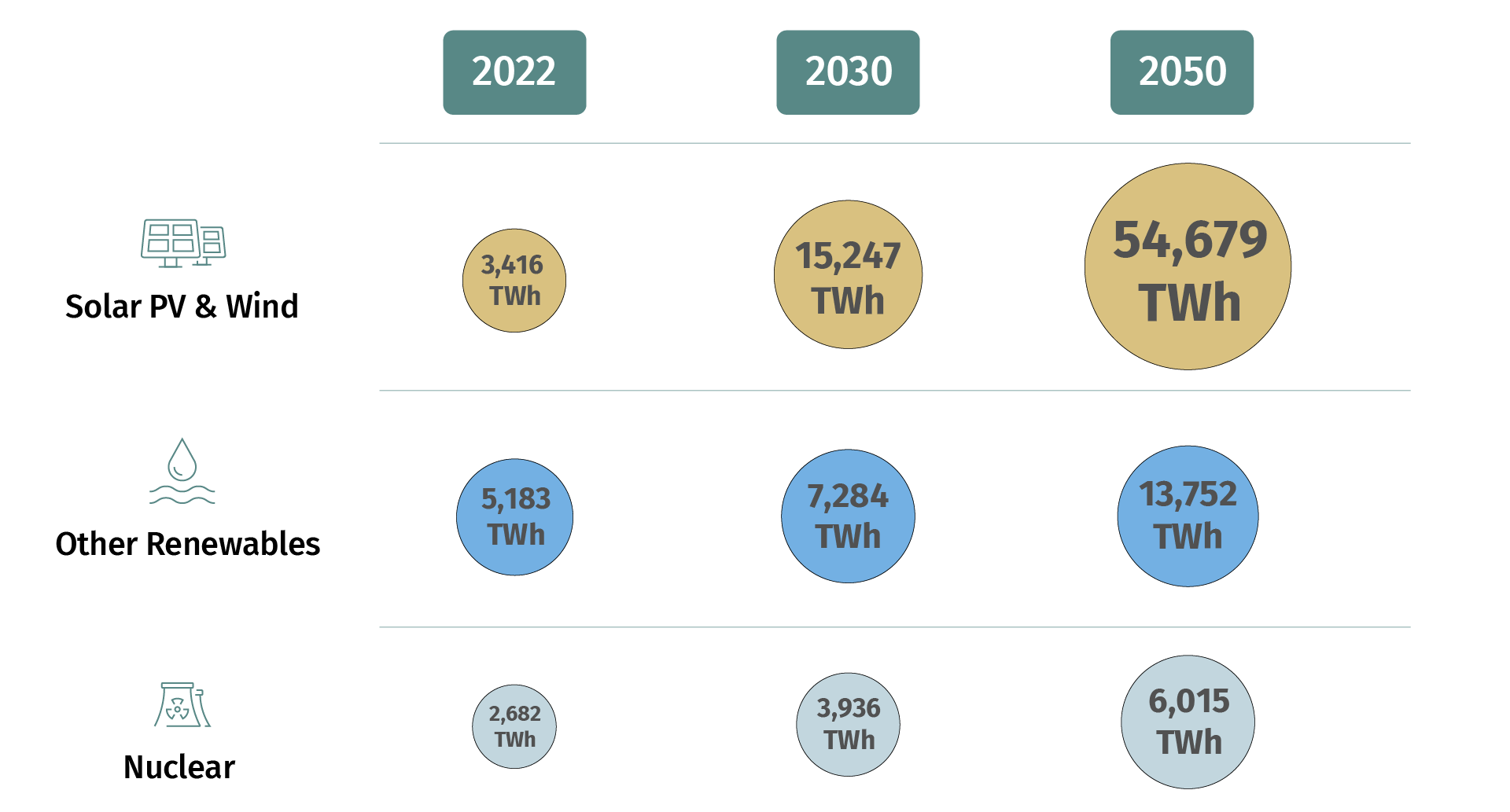

As many as 118 nations, including Canada and the United States, pledged to triple renewable energy capacity by 2030 and double energy efficiency to wean themselves off “unabated fossil fuels.” However, the pledge lacks bite as China and India—two major fossil fuel energy consumers—are not among the signatories.

Tripling Renewables, Cutting Fossil Fuels

(Terrawatt Hours)

Source: IEA WEO 2023

ZEROING IN

8x

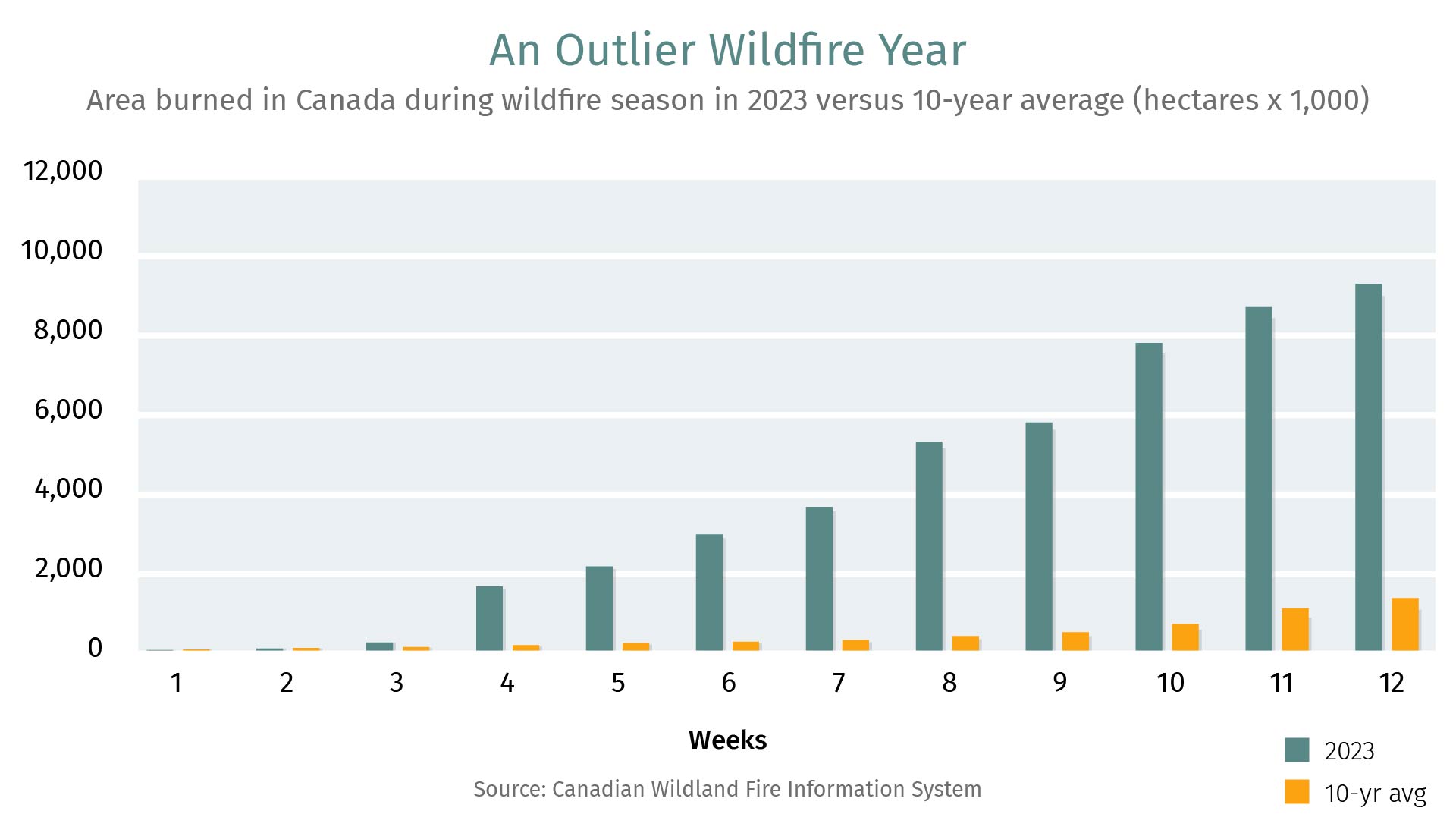

The estimated rise in global carbon dioxide emissions due to an extreme wildfire season in Canada in 2023, according to the Global Carbon Budget. The 8 gigatons of fire-related emissions is equivalent to about 70% of China’s emissions from burning fossil fuels.

In this week’s edition: As this year’s UN climate summit kicks off, COP28 president Sultan Al Jaber emerges as a man of contradictions, Alberta takes on Ottawa’s Clean Electricity Regulations, and it’s tough being a clean tech investor these days.

COP28 saw a breakthrough on Day 1. Germany and host UAE both pledged US$100 million each for a new $429 million loss and damage startup fund to help developing countries cope with the impacts of climate change—seen as an early win for this year’s annual UN climate conference taking place in Dubai. The UK chipped in with US$75, but the U.S. has been criticized for its “embarrassing” US$17.5 million contribution.

Canada has a full COP agenda. Steven Guilbeault, Minister of Environment and Climate Change, has a long to-do list at the climate jamboree: pushing for the US$100 billion climate finance goal, a global coal phaseout, the Global Methane Pledge and Canada’s Global Carbon Pricing Challenge.

Cut back on steaks to save the planet. Less meat consumption and boosting livestock productivity are among several recommendations being unveiled by the UN Food & Agriculture Organization at COP28 as part of a Net Zero plan for food systems. The Dubai summit will walk the talk, with two thirds of the catering expected to be plant-based.

It’s tough being a clean tech investor these days. The U.S. S&P Global Clean Energy Index, featuring the 100 largest clean energy-related firms, has plunged 30% year-to-date, compared to a 1% decline for the fossil-fuel heavy S&P 500 Energy Index. Cancellation of several high-profile U.S. renewables projects due to higher rates and costs triggered a broad sell-off. Given the wave of investments streaming into renewables, are investors being too short-sighted?

CLIMATE SUMMIT

Meet Mr. COP28

Sultan Al Jaber is a man of contradictions: As the head of the Abu Dhabi National Oil Company he has signed off on a US$150 billion investment plans over five years to expand the UAE’s oil and gas production. And as president of the COP28 summit in Dubai starting this week, Al Jaber is leading the global fight against climate change, at least this year. The host nation is reportedly setting up a US$30 billion climate-related investment fund with BlackRock, TPG and Brookfield on the eve of the summit. Al Jaber is eyeing “transformational progress” at the summit as he thinks the phase down of fossil fuels is “inevitable.” Yet, reports have emerged that the UAE is planning to use its role as the host of the UN climate summit talks to strike oil and gas deals, including with Canada. Al Jaber has denied the reports. This past year alone, ADNOC invested in carbon capture and direct-air capture projects, but also shipped LNG to Germany for the first time ever, opening a new fossil-fuel revenue stream.

Contradictions, indeed. Or will all energy executives need to keep two opposing ideas in their heads to solve a very complex challenge?

While oil-heavy ADNOC has thrived under the 50-year-old, Al Jaber’s record in the renewable energy space is not as enviable. His vision to build Masdar City, a new low-carbon city on the outskirts of the capital Abu Dhabi in 2008, remains a work-in-slow-progress despite the government sinking US$15 billion on the project.

Climate observers were opposed to his presidency, with 400 climate and environmental groups writing to the United Nations earlier this year to “kick out big polluters,” on concerns that major oil exporting countries are impeding climate progress. Among oil and gas firms, ADNOC is among the world’s top emitters of greenhouse gas emissions, and has a vested interest in delaying regulations around sequestration or policies that lead to declines in global oil and gas demand.

While that’s true, climate politics is complicated. The UAE is a representative of the loose coalition of emerging economies, the so-called Global South, that are driving global growth and want climate policies framed in ways that do not damage their growth prospects. The UAE and other major exporters such as Saudi Arabia are closely aligned with major energy consumers such as China, India and South Korea in climate policy. Together they will form a powerful group influencing discussions at COP28. Al Jaber is their voice this year.

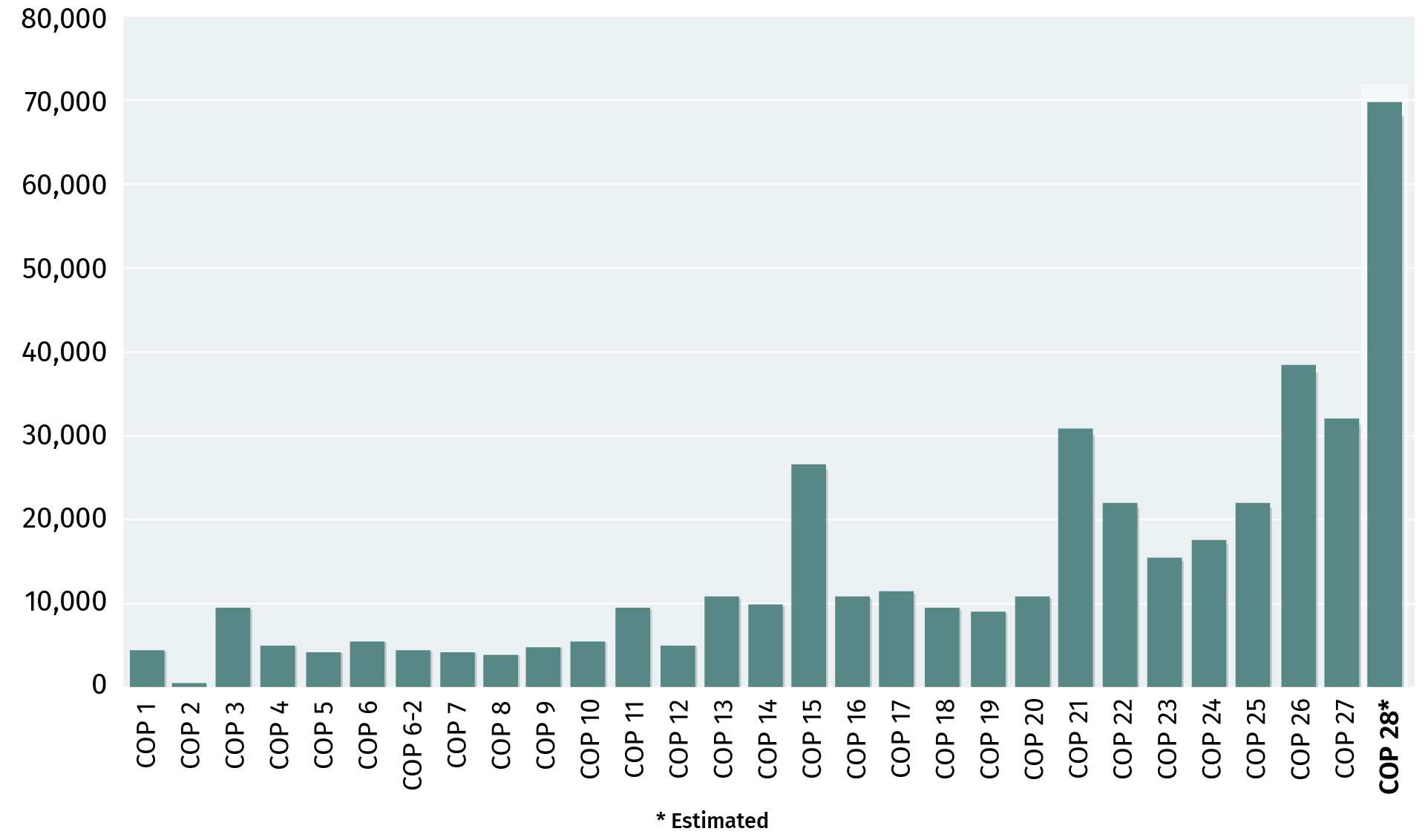

New Climate Conference Peak

Number of attendees at COP28 could set a new record

Source: Carbon Brief

CHART OF THE WEEK

The annual UN Climate Change Conference, or COP, is experiencing attendance inflation as diplomats, scientists, environmentalists, lobbyists, executives and media rub shoulders with presidents, prime ministers and heads of states. The event in Dubai till December 12 is expected to be the biggest ever concentration of climate folks yet, befitting the urgency of the crisis.

CANADIAN POLICY

Clean Electricity Regulations Get Messy

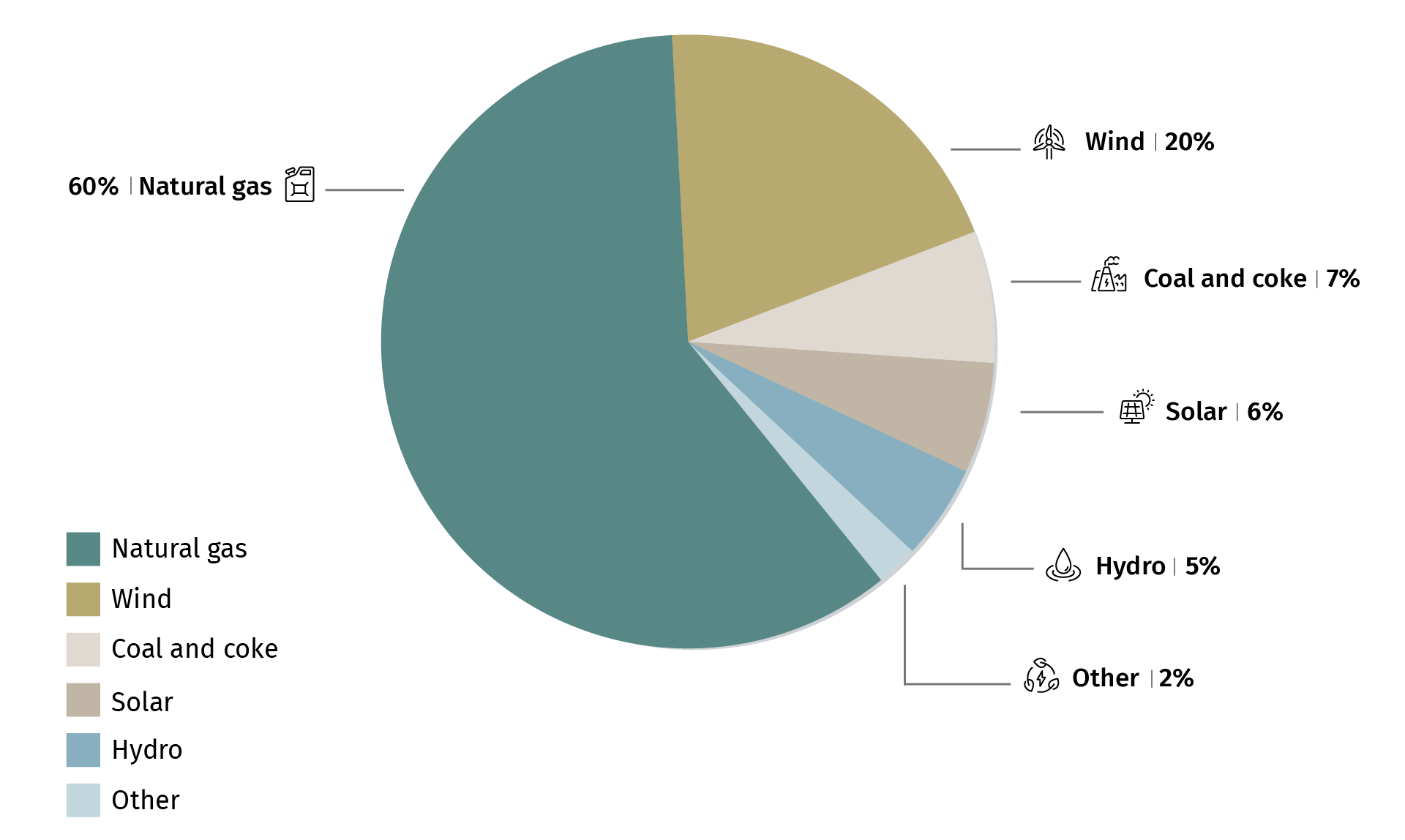

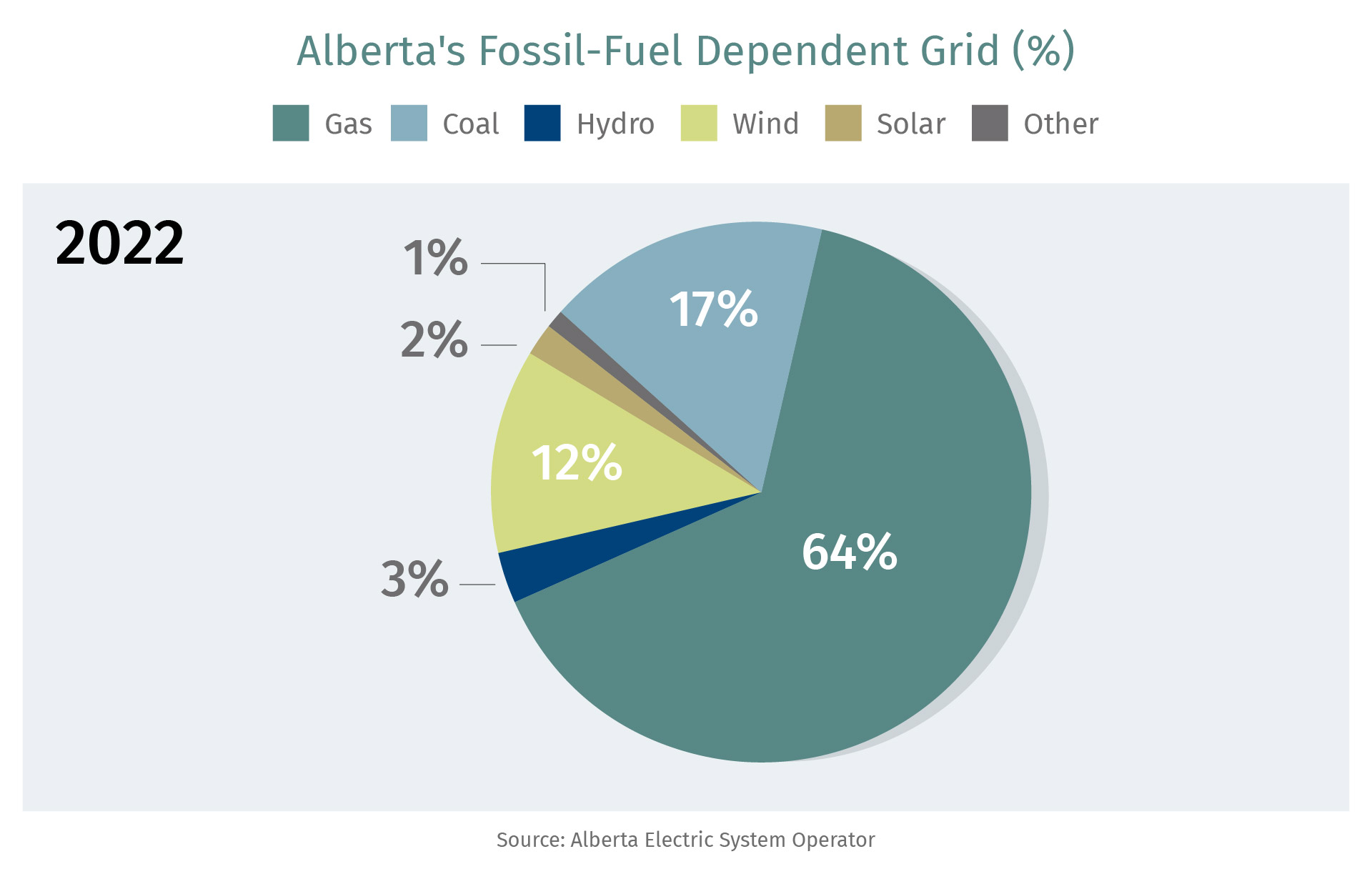

Alberta is stepping on the gas. By invoking the Sovereignty Act, Danielle Smith’s government is challenging the federal draft Clean Electricity Regulations, which aim to cut emissions from electricity starting 2035, meaning limited room for natural gas on the grid. Alberta says the timeline won’t work as the province only recently switched from coal to natural gas and the leap to renewables would be difficult without raising prices or affecting grid reliability.

The province is also eyeing a Crown corporation that could operate natural gas plants without worrying about falling foul of federal rules.

Ottawa has lately faced some resistance on its climate policies. In recent months, the federal government announced carbon tax exemption on heating oil in Atlantic Canada, while a federal court overturned Ottawa’s single-use plastic ban this month. A recent Supreme Court ruling limited federal influence over resource projects, but it was not quite the reversal its opponents were hoping for. While it’s seen as a pushback on federal climate policies, more likely it’s the push and pull of negotiations on policies.

Elsewhere, there are signs of progress on bringing emissions down. The Pathways Alliance, for example, is on the move. Engineering work is underway on the proposed carbon capture, utilization and storage (CCUS) project in northeastern Alberta with a potential launch date of 2030, according to a consortium of Canada’s six largest oilsands producers. The Alberta government added to the momentum this week, providing up to 12% of new eligible capital project costs, building on the federal CCUS investment tax credit. Crucially, the federal credits will be applicable retroactively from the start of 2022 to businesses that have incurred eligible CCUS expenses. Canada’s climate progress may not be linear, but it’s not off track either.

Alberta’s Gassy Electricity Grid

Distribution of electricity generation in Alberta by source

Source: Statista

Elsewhere, there are signs of progress on bringing emissions down. The Pathways Alliance, for example, is on the move. Engineering work is underway on the proposed carbon capture, utilization and storage (CCUS) project in northeastern Alberta with a potential launch date of 2030, according to a consortium of Canada’s six largest oilsands producers. The Alberta government added to the momentum this week, providing up to 12% of new eligible capital project costs, building on the federal CCUS investment tax credit. Crucially, the federal credits will be applicable retroactively from the start of 2022 to businesses that have incurred eligible CCUS expenses. Canada’s climate progress may not be linear, but it’s not off track either.

ZEROING IN

43%

The decline in emissions needed by 2030 from 2019 levels to limit global warming to 1.5 Celsius above pre-industrial levels, according to the UN’s Intergovernmental Panel on Climate Change. A key part of the COP28 agenda is the “global stocktake” to assess progress countries have made towards cutting emissions.

In this week’s edition: What the federal Liberals really, really want for Christmas, five themes to watch for at COP28, and why even Taylor Swift can’t escape the ravages of climate change.

Charting The Fall Of Climate In The Fiscal Update

By John Stackhouse

If there were any doubts how far climate has fallen down Santa’s wish list for the Trudeau government, read Chrystia Freeland’s Fall Economic Statement. She delivered the government’s annual economic strategy without once mentioning “climate change” or “environment.” (“All I Want for Christmas is Two” could be her holiday jingle, as she dreams of 2% inflation.) Such a narrow consumer focus may be bad news for her green caucus. But Freeland’s renewed focus on execution may be welcome. In her government’s strategy for the “clean economy”—Ottawa speak for climate—she made a few things clear.

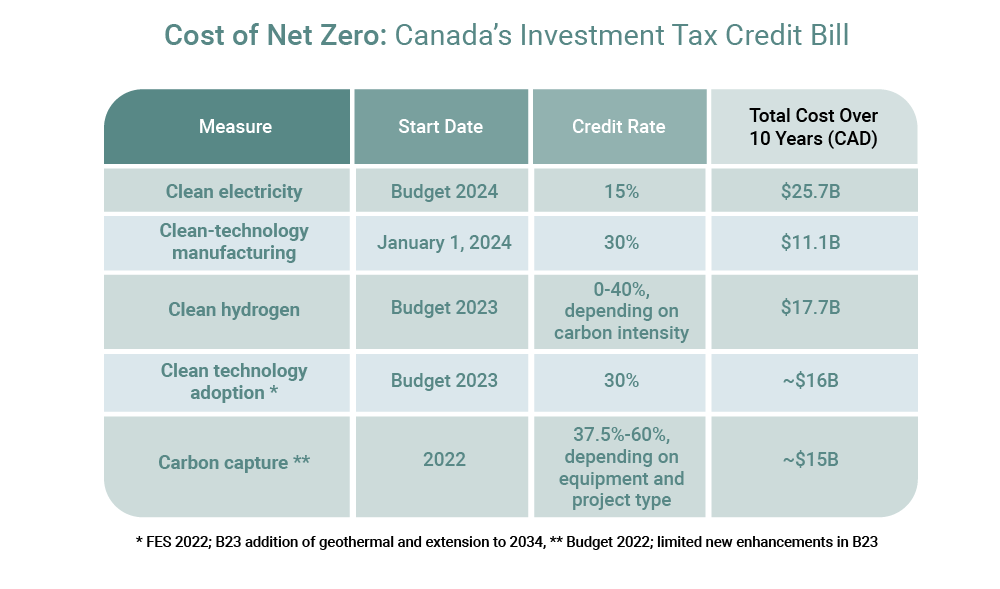

First, the new Canada Growth Fund will allocate roughly half its $15 billion funding for “carbon contracts for difference”—essentially carbon price guarantees if government policy changes. That’s a lot of money but may not be enough to underwrite a clean economy. Second, the government will soon introduce legislation for investment tax credits for carbon capture and clean technology projects, which were promised a year ago but never finalized. They will be critical to decarbonization projects, and there is some concern they’re still not competitive with U.S. incentives. Ottawa is also pushing ahead with its hydrogen agenda, promising tax breaks for ammonia, and giving more incentives for waste biomass (wood chips and crop residue) that can be used in sustainable aviation fuel. To attract more capital, Freeland gave the green light for a “taxonomy” to help banks and pension funds label investments as “green” or “transition,” and she will push pension funds to invest more in Canada’s “clean economy.”

How a taxonomy treats natural gas will be contentious, as will another Freeland proposal: a national Indigenous loan guarantee. Will Ottawa limit what Indigenous communities can buy, depending on its climate impact? A group of 130 Indigenous nations were quick to say, not a chance. After centuries of colonization, they’ll pick their own projects, including natural gas, thank you very much. Such debates will dominate the winter term, as the Trudeau Liberals try to show they can manage the current economy and help build a new one.

Hydro-Quebec’s energy investment bill will hit $185 billion by 2035. It’s four times higher than the provincial utility’s average annual spend in the past five years, but the company has pledged to keep electricity rates affordable. The utility forecasts that it will need to produce about twice as much power by 2050 as it can currently—an additional 150 to 200 terawatt-hours—for homes and the province’s growing industrial and clean-tech sector.

Article 6.4 could come down the pipe by 2024. That’s according to the chair of the U.N. supervisory body charged with setting rules that would allow a company, say an LNG exporter in Canada, to reduce emissions domestically and have them credited and sold to a different company in another country.

The body hammered out a deal after two years of “tense” negotiations, which will now be reviewed by country negotiators at COP28.

Ontario is helping Saskatchewan dabble in small modular reactors. Ontario Power Generation unit Laurentis Energy Partners and SaskPower will work together to support the provincial utility’s nuclear program management and project licencing processes. SaskPower aims to cut greenhouse gas emissions by at least 50% from 2005 levels by 2030.

No one is shielded from climate change—not even Taylor Swift. The pop-cum-economic powerhouse postponed the Brazil leg of her Eras tour after a 20-year-old fan’s death at her concert was connected to Rio de Janeiro’s extreme heat. Thousands of Brazilian cities are under the spell of “unbearable” heatwaves. It serves as a wake-up call for the multi-billion dollar outdoor events industry.

CLIMATE POLICY

Five COP28 Themes To Watch For

COP28 hopes to set the tone for tackling climate change this decade. But there is pessimism whether host UAE, a major oil producer, can corral around 200 countries on at least some of the climate change challenges. The UAE has a long history of punching above its weight—and a self-serving ambition to have a summit as memorable as Paris back in 2015.

The event, taking place in Dubai from Nov 30-Dec 12, will tackle virtually every climate topic, but these five are worth paying close attention to as they could be instrumental in tackling emissions.

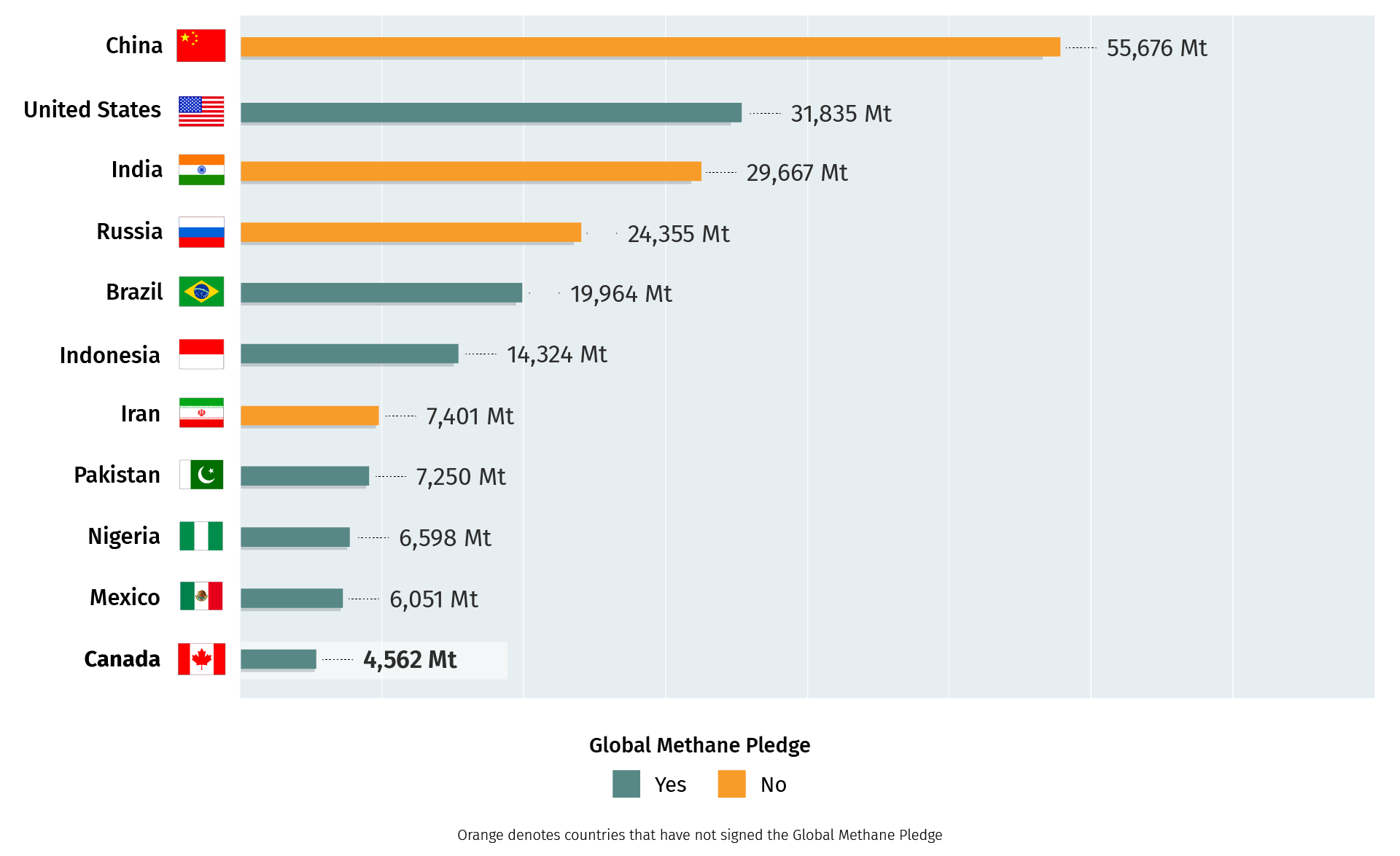

Snuffing Out Methane: The U.S.-China commitment earlier this month to cut methane emissions is seen as a major step, given the pollutant’s potency. Building on their surprisingly collaborative approach on climate, the U.S. and China plan to host a meeting on methane and other greenhouse gas emissions at COP. A number of countries, including Canada, have signed the Global Methane Pledge (GMP) to cut methane emissions by at least 30% from 2020 levels by 2030, but 46% of the emissions reduction opportunity is within the countries that have not endorsed the GMP. Expect pressure on them to sign up.

Tackling The Methane Menace

Countries with the biggest methane footprints

Source: International Energy Agency

3X-ing Renewables: The U.S. and Europe are pushing to triple renewable capacity and a doubling of energy savings by the end of the decade. China, seen as key to the endorsement, pledged to ramp-up renewables along with the U.S. during their summit, which could spur further development. The twist is that it could lead to a continued dependence on China’s cleantech supply chains.

Return Of Nuclear: Expect the U.S. to lead a push to triple the amount of installed nuclear power capacity globally by 2050. That would be a turnaround for an industry that has been castigated by climate activists. Canada, which is actively pursuing a few nuclear and small modular reactor projects, could play a role in the industry’s worldwide expansion.

Loss and Damage Fund: Finance is expected to be among the hottest—and most heated—debating points at the event. The EU has pledged a “substantial” contribution to the L&D fund aimed at providing financial assistance to nations most impacted by climate change. But it will be hard to convince other countries given the fiscal pressures on most economies. The UAE is expected to make a significant contribution that could help the fund flow.

Agriculture’s Big Day: The sector will get good play at COP as the world belatedly connects food to climate. Global food security is under threat as disasters affecting agrifood systems have quadrupled in the past 20 years, according to the United Nations. There is a push to sign a Leaders Declaration on Food Systems, Agriculture and Climate Action with the aim to integrate food systems and agriculture into national climate agendas. COP’s focus on methane dovetails nicely with agriculture as it’s the largest source of anthropogenic methane emissions.

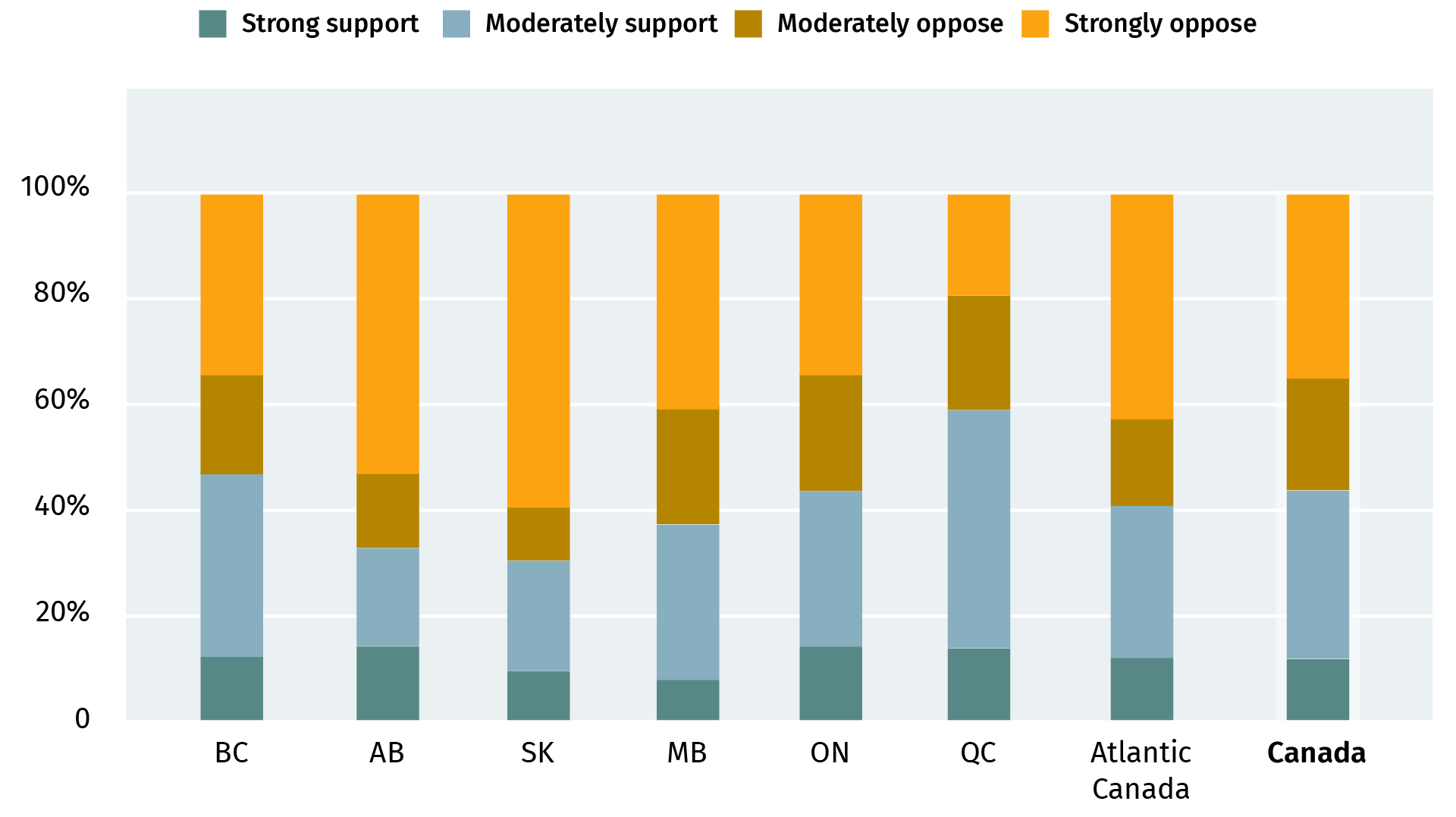

CHART OF THE WEEK

Vexed By Carbon Tax

Support for carbon tax pricing across Canada

Source: Angus Reid Institute

A new survey reveals a profound lack of awareness, and misconceptions about how much carbon tax Canadians believe they pay, whether they receive a rebate and its net financial benefits to households. Meanwhile, ongoing cost-of-living crisis and skepticism over carbon pricing’s role in fighting climate change are driving 42% of Canadians to call for the tax to be abolished, according to an Angus Reid Institute poll. It echoes a recent European poll that suggests climate fatigue despite deep conviction that climate change poses a threat to the continent’s economy.

35 million

The number of people employed in the low-carbon sector, compared to 32 million in hydrocarbons’ sector in 2022, according to the International Energy Agency. Energy job grew 5% (versus 2019) compared to global job growth of 1%. The growth came primarily from solar PV, wind, electric vehicles and battery manufacturing, heat pumps and critical minerals mining.

In this week’s edition: Why unabated is going to be a buzzword at COP28, Australia’s climate diplomacy trumps China, and the U.S.’s small modular reactor ambition suffers a major blow.

U.S and China are coming together on climate. The world’s two largest greenhouse gas emitters agreed to triple renewable energy capacity to “accelerate the substitution for coal, oil and gas generation,” as the two powers seek to reset their frosty relationship. The 25-point plan also aims to cut methane emissions, advance carbon capture projects and halt and reverse forest loss by 2030.

The U.S.’s first direct air capture facility has a Canadian connection. U.S. startup Heirloom Carbon Technologies unveiled a commercially facility capable of removing and storing 1,000 tons of carbon dioxide—a tiny but groundbreaking debut. The company is deploying Halifax-based CarbonCure’s green concrete technology to permanently store atmospheric CO2 captured in the building material.

Climate diplomacy helped Australia thwart Chinese influence in the Pacific. Australia is offering permanent residency to 280 Tuvalu citizens each year under a climate security guarantee to the remote atoll nation, which is threatened by rising sea levels. The treaty gives Australia the ability to block any policing tie-up between China and Tuvalu, as well as any telecommunications, energy, or port deal.

A landmark EU deal on deforestation would raise food prices, industry warns. The new law, which obliges food companies to prove their goods are not produced on recently deforested land, will be enforced by the end of 2024. Emerging economies also say the new law is “inconsistent with WTO obligations.” Palm oil, coffee, cocoa, beef, and rubber are among commodities expected to be affected.

CLIMATE POLICY

The Fuzzy COP28 Word That Could Move Billions Of Dollars

One fuzzy word, “unabated,” could move, or even, halt the flow of billions of dollars. The European Union’s starting position at COP28 is a “global phase-out of unabated fossil fuels.” Canada and United States are also on board with “unabated,” and are pushing for carbon capture and storage (CCS) technology–a key carbon abatement option.

Summit host UAE has called for an “energy system free of unabated fossil fuels in the middle of this century,” while oil and gas producers Saudi Arabia and Russia and fossil fuel dependent nations such as India and China favour more vague language.

There is a lot riding on the word: abatement suggests a focus on emissions rather than production, heavy investments in nascent carbon capture technologies, perhaps even a crowding out of investments in renewable energy. And it could lead to more emission-inducing (but captured) oil and gas drilling.

And what constitutes abatement, anyway? Some suggest CCS must separate high levels of carbon dioxide from emissions—preferably 95% and above—with low methane leakage or fugitive emissions to pass the smell test. Should offsets be excluded? Entire emissions life cycle covered? And should laws be put in place to ensure captured carbon is not used for enhanced oil recovery? These questions will lead to heated debates at COP28. And answers will help companies decide between funding CCS or switching to electricity or hydrogen.

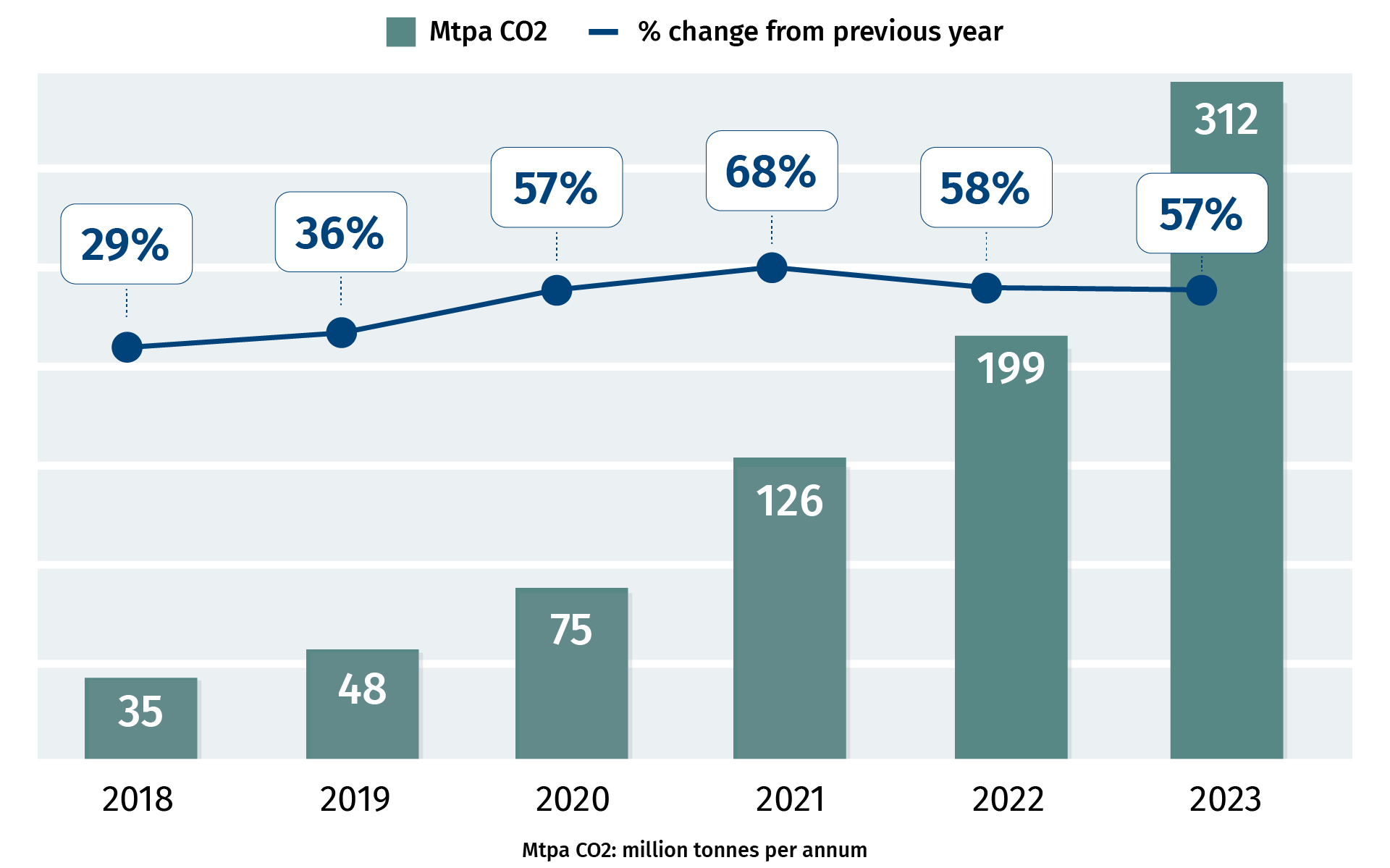

The Global Hunt To Capture Carbon

Growth in capture capacity of CCS projects in construction and development (excludes capacity in operation)

Source: Global CCS Institute

Without a clear global rule of thumb or norm for what constitutes “abated enough,” many investments could become stranded, warns a Centre for Global Economic Policy report.

Billions of dollars are poised to be injected based on the understanding of the word: CCS capacity under development surged 57% in a year to 312 metric tonnes in 2023, and the industry requires investment of US$130 billion annually until 2050 to hit global decarbonization targets, according to McKinsey.

The fight over language comes as the world wavers on its climate goals. Emissions are expected to rise around 9% by 2030, compared to 2010 levels based on current climate commitments, according to a recent UN scientific body. A separate UN report noted that many Net Zero targets that remain uncertain or have been kicked down the road need to take place now, to cut emissions and keep “1.5 alive,” a reference to maintaining global warming to levels agreed to in Paris, in 2015. Separately, the latest World Resources Institute’s State of Climate Action report is littered with phrases like “off track” (it appears 98 times) and “insufficient” (66 times).

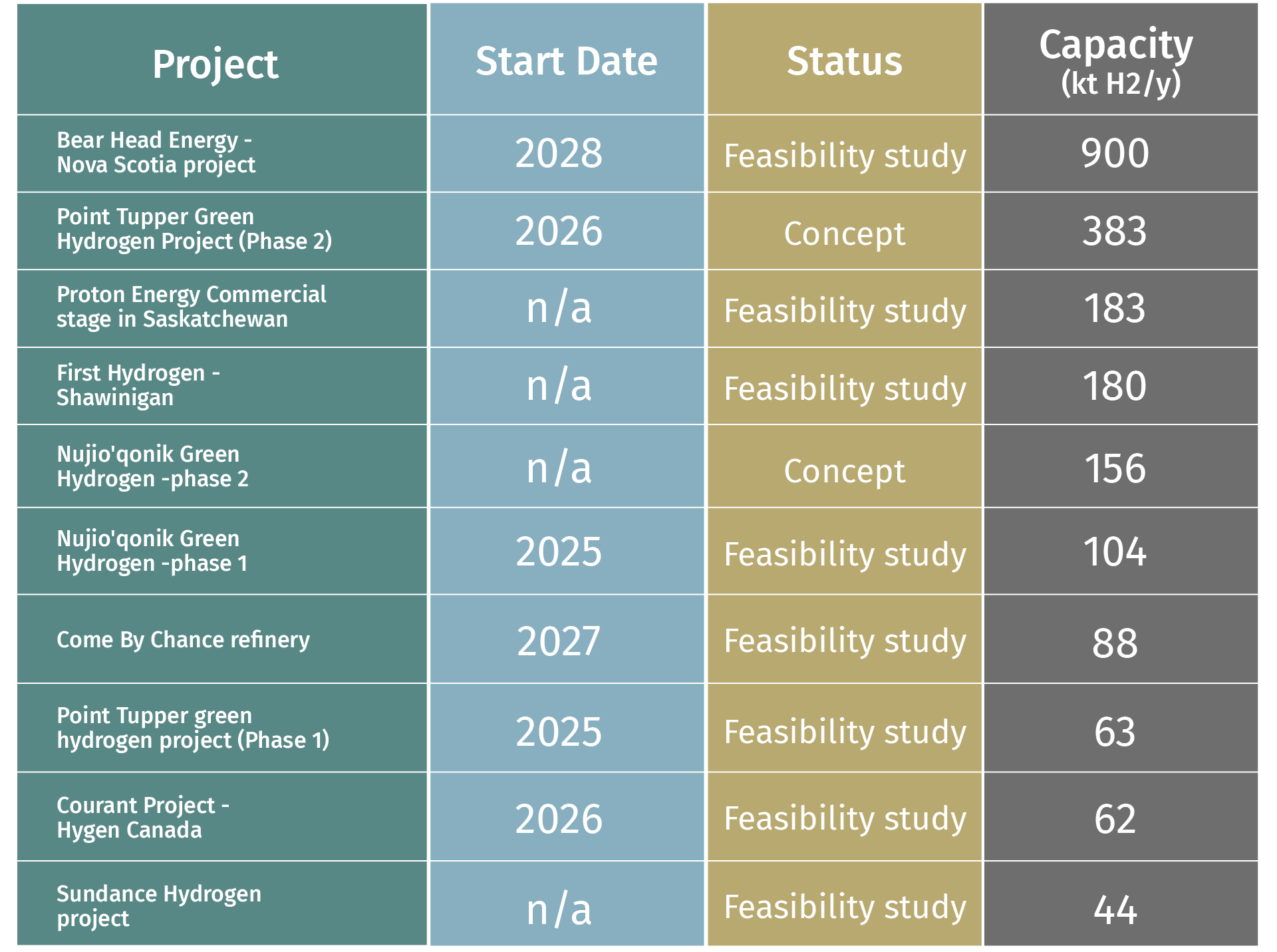

CHART OF THE WEEK

No Emissions, High Ambitions

Major proposed green hydrogen projects in Canada

Source: International Energy Agency

Quebec’s cheap hydropower just snared a major green hydrogen project. Belgian-based Tree Energy Solutions plans to build a US$4-billion plant in the province to produce “electric natural gas.” Apart from cheap hydropower, the company cited federal tax incentives for its decision to build the 70,000-tonne project by 2028. The facility alone is expected to help Quebec cut its emissions by 3% by 2030. The project is one of several announced in Canada (see chart) in recent months, as the country competes with the U.S. and others for green hydrogen dollars.

ZEROING IN

75%

The estimated jump in the cost of a U.S. small modular reactor (SMR) project to US$9.3 billion. Oregon-based NuScale Power abandoned the project as costs ballooned, and customers balked at the 53% hike in power tariffs. The project cancellation is seen as a blow to the U.S.’s SMR ambitions.

In this week’s edition: Canada’s climate season turns gnarly, Enbridge emerges as a dominant green gas player, and an obscure Paris clause could boost Canada’s LNG prospects.

Editorial

by John Stackhouse

The weather in Ottawa turned gnarly this week, as did the politics around Net Zero. Is this the winter of our climate discontent? I spent Thursday at the Canadian Climate Institute’s third annual conference, and it was hard not to feel a change in weather. The sunny ways of the past decade are now clouded by economic reality, as governments (and consumers) look increasingly for economically-minded ways to decarbonize our world. The days of free money are gone, which is undermining venture capital and all those innovators trying to create and scale new energy technologies. Governments (like consumers) are running low on fiscal gas, which will limit the billions they had hoped would stimulate climate action. The mood for regulation also seems to be dwindling, judging by the Trudeau government’s muted presentation of an oil and gas emissions cap (now called a “framework”) at the event. And then there’s all that global volatility—two hots wars and a cold one—that’s got energy markets (and market confidence) everywhere on edge.

Looking to 2024, the outlook for climate action may seem dark. But if there’s hope, it’s in private sector. This year’s CCI conference had a greater business focus, with steelmakers, oil producers and builders sharing their plans to decarbonize—not just for the planet but for their own competitiveness. That was also a clarion call from the Biden Administration, which sent its top energy diplomat to Ottawa this week to talk up business-led climate action. Geoffrey Pyatt laid out how the Inflation Reduction Act is transforming America’s energy systems (and its competitiveness), creating significant opportunities for business and trade for its allies. On that count, Pyatt wanted to know about Canada’s “political geography,” and how we can fit into a continental energy strategy that will include oil, nuclear, hydrogen and natural gas. In other words, climate security is now energy security, and both are about national security. The climate crowd didn’t embrace every word, but they did get the message. It’s a new season.

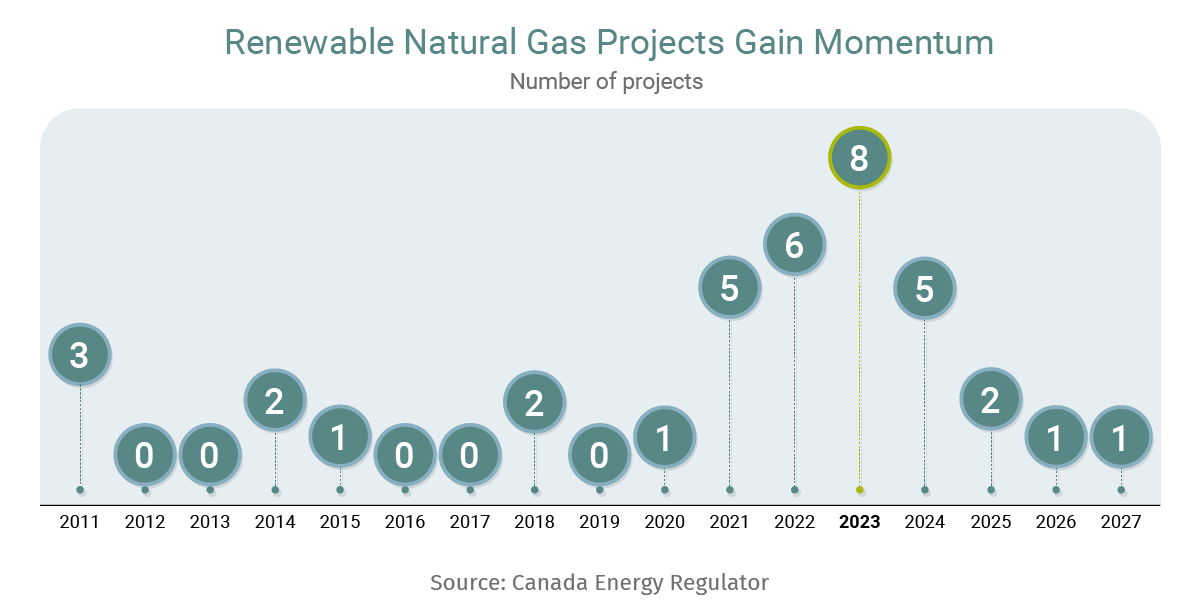

Enbridge is now a green gas powerhouse. The Calgary-based pipeline company snapped up seven renewable natural gas facilities for US$1.2 billion from U.S.-based Morrow Renewables, driven by strong U.S. policy incentives. The acquisition makes the company the third biggest RNG player after BP and Shell. RNG is made from food waste and farm waste and can be blended with conventional gas.

Carbon capture is about to take off. Investments in carbon capture, utilization and storage infrastructure hit US$6.4 billion in 2022, with another US$5 billion expected this year, as industry tackles hard-to-abate sectors, according to BloombergNEF. The U.S. could capture 40% market share by 2035, followed by the U.K. (14%) and Canada (12%). Carbon capture still has its critics, though, notably tech—and now cleantech—billionaire Bill Gates.

Here comes the IRA rush. More than 10,000 green energy power projects were in the queue waiting to be connected to the U.S. electricity grid at the end of 2022, as the Inflation Reduction Act sparked an investment surge, according to a Lawrence Berkeley National Laboratory report. Cancellations are also on the rise, however, with interest rates, supply-chain snarls and permitting delays taking some shine off the IRA driven boom.

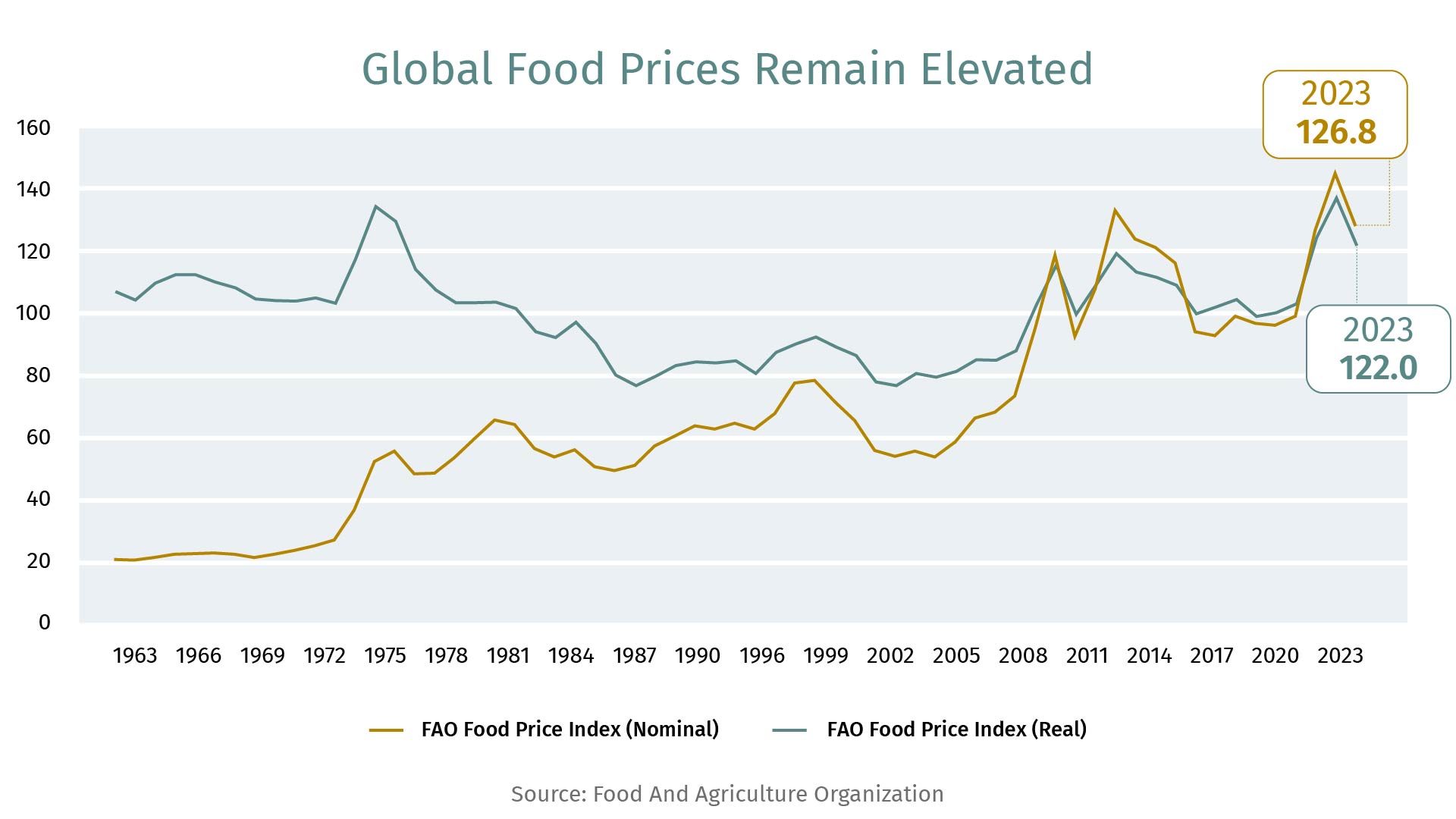

The world’s food bill is US$10 trillion higher partly due to emissions. While our love of ultra-processed foods is responsible for 70% of the hidden costs of food production, a fifth of the total agrifood systems costs are environment related, says a new Food Agriculture Organization report. Greenhouse gas and nitrogen emissions, land-use changes and inefficient water use are the key culprits.

ENERGY

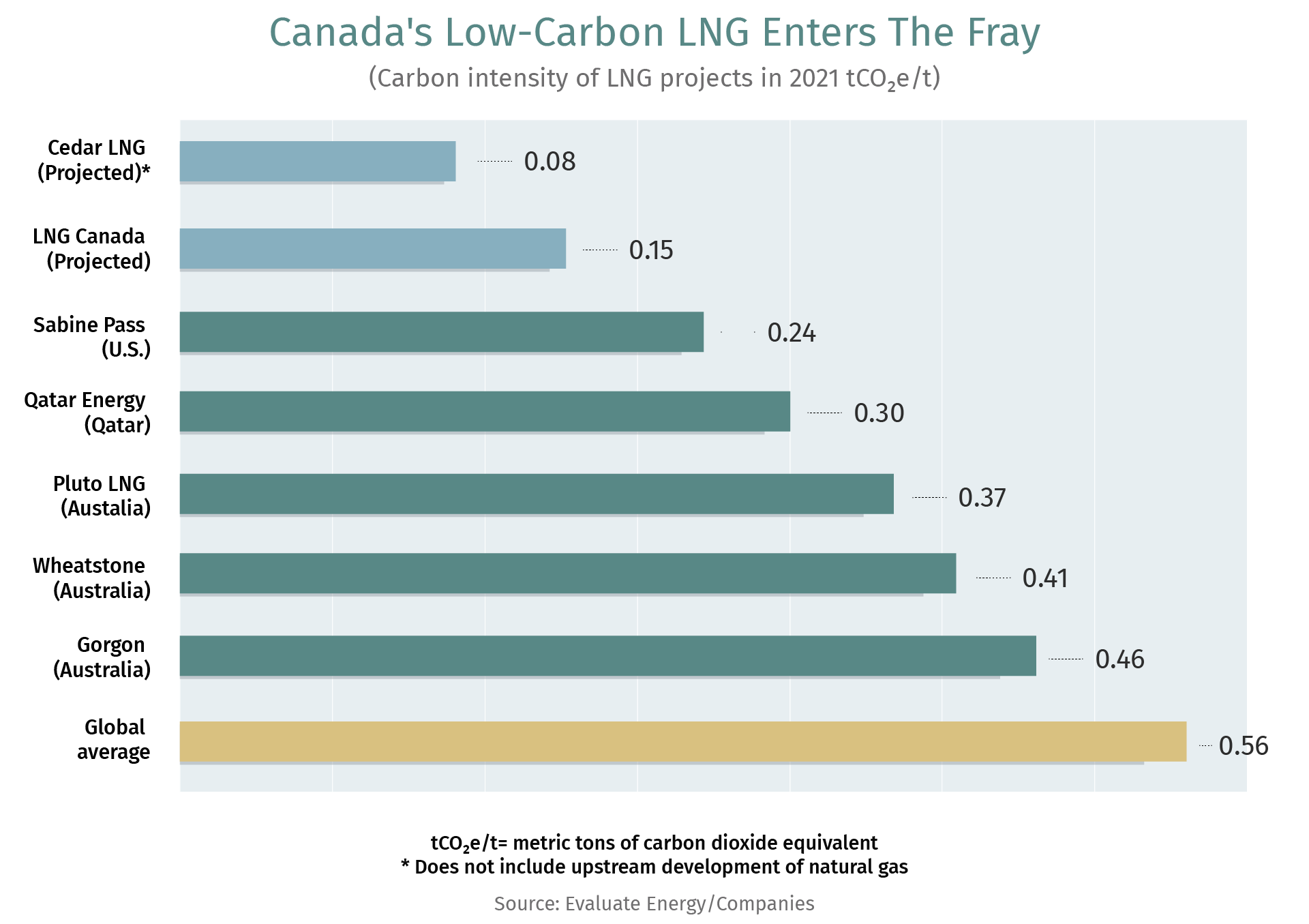

How An Obscure Paris Clause Could Lift Canada’s LNG Hopes

It’s awkward. Canada is set to join a new wave of liquefied natural gas production that will dramatically alter global LNG trade. It comes at a time when Canada is eyeing oil and gas caps on emissions (to be clear, not production) and British Columbia is imposing stringent emissions test and rules for future LNG projects. Federal environment minister Steven Guilbeault also does not believe Canadian oil and gas can solve Europe’s energy crisis triggered by the Russian invasion of Ukraine.

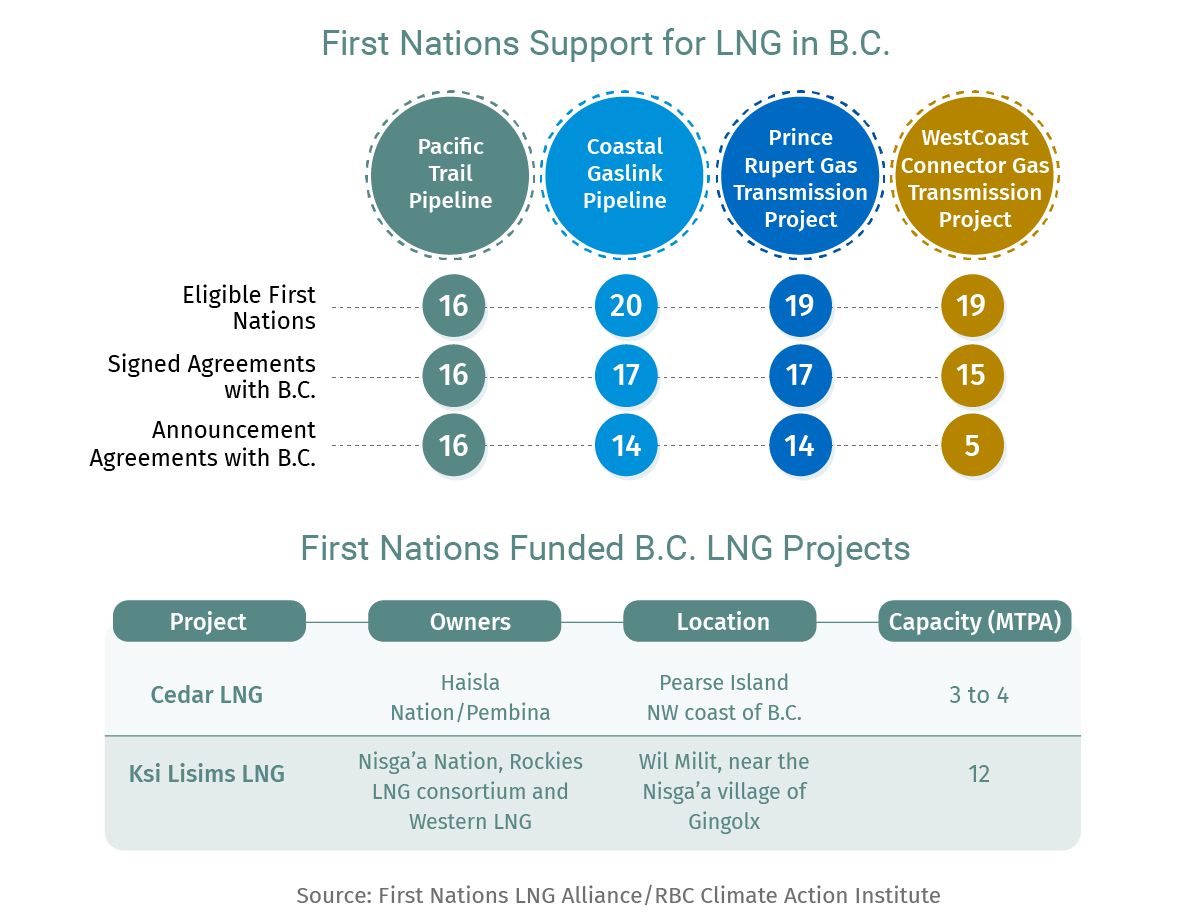

But the LNG train in Canada chugs along. The completion of the Coastal Gas Link pipeline in B.C. that connects Shell-backed LNG Canada (which is 85% complete and preparing to ship first cargo by mid-decade) to Montney reserves is an important industry milestone. First Nations’-backed Cedar LNG has secured environmental approvals and eyeing a final investment decision by the fourth quarter of 2023, while Enbridge-backed Woodfibre LNG is also the move.

It’s part of a coming North American dominance in LNG production. Major exporters Qatar and Australia are set to lose their stranglehold over the market, with U.S. and Canada expected to account for 39% of all LNG production capacity by 2030.

“This new supply will reshape global trade flows,” wrote Evaluate Energy in a new report.

Canada could emerge as the world’s fifth largest LNG producer before the end of the decade, Evaluate forecasts. More crucially, Canada could be one of the lowest carbon suppliers if B.C. continues to expand its green electricity grid.

The global climate regulatory cogs are also moving to help Canadian governments’ get over their awkwardness, with Article 6.4 of the Paris Agreement making some progress behind the scenes, although more works needs to be done.

The clause provides a structure for a carbon credit market on which greenhouse gas emission reductions or removals may be transferred internationally. That means, in theory, an LNG project in B.C. could get credit for displacing coal power in China. A 2020 report noted Canadian LNG exports could cut Chinese coal emissions by 34-62%.

The obscure clause gained momentum behind the scenes in recent weeks with the supervisory body adopting more than 100 crucial decisions. In October, Olga Gassan-zade, the chair of the Article 6.4 Supervisory Body, told S&P Global she was “confident but apprehensive” on the ratification of a finalized document by countries at COP28 in Dubai. But the group failed to finalize carbon trade text with new meetings planned as it scrambles to present a final text. If the text is endorsed by countries at COP28, the UN can proceed to registering projects under Article 6.4 next year. Big if.

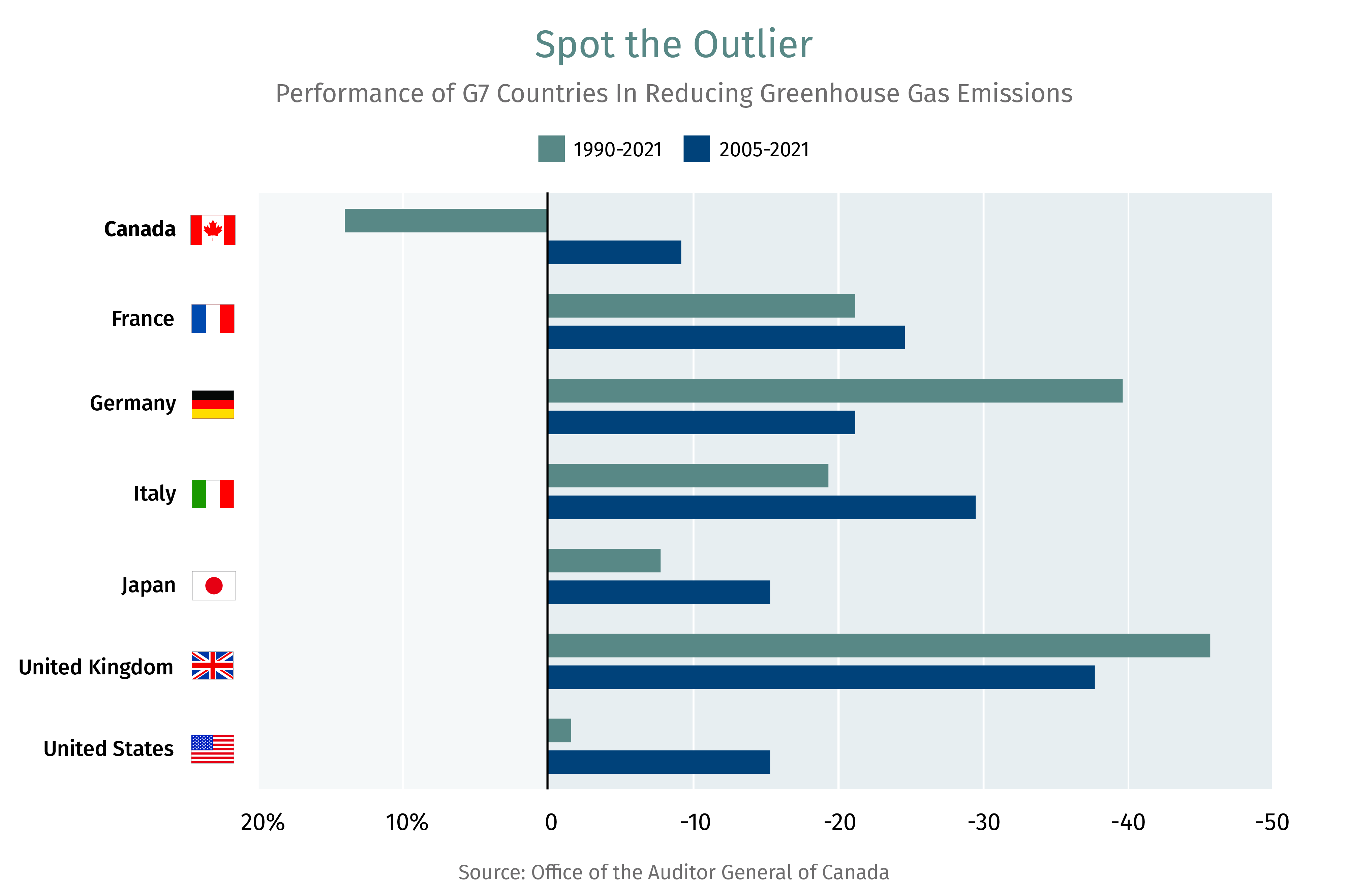

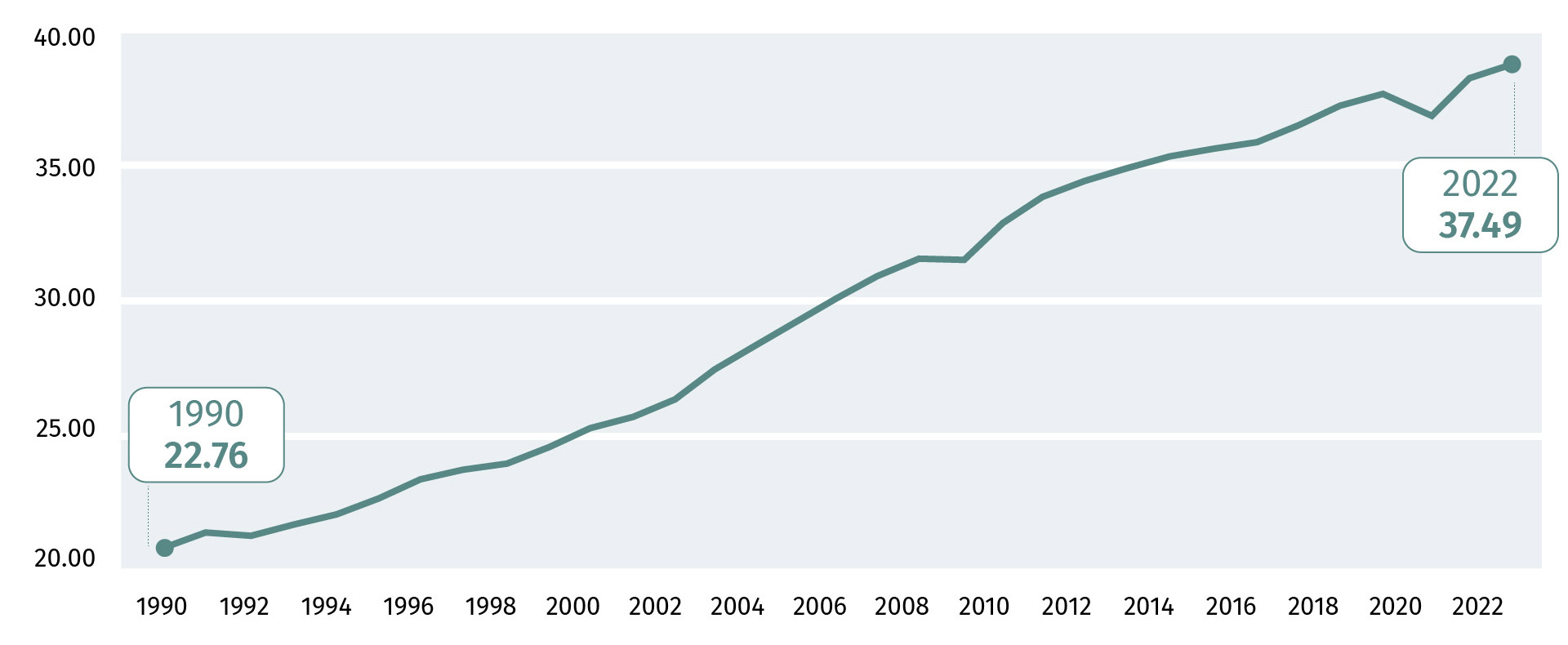

CHART OF THE WEEK

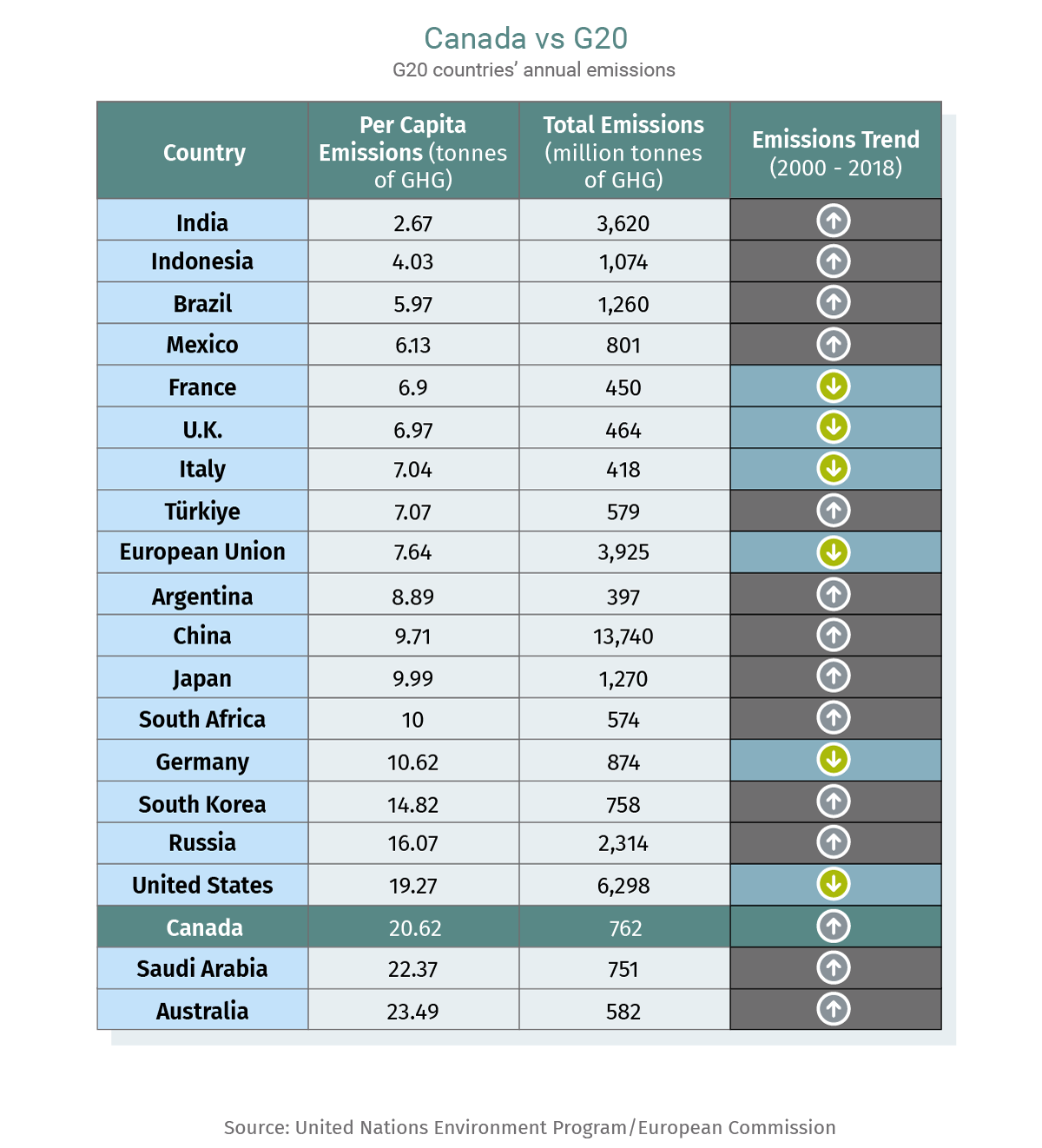

Canada is the worst performer among G7 countries since 1990 in reducing emissions, according to a report by the federal environment commissioner. The U.S. and the U.K. are the other two oil and gas producers. The pessimistic assessment also suggested that the Emissions Reduction Plan— Ottawa’s signature climate policy—is also insufficient to meet 2030 climate targets.

ZEROING IN

90%

The percentage of graphite refined by China. New Chinese export restrictions on a key electric vehicle battery material has left automakers scrambling for new supplies.

In this week’s edition: Provinces fume over new federal carbon tax exemptions, offshore wind is facing headwinds, and COP28’s big debate: who should pay more in the climate loss and damage fund?

Ottawa has no plans to boost carbon capture subsidies for the oilsands. The feds believe the proposed 50% tax credits are sufficient for the oilpatch to build carbon capture and storage (CCS) plants. Alberta has yet to disclose details of its support. Oilsands firms were hoping for more from the federal government as they plan CCS projects aimed at slashing industry emissions by around 27% by 2030.

Coastal Gas Pipeline is complete. Some First Nations are opposed but 17 Indigenous groups are eyeing equity co-ownership of the natural gas conduit connecting Shell-backed LNG Canada’s Kitimat plant to shale basins in B.C. The liquefied natural gas export project is set to raise Canada’s greenhouse gas emissions by 4 million tonnes when it starts in 2025.

Global offshore wind is facing a stiff breeze. Higher financing costs, supply chain bottlenecks and labour shortages have squeezed developers’ margins, and short-circuited a fantastic growth spurt. Orsted, the world’s largest offshore developer, cancelled two projects off the New Jersey coast this week, due to rising costs. The slowdown could impact global installations that must rise to 77GW by 2030, compared to a current annual average of 3GW (outside China) to meet Net Zero targets, Wood Mackenzie estimates.

Electric vehicle makers are slowing down. Tesla is delaying plans for a Mexico factory while Ford is slowing production of its F1-50 Lightning pickup truck, as higher interest rates sap consumer sentiment. While U.S. EV quarterly sales topped 300,000 for the first time in Q3, companies are predicting gloomier times as global economic growth slides.

PUBLIC POLICY

How Energy Inflation Threatens Canada’s Climate Policy

Natural Gas & Fuel Costs Across Canada Remain Elevated

% change, latest 3 months change from 2018 average

Source: Statistics Canada, RBC Economics Research

First Europe, and now Canada.

Across the Atlantic, policymakers have been chipping away at their own ambitious climate change rules to rein in energy inflation and keep consumer and business ire at bay. An alarmed European parliament president Roberta Metsola recently warned that climate progressives could be in trouble in next year’s EU elections if they don’t square their long-term climate policies with immediate cost-of-living priorities.

That politically-tinged debate has now reached Canada through the Atlantic shores and cascaded across the country.

Ottawa’s three-year exemption for heating oil from the carbon tax as part of an affordability package to shore up political support in the Atlantic, has riled up other provinces who say their citizens are also hurting from high energy bills.

The Liberals themselves are to blame for inflicting a blow to their once iron-clad policy. Bank of Canada governor Tiff Macklem had recently estimated the carbon tax is only responsible for 0.15 percentage point of inflation. That was exactly the argument Liberals had been making all along—until they didn’t with their new “energy affordability package.”

Non-Atlantic provinces now have a compelling argument to make: Why not extend the exemption to natural gas, which has a smaller carbon footprint than heating oil, and a bigger impact on energy bill inflation across Canadian households?

Statistics Canada data shows household spending on energy in the Atlantic remains historically higher than other parts of the country. But that’s due to the region’s heavy reliance on higher-cost heating oil that is linked to global oil markets. In fact, household energy spending in the Atlantic dropped slightly (as of 2021) as a share of total spending compared to pre-federal carbon tax days (2018). In contrast, Alberta, Ontario, Manitoba, Saskatchewan and British Columbia saw a jump in energy’s share of spending compared to 2018.

At a broader level, it challenges the federal government to reset its climate policy lest it’s completely dismantled in the next election cycle. (Federal Conservatives, currently leading in the polls, have pledged to “axe the tax.”)

It’s going to be tricky. The political fallout from the Liberal’s climate retreat has been rapid, with their first major show of flexibility on climate policy seen as a political miscalculation.

But it’s also true that we are in a new economic reality where geopolitics, global warming and supply-chain constraints are making commodities and manufacturing inputs costlier—and the fight against climate change even more complicated.

Buildings

Three Ways to Unlock Canada’s Mass Timber Opportunity

Canada can leverage its abundant forestry resources to develop a new, low-carbon-building material: mass timber. Made of engineered wood, the material can replace or complement hard-to-abate cement and steel in mid-rise towers. As a bonus it could help solve Canada’s housing supply crisis.

So why aren’t we doing it on a mass-scale? Timber Rising, a new report by RBC Climate Action Institute, explores how Canada can unleash a new low-carbon industry.

“Mass timber deployment in new apartments, condos, and office towers could cut emissions by at least 9MT, or nearly 10% of the sector’s emissions, by 2030,” wrote Myha Truong-Regan, the report’s lead author and the Institute’s head of climate research.

But three key challenges are impeding the industry’s growth:

- Insurance premiums to build a mass timber building can be 10 times costlier than a similar building constructed with steel and concrete. That’s keeping many developers on the sidelines.

- A mismatch between location of mass timber production (Western Canada) and demand for the material (Eastern Canada).

- High cost of manufacturing equipment is preventing new players from entering the sector.

Canada can emerge as a leader in mass timber, capturing at least 25% of the global market but, the reports argues, it must first address these three barriers to unlock the industry’s growth potential.

Read the full report here.

CHART OF THE WEEK

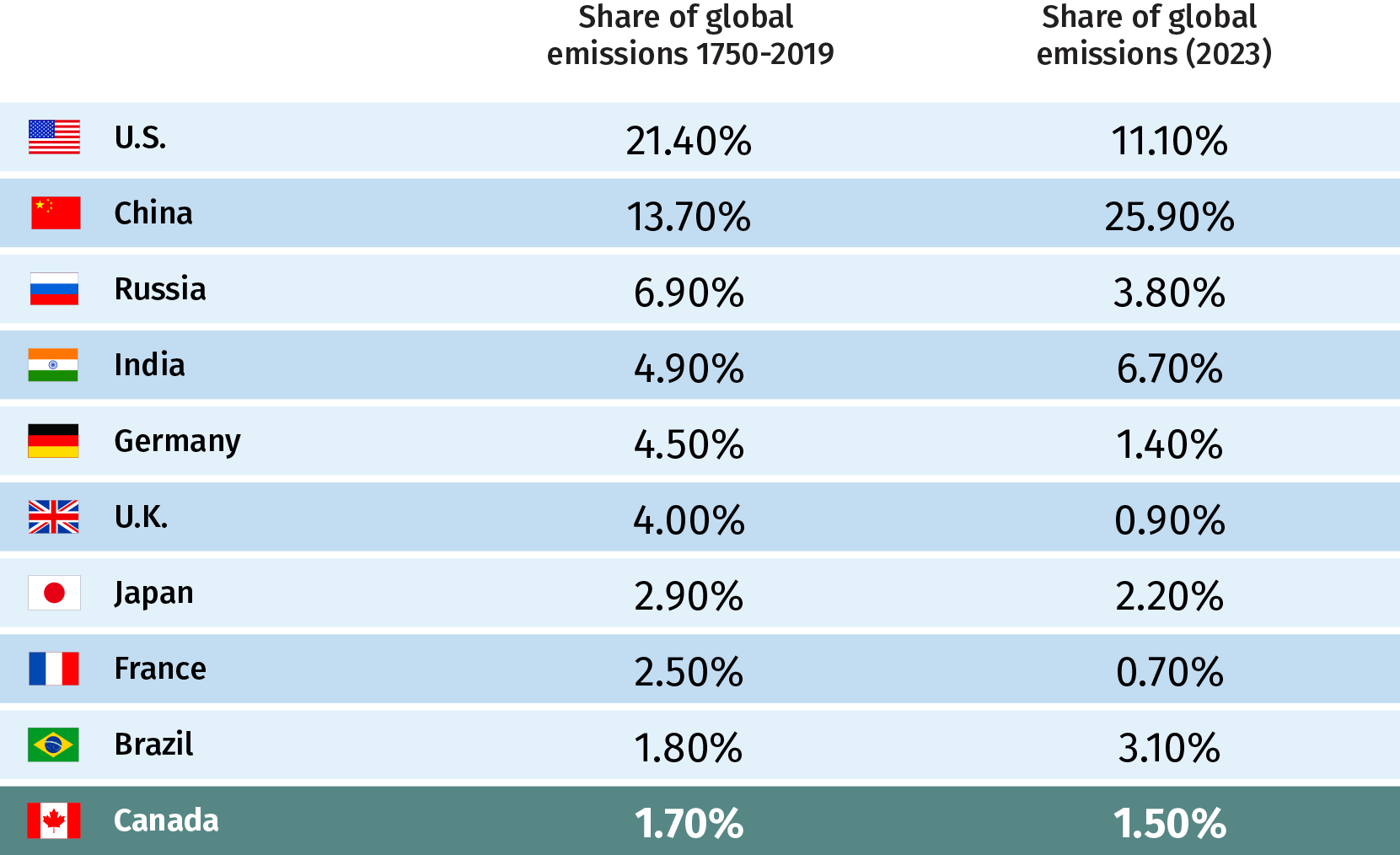

Who Pays For Emissions?

The countdown has begun for COP28 in the UAE. So does the accounting of emissions. For years, wealthy nations have rejected poor nations’ demands for “compensation” for their high share of planet-heating emissions that have triggered frequent extreme floods, droughts, and storms. So how should reparations be calculated: on a per capita basis (to account for population), historic or current emissions?

Global Fight Over Emissions

Selected G-20 members emissions per capita and historic share of global emissions

Source: BloombergNEF

ZEROING IN

US$1.8

The proportion of investment in clean energy systems in 2022 compared to every US$1 invested globally in fossil fuels. Five years ago, the ratio stood at 1:1.

In this week’s edition: One of Canada’s first Indigenous premiers could help Manitoba lead the country’s race to Net Zero, Ottawa softens its climate policies amid provincial pressure, and oil companies defy IEA warning.

The Wab Kinew Way

By John Stackhouse

I visited Winnipeg last week and there’s a new energy in the air. The election of Wab Kinew as Manitoba premier—one of the first Indigenous persons to lead any province—has put a new spotlight on the province, its role in reconciliation and leadership in the race to Net Zero.

I met with Premier Kinew to discuss his climate policies, insights from the RBC Climate Action Institute, and whether Manitoba could be a new model for Canada’s transition. He kept returning to a single word: hydrogen. His NDP government wants to make Manitoba a green hydrogen hub, even though the province is running short of surplus industrial power. Kinew is also keen to advance electric vehicle adoption, especially for the buses, trucks and farm machines that account for a third of Manitoba’s emissions. He has a hometown advantage in New Flyer Industries, a global player in electric and hydrogen buses, but needs a growing economy to finance the transition.

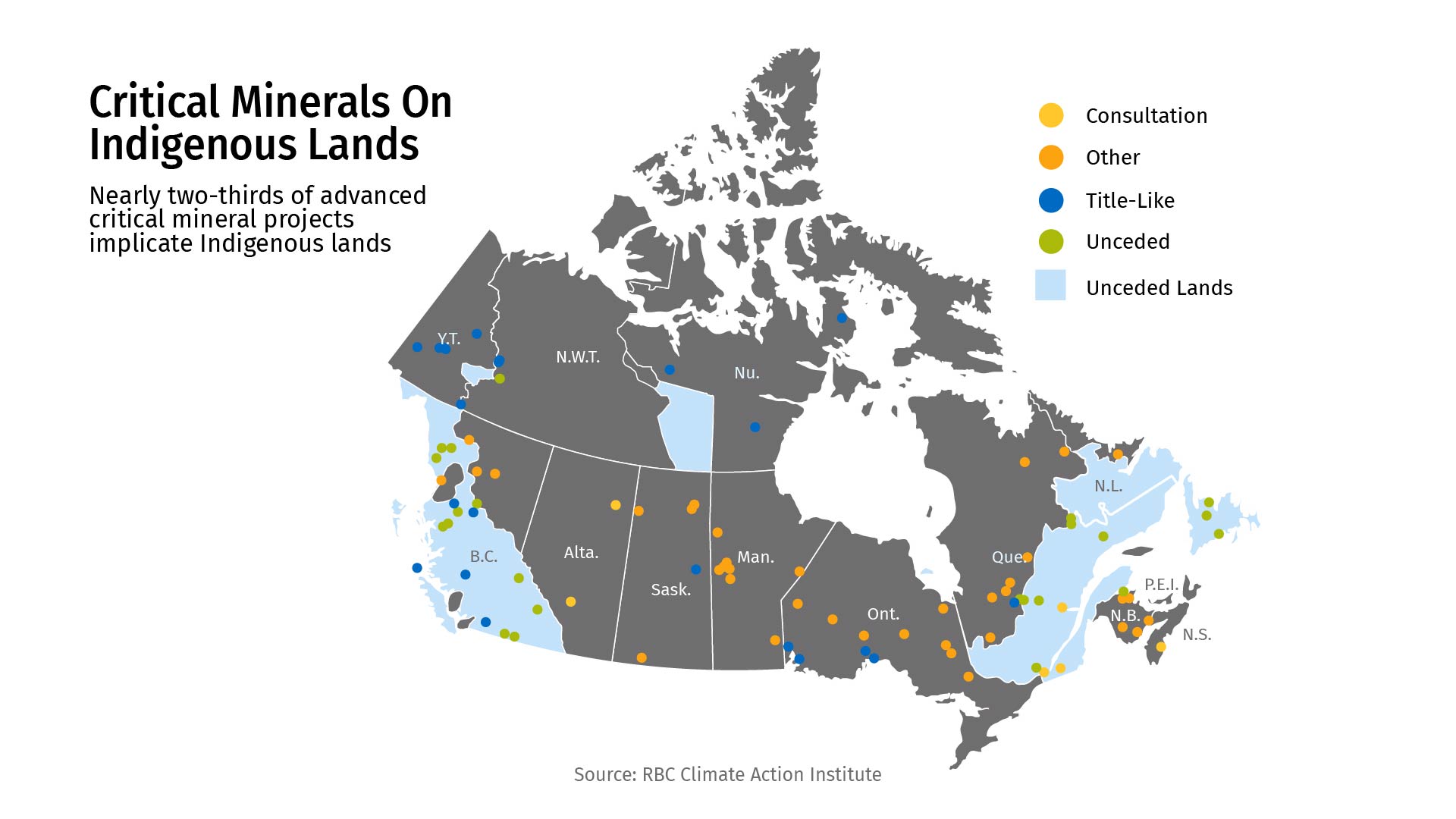

More electricity generation and transmission will be an added challenge for Kinew’s promise of reconciliation. His province’s population is 20% Indigenous, the highest in Canada, and new projects will face growing tests of “free, prior and informed consent.” The same challenge will face the NDP’s promise of critical minerals production. (The province claims to hold 29 of 31 key minerals, including lithium.) Kinew said he is hoping to see “enthusiastic consent” exhibited through business partnerships.

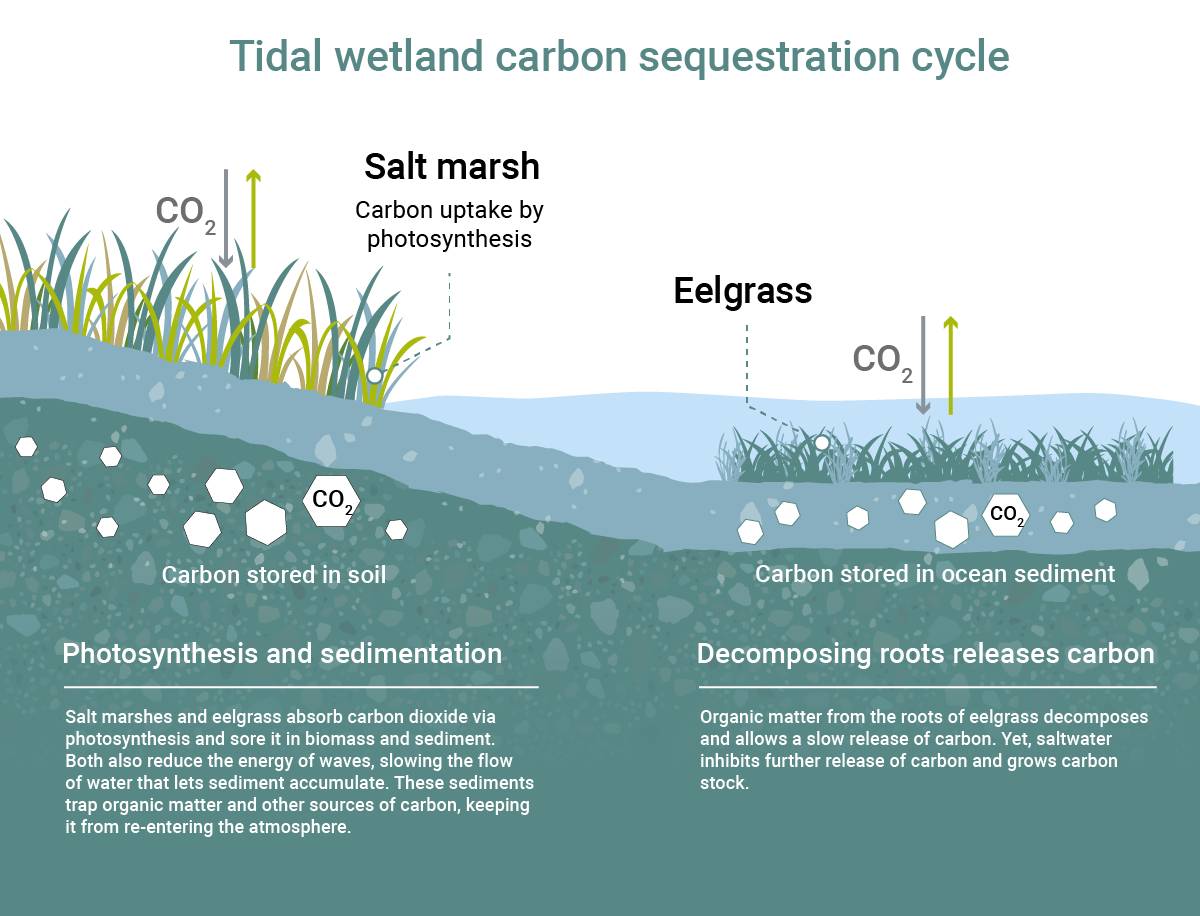

Manitoba’s other great climate opportunity? Agriculture. I visited the University of Manitoba’s Glenlea Research Station, south of Winnipeg, to see Canada’s oldest soil sequestration test site, aimed at capturing greenhouse gases. The station is also developing technologies to capture gases from the province’s four million cows, hogs and pigs.

Manitoba is home to only 1.4 million people. It will need all the climate tech it can develop to harness their—and the province’s—energy.

Cracks appear in Ottawa’s climate policy. Higher rural rebates on carbon pricing and exemptions on home heating oil are among the measures in Ottawa’s new “energy affordability package.” The federal move comes amid provincial pressure to soften climate policies and a chastening Supreme Court decision. The big question: could the Feds’ policy flexibility lead to more exemptions and carve-outs, ultimately threatening Canada’s ambitious climate targets?

New EU climate rules put 50,000 multinationals on notice. The new law expands the number of international firms, from 10,700 currently, that must disclose detailed data on their businesses’ impact on people and the planet and any sustainability risks they are exposed to, starting next year. A number of Canadian companies are already on the hook.